Sensex V/S Gold: Where Do We Stand in this Debate?

- In this issue:

- » IPO frenzy at its peak

- » E-commerce giants waking up to reality

- » ....and more

A few years back, our curiosity got the better of us. We wanted to know how much of the Sensex ten grams of gold would buy...and what this ratio's trend had been over the years. We weren't sure where this would lead, but we soon realized this ratio can be a good way to measure the genuine wealth creation of an economy.

Let me explain.

Long term, the Sensex is a good proxy for India's economic potential. It represents the largest companies from which you can expect a certain earnings stream.

Gold, on the other hand, is the perfect inflation hedge. It is real money and the only currency that retains its purchasing power over the long term. An ounce of gold buys approximately the same quantity of wheat it did a few decades back.

So is it fair to say that, if genuine wealth creation in the economy exceeds the rate of inflation, the long-term Sensex-to-gold ratio should be greater than 1? At any rate, we believe this is a useful metric, especially for the long term.

Now for the results.

In 2010, we published a study assessing the movements of the Sensex and gold over a ten-year period. And while the ratio was volatile, it did average 1. From the study:

- Stock market indices are more amenable to manipulation than gold prices because even money printing or an increase in money supply can give the impression that economy is growing. But as the recent crisis has shown, it could all turn out to be phony, making stock market indices come down as sharply as they went up. Gold supply on the other hand cannot be manipulated and hence, tends to show far more stability in its price.

Not much has changed in the five years since we published the study. As I write, the Sensex and gold are priced fairly close to each other despite considerable volatility in the interim.

While one ratio shouldn't dictate your decisions, we don't think this one can be ignored either. If after fifteen years, an investor gets the same returns from gold as he would have from the benchmark index, then policymakers need to go back to the drawing board.

We know that gold prices have very little to do with local factors. International factors - predominantly the health of the US dollar and other major currencies - largely determine gold prices.

However, if the trend persists more than fifteen years, then certainly something is cooking between the gold price levels in India and the health of the Indian economy as portrayed by its stock markets. Maybe the growth has come in by simply pumping in more money and there's a serious need to improve productivity and bring in the next round of reforms.

It is only when we improve our efficiency - when we produce more with less capital - that we see structural improvements to the economy. We want to grow 8-9% all right, but that shouldn't come with high single-digit/low double-digit inflation. Because if that's the case, gold's returns are roughly the same as the Sensex's, which means negligible real wealth creation.

We want to see the ratio comfortably higher than 1 on a sustainable basis.

Do you agree? Do you think the long-term Sensex-to-gold ratio is a good indicator of the overall health of the economy? Let us know your comments or share your views in the Equitymaster Club.

|

--- Advertisement ---

Profit From Junior Blue Chips... We have released our latest Special Report on the best of the best small caps - Junior Blue Chips! Yes, we believe Junior Blue Chips possess the high growth potential of small caps along with the stability of blue chips. That is an amazing combination every investor would want in his portfolio. And the best part is you can get this report for FREE! Just click here to know how... ------------------------------ |

2:25 Chart of the day

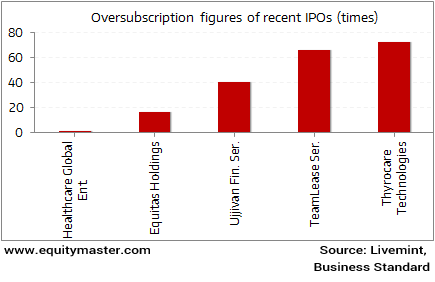

Demand of 73 shares for every one share on offer - that is the kind of oversubscription healthcare and diagnostics firm Thyrocare Technologies saw for its recent IPO. As today's chart of the day shows, it isn't alone. Other IPOs that have come out recently like TeamLease Services and Ujjivan Financial Services also saw oversubscription to the tune of 66 times and 41 times respectively.

These are the kind of numbers that typically only come in when the IPO season is in full swing. Unlike winter and summer, the IPO season doesn't follow a yearly pattern. It comes when the markets are rising and investors are willing pay up. Slightest sign of a weak market, and it is quick to go away too. And so does the hype around many of the stocks, especially the fundamentally weak ones.

We've been highlighting the perils of the IPO season to you. Note: of the 66 IPOs we've covered (and that still trade) since CY08 to CY15, forty are trading below the closing price on the day of listing. That's a 61% failure rate. Actually, it's higher as the positive returns on some of the IPOs lag the Sensex's returns for the same period.

As a long term investor, you will do well not to get swayed away by the buoyancy surrounding IPOs.

IPO season in back in full swing

The Economic Times reports that e-commerce firm Snapdeal will no longer use Gross Merchandise Value (GMV) as an indicator of its revenues. Rather, the company's CEO Kunal Bahl has said that Snapdeal will target adding and retaining high-quality users as its business goal. These are frequent shoppers purchasing high margin products.

