Will Valuations of Loss Making Startups Soon Bite the Dust?

- In this issue:

- » Online retail spending to surge in India

- » How do you find dividend multibaggers?

- » ...and more!

Flipkart's growth story in India has always caught the fancy of the average Indian. It's not just about the company but the much anticipated future growth potential of ecommerce in the country. And the way Flipkart has managed to get funding for its operations also continues to interest a lot of us.

Fathom this. In July 2015, Flipkart raised US$700 million with a valuation of US$15.2 billion. This valuation is worth nearly eight times the combined market capitalisation of retail giants Future Group, Trent, and Shoppers Stop.

Flipkart would be the twentieth largest company by market capitalisation and by that yardstick can easily become a part of the BSE 30 Index. Thus, it appeared that the sky was the limit for Flipkart. It seemed like Flipkart had become a darling of private equity investors and venture capital funds.

But as they say, sometimes reality hits you straight in the face and knocks you down. Last month, Morgan Stanley Institutional Fund, a mutual fund investor in Flipkart, trimmed Flipkart's valuation by US$4 billion in their recent valuation report. This is a whopping 27% drop in valuation.

Flipkart's valuation markdown will have consequences for the other start-ups and ecommerce companies as everyone seems to be riding in the same boat.

As an analyst, I always wondered about this crazy valuation. Is this valuation realistic or just one big bubble? With every round of funding, valuations of ecommerce companies keep surging to exorbitant levels.

What were investors thinking during these rounds of funding? Were they looking for big gains like Facebook investors did back in 2012? If that's the case, then the question is whether these ecommerce companies are earning a profit like Facebook. If not, how could they come up with an IPO?

As I have written previously, Flipkart is reportedly planning to list on an international exchange, possibly the NASDAQ. Why NASDAQ? India's IPO rules are a bit strict when it comes to listing an un-profitable firm. But that is not the case on the NASDAQ.

As per regulatory filing, Flipkart has reported a loss of Rs 20 billion in FY15. In FY14, the company reported a loss of Rs 7.15 billion. Clearly, the losses have gotten bigger.

You have to then wonder how ecommerce companies use the funds they raise. I have observed that after the rounds of funding, these companies normally come out with full-page advertisements on the front-pages of newspapers. They come up with discount offers, flash sales, cash backs, etc. Is this the way they acquire new customers? Or are they just burning money?

Another question is how this business will sustain over a period of time. How many times will the founders of start-up ecommerce firms raise money to stay in business? Do they think the customer will stick with them when a plethora of other options are available?

The key here is how profitable these businesses are. What is the use of selling goods worth US$1 billion or US$10 billion if not a single penny is coming through the bottomline?

How would you value such business? On the basis of GMV (gross merchandise value)? A GMV number that is neither transparent nor correct. GMV does not include discounts, costs, or product returns. In other words, actual cash collected by ecommerce companies is far less than the GMV value. GMV is an inflated figure.

As an investor, you may want to participate in a growth story such as Flipkart. After all, it is the biggest ecommerce company in India, a market leader, has good penetration across India, and so on.

But the basic question remains unanswered. How will you value Flipkart's business? Does the company even earn a profit? Does the company have a sustainable business model? Can it withstand competition? My guess is that venture capital funds and other investors have now finally started to ask these questions.

When it comes to businesses, valuations, and investment opportunities, my colleagues and I at Equitymaster think differently. It is important to ignore the hype and publicity and focus on the fundamentals. How will the business grow? What are the key revenue drivers? Does the business have any competitive advantages How effectively does the company allocate capital? What are the risks and challenges? All of these questions are important because they help us separate the wheat from the chaff.

Our subscribers may criticise us for being skeptical about most of the IPOs. Similarly, when the stock market is overvalued, we might not come out with many buy recommendations. But we certainly know how to profit from a crisis.

In fact, the recent correction in the stock markets provided a rare opportunity. Last month, the StockSelect team recommended four stocks in one go.

The last time we were spoilt for choice with so many safe stock ideas was in 2009 and 2013. And it could be another three or four years before we get an opportunity like this again.

You can get full details of these four bluechips today via StockSelect. StockSelect is our bluechip stock recommendation service with an excellent track record average of 77.3% from 2002 to 2015. This means about eight out of every ten stocks recommended through StockSelect have hit their targets. See for yourself if you too wish to give it a try.

|

--- Advertisement ---

Profit From Junior Blue Chips... We have released our latest Special Report on the best of the best small caps - Junior Blue Chips! Yes, we believe Junior Blue Chips possess the high growth potential of small caps along with the stability of blue chips. That is an amazing combination every investor would want in his portfolio. And the best part is you can get this report for FREE! Just click here to know how... ------------------------------ |

Besides investing in stocks with strong businesses, another indicator of a good quality stock is the dividends that the company doles out to its shareholders. After all, dividend forms an important component of total returns. Infact to a large extent, it is the predictable component of total returns. But the question is - Should you invest in all dividend paying stocks?

Not really. It all depends on the business fundamentals of the company. How stable are its revenue streams? For this, it is necessary to understand whether the business of the company is stable or is it risky, cyclical, based on too much debt, etc. The former is the better business. Because if the company's own income is dicey, then its dividend stream will eventually follow suit.

