Can You Compress Sound Investing into Just One Sentence?

In this issue:

» ROEs of Indian companies on the decline

» Savings and borrowings of Indian households fall

» ...and more!

00:00 |

|

|

|

We know this is a very difficult scenario to imagine. But the odds of such a cataclysm happening over the next 50-60 years have only gone up. We are more than seven billion people and counting, and we need only one of them to succeed.

Nevertheless, we are not discussing odds here. We are imagining the worst has already happened. So let's get back to the exercise. What if, along with life and matter, all of knowledge is also destroyed...except just one statement?

Yes, that's correct. If just one statement could be passed on to the next generation, what statement would contain the most information in the fewest words?

Well, for the field of science at least, the great physicist Richard Feynman had it all figured out.

He felt strongly about the atomic hypothesis, that 'All things are made of atoms -- little particles that move around in perpetual motion, attracting each other when they are a little distance apart, but repelling upon being squeezed into one another.'

Feynman believed this statement held an enormous amount of information about the world. All one had to do was apply a little imagination and thinking. Feynman's statement is widely acknowledged as pure genius.

Let's move from science to investing. If the next generation were to become successful long-term investors, what one statement contains the most information in the fewest words?

Well, like Feynman, Benjamin Graham, the father of value investing, had it all figured out. He may not have anticipated a nuclear scenario, but he did believe that the secret to sound investing could be reduced to a single statement -- in fact, to just three words: 'margin of safety'.

Do you agree? Perhaps you'd prefer this gem from Warren Buffett, the simple rule that dictates his buying: 'Be fearful when others are greedy and be greedy when others are fearful.' Does this statement contain the most information in the fewest words about sound investing?

Take a closer look and you will realise Graham and Buffett's rules are intertwined. An investor's odds of finding a stock with an adequate margin of safety increase as fear spreads through a sector or market. And it is mostly in these fear-infested waters that the investor should fish.

Now, we don't mind combining the two to come up with a most informative rule of our own: 'Look for the stocks most investors fear and invest in the ones trading at a significant margin of safety to their intrinsic value.'

We are sure the next generation will benefit from this simple rule as greatly as the current generation has.

What do you think? Do you agree the investment statement we just highlighted is the most informative one? Is there any other rule that has played the single biggest role in your investing success? Let us know your comments or share your views in the Equitymaster Club.

|

--- Advertisement ---

Even Just Around Rs 5 Per Day Could Help You Accumulate Solid Returns... Yes, if invested wisely, even just around Rs 5 per day could help you accumulate solid returns...

|

02:50 |

|

|

Business daily Mint recently observed that the just ended financial year (FY15) saw every Rs.100 of shareholder capital generate only about Rs 11.7 in net profit. That's a level last seen in way back in FY01, a time when the Indian economy was going through one of its roughest patches. And this fall from grace comes on the back of ROEs touching levels as high has 20% during FY06-FY08. The report goes on to observe that at its peak in the last ten years, companies that make up the MSCI India Index had ROEs as much as 9-14% higher than its peers in the rest of the globe. This is down to just 3-5% now.

Make no mistake. These developments have real implications for stock prices. ROEs are closely intertwined with valuations. The more profitable a company, the higher its value. And vice versa. Indian companies have traditionally enjoyed premium valuations compared to their global peers. If we are to hold the fort on this front, one hopes that these declines are only cyclical and not structural in nature.

03:55 |

Chart of the day | |

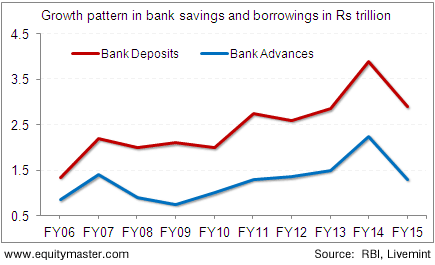

Things are similar on the borrowing side too. Households' bank borrowings fell 40% YoY in FY15. Considering that borrowings by households often represent physical investments, these too are likely to be down. Economic analysts speculate that these indicators might have declined further in FY16. Hardly good news for an economy that is looking to kick-start its investment cycle once again.

|

04:45 |

|

|

04:55 |

Today's investing mantra |

Many Indians do not give much thought to retirement planning. While they focus on leading a rich and fulfilling life in their younger years providing for their kids and families, most are not able to maintain that lifestyle once they become senior citizens. Anisa Virji, the Managing Editor of Common Sense Living, has made a very strong case for retirement planning and why it is necessary if you want to continue leading a rich, independent life without having to depend on your children. Well, if you are serious about living well today and retiring well tomorrow, I recommend you read Anisa's thoughts on this and how you can get access to the Ultimate Retirement Bundle...

Today's Premium Edition.

Ecom Companies for Sale: Buyer Beware!

Do e-commerce firms deserve the valuations they are enjoying.

Read On...

| Get Access

Recent Articles

- All Good Things Come to an End... April 8, 2020

- Why your favourite e-letter won't reach you every week day.

- A Safe Stock to Lockdown Now April 2, 2020

- The market crashc has made strong, established brands attractive. Here's a stock to make the most of this opportunity...

- Sorry Warren Buffett, I'm Following This Man Instead of You in 2020 March 30, 2020

- This man warned of an impending market correction while everyone else was celebrating the renewed optimism in early 2020...

- China Had Its Brawn. It's Time for India's Brain March 23, 2020

- The post coronavirus economic boom won't be led by China.

Equitymaster requests your view! Post a comment on "Can You Compress Sound Investing into Just One Sentence?". Click here!

2 Responses to "Can You Compress Sound Investing into Just One Sentence?"

Savio

Sep 28, 2015I wonder if we can assess the potential losses that the companies are making.

So like say 20% of GMV are losses (if not more). I am not sure of the percentage.

So if we estimate total losses (running into billions I suppose), we can then figure out how many years it would take the company to turn profitable, once (and if?) it starts making profits.