Interestingly, Mr Bahl is reported to have declared sometime back that his company would dethrone Flipkart GMV terms in fiscal 2016. That goal has now changed into growing the number of daily users on Snapdeal 20 fold in five years.

The money from investors that was used to drive up GMV is increasingly becoming harder to come by for even the big name Indian e-commerce firms. And such changes to strategy, or should we say the dawning of reality, seems to be the result of that.

In his column today, Vivek Kaul throws light on an interesting phenomenon - how for many Indians, a home loan is taken on only as a bridge loan. This could mean that people have used black money to pay a substantial part of the price of the home and have financed the remaining through taking on a home loan, especially amongst self-employed individuals (as against the salaried class). By not declaring the fact that they are paying an interest on their home loan, the hope is not to attract attention on their rather expensive home in comparison to the home loan amount that has been borrowed.

The Indian stock markets were trading strong today on the back of sustained buying activity across most index heavyweights. At the time of writing, the BSE-Sensex was trading up by around 200 points. Gains were largely seen in capital goods and realty stocks.

4:55 Today's investment mantra

"Risk comes from not knowing what you are doing" - Warren Buffett

This edition of The 5 Minute WrapUp is authored by Rahul Shah (Research Analyst).Today's Premium Edition.

Ecommerce: Another Tech Bubble?

E commerce companies are losing their charm, and deservedly so.

Read On...

| Get Access

Recent Articles

- All Good Things Come to an End... April 8, 2020

- Why your favourite e-letter won't reach you every week day.

- A Safe Stock to Lockdown Now April 2, 2020

- The market crashc has made strong, established brands attractive. Here's a stock to make the most of this opportunity...

- Sorry Warren Buffett, I'm Following This Man Instead of You in 2020 March 30, 2020

- This man warned of an impending market correction while everyone else was celebrating the renewed optimism in early 2020...

- China Had Its Brawn. It's Time for India's Brain March 23, 2020

- The post coronavirus economic boom won't be led by China.

Equitymaster requests your view! Post a comment on "Sensex V/S Gold: Where Do We Stand in this Debate?". Click here!

6 Responses to "Sensex V/S Gold: Where Do We Stand in this Debate?"

Vishal Vora

May 5, 2016Actually gold is a hedge against govt actions ( or inactions). That's the reason Indian farmers buy gold when times are great and mortgage gold when times are depressing because they believe gold won't loose value. If you look international prices declined 45% from 1900 to 1050$ but in Indian context the fall was 25% only from 33k to 25k due to fall in rupee value. India being an importer it causes inflation when rupee goes down and therefore this cycle exacerbates further creating more inflation. Therefore while most equity analyst believe gold is not useful asset in the past decade due to excessive money creation by central banks and lack of fiscal reforms real growth has not happened and also due to indebtedness due to malinvestment in the previous bull market the pain will continue due to central banks trying to maintain asset prices the world over while their economies are crippled by debt created to keep the same system alive. Hence gold will continue to outperform due to excessive uncertainties in developed and developing economies.

Sonu

May 5, 2016I am a novice in the financial world, but I'll make an attempt to understand.

Equity has certainly been the most lucrative asset class, but so was real estate before the 2008 crisis proved otherwise.

Just like real estate, there has always been a lot of speculation and debate around gold being one of the bubbles to burst next. Also, just like oil prices that are affected by international forces, have taken a nose dip, there is no certainty, on the direction of the prices of the yellow metal in the long term. But one thing that is for sure is , as long as the Sensex CAGR beats the average inflation rate (which has mostly been) over the long term, things should be good. Policy interventions would unnecessarily inhibit free and open market operations with the retail investor as the ultimate sufferer. An investor with substantial investment in gold shouldn't suffer just because gold is giving higher return than the Sensex for a certain period. Could be wrong, but this is what I feel.

Prem Shanker Agrawal

May 5, 2016I donot agree with the opinion that long term sensex to gold is a good indicator of the overall health of the economy.

VIBHAKAR BOKIL

May 5, 2016No Direct OR Indirect Relation In Gold And Long Term Sensex.

There Are Different Valuation Driving Forces Of These Two Asset Class In The Long Term.

Over And Above It Is The Only Global QE Policy Coupled With

Global And Local Interest Rate

While Local Policy / Guidelines Determines The Value Or RoI

Of All Asset Class In Short Term

P.R.RAVINDRAN

May 7, 2016I don't agree with the view the long-term Sensex-to-gold ratio is a good indicator of the overall health of the economy . It is hard to believe that ratio greater than 1 , hence a higher growth in Senses vis-a vis Gold, would directly imply that GDP growth also is healthy. Each of these indicators have several underlying factors affecting them while , no doubt, there are to some extent interlinked. Do we have data for , say, last 30 years on this ratio vis-a-vis GDP? Is it true for other economies , like USA, UK and Saudi Arabia? Gold, is perhaps ,one asset, where , we have no clue on how much has been hoarded by households-most of the purchases are done with black money ( cash ) . Finally I appreciate the Author's genius to come up with one more economic ratios- good for Research