The other factor to be considered is whether the company is able to grow its earnings or not. If it has stable cash flows and is able to grow them, then it should ideally follow that earnings are growing too. If earnings don't grow, then it will follow that dividends will not grow.

But if the earnings growth is really healthy and this translates into healthy dividend payouts then you as the investor can really benefit immensely.

Indeed, in yesterday's edition of the 5 Minute WrapUp, Tanushree Banerjee, managing editor of The India Letter, talked about how in their unique way, dividends from fast-growing companies can yield great returns. The compounding of dividends over several years can fetch you several times your invested capital.

That is why it is crucial to not invest in each and every dividend stock. What you want to do is to buy the most solid, consistent, and fastest-growing dividend companies - dividend multibaggers, in other words.

But what exactly are dividend multibaggers? How do you find them? And what price should you pay for them?

Tanushree laid out just the details you need in her special report - How to Pocket 10-30% Returns Without Selling Your Stock. Click here to join in and benefit from great dividend stocks right away...

3:02 Chart of the day

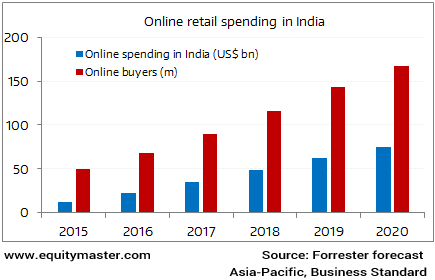

Despite growing losses, the growth potential of ecommerce continues to excite many. As reported in the Business Standard, Forrester expects ecommerce in India to grow from US$12 billion in 2015 to US$75 billion in 2020. Today's chart shows this.

The growth is based on the idea that the online buying population will grow in India at a compounded annual rate of 28%.

And it's not just India. Online retail spending is expected to surge in China, Japan, South Korea, and Australia too. But the rate of growth is touted to be faster in India and China.

The growth potential may be there. But we maintain that ultimately what matters for ecommerce firms is profitability. Currently, most are mired in losses. And if these losses keep getting bigger, there will be a point when venture capitalists and private equity funds will re-assess their investments. And start thumbing down valuations. A glimpse of which we have already seen for the biggest of them all, Flipkart.

Ecommerce Expected to Grow in India

Do you think that strong revenue growth from online retail will translate into profit growth for Indian ecommerce firms? Let us know your comments or share your views in the Equitymaster Club.

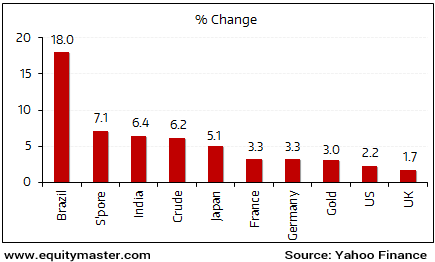

Global markets closed on quite an encouraging note in the week gone by. Stock indices across Asia, US and Europe surged, as signs of an improving US economy seemed to restore investor confidence. Positive employment data announced also cheered investors. The US markets ended higher for the third consecutive week. Major indices touched two-month highs, posting the highest weekly gain since October 2015.

The most noticeable rally was seen in the Brazil stock market, that surged by almost 18% in a week's time. The stocks rallied as prospects increased of a change in government. The commodity prices moved upwards with oil prices touching two month highs.

China equity markets closed higher by 3.9%. Investors are closely watching the National People's Congress, an annual legislative session that will begin today. Policy makers are expected to rollout plans to revive the slowing economy.

Back home, the BSE Sensex ended the week higher by 6.4%. Both domestic and macro factors boosted market sentiments. Foreign investors poured money into Indian equities post the budget. The rally in the markets was driven by sectors such as banks, capital goods, and metals.

Performance During the Week Ended 5th March, 2016

4:55 Weekend investment mantra

"To invest successfully, you need not understand beta, efficient markets, modern portfolio theory, option pricing or emerging markets. You may, in fact, be better off knowing nothing of these. That, of course, is not the prevailing view at most business schools, whose finance curriculum tends to be dominated by such subjects. In our view, though, investment students need only two well-taught courses - How to Value a Business, and How to Think About Market Prices." - Warren Buffett

This edition of The 5 Minute WrapUp is authored by Radhika Pandit (Research Analyst).Today's Premium Edition.

Today being a Saturday, there is no Premium edition being published. But you can always read our most recent issue here...

Recent Articles

- All Good Things Come to an End... April 8, 2020

- Why your favourite e-letter won't reach you every week day.

- A Safe Stock to Lockdown Now April 2, 2020

- The market crashc has made strong, established brands attractive. Here's a stock to make the most of this opportunity...

- Sorry Warren Buffett, I'm Following This Man Instead of You in 2020 March 30, 2020

- This man warned of an impending market correction while everyone else was celebrating the renewed optimism in early 2020...

- China Had Its Brawn. It's Time for India's Brain March 23, 2020

- The post coronavirus economic boom won't be led by China.

Equitymaster requests your view! Post a comment on "Will Valuations of Loss Making Startups Soon Bite the Dust?". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!