Multibaggers: A Gut-Wrenching Roller Coaster Ride

- In this issue:

- » The Airlines Industry profits have peaked

- » What defines a successful trading strategy?

- » Global market roundup

- » ...and more!

- If you end up owning a fantastic business, then plan to hold it for a long time. And prepare yourself for a roller coaster ride. If you have chosen the right business to own, the ride will be worth it.- Professor Sanjay Bakshi

Picture this, you are in a theme park looking to have some fun. The park has a variety of rides and entertainment options to choose from.

Similarly, if you're in the markets looking to make some profits, you have a plethora asset classes and of financial instruments to choose from.

Fixed deposits are like a slide: A steady rate of descent. Adjusted for inflation, they erode capital in the long run.

Stocks are like a roller coaster: Sudden, gut wrenching lurks. But they have the potential to provide real inflation-adjusted returns in the long run.

However, holding on to stocks for the ups and the downs is easier said than done.

Consider this...

Amazon's stock price has given compounded annual returns of 37% since inception in 1997. That means every rupee invested in Amazon back then would be worth Rs 385 today.

That's a whopping growth of 38,456%.

The ride, though, has been anything but smooth for Amazon shareholders.

Maximum drawdown is a measure of the percentage change of a stock's high to its low.

The stock price of Amazon, adjusted for splits, etc, reached a high of $107 in December 1999.

It was almost ten years before it reached this level again.

Amazon shareholders...those who held on...also rode a gut-wrenching drop of 94% from its earlier highs. The stock even traded in the mid-single digits in 2002.

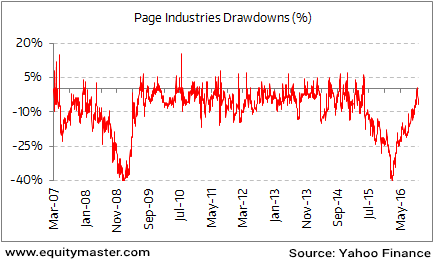

Page Industries - a Hidden Treasure recommendation since 2009 and a huge winner for our subscribers - has a similar story.

It's returned more than 53% compounded annually for the past ten years.

Yet, this was no smooth journey.

The stock reached a peak of Rs 454 in May 2008 and a trough of Rs 267 in January 2009. The stock took more than a year and two months to return to its 2008 highs.

It fell more than 41% from peak to trough.

The takeaway here is that equities can have huge volatility and wild swings in the short run.

However, if you own business with good fundamentals driven by honest managements and bought at reasonable prices...you will be rewarded handsomely in the long run.

The charts of Amazon and Page Industries are a gentle reminder of the volatile-yet-rewarding nature of equities.

Richa and the Hidden Treasure team look for small-cap companies that have good underlying business - regardless of the stock's price fluctuations.

They have their eye set on long-term business drivers.

Remember, all your big winners will have huge drawdowns. But they will be a blip in the long run.

03:45 Chart of the Day

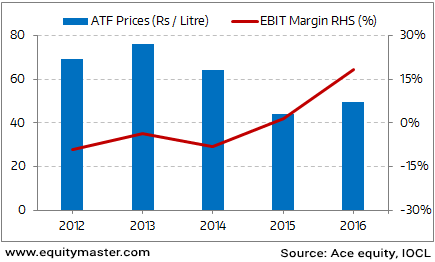

Berkshire Hathaway has recently reported of buying a stake in some of the airline companies. This has surprised the markets since his abhorrence for airline stocks and the industry as a whole is well known. We had a look at the performance of our airlines industry. Lower Aviation Turbine Fuel (ATF) prices has resulted in the industry reporting positive operating profit margins since 2015. With 2016 reportedly being the best year of profitability in over a decade. The ATF prices stayed at multi year lows of Rs 30-40 per litre of fuel. Lower fuel prices have in turn reduced airfares which has led to increase in the load factor i.e. utilisation rates for the airlines. The utilisation rates are now at record highs.

