Dear Reader,

I’m Sarit Panackal, Editor of Equitymaster... a leading independent financial research house in India.

I’m here to reveal a mega wealth creation opportunity... discovered by our co–head of research Tanushree Banerjee.

She has uncovered 3 cutting edge tech stocks, which could potentially create a wave of Indian millionaires.

She calls them the India’s 3 Unstoppable Tech Stocks.

Why unstoppable?

Well, because even the Covid–19 crisis couldn’t stop their growth. In fact, as you’ll see, it has helped accelerate their growth.

In the current times when growth is hard to come by... these companies are showing double–digit growth rates.

Today, when weaker companies are finding it tough to grow... these 3 tech companies are turning this crisis into their advantage.

They’re snatching away the market share from their weaker competitors.

They’re increasing their dominance like never before.

They’re getting on the fast track of growth to become the leaders of their respective domains.

If you grab them today... then you could potentially generate incredible wealth over the coming years.

I’m talking about...

Gains Like 300%... 500%... Even 1,000%

or More in the Long Run

Yes, this is a huge wealth making opportunity.

One of these 3 companies is creating the clean energy backbone of India by partnering with Indian Space Research Organization (or ISRO).

It is present in the sector which is expected to GROW over 300 times by 2030.

Another one is one of the leading players in Artificial Intelligence technology. It is very likely that the next car you buy will be powered by the technology from this company.

And the next one is involved in putting up a global safety net to save the world from cyber criminals.

All these companies are growing fast on the base of their superior technology.

And over the years, they are going to potentially create huge wealth for their investors.

As you read further, you’ll learn more details about these 3 unstoppable tech stocks.

Now before I share the message from Tanushree explaining about this massive opportunity... let me give you some background about her work.

Tanushree Banerjee

Co–head of research

Like I shared earlier, Tanushree is the co–head of research at Equitymaster.

Tanushree’s work over the last 17+ years has guided potentially tens of thousands of Indians to achieve financial freedom.

Her articles hit the inboxes of more than 4 lakh Indians daily.

She is one of the most successful stock pickers in India....

Since 2002, every 7 out of 10 stocks recommended and closed by Tanushree has been a hit... offering gains like,

3,309% in L&T in less than 8 years.

Note: Past performance does not guarantee future results. Return(s) stated above are chosen from among our best performers. Full details on how these returns were calculated is given here. Some of our losing recommendations and our overall success ratio is shared here.

2,740% in Voltas in around 7 years.

Note: Past performance does not guarantee future results. Return(s) stated above are chosen from among our best performers. Full details on how these returns were calculated is given here. Some of our losing recommendations and our overall success ratio is shared here.

1,821% in M&M in less than 7 years.

Note: Past performance does not guarantee future results. Return(s) stated above are chosen from among our best performers. Full details on how these returns were calculated is given here. Some of our losing recommendations and our overall success ratio is shared here.

777% in Asian Paints in less than 7 years.

Note: Past performance does not guarantee future results. Return(s) stated above are chosen from among our best performers. Full details on how these returns were calculated is given here. Some of our losing recommendations and our overall success ratio is shared here.

1,082% in Titan in just two and a half years.

Note: Past performance does not guarantee future results. Return(s) stated above are chosen from among our best performers. Full details on how these returns were calculated is given here. Some of our losing recommendations and our overall success ratio is shared here.

Well, I can go on and on but you get the idea.

Over the years, Tanushree has identified many companies in early stages of their explosive growth phase.

And now she has once again discovered 3 high–potential stocks... which have the potential to generate the kind of returns I showed you just now.

So, here’s the message explaining about this massive opportunity straight from Tanushree Banerjee

Tanushree:

Hi, I am Tanushree Banerjee, the co–head of research, here at Equitymaster.

And today, I’m here tell you about how to get rich with India’s three unstoppable tech stocks.

I strongly believe, these companies with cutting edge technology could potentially create a wave of Indian millionaires.

Over the next decade, we’ll see money flowing into technology stocks in a massive way.

In fact, this is already happening in other parts of the world.

Take the U.S. stock market for example.

It is the biggest and the most influential stock market in the world.

Financial stocks once lorded over the U.S. stock markets. Just like they do for Indian markets today.

But over the last decade, money has been moving out of financials and into the technology stocks.

And this has led to a mega bull run in the U.S. tech stocks.

As you can see from the chart below, the returns of S&P 500 index look puny compared to the tech stocks, also popularly known as the FAANG stocks.

(Source: NASDAQ)

150% in S&P 500 versus 1,501% in FAANG stocks. That’s a HUGE difference.

And over the next decade, I see a similar bull run play out here in the Indian tech stocks.

Now I don’t have any acronym for these stocks like FAANG, so I simply call them India’s 3 unstoppable tech stocks.

But I’m sure, once what I reveal today becomes headline news... you’ll see FAANG like acronyms pop–up for these Indian tech stocks also.

For now, let’s focus on the 3 big opportunities right in front of us...

So, here’s the first one out of the three...

The first company is creating the clean energy backbone of India.

It is present in the sector which is expected to grow exponentially over the coming years.

Up to 300 Times Bigger by 2030

I’ll tell you more about this growth opportunity... but first let me give you some background around it.

If you remember, some time back, we saw a huge disruption in the oil market.

On one particular day, crude oil prices had even gone below zero.

This was a clear sign of the problems faced by the oil industry. And these problems are not going to end soon.

If fact, they’re going to become even worse.

According to International Energy Agency, global oil demand may have already peaked.

Here’s what IEA executive director Fatih Birol said recently,

"Many people have said, including some CEOs of some major companies, with the lifestyle changes now to teleworking and others we may well see oil demand has peaked, and oil demand will go down."

