What Really Moves Stock Prices?

- In this issue:

- » Signs of pick-up in economy fade

- » Implications of a yuan devaluation

- » ...and more!

'Would your analyst friend working at this brokerage firm have a small bit of information we need on the company?' we asked one of our colleagues. 'Of course,' he nodded, 'in their community, they take pride in having the most detailed spreadsheets on a company amongst all the other analysts. And they do a very good job at providing even the most miniscule of details on a company.'

Now, this made us somewhat nervous. Not that we don't use spreadsheets. But the variables and calculations in our spreadsheets would look like a pygmy in front of what our colleague was hinting at.

We wondered if this was a disadvantage. Should our spreadsheets be as detailed as the brokerage houses?

To answer this question, we must first look at what moves stock prices. And over the long term, it is nothing but the trend in earnings that move prices.

Now, how are earnings determined? Well, it's an interplay between the company's revenues, margins, and asset utilisation. We reckon a reasonable grip on these factors is enough to gauge the future earnings trend of a company. You see, the future is inherently uncertain, and an excessively detailed spreadsheet won't change that.

In our view, twenty hours spent on ten different companies would be much more productive than twenty hours spent on one company. That's not to say we do not keep spreadsheets. Spreadsheets with at least ten years of financial history are essential to our analysis.

But obsessing over minute details is not a productive use of an analyst's time. The 80:20 rule applies here - 80% of the information you need on a company can be ascertained in the first 20% of the time you spend researching it.

And we are not the only ones to say so. Most investors want to invest in no-brainer ideas. They want an opportunity where the value is so apparent that they don't even need to run a basic spreadsheet. In fact, needing to use a detailed spreadsheet is a sign that the investment is too complex and should be discarded.

We also hear a lot of successful investors say that investment is all about focusing on a few key variables. And a good grip on these variables is all one needs to make a successful investment. Everything else is just noise.

Charlie Munger often points out that they can tell in minutes whether the business they are considering is a 'yes', 'no', or 'too hard'. The majority of the companies, he says, end up in the box labelled 'too hard'.

So do we need detailed spreadsheets? Our answer is an emphatic 'no'. Like in most other areas, 'easy does it'...even in investing. The idea is to develop an investment philosophy that has worked successfully in the past and stick to it no matter what.

Do you rely on detailed spreadsheets in your equity investing process? Let us know your comments or share your views in the Equitymaster Club.

|

--- Advertisement ---

Tap Into Profits From Junior Blue Chips! Imagine that you could combine the high growth potential of small caps with the kind of stability which is associated only with blue chips? That's an amazing combination, wouldn't you agree? Well, today we have 4 'Junior Blue Chips' which give you exactly that! And we will tell you all about them in our Special Report - Junior Blue Chips. Click here to know how you can claim your free copy... ------------------------------ |

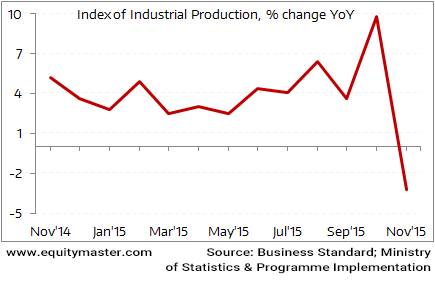

03:03 Chart of the day

After registering growth every month in the past one year, industrial production in the country fell sharply in November. The 3.2% contraction in the Index of Industrial Production (IIP) for the month has been the steepest in the past four years. Further, the number of manufacturing subsectors that recorded declines jumped dramatically to seventeen in November compared to five in the preceding month. The much-awaited pick-up in investments continues to remain elusive; capital goods output plunged by 24.4% during the month.

Going ahead, the pain is likely to continue as the impact of the devastating floods in Chennai weigh down on production in the country. Even Nikkei's Purchasing Manager's Index slumped to a 28-month low in December. The situation has been further aggravated by the fact that inflation has been rearing its head again on rising food prices. And with a year-on-year fall in rabi sowing, chances are that inflation will continue to remain high in the near term. In such a scenario, chances of interest rates coming down appear slim. This leaves no room except increased public spending by the central government, even at the expense of deferring the fiscal deficit target, in order to stimulate the economy.

