The Not-So-Well-Known Competitive Advantage That Buffett So Loves...

In this issue:

» Are MNCs milking business growth in India?

» China's central bank invests in Indian government bonds

» ...and more!

00:00 |

|

|

|

Buffett swears by any businesses that have an unbeatable, solid moat or a strong competitive advantage. One of the best known moats that he loves is brand power - an advantage that most FMCG companies enjoy.

But Buffett loves another type of competitive advantage, and it's one that probably does not get the attention it deserves. We are talking about the low-cost competitive advantage. This moat is just as valuable to Buffett as the strength of the brand. It also explains why he chose to invest in Wells Fargo.

As reported in Business Insider, Buffett's company Berkshire Hathaway owns 10% of Wells Fargo, which is the fourth biggest bank in the US by assets. Wells Fargo does not boast of a product basket that is significantly different from that of the other banks. However, it has become one of the bank industry's lowest-cost providers.

How can a low-cost advantage become an economic moat? In three ways. One is through economies of scale. Indeed, the bigger the scale of a company's operations, the greater the cost benefits it can enjoy over its peers. This becomes especially relevant in a scenario where the fixed costs are so high that it discourages new entrants in the industry.

The second way to achieve a low cost advantage is through processes. Process-based cost advantages accrue through efficient and cheaper production or supply processes. The idea is that, in building better processes, a company can provide its products at a cheaper price compared to its peers.

The third way to be a low cost player is through cheaper access to resources. This is typically true for commodity and mining companies where the access to key raw materials has an important bearing on keeping the cost structure under control.

Where does Wells Fargo fit in? The bank, over the years, has put in place efficient systems, has made effective use of data, has garnered a good credit rating, and has imbibed a culture of prudence and savings. All of this has helped it reduce overall expenses and still offer quality products to its customers cheapest than its peers.

In fact, this is a competitive advantage that I have given great importance for my ValuePro service as well. Each of the two ValuePro portfolios comprise companies in the banking, mining and commodity spaces that are low cost providers and hence have an edge over their peers in their respective industries. And we believe they have the potential to add a lot to shareholder wealth over the longer term.

Do you give importance to the 'low-cost advantage' moat when building a portfolio of solid stocks? Let us know your comments or share your views in the Equitymaster Club.

|

--- Advertisement ---

This Special Segment Should Not Be Missed... Returns like 288% in 2 years and 5 months, 124% in just 7 months, 250% in 2 years, 123% in just 3 months and more... all from the small cap segment... are too good to be missed.

|

03:01 |

Chart of the day | |

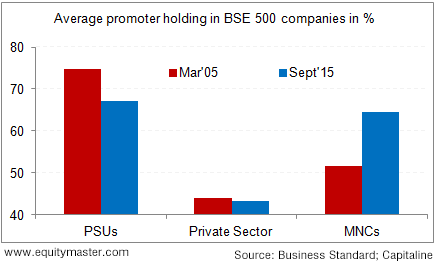

Domestic companies were on an aggressive expansion spree in the last decade. And a large number of companies particularly in infrastructure, banking and financial services have resorted to equity dilution to raise fresh capital. Even the divestment program led by the government to raise funds has led to decline in promoter stake in public sector enterprises.

But as the Indian subsidiaries of large multinational companies enjoy a strong parentage; their need for fresh capital has been limited. Moreover with their home markets in developed economies yielding much lower return on equity as compared to India, many multinational companies have raised stakes in their Indian subsidiaries.

Companies such as Hindustan Unilever, Bosch, ACC, Ambuja Cement and Nestle India have seen a jump in promoter holdings in the last decade. However, the royalty charged by a number of parent companies such as Hindustan Unilever, Nestle has also risen over the years. This in turn is proving out to be a raw deal for minority shareholders in these companies.

|

04:02 |

|

|

So what does China investing in Indian government bonds signify? One could be that it gradually wants to reduce its exposure to US government bonds.

The other reason can be attributed to the Chinese central bank wanting to diversify its holdings to other currencies and not depend too much on dollars. So China buying Indian government bonds elevates the importance of the rupee. It could also mean that China has more faith in India than the other emerging markets.

Prime Minister Modi's efforts to convince foreign investors to invest in the country seem to be working. But he also needs to get the Indian economy going and effectively implement reforms in order to make good on his promises. This is especially critical if foreign investors are to remain interested in India for longer periods of time.

04:45 |

|

|

04:56 |

Today's investing mantra |

Today's Premium Edition.

L&T: Are Things as Bad as They Seem?

A discussion about the company's recent results and its implications for the future.

Read On...

| Get Access

Recent Articles

- All Good Things Come to an End... April 8, 2020

- Why your favourite e-letter won't reach you every week day.

- A Safe Stock to Lockdown Now April 2, 2020

- The market crashc has made strong, established brands attractive. Here's a stock to make the most of this opportunity...

- Sorry Warren Buffett, I'm Following This Man Instead of You in 2020 March 30, 2020

- This man warned of an impending market correction while everyone else was celebrating the renewed optimism in early 2020...

- China Had Its Brawn. It's Time for India's Brain March 23, 2020

- The post coronavirus economic boom won't be led by China.

Equitymaster requests your view! Post a comment on "The Not-So-Well-Known Competitive Advantage That Buffett So Loves...". Click here!

1 Responses to "The Not-So-Well-Known Competitive Advantage That Buffett So Loves..."

Subhash Moharir

Nov 4, 2015The Chinese are planning to pull the carpet from underneath the Indian economy to hurt it seriously.