– Asia Times

With falling oil demand there is cut throat competition between oil producers to gain market share.

They need to compete harder with each other to make money.

But even as this war plays out, here’s what’s interesting...

Do you know what giant oil companies of this world are doing right now?

The likes of Royal Dutch Shell, France’s Total, British Petroleum, and America’s ExxonMobil...

They are preparing for a future where oil is no longer at the top of the energy market.

They are investing in the future.

They know demand is shifting, from the internal combustion vehicle to electrics.

That’s why they have started investing into the electric vehicle industry at a rapid pace.

These giant oil companies know that this new industry will deal a death blow to the oil industry.

So, they want to be prepared well in advance.

Tony Seba, a Stanford economist and a reputed thought leader in the energy sector said:

“Electric vehicles will kill global oil industry by 2030”

And the signs are everywhere.

Today, the demand for electric vehicles is rising all over the world.

For instance, according to news reports...

3 out of 4 new cars sold in Norway are electric or hybrid vehicles.

China is producing more than 1 million electric vehicles every year... and the US is not far behind.

UK is even deciding on imposing a complete ban on non–electric vehicles by 2035.

And India is forecast to become the fourth–largest market for electric vehicles by 2040.

The massive shift away from oil and into electric vehicles is happening around the world.

I believe the growth in electric vehicle industry is going to be exponential.

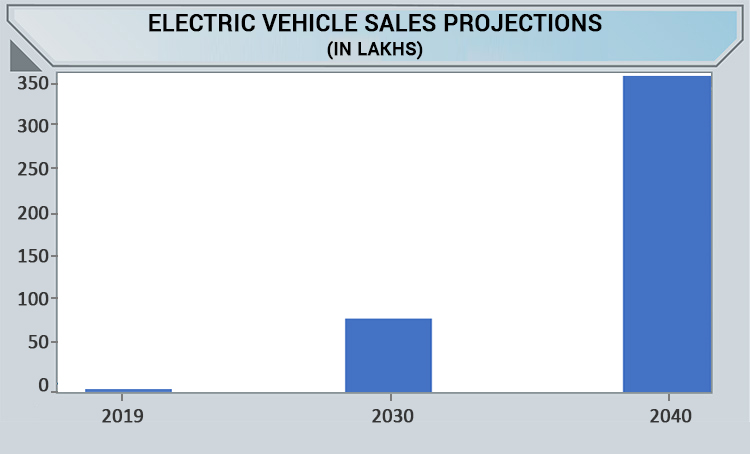

Take a look at this chart...

(Source: NITI Aayog, and Society of Manufacturers of Electric Vehicles)

The biggest example of the growth potential of this industry is Tesla.

You may already know about Tesla. Tesla is an American company. And it makes electric cars.

In less than two decades, Tesla has become world’s most valuable car company.

(Source: NYSE)

Today, Tesla is worth more than many

of its rivals combined

Yes. Companies like Ford, Ferrari, General Motors, BMW, Honda, Volkswagen... they have been making cars for decades.

But they all missed the electric vehicle trend.

Tesla grabbed this giant opportunity and became more valuable than all these companies.

Now after seeing the growth of Tesla, all global majors are rushing in to capture the slice of this exponentially growing market.

Even as the plays out in the international markets...

One Indian company is tapping very smartly into electric vehicles space.

This company builds power packs which will run these electric vehicles.

The technology is very complex and expensive.

In fact, these power packs cost as much as half of the car price.

For most vehicle makers, it is effectively unviable to start making key components of power packs on their own.

So, they need to rely on the company which has expertise in this domain.

In fact, even Tesla had to partner with a foreign company which had expertise in making power packs.

These power packs are the secret sauce of Tesla.

They are the reason for Tesla’s explosive growth.

And that’s why I’m so confident about growth of this Indian company.

Unstoppable Tech Stock #1:

‘Electric’ Profit Growth

This company is already one of the country’s biggest traditional energy modules manufacturer.

Almost half of the telecom towers in India run on their energy modules.

One out of three cars in Singapore runs on their modules. And that’s not the end of it.

This company supplies energy modules to over 32 countries around the world.

In India, their modules are used by...

- Ford

- Honda

- Hyundai

- Mahindra & Mahindra

- Maruti Suzuki

- Ashok Leyland

- Tata Motors

- And many more...

Not only that, they also provide power backup solutions to...

- Indian Railways

- Major metro stations

- Indian defence forces, especially paramilitary

And now the company has tied up with Indian Space Research Organization or ISRO to develop power packs for electric vehicles.

This is the technology which made Tesla so successful.

Today, the electric vehicle power packs market in India is less than US$1 billion.

But it is estimated to grow to US$300 billion by 2030.

That’s more than 300 times growth by the end of this decade.

(Source: Rocky Mountain Institute, NITI Aayog, India Energy Storage Alliance)

That’s why I’m confident that the future potential for this local company is huge.

Now electric vehicle power packs is just one of the growth areas for this company.

There is Endless Demand for

Energy Storage Modules

Almost all industries need energy storage modules for running their operations at full capacities.

And their demand is endless.

For instance... massive data centres which power everything from your email, chats, videos, almost every online interaction... consume huge amount of energy.

And they need heavy–duty energy storage modules.

The telecom towers which help you stay online and connected also need high capacity energy storage modules.

And the mission critical military operations also rely on them.

E–commerce companies are also heavy users for their warehouses.

Multi giga–watt solar and wind power installations also need them.

So as you can see, the demand is endless.

And the interesting thing is that this is just the beginning.

According to the latest forecast by BloombergNEF (BNEF)

‘Energy storage installations around the world will multiply exponentially, from a modest 9GW/17GWh deployed as of 2018 to 1,095GW/2,850GWh by 2040.’