Signs of pick-up in economy fade

The US economy is not doing exactly great. But there could be more trouble in store. This time it is likely to be from the emerging economies, David Levy of the Jerome Levy Forecasting Center has warned. Indeed, according to him, emerging market weakness will intensify a global recession and the US will not be spared either.

We are already seeing signs of trouble in the emerging countries. Russia continues to grapple with problems related to low oil prices and economic sanctions. Most of South America including Brazil is pretty close to recession.

And China is not far behind. Concerns of a prolonged slowdown in China have intensified and this was manifest in its stock markets which went into a freefall last week.

The fact that China is also letting its currency yuan devalue is ruffling a lot of feathers.

Infact, Vivek Kaul, Editor of Vivek Kaul's Diary has written a very compelling piece on how the Chinese central bank has ensured that the value of the yuan has fluctuated in a fixed range around the dollar.

This is what he has to say:

- The People's Bank of China likes to maintain a steady value of the yuan against the dollar. What does the Chinese central bank do when more dollars are leaving China? In order to ensure that there is no scarcity of dollars in the market, it buys yuan and sells dollars. This is exactly the opposite what it has been doing all these years, when more dollars where entering China than leaving it.

The trouble is that China cannot create dollars out of thin air, only the Federal Reserve of the United States can do that. China does not have an endless supply of dollars and cannot constantly keep defending the yuan against the dollar. This explains why it has gone slow in defending the yuan against the dollar, in the recent past, and allowed its currency to depreciate against the dollar.

And this has implications because the global currency war which has been on for a while, will continue. Vivek says:

- The question is why is all this worrying the world at large? A weaker Chinese yuan will make Chinese exports more competitive. This will mean a headache for other export oriented economies like Japan, Taiwan, South Korea, Germany, and so on. They will also have to push the value of their currencies down against the dollar. Hence, the global currency war which has been on a for a while, will continue. Further, a weaker yuan might lead to China exporting further deflation (lower prices) all over the world.

Indian equity markets had a volatile trading session today. While the indices began the day's proceedings on a positive note, selling activity intensified in the afternoon session pushing them into the red. At the time of writing, BSE Sensex was trading lower by 239 points and NSE-Nifty was trading down by 65 points. Mid cap and small cap stocks fared worse and were trading lower by 2% and 4% respectively. Losses were largely seen in oil & gas, healthcare, and metals stocks.

04:55 Today's investment mantra

"If investing is entertaining, if you're having fun, you're probably not making any money. Good investing is boring." - George Soros

This edition of The 5 Minute WrapUp is authored by Radhika Pandit (Research Analyst) and Madhu Gupta (Research Analyst).Today's Premium Edition.

What to Look for When Picking an Engineering Stock

Pointers to help you navigate the choppy waters of the engineering sector.

Read On...

| Get Access

Recent Articles

- All Good Things Come to an End... April 8, 2020

- Why your favourite e-letter won't reach you every week day.

- A Safe Stock to Lockdown Now April 2, 2020

- The market crashc has made strong, established brands attractive. Here's a stock to make the most of this opportunity...

- Sorry Warren Buffett, I'm Following This Man Instead of You in 2020 March 30, 2020

- This man warned of an impending market correction while everyone else was celebrating the renewed optimism in early 2020...

- China Had Its Brawn. It's Time for India's Brain March 23, 2020

- The post coronavirus economic boom won't be led by China.

Equitymaster requests your view! Post a comment on "What Really Moves Stock Prices?". Click here!

1 Responses to "What Really Moves Stock Prices?"

R Ramesh

Jan 16, 2016Vivek Kaul in his Diary noted that The People's Bank of China does not have an endless supply of dollars and cannot constantly keep defending the yuan against the dollar. This explains why it has gone slow in defending the yuan against the dollar, in the recent past, and allowed its currency to depreciate against the dollar. Unquote

This could be intentional to boost export. China being one of the largest holder of US Debt instruments could have got into the market with the instruments to raise dollars in a controlled manner.