A Three-Legged Stool Approach to Generating 3,600% Returns

- In this issue:

- » Startups with the least funding have done best

- » Will the government achieve the fiscal deficit target for FY17?

- » ...and more!

Looking to build a portfolio of quality stocks with a twenty-year time horizon?

Warren Buffett uses the 'punch card' analogy to drive home the importance of selective bets in public securities.

This punch card has twenty holes, and each investment in a security will take a hole.

So, throughout entire investing life, you will only be able to buy into twenty opportunities.

How, then, would you go about finding future multi-baggers?

Today, I would like to share a simple idea from a renowned value investor.

Chuck Akre, who runs Akre capital management is renowned for his ability to identify companies with great potential. He first identified and invested in Berkshire Hathaway way back in 1977.

Mr Akre draws inspiration from Thomas Phelps, whose idea was finding stocks which can compound capital at high rates and thus have the potential to deliver 100 baggers.

He has shared a simple construct which will help you in your search for outstanding investments. A three-legged stool construct.

A company must be evaluated on three important aspects.

- The Business model of the firm.

- The Management quality of the firm.

- Reinvestment prospects of the firm.

Three-Legged Stool Construct

Here's Mr Akre:

- The first leg has to do with the quality of the business enterprise, and we're looking for businesses that earn high returns in the owner's capital. We spent a lot of time trying to focus on what's causing that better-than-average result, return on capital, to occur, and is it getting better or worse.

The second leg of the stool goes to the issue of the people who manage the business. And not only are they terrific managers, but are they honest and do they have high integrity? Do they see that what's happening at the company level is happening identically at the per share level?

And then lastly, the third leg is the issue of reinvestment. We call it sometimes the glue that holds these together. That is, is there an opportunity that exists because of the skill of the manager, the nature of the business to reinvest what we presume is excess cash. To reinvest that in a way to continue to earn these above-average rates of return.

That's it. If you can find companies with these three qualities, you have a potential compounder of your capital.

Once you have found a great business run by an ethical management that has the potential to reinvest its own capital, compounding takes over.

Think about it. A company growing its earnings at 20% CAGR will multiply its earnings 36 times in twenty years, assuming the valuation multiple stays constant.

In a business which can earn a good return on capital and has an ability to reinvest its profits will provide good returns even if you end up paying an optically expensive looking price.

- If a business earns 18% on capital over 20 or 30 years, even if you pay an expensive looking price, you'll end up with a fine result - Charlie Munger

Why are institutions not able to find these great ideas?

Institutions are often pressured to deliver results every quarter, face redemption pressures etc. and thus miss out on staying put in such good companies for long term.

Thus, thinking in terms of longer time horizons is an edge that individuals have while institutions lack.

If Chuck Akre's philosophy of finding profitable investments interests you, here is something you must look at.

The India Letter team is always on the lookout for outstanding businesses with an impeccable management quality which are riding on a secular macro trend of India's long term prospects.

Join us here to help you find your next potential wealth compounder.

03:50 Chart of the Day

Indian startups are facing tough times. Valuations are falling, venture capital funding is not easy anymore, competition has become fierce, and profits remain elusive. Many startups that were considering IPOs have had to rethink their plans.

In this situation, it is unlikely that we will see a flood of startup IPOs anytime soon. But what if there was a change in sentiment? If Indian investors get a change to put their money in such IPOs, should they? It would be instructive to find out how the many VC funded startups have performed in the US after listing.

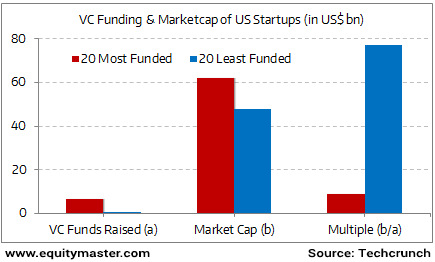

Today's chart shows the gains from US startup IPOs between 2011 and 2015. Facebook has been excluded due to the fact that its huge size distorts the average numbers.

Clearly, the 20 startups with the least VC funding (only US$ 623 million) have done the best. In contrast, the 20 with the most VC money backing them, have lagged far behind.

What do we learn from this? It's simple. If a startup has a lot of VCs backing it, then it likely commands a big valuation even before the IPO. Thus retail investors looking to make a fortune would probably be disappointed.

It would be prudent to identify the right entrepreneur and the right business model in such cases, rather than looking at the amount of VC money that the startup has raised. Last but not least, IPOs that hit the market at sky high valuations are better avoided.

The fiscal deficit is back in news. The slow progress of the disinvestment program and the muted response to the recent telecom spectrum auction has made the deficit target difficult to achieve. The government has committed to a fiscal deficit target of 3.5% of GDP for FY17. The government reiterated that this would be met.

But how? It could turn to the tried and tested formula of cutting planned expenditure in the last few months of the year. However, the government stated yesterday that there would be no cut in expenditure. So what is the government banking on?

Revenue from Income Disclosure Scheme (IDS) would provide some cushion as per an article in the Financial Express. About Rs 652.5 billion of undisclosed assets were declared, yielding Rs 293.62 billion in taxes to the government spread over two fiscal years.

Will this be enough? Only time will tell but we won't be surprised if the income tax department gets more aggressive from now on and if LIC were to be asked to fund the disinvestment drive for the remainder of the year.

The Indian stock markets started on a positive note with the markets trading well above the dotted line at the time of writing. The BSE Sensex is trading higher by 459 points (up 1.6%) and the NSE Nifty is trading higher 135 points (up 1.6%). The BSE Small Cap and BSE Mid Cap indices are trading up by 1.3% and 1.7% respectively.

04:55 Today's Investing Mantra

"It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price." - Warren Buffett

This edition of The 5 Minute WrapUp is authored by Rohan Pinto (Research Analyst).Today's Premium Edition.

Cox & Kings: Aggressive Acquisition-Led Growth - Part 2

What is the impact of aggressive acquisition? How does it impact financial ratios? Let's look at the curious case of Cox & Kings. This is part 2 of the series. Read more to find out...

Read On...

| Get Access

Recent Articles

- All Good Things Come to an End... April 8, 2020

- Why your favourite e-letter won't reach you every week day.

- A Safe Stock to Lockdown Now April 2, 2020

- The market crashc has made strong, established brands attractive. Here's a stock to make the most of this opportunity...

- Sorry Warren Buffett, I'm Following This Man Instead of You in 2020 March 30, 2020

- This man warned of an impending market correction while everyone else was celebrating the renewed optimism in early 2020...

- China Had Its Brawn. It's Time for India's Brain March 23, 2020

- The post coronavirus economic boom won't be led by China.

Equitymaster requests your view! Post a comment on "A Three-Legged Stool Approach to Generating 3,600% Returns". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!