– Economic Times

That’s more than 100 times growth

from the current levels

The same study says

‘India may emerge the third largest energy storage installation country by 2040.’

– Economic Times

And the company I’m talking about is going to be benefit hugely from this growth.

Now even if this company manages to capture a small slice of this massive market... the potential returns for its investors could be mind–blowing.

Today, very few people know about this giant opportunity. But as soon as the news spreads, the stock price of this company could skyrocket.

Remember, this company is already a strong player in the traditional energy modules segment.

And it is tapping early into the massive market for electric vehicles.

Plus this company is almost debt free.

In fact, it holds hefty cash reserves...

This financial muscle, gives it the ability to not only tide over any kind of crisis.

But also allows it to be aggressive in snatching away the market share from its weaker competitors.

With its advanced technology and support from ISRO... this Indian company is strong enough to compete with even global players... especially the Chinese.

Thus, I believe this company has the potential to grow at a rapid pace in the coming years.

Remember, it has a US$300 billion runway to expand.

Now when this company is creating the clean energy backbone of India with its innovative technology...

There’s another company which is disrupting many industries with Artificial Intelligence.

This technology is going to be a game changer

We saw how electric vehicle adoption is increasing all over the world.

Vehicles are not only going electric, they are also becoming driverless.

Driverless vehicles is the future.

In the U.S., many states have already passed the laws to allow driverless cars on public roads.

Many European countries are not behind.

China already is running large scale trials of self–driving cars.

And South Korea has even created an entire new city just for testing of driverless cars.

This is one area where growth is happening at a breakneck speed.

Driverless cars are not present in India yet.

But that didn’t stop this one Indian company from taking a giant leap in this technology.

Unstoppable Tech Stock #2:

A Futuristic Tech Player Leading the

Race with Artificial Intelligence (AI)

My #2 Unstoppable tech stock makes its own machine–controlled cars.

Yes you read that right.

Machine controlled cars.

It is partnering with one of the biggest global players in development of driverless cars.

And here’s what is important...

Its cars are already running on test tracks in Germany.

This company works with some of the major global brands like...

- Ford

- Jaguar Land Rover

- BMW

- Daimler (which is owner of Mercedes–Benz)

- Time Warner

- Indian Army

- Hyundai

- Panasonic

- Motorola

- Comcast (Owner of CNBC and biggest cable TV player in America)

and many more...

This company serves many clients across the world...

And its innovations touch millions and millions of people every day.

This company is now the leading player in its category...

And its profits are expected to multiply several times over the long term.

But this is just the beginning.

This company has positioned itself for the future.

IoT or Internet of Things will forever change the way we live. Everything will be connected. Most of the things will be autonomous and making smart decisions using Artificial Intelligence (AI).

Basically, IoT is about turning dumb objects into smart objects... by inserting chips into them and connecting them to Internet.

Cars, TVs, shoes, toasters, fitness trackers, factory machines, drones, cameras, even your cricket ball are all candidates for IoT.

World wide spending on IoT was $646 billion in 2018. And it is projected to surpass $1 trillion by 2023.

(Source: IDC)

This company is geared up to be one of the strongest players in the IoT space.

In fact, the growth potential in this industry is so huge that today...

Every major tech company is pouring

billions of dollars into IoT

For instance,

Microsoft is set to pour $5 billion over the next few years into the IoT

– Business Insider, Apr 11, 2018

Xiaomi to invest $7.18 billion in 5G, AI and IoT over next 5 years

– Business Today, Jan 12,2020

Alibaba to invest $1 billion into AI and IoT ecosystem

– Zdnet, May 20, 2020

Samsung to invest $22 billion into A.I., 5G and IoT

– CNBC, Aug 08, 2018

And the company I’m talking about is also expanding aggressively into this market.

Once this gets out in the open... its stock price could potentially see explosive rise.

This rare opportunity to grab this futuristic stock at an affordable price can vanish at anytime.

And did I tell you that this company is a zero debt company. Plus, it has huge pile of cash.

It is already on lookout for buying out smaller companies to grow itself faster in the future.

With strong capabilities in AI and IoT, I believe this company is going to be a huge wealth creator in the years to come.

This company’s stock could potentially rise by 500% or even more in the next ten years.

These companies with cutting edge technology will create new wave of millionaires in India

I can tell this to you based on my 17+ years of experience in the stock market.

In fact, I’ve spotted many hyper–growth stocks which have gone on to generate immense wealth.

For instance, today Voltas is the number 1 AC brand in India. But back in 2003 it was a small company. And it was facing tough competition from many multi–national brands.

But this competition did not deter Voltas from aiming for number 1 spot.

The company had the technological prowess. Plus, it was just beginning to get on a high growth trajectory.

The team had spotted this opportunity as early as 2003. So, we recommended a buy on Voltas in 2003.

And within just a few years... Voltas won prestigious contracts like,

- The Burj Khalifa Tower (world’s tallest residential project) and the Mall of Emirates (world’s biggest shopping mall) in Dubai

- The Airbase project in Qatar

- Plus contracts for many private airports in India.

The company increased its market share like never before. No wonder, its stock price shot through the roof.

And in 2010, when I believed it was time to exit the stock, the stock price had gone up by 2,740%

A small investment of Rs 1 lakh would have turned into Rs 28.4 lakh in 7 years.

Or Rs 3 lakh into Rs 85 lakh.

Note: Past performance does not guarantee future results. Return(s) stated above are chosen from among our best performers. Full details on how these returns were calculated is given here. Some of our losing recommendations and our overall success ratio is shared here.

In the same year, that is 2003, we also saw M&M gaining strength with their newly launched Scorpio SUV.

M&M was the dominant player in the utility vehicle segment then.

