I Just Acted on Vijay's Advice and Invested in This...

Today I want to share something very exciting...

I just made an investment. And it's something that I have been strongly recommending my subscribers at Insider for months.

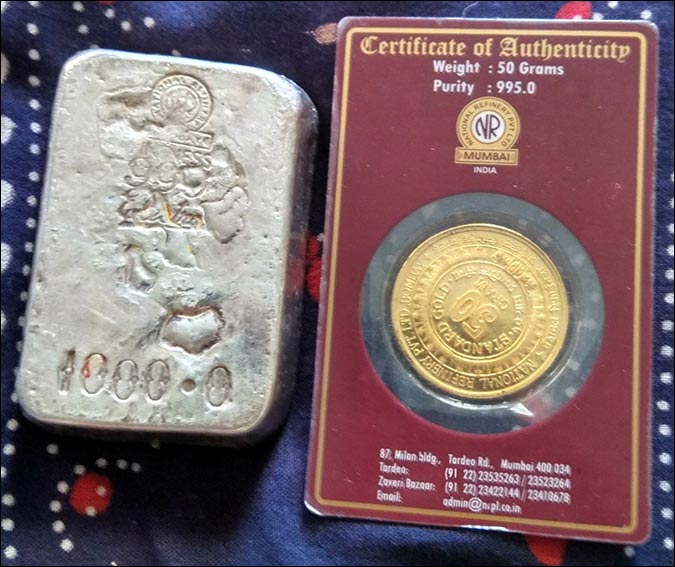

Yes, I just made my very first investment in physical gold and silver.

Why is that exciting? Isn't that the most obvious investment for an Indian?

It's true. Indians love gold. And no one gets brownie points for doing the most obvious thing.

Yet, I must admit this wasn't the most obvious thing for me.

You see, I'm a millennial. We are more comfortable renting things that owning them. We like buying digital assets rather than physical assets.

Moreover, I had always presumed that buying gold and silver was something best left to the family elders. They know why to buy, how to buy, and from where to buy. It seemed like too much of a hassle for me.

But that changed this year. And it changed because of one man - Vijay Bhambwani.

Some of you already know a little bit about him. He is a very seasoned trader - he's been an active trader since 1986!

From being a successful professional trader, to being a trading mentor and author, to being a columnist, to appearing on more than 8,000 TV shows... Vijay has many laurels to flaunt.

It wouldn't be an exaggeration to say that financial markets are his life and passion. Everything else in his life revolves around his main objective - trading.

Now, imagine having the opportunity to regularly meet and interact with such a man?

That's precisely my story. Over the last one year, I've had the privilege to meet Vijay several times. And trust me, every meeting with him has been a very enriching learning journey for me.

I've not met many people in my life who have such a rich, deep worldview and an equally amazing ability to articulate it with utmost clarity and confidence.

He has a rare knack for connecting the dots between politics, current events and the global markets, which has helped him make millions in profits over his 30-year trading career.

I know I sound like a complete fanboy talking about Vijay. But if you get a chance someday, do meet him. Ask him about his views on geopolitics and financial markets. Listen to the hundreds of anecdotes and stories from his over three decades of experience as a trader. And I bet you, it's difficult to not be in awe of him.

So, going back to my investment in gold and silver.

Vijay had been signaling a potential bull rally in gold and silver since quite some time. In fact, I'd revealed his bullish views on bullion to my Insider readers in July 2019.

Here's a gist of what he had said back then:

- All asset classes move in cycles. Equity has had a good run up after the global financial crisis occurred in 2008. Then the markets bottomed out and started rallying in 2009. So, we almost had a decade of good appreciation in financial assets. After 2013, we've seen somewhat mediocre returns in dollar prices of gold.

I think that cycle is about to turn. Let us not forget that for over 3,000 years, mankind has deployed money in gold as a final kind of refuge, a store of value, and a hedge against inflation.

What we are seeing is a shift from paper assets to hard assets - hard assets being commodities. Typically, the best commodity of all we know is gold. So, as returns start to peak out in paper assets, I would suspect that gold is likely to see a beneficiary inflow from the outflows of equities. This inflow into gold is going to push up prices I think for many quarters now.

Since then, I'd been watching the global markets as well listening attentively to Vijay's perspectives on how events were unfolding.

I was so inspired and convinced with Vijay's perspective that I decided to do something I had never done before - I made my first investment in gold and silver.

Vijay was very kind to guide me through everything. He even suggested me a reliable refiner in Mumbai from where I could buy these precious metals. I completely trust him. So, I just followed his advice.

But There's a Lot More that Vijay Can Offer...

I've been actively following the stock markets for 15 years now. I've met and known many interesting investors and traders through this journey.

And it's occasionally that you come across someone like Vijay who is a trading genius, with a 30-year track record of finding profit opportunities in places that others largely ignore.

Most of the times, such people are very reluctant to share their trade secrets and success formulae.

But Vijay has finally agreed to reveal his secret sauce. He's going to do it at his Weekly Cash Summit on Tuesday, 26 November at 5 PM. Register for free here. I strongly recommend it.

Chart of the Day

When I started my investing journey as a teenager and saw Warren Buffett as my role model, I'd borrowed his distaste for gold. (You know, right, Buffett has been a big gold critic?)

I saw gold accumulation as a crazy, compulsive, old Indian habit.

Of course, over the years I came to appreciate the intelligence ingrained in this tradition.

And ever since I met Vijay Bhambwani, I started seeing gold in a much broader perspective and also discovered a much bigger wealth-creation universe beyond just stocks.

I thought it would be interesting to see how lucrative gold has been as a long-term investment in India.

The chart shows the annual returns on gold over the last 15 years.

Gold Has Been a Shining Long-Term Investment

As you can see, barring just two years - 2013 and 2015, gold has delivered positive returns in 13 of the last 15 years.

In fact, gold has delivered double-digit gains in 10 of the last 15 years.

During the entire 15-year period, gold has shot up 555% (compounded annual return of 12.1%).

During the same period, the Sensex surged 511% (compounded annual return of 12.0%). If you include dividends, the Sensex returns would be higher than gold by a couple of percentage points.

One must note that the Sensex returns are not representative of the broader market returns. Moreover, gold was a no-brainer. You didn't have to study financial statements, business models and forecast future earnings growth to get a double-digit return on your investment.

If you grab a pie of the big money-making opportunities beyond stocks, I would strongly insist you attend Vijay's Weekly Cash Summit here (It's free).

Warm regards,

Ankit Shah

Editor, Equitymaster Insider

Equitymaster Agora Research Private Limited (Research Analyst)

PS: On Tuesday, 26 November, India's #1 trader will reveal his super profitable personal trading blueprint. Click here to register FREE for Vijay Bhambwani's Weekly Cash Summit.

Recent Articles

- All Good Things Come to an End... April 8, 2020

- Why your favourite e-letter won't reach you every week day.

- A Safe Stock to Lockdown Now April 2, 2020

- The market crashc has made strong, established brands attractive. Here's a stock to make the most of this opportunity...

- Sorry Warren Buffett, I'm Following This Man Instead of You in 2020 March 30, 2020

- This man warned of an impending market correction while everyone else was celebrating the renewed optimism in early 2020...

- China Had Its Brawn. It's Time for India's Brain March 23, 2020

- The post coronavirus economic boom won't be led by China.

Equitymaster requests your view! Post a comment on "I Just Acted on Vijay's Advice and Invested in This...". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!