Aviation Turbine Fuel Prices on a Rise

However, the past few months has seen fuel prices recover from mid 30's over Rs 49 per litre. This will put pressure on the airlines to raise their fares. If the airlines are unable to pass this rate hike via air fares increases, this will then result in dented profitability for airlines. However, higher airfares will impact passenger traffic resulting in lower revenues for the airlines.

For now, the profitability of these airlines seem to have peaked.

What defines a successful trading strategy? One that is highly profitable? Sure, making a profits important. But it isn't enough.

My colleague Asad Dossani at Daily Profit Hunter, looks at these three ingredients for a successful trading strategy:

First, it should be profitable without taking undue risk. When we consider the performance of any trading strategy, we must take into account risk and return. It's no use making regular profits if one big loss can wipe you out.

Second, it should make sense. This means we need to understand why a strategy works. It's not enough to be told that a particular indicator predicts the market. We need to understand why that indicator works. If we don't, we can't be confident it'll keep working.

Third, it should be easy to execute. This one is often overlooked. What good is a trading strategy that requires you to watch the screen all day? We all have jobs, families, and households to manage. Trading shouldn't be a struggle. It should be simple, and should fit easily into your life.

You see, Asad has been working on a new trading strategy for months. One that fits the three criteria for success. And we want our readers to have access to this right away.

You're going to hear more from Asad over the next few days. Keep an eye on your inbox for a big announcement...

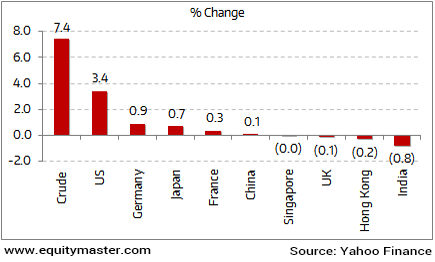

Markets worldwide continued to remain volatile, ending on a mixed note in the week gone by. Fed Chair Janet Yellen strongly hinted that improving US economy has raised chances of an interest rate hike in December. This along with encouraging domestic economic data - that include a rise in inflation and robust growth in house starts - saw the US markets gaining the most. Markets in Germany and France also ended in the positive territory.

While there is concern that higher U.S. rates could draw money out of emerging markets, the impact has been felt more in the Hong Kong stock market which is more exposed to global shifts in funds. The Chinese market, on the other hand, ended the week marginally higher. Among other Asian markets, the Japanese market climbed to an 11-month high as the yen weakened further against the surging dollar boosting prospects of good export realisations.

Back home in India, the markets continued to feel the tightness in liquidity as a result of the government's demonetisation move last week. The benchmark indices were down by 0.8% for the week. The rupee also remained volatile on rising US bond yields.

Sectoral indices largely ended the week on a negative note with stocks from metal and consumer durable space witnessing maximum selling pressure. Only power stocks have managed to stay afloat.

Performance During the Week Ended 18th November, 2016

04:55 Today's Investing Mantra

"Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble." - Warren Buffett

This edition of The 5 Minute WrapUp is authored by Rohan Pinto (Research Analyst).Today's Premium Edition.

Today being a Saturday, there is no Premium edition being published. But you can always read our most recent issue here...

Recent Articles

- All Good Things Come to an End... April 8, 2020

- Why your favourite e-letter won't reach you every week day.

- A Safe Stock to Lockdown Now April 2, 2020

- The market crashc has made strong, established brands attractive. Here's a stock to make the most of this opportunity...

- Sorry Warren Buffett, I'm Following This Man Instead of You in 2020 March 30, 2020

- This man warned of an impending market correction while everyone else was celebrating the renewed optimism in early 2020...

- China Had Its Brawn. It's Time for India's Brain March 23, 2020

- The post coronavirus economic boom won't be led by China.

Equitymaster requests your view! Post a comment on "Multibaggers: A Gut-Wrenching Roller Coaster Ride". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!