But with Scorpio, it was spreading the wings quickly from rural to urban markets.

And apart from the automobile sector, M&M was also expanding rapidly into information technology, infrastructure and financial services.

I knew that technical and engineering expertise of this company is going help it grow exponentially in the future. So, we recommended a buy on M&M.

By the time I decided to exit the stock... the stock had returned a hefty 1,821%.

Note: Past performance does not guarantee future results. Return(s) stated above are chosen from among our best performers. Full details on how these returns were calculated is given here. Some of our losing recommendations and our overall success ratio is shared here.

It would have turned Rs 1 lakh into over Rs 19.2 lakhs in just 7 years.

Or Rs 3 lakh into 57 lakh.

And did I tell you about L&T?

Today L&T is a well known brand. You see this company’s name everywhere.

Whether it is flyovers, trans–harbour sea links, metro rail, oil rigs, power plants, defence equipments. The company is present everywhere.

It’s a Rs 1,32,000 crore behemoth.

But twenty years back it was a small company, worth only Rs 2,000 crore.

Then what led to this gigantic growth?

Well, it’s their single–minded focus on growth. They used their technology and engineering skills to propel them forward.

Back in 2002, we understood the capabilities at L&T.

And we recommended a buy on this stock.

And see what happened in just 8 years.

Note: Past performance does not guarantee future results. Return(s) stated above are chosen from among our best performers. Full details on how these returns were calculated is given here. Some of our losing recommendations and our overall success ratio is shared here.

It jumped by a whopping 3,309%.

Enough to turn a small sum of Rs 1 lakh into Rs 34 lakh.

Or 3 lakh into Rs 1 CRORE.

That’s the kind of returns YOU could potentially

get from exponential growth stocks

And the two stocks I told you about today, hold similar potential for the long term gains.

The first of which is creating clean energy backbone of India by partnering with ISRO.

And the other is a leading player in Artificial Intelligence technology.

Now before I tell you about my third unstoppable tech stock... let me tell you about a virus attack that happened a few years back.

This was not a biological virus like the coronavirus.

But a deadly computer virus.

Imagine, you start–up your computer or laptop one day.

And suddenly you can’t access any of your files.

Your important documents, your photos, your videos, all the files where you’ve stored critical information.

You can’t access any of it.

And a pop–up appears on your screen saying something like this.

“We’ve encrypted your files.

Send $300 worth of bitcoins to this address in 3 days.

Or we’ll delete all your files.”

Imagine the kind of fear you would be in... if this kind of virus attacked your computer.

This virus attacked more than 200,000 computers across 150 countries.

India was the third worst hit nation.

The attackers used security loopholes in computers to spread this virus.

Though security experts found a way to stop this virus but by then a lot of damage was already done.

But the worrying thing is that this kind of cyberattacks are only going to rise in the future.

With the increasing use of technology in our daily lives, the threat of cyberattacks is growing every year.

In fact, Cybersecurity Ventures, which is a leading authority on this subject predicts...

“Cyber crime damages will cost the world $6 trillion annually by 2021.”

To put this number in perspective.

The total size of the Indian economy is just over US$ 3 trillion.

So, that’s more than two times India’s 2019 GDP.

It’s shocking how much damage these cyber attacks are causing every year.

Thus there’s a huge demand for companies which can prevent enterprises from these cyber attacks.

And the tech company that I’ve shortlisted is one of the strongest players in this space.

Unstoppable Tech Stock #3:

The Great Wall of Safety

My Unstoppable tech stock #3 has set up dedicated cyber security centres spread across three continents.

These centres monitor for cyber threats 24x7, 365 days a year.

They use advanced machine learning and artificial intelligence to detect threats in advance.

This gives them ability to prevent attacks well before they start doing damage to their clients’ data.

In the digital world, data security becomes a prime concern for any enterprise or even an individual.

That’s the reason why the global spending on cyber security is rising every year.

According to Australian Cyber Security Growth Network,

‘The global cybersecurity market is currently worth $173B in 2020, growing to $270B by 2026.’

– Forbes

And cyber security spends are only going to speed up in the post covid world.

A recent LearnBonds report found,

‘Nearly 70% of major organizations plan to increase cybersecurity spending due to the effects of the coronavirus pandemic.’

I expect it to be much larger than what these think tanks are predicting.

Why?

Because, nowadays many companies are deciding to adopt the concept of Work From Home.

Plus, many businesses which operate in traditional way are now going digital.

Thus, cyberattacks are only going to increase in the future... giving further boost to data security spend.

And this company is already a strong player in data security space. And its profits are set to grow at a rapid pace.

In fact, the government of India has shortlisted this company as one of the companies to develop a software for secure video communication between government offices.

Now apart from being a strong player in data security space... this company also has a leadership position in several segments of engineering.

It operates out of more than 40 countries around the world.

Trusted by Fortune 500 Companies

It works with half of Fortune 500 companies.

It has decades of experience in innovation and technology.

And this company is almost debt free. In fact, it has been debt free for many years.

Plus, it holds giant cash reserves.

This dual benefit has allowed it to buy out many other tech companies.

Over the last few years it has been very aggressive with acquisitions.

It has acquired many multi–million dollar and even billion dollar plus companies... giving it an edge few companies in the world have.

This company has already been a major wealth creator in the last two decades.

And I believe it will continue to do so for the foreseeable future.

All 3 stocks I told you about today are on the verge of a massive growth.

They are affordable today. But as the world discovers about their exponential growth potential... there is no limit to how high their stock prices could rise.

That’s why I believe, the time to take action is NOW.

Top 3 Stocks for 2020 and Beyond

I’ve compiled every single detail about these 3 fast–growing tech stocks in my special report.

