The Link Between Technology and Price of Your Favorite Dosa!

- In this issue:

- » Government laughing all the way to bank on crude price plunge

- » Still not the time for aggressive buying, says Howard Marks

- » ...and more

'Why are dosa prices not going down?'

It's a casual question - probably not one you'd think was asked during a high-level discussion on economics. So when a young student recently asked the RBI governor about dosa prices, everyone around was taken aback. The student wanted to know why they haven't come down despite the central bank claiming victory over inflation.

Raghuram Rajan replied with his trademark candour. 'Blame it on lack of technology,' he said. The technology for making dosa hasn't changed. The person puts the dosa batter on a Tawa, spreads it around, and removes it when it's ready. No technological improvements there.

Rajan was alluding to the idea that technology can reduce inflation. It can make people more productive and bring down the prices of goods and services. Therefore, we should use as much technology as possible.

Okay...

Now compare that to what Asad Dossani, my colleague over at Daily Profit Hunter, wrote last week. With help from a bunch of charts, Asad argued that income inequality across some major economies has steadily increased since the 1980s. And what, according to Asad, has been the main culprit?

Technology!

Yes...technology. If Asad is right, Rajan's wish for more technology could deepen India's income inequality. But if Rajan is correct, something else is responsible for income inequality.

I have to side with Rajan here.

Technological improvements been a constant since we walked the grasslands of Savannah. It needn't be complex. The clock...or a pair of eyeglasses...may be banal these days. But they were once technological marvels. To say technology has suddenly widened the gap between the haves and the have-nots does not stand the test of history.

To be fair, Asad does make the point that the pace of innovation has really accelerated in the past few decades. And it is this big shift that has led to income inequality to record highs.

To be honest, we don't have a strong counterargument to this. But we can certainly ask you to look at the GDP data of the developed countries. The reason being that if the pace of innovation has really accelerated, then it should also result in higher GDP growth.

That's hardly the case though. Most developed nations, the so-called hotbeds of innovation, are witnessing what can be called 'The Great Stagnation'. GDP growth has either come to a standstill or is growing at a much slower pace than before. This shows that pace of innovation may not have accelerated after all. And if pace of innovation has not accelerated, it couldn't have possibly lead to greater inequality.

Technology is not the culprit. Other factors - such as the rise of artificial money in the US and capitalism in countries like China and India - are responsible for greater income inequality.

Just as income inequality was rearing its ugly head in the 1980s, the US central bank was beginning to create money out of thin air. With the gold standard no longer in place, there was no need to dig money out of the ground. In fact, the money supply could now be increased faster than the supply of goods and services. And that is exactly what happened.

The US money supply rose at a record pace between 1970 and 2008. Almost all of it ended up into the pockets of the rich and the insiders. Meanwhile, middle class America suffered.

We call this money 'sham money'.

It leads to an economy where most people get poorer, not richer. Sham money has led to the huge income gap in the US - not technology.

Truth be told, sham money is mostly a US phenomenon. And therefore does not explain the rising inequality in other countries like China and India. Well, we can attribute inequality in these countries to emergence of capitalism. Until recently, both countries had a top-down economic system. But once market forces were unleashed, their economies took off.

It is the nature of capitalism for gains to be uneven. We shouldn't mind this though. Gains from capitalism are indeed disproportionate. However, at the end of the day, everyone is better off than before.

Technology should be encouraged. What we should really be worried about is sham money and crony capitalism - the real causes of income inequality.

Do you agree that sham money leads to income inequality? Let us know your comments or post them on Equitymaster Club.

3.00 Chart Of the day

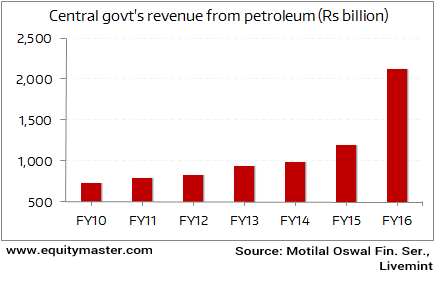

The world may be a worried lot, and crude prices may be plunging as a result. But the Indian government for one is busy making hay while the sun shines.

Even as prices have been falling rapidly, not all of this has been passed on to the Indian consumer. The government has been quick to repeatedly hike excise taxes on petroleum products. And as per reports cited in business daily Mint, the government is likely to garner Rs 2.1 trillion as revenue from the oil sector in FY16. This includes revenue by way of cess, excise and royalties. This is a figure that is almost double that of FY15.

And that's not the only positive.

The government has also had to bear lower subsidy payments due to lower crude prices.

All these factors put together are likely to take the government closer to meeting its fiscal deficit target for the year, despite some other macroeconomic negatives.

The government's windfall from the crude price plunge

Apart from being worried, investors the world over also seem quite confused these days. So in an interview with ET Now when Howard Marks, Co-Chairman of Oaktree Capital Management, gave his opinion on the state of things as they stand today, we were all ears. Marks is a value investor well-known for his clear thinking and keen insight.

Marks is of the opinion that we are in state of transition currently. Thus this not currently a massive buying opportunity like it was in the fourth quarter of 2008 after the Lehman bankruptcy. He feels that if one does not have any investments then now is a good time to have a few investments or to add a little more to your investments. However, this is far from a time for aggressive buying. That's because fundamentals in the world may be getting worse and attitudes have just begun to turn from positive to negative and this may have further to go. So this is not a time for massive buying.

We couldn't agree more. Even when looked at from the prism of valuations, the markets may have fallen, but not yet reached a level that calls for backing up the truck. Whether they will fall to such a level in the near future or not is anyone's guess. It hasn't happened yet though, that is for sure.

Meanwhile, benchmark indices were trading positive today with the Sensex higher by more than 60 points at the time of writing. BSE Mid cap and Small cap indices were also amongst the gains today. Amongst sector stocks, Pharma and Energy were seen particularly in demand.

4.50Today's Investment mantra of the day

"The poor are most definitely not poor because the rich are rich. Nor are the rich undeserving. Most of them have contributed brilliant innovations or managerial expertise to America's well-being. We all live far better because of Henry Ford, Steve Jobs, Sam Walton and the like." - Warren Buffett

This edition of The 5 Minute WrapUp is authored by Rahul Shah (Research Analyst).Today's Premium Edition.

Are These the Best Wealth Creators in the Small-Cap Space?

A discussion on Economic Value Addition and its importance.

Read On...

| Get Access

Recent Articles

- All Good Things Come to an End... April 8, 2020

- Why your favourite e-letter won't reach you every week day.

- A Safe Stock to Lockdown Now April 2, 2020

- The market crashc has made strong, established brands attractive. Here's a stock to make the most of this opportunity...

- Sorry Warren Buffett, I'm Following This Man Instead of You in 2020 March 30, 2020

- This man warned of an impending market correction while everyone else was celebrating the renewed optimism in early 2020...

- China Had Its Brawn. It's Time for India's Brain March 23, 2020

- The post coronavirus economic boom won't be led by China.

Equitymaster requests your view! Post a comment on "The Link Between Technology and Price of Your Favorite Dosa!". Click here!

1 Responses to "The Link Between Technology and Price of Your Favorite Dosa!"

San

Feb 22, 2016I am sorry but it seems that everyone missed the