‘How to Get Rich with India’s 3 Unstoppable Tech Stocks’

And today, I would like to rush this special report to you.

The stocks in this report can potentially offer life–changing gains in the long run.

You see, there are thousands of stocks available for buying. But the kind of stocks that can make one rich are only a few.

I’m saying this based on my almost two decades of experience in the stock market.

This is a rare opportunity and I believe NOW is the time to grab it with both hands.

I believe, the 3 unstoppable tech stocks covered in my special report could potentially create a wave of Indian millionaires.

Please read further to know, how to claim your copy of my special report for virtually FREE.

Sarit Panackal:

Sarit Panackal

Managing Editor

Hi, Sarit here. So, that was the message from Tanushree Banerjee.

You saw how it’s possible to get rich from just 3 stocks.

Now given the times we’re in right now... major growth is only going to come from tech companies.

And not some random tech companies.

But the companies with cutting edge technology which are present in fast–growing markets.

With the kind of potential wealth these stocks help you generate... you could...

Enjoy endless vacations you’ve always dreamed of...

Source: www.istockphoto.com/CreativaImages

Upgrade to a larger, more luxurious home...

Source: www.istockphoto.com/JamesBrey

Buy a luxury car that suits your personality...

Splurge on a grand wedding of your daughter...

Fund your child’s education to get into Harvard, Oxford - the best schools in the world...

Or even donate to your favourite charity...

You could achieve the ultimate financial freedom.

The freedom to do what you want.... when you want... with whom you want.

Many people dream about achieving financial freedom, but very few end up achieving it.

Because most of them have no idea that it’s even possible.

Many in the mainstream media and stock brokers... in pursuit of their self interest... only mislead them.

So, they give up on their dreams and settle for the life of mediocrity.

But... with right guidance, one can not only achieve the financial freedom.... but also build enough wealth that can last for generations.

At Equitymaster, we are committed to providing unbiased and honest research to our subscribers.

Basically, we want you to strike it rich.

That’s why I want to send you a copy of this latest report...

‘How to Get Rich with India’s 3 Unstoppable Tech Stocks’

The information contained in this report could help you generate life–changing gains in the long run.

These 3 cutting edge tech stocks could generate mind–boggling returns in the long run.

Remember, the American FAANG stocks, I’ll once again show you the chart...

(Source: NASDAQ)

The 3 stocks covered in Tanushree’s report hold similar potential in the Indian markets.

Now this special report is worth Rs 6,000...but today you can get it FREE, if you agree to a risk free 30–Day trial of Tanushree’s bluechip stock recommendation service, StockSelect.

StockSelect

With StockSelect, Tanushree recommends India’s most stable, safe, and proven stocks. And she does it with very high precision.

I’ll give you a glimpse into how Tanushree guides StockSelect subscribers capture incredible gains in record time.

Just see this chart of L&T.

Note: Past performance does not guarantee future results. Return(s) stated above are chosen from among our best performers. Full details on how these returns were calculated is given here. Some of our losing recommendations and our overall success ratio is shared here.

You can clearly observe how the entire bull run in the stock price was captured. This was the high–growth phase of L&T.

StockSelect subscribers who acted on this stock recommendation could have turned Rs 1 lakh into Rs 34 lakh.

Or Rs 3 lakh into a mind–boggling Rs 1 crore.

All in less than 8 years.

A similar story can be seen with State Bank of India.

As you can see from the chart...

Note: Past performance does not guarantee future results. Return(s) stated above are chosen from among our best performers. Full details on how these returns were calculated is given here. Some of our losing recommendations and our overall success ratio is shared here.

Prior to our buy recommendation on this stock, there was hardly any growth in the stock price.

But according to Tanushree’s research, State Bank of India was about to take off in a massive way...

Thus we recommended a buy, and as expected the stock went on a mega bull run.

And just before the trend was beginning to die out, we got out of it.

This stock went on to offer 1,197% returns.

Which means, Rs 1 lakh would have turned into around Rs 13 lakh.

Or Rs 3 lakh into a whopping 39 lakh in just 8 years.

We can take the case of Bajaj Auto.

Note: Past performance does not guarantee future results. Return(s) stated above are chosen from among our best performers. Full details on how these returns were calculated is given here. Some of our losing recommendations and our overall success ratio is shared here.

Once again almost the entire growth trend was captured.

This stock went on to offer 575% returns in less than 5 years.

I’ll tell you about a few more... for instance...

2,740% in Voltas in around 7 years.

Note: Past performance does not guarantee future results. Return(s) stated above are chosen from among our best performers. Full details on how these returns were calculated is given here. Some of our losing recommendations and our overall success ratio is shared here.

1,821% in M&M in less than 7 years.

Note: Past performance does not guarantee future results. Return(s) stated above are chosen from among our best performers. Full details on how these returns were calculated is given here. Some of our losing recommendations and our overall success ratio is shared here.

453% in Dr Reddy’s in eight and a half years.

Note: Past performance does not guarantee future results. Return(s) stated above are chosen from among our best performers. Full details on how these returns were calculated is given here. Some of our losing recommendations and our overall success ratio is shared here.

1,004% in Exide Industries in less than 9 years.

Note: Past performance does not guarantee future results. Return(s) stated above are chosen from among our best performers. Full details on how these returns were calculated is given here. Some of our losing recommendations and our overall success ratio is shared here.

So, you can see yourself, just a handful of StockSelect recommendations like these could help one achieve amazing wealth in a matter of a few years.

As a member of StockSelect, you can get one such high–potential stock recommendation from Tanushree, every month.

As and when Tanushree discovers a new mega trend... a new money–making opportunity... a new hidden gem...

You get to grab it first–hand.

Now I want to make one thing clear here.

Not every StockSelect recommendation may go on to offer massive gains.

Some may fail also.

In fact, if someone tells you, they have 100% positive track record, then you should ideally run away from that person.

It’s very possible that they may be lying to you.

Because in the stock market there are no guarantees.

For instance, some companies simply did not do as per our expectations.

Indian Hotel, for example, was a 42% loss. Then there was Crompton Greaves with 61% loss, and BHEL was a 39% loss.

But since 2002, every 7 out of 10 stocks recommended and closed by Tanushree has been a hit... generating superb returns for StockSelect subscribers.

Note: Past performance does not guarantee future results. Return(s) stated above are chosen from among our best performers. Full details on how these returns were calculated is given here. Some of our losing recommendations and our overall success ratio is shared here.

And this incredible track record of success is the reason why over 12,000+ subscribers rely on Tanushree and her team to pick the winners for them.

Hear out what some of the StockSelect subscribers have to say about us:

“Happy to have made a lot of money”

I have been with equitymaster for nearly 20 years – happy to have made a lot of money – Really investor friendly and independent analysis.

– Dildar Singh, Thane

“recommending reliable multibaggers time and again...”

My experience is that the StockSelect is the most reliable for short and long term. I appreciate the solid analysis done by Mrs. Tanushree Banerjee that helps her in recommending reliable multibaggers time and again inspite of the market’s erratic behaviour.

- Y V S C Chowdary

“Enjoying handsome returns...”

I am a subscriber of Equitymaster since 2009. Also enjoying handsome returns since then. I made this decision of joining Equitymaster in one of the tough phases in my life and fully got paid for the right decision.

– Pankaj Deshkar, Pune

“[Equitymaster has] given me more wealth than my professional career”

Equitymaster has made me more and more richer every year since my association with them. It has given me more wealth than my professional career.

– Dr C V Ajmera, Rajkot

I’m sure in the coming years I can expect one such letter of praise from you also.

Now since you took the time out to read this message today, I’m giving you an opportunity to claim a 30-day trial of Tanushree’s StockSelect service, at a price much lower than it’s regular price.

Here’s Everything You Will Receive As Soon As You Agree to a 30 Day Trial of StockSelect

Details of the Biggest Wealth Creators of the Next Decade

Tanushree’s latest special report cover all the details on the biggest wealth creators of the next decade...

‘How to Get Rich with India’s 3 Unstoppable Tech Stocks’

The 3 stocks covered in this report have the potential to generate life–changing gains for you.

Now this special report is worth Rs 6,000.

But if you join StockSelect today, you’ll get it for absolutely FREE.

StockSelect: Your Guide to Help You Achieve Financial Freedom

Our oldest and most popular stock recommendation service, StockSelect, would be your guide to achieve financial freedom over the coming years.

As a member of StockSelect, you will get your hands on everything – from our past records to our present recommendations.

From our past recommendations, you can even cross–check everything – whatever facts we have mentioned in this report.

Returns like 3,309%, 2,740% and 1,821% and many more.

Note: Past performance does not guarantee future results. Return(s) stated above are chosen from among our best performers. Full details on how these returns were calculated is given here. Some of our losing recommendations and our overall success ratio is shared here.

You can also see all of our current recommendations.

Monthly Recommendation Report

On or before the last Friday of every month we’ll release a detailed recommendation report which includes:

- One new recommendation report

- Latest views and updates on existing recommendations

Monthly Webinar

We record a webinar every month with updates on the open positions. With these updates, you will never be left in the dark.

StockSelect’s Archives

Once you subscribe to the StockSelect, you will get access to all issues and recommendations of the StockSelect shared in the past...

Equitymaster’s Private Briefing: Never Miss A Single Thing We Publish

We now release a weekly email titled "Private Briefing" which gives you a round–up of our best research published during the week.

However, the Private Briefing isn’t just about compiling everything in one place...

If we’ve met any companies lately, or if there’s some interesting discussion going on within our research team with regard to some company, we also tell you about it in the Private Briefing.

Private Briefing is generally valued at Rs 60,000 a year.

But as member of StockSelect, you get it for FREE as long as you stay with us.

Equitymaster Investor Hour: A Weekly Podcast

At Equitymaster we truly believe in the saying, "learning is earning". And what better way than to learn from the very best in the business!

That’s why, exclusively for the benefit of our valued premium members, we invite the smartest investing minds from across the world, to share their investing secrets.

This is a rare chance to go inside the minds of the investing gurus and ask questions that the mainstream media ignores.

You will hear directly from them about their best recommendations, how they found them, where they’re investing now and much more.

We have already had Investing stalwarts like Marc Faber, Jim Rogers, Ajit Dayal, Vijay Bhambwani, and Rahul Shah share their ideas....

And as member of StockSelect, you get absolutely FREE access to this premium podcast.

24/7 Access to a Members Only Website

Any time, any day, you can log onto the website... read every report, every newsletter issue, review all the recommendations, or report a concern about your membership.

Equitymaster... On the Go!

Now, you can access Equitymaster on your smartphone through our Mobile Apps as well. Through the app, you can access the latest research reports, stock updates, all our Free e newsletters, all other subscriber features...on the go!

A Dedicated Customer Service Team

If you ever have questions about your membership, send our customer service team an email. They will get back to you at the earliest and walk you through whatever you need.

So again, you’ll never have to worry about missing any critical research from the StockSelect or any of our other services you’re subscribed to.

You can click on a link in your email, and get the full information whenever you want.

Most important of all, though, once you join the StockSelect, you will have access to all our research and analyses that can help you to retire early and wealthy.

Now the question is what all with this cost?

You Get All These Benefits For...

Well, if we were to offer all the benefits I mentioned to you to high net worth individuals...

We could have easily charged upwards of Rs 1,00,000 per year.

But we are not here to make rich folks richer.

Our mission is to guide regular investor like you achieve incredible wealth.

We want you to strike it rich.

That’s what we’ve been doing for the last 25 years.

And our commitment and solid track record of success has allowed us to win the trust of more than 30,000 subscribers.

Over the years, we’ve guided many of them to achieve financial freedom.

Now since we’ve so many subscribers, we pass on the benefits of this scale to everyone.

Thus, a single subscriber ends up paying a very nominal amount.

And considering the amount of efforts that go behind running a service like StockSelect...

We have priced StockSelect at only Rs 6,000 per year.

Now if you think about it, a single winner from StockSelect recommendations can cover that cost for hundreds of years into the future.

Thus, StockSelect at Rs 6,000 per year is an absolute steal.

But since you took the time out today to read this message... you won’t pay anywhere near that amount.

Today, you can get access to StockSelect

at a huge 50% OFF.

Yes, if you join us today, then you get all the benefits I mentioned to you at only Rs 2,950 per year.

Now Rs 2,950 per year comes to around 8 rupees per day. That’s less than price of a cup of tea.

With these resources in your hand, and Tanushree on your side, there is nothing to stop you from building life–changing wealth over the coming years.

And for that, all you have to do is give a risk–free try to Tanushree’s StockSelect service.

Now if you still have doubts then try StockSelect for 30 days and see whether it is right for you or not...

Take 30 Days to Decide

Like we said before, you can see all our past recommendations as well as our current recommendations.

And if there is a one in a million chance that you’re not satisfied...

Then at any time within the next 30 days...

You can cancel our service and get your full refund.

Is it Fair Enough?

So, the control is always with you.

We’ll refund every penny of your membership fee.

Plus, you can keep everything you’ve received.

It’s our way of saying “thank you” for giving it a try.

I think you’ll agree that’s more than fair.

Now all the 3 stocks covered in Tanushree’s special report are tapping into high growth industries.

They’ve been consistent wealth creators for many years. But Tanushree believes, this is just the beginning.

Because,

- They have presence in multi–billion dollar markets.

- They are aggressively expanding into these markets and crushing their competition.

- And they are strong enough to beat even the global giants.

Their growth has just begun. A major rally in their stock prices is yet to come.

Now, you need to take a decision.

Because as Tanushree said, there are thousands of stocks available to buy. But only a few have the potential to make you rich.

You certainly wouldn’t want to tie your money in laggards while your neighbours become rich with winning stocks.

So, the choice is yours.

Once you click on that orange button appearing on the screen saying, ‘I Want to Get Rich’

You’ll be taken to a secure page where you can once again review everything you’ll get today.

And with our 30 Day Money back guarantee, you have absolutely zero risk.

If you don’t like what you get today, then just call us before the 31st day and we’ll refund every single rupee you paid to us.

Now I leave the final decision to you.

If you want to achieve a potential eight–figure fortune in the long run...

If you want to obtain true financial freedom...

If you want to build great wealth, not just for yourself... but even for your future generations...

Then click on that orange button on the screen saying, ‘I Want to Get Rich’

We look forward to having you onboard as one of our members... and showing you how to achieve financial freedom over the coming years...

Thank you for your time. We’re excited to welcome you to our growing family of the StockSelect.

Best Regards,

![]()

Sarit Panackal

Managing Editor,

Equitymaster Agora Research Private Limited (Research Analyst)

Frequently Asked Questions:

Still have questions?

We’ll do our best to answer them right here so that you feel completely comfortable when you decide to join StockSelect today.

What are FAANG stocks?

FAANG is a short-form for Facebook, Amazon, Apple, Netflix, Google. These are the fastest growing tech companies in the U.S.

This seems to be too good to be true...what’s the “catch” in this offer?

The only catch is you need to act fast now. We have over 1.7 Million readers across the globe. Once we feel that we have good enough number of members on board, we reserve the right to say "No" to you.

So, the only way you can take advantage of this offer is by hitting the “Subscribe Now” button before we reach our limit...Remember, hitting this button does not obligate you to anything. You will simply be redirected to another page with additional information about this special offer.

Why do I need your research service, StockSelect?

StockSelect saves you a lot of time and headache of doing the research work yourself.

You can leave all the hard–work to us. For instance, efforts to research the company financials, talk to the company’s management directly, dig deep into their numbers and do all the other home works necessary.

You see, behind each of our recommendations, there is a tremendous amount of mental work and physical work involved.

But if you can do all this...You’re more than welcome to attempt to try this on your own with what we’ve shown you today.

That being said, you can save yourself a lot of time and heartache by simply subscribing to our research service and seeing the strategy laid out for you, step by step.

How much will it cost?

The cost of a one–year Membership is Rs 6,000...which is an absolute steal considering the amount of value you’re going to get for the next 12 months.

HOWEVER – if you act right here, right now, we’ll slash the cost of membership to just Rs 2,950. That saves you Rs 3,050 that you can spend however you’d like: Whether you use it to invest in your next StockSelect stock recommendation or treat your spouse to dinner at the fanciest restaurant in town.

You can find the complete details by hitting the "Subscribe Now" button. Remember, hitting this "Subscribe Now" button does not obligate you to anything.

How much could I make if you’re right?

See, we’re not financial advisors. We’re an independent stock research firm. We do not guarantee any returns. And if someone guarantees you any kind of return in stock market, you should be suspicious.

What we can certainly guarantee you is our 100% commitment to guide you in finding the best stocks that have the highest chance of generating best possible returns in the next 3–5 years.

How are the returns calculated?

The returns mentioned here are calculated as the % difference between the price on the date of closure of the recommendation and the price on the date of the recommendation. Details of the calculation are as below:

| Stock name | Price on date of Recommendation (Rs) | Price on date of closing (Rs) | % Returns achieved |

| State Bank of India | 23 | 298.3 | 1197% |

| Voltas | 7.5 | 213 | 2740% |

| L&T | 31.68 | 1080 | 3309% |

| M&M | 26.5 | 509 | 1821% |

| Asian Paints | 30.6 | 268.4 | 777% |

| Bajaj Auto | 277.5 | 1872 | 575% |

| Dr Reddy’s | 542 | 2999 | 453% |

| Titan | 3.35 | 40 | 1,082% |

| Exide Industries | 12.5 | 138 | 1,004% |

| Indian Hotel | 147 | 86 | -42% |

| Crompton Greaves | 248 | 97 | -61% |

| BHEL | 151.3 | 92 | -39% |

Do note that past performance is no guarantee for future results.

How much could I lose if you’re wrong?

No investment strategy is 100% safe. And you should not invest anything more than you could afford to lose. With that being said, you should talk to your financial advisor regarding asset allocation and appropriate risk profile.

Please remember that despite doing all the hard work we do every day, sometimes even we go wrong.

For example – We recommended Wockhardt Ltd in 2013 that ended up going down 67%.

Then, there’s Petronet LNG we recommended in 2011 which did not meet out returns expectations and went down 31%.

Having said that, the overall success ratio of StockSelect is 73% for all closed positions in the period 2002-2020.

Which means, 7 out of every 10 closed recommendations have hit their mark in the past.

Can I really try this out for 30 days?

Yes, you can! In fact we encourage you to do that right now. Just check all our past issues, current open recommendations, and read all special reports at your own leisure time. If in 30 days, you’re not absolutely thrilled, then simply contact us on the 31st day, and we’ll refund 100% of your subscription fee right away. Of course, you get to keep whatever you have read and downloaded. That’s our way of thanking you of giving us a try.

Does StockSelect genuinely only cost Rs 2,950 per year? And how can you make it so cheap?!

Yes, for a very limited time, we’ve decided to price it for only Rs 2,950/year. The reason we make it so cheap is because we want as many people as possible to access our research.

Since 1996, we have been guiding hundreds of thousands of readers like you with our unbiased stock research. And we want to do the same for many years to come.

How difficult will it be for me to act on a StockSelect recommendation?

It’s not difficult at all. There is no technical analysis that you’ll have to perform. All you need to know is the specific play, and when to get in and when to get out. We will do all the hard work for you. Each stock alert will tell you exactly what to do. You just have to decide whether you want to follow what we recommend!

This sounds like a “get rich quick scheme” to me – are you for real?

This is NOT a “get rich quick” gimmick. Equitymaster, is in the business of sharing ideas and actionable research that can help you thrive in any type of market. And we’ve been doing this since 1996. If we published foolish or dishonest material – we’d be out of business by now.

Can anyone really do this? Even me?

YES, anyone can learn to do this. Why? Because we designed this research service especially for readers like YOU. That is, a regular Indian who wants to improve their financial circumstances, now have a very realistic chance to do that without taking ANY unnecessary risks.

Don’t wait until it’s too late. Hit the “Subscribe Now” button and take advantage of this limited-time offer while you still can. You won’t be obligated to do anything by clicking this button. You’ll just be sent to another page with more information on this special offer.

(You Can Review Your Order Before It’s Final)

Copyright © Equitymaster Agora Research Private Limited. All rights reserved.

Any act of copying, reproducing or distributing this newsletter whether wholly or in part, for any purpose without the permission of Equitymaster is strictly prohibited and shall be deemed to be copyright infringement.

LEGAL DISCLAIMER:

Equitymaster Agora Research Private Limited (Research Analyst) bearing Registration No. INH000000537 (hereinafter referred as ‘Equitymaster’) is an independent equity research Company. Equitymaster is not an Investment Adviser. Information herein should be regarded as a resource only and should be used at one’s own risk. This is not an offer to sell or solicitation to buy any securities and Equitymaster will not be liable for any losses incurred or investment(s) made or decisions taken/or not taken based on the information provided herein. Information contained herein does not constitute investment advice or a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual subscribers. Before acting on any recommendation, subscribers should consider whether it is suitable for their particular circumstances and, if necessary, seek an independent professional advice. This is not directed for access or use by anyone in a country, especially, USA, Canada or the European Union countries, where such use or access is unlawful or which may subject Equitymaster or its affiliates to any registration or licensing requirement. All content and information is provided on an "As Is" basis by Equitymaster. Information herein is believed to be reliable but Equitymaster does not warrant its completeness or accuracy and expressly disclaims all warranties and conditions of any kind, whether express or implied. Equitymaster may hold shares in the company/ies discussed herein. As a condition to accessing Equitymaster content and website, you agree to our Terms and Conditions of Use, available here The performance data quoted represents past performance and does not guarantee future results. Equitymaster may hold shares in the company/ies discussed in this document under any of its other services. Please read our detailed Share Trading Guidelines here

If you have any questions about your subscription, or would like to change your email settings, please contact Equitymaster at +91 22 61434055, Mon-Fri 10.00 AM to 6.00 PM (IST). If you wish to contact us, please click here

SEBI (Research Analysts) Regulations 2014, Registration No. INH000000537.

Equitymaster Agora Research Private Limited (Research Analyst) 103, Regent Chambers, Above Status Restaurant, Nariman Point, Mumbai – 400 021. India.Telephone: +91–22–6143 4055. Fax: +91–22–2202 8550.

Email: info@equitymaster.com.

Website: www.equitymaster.com. CIN:U74999MH2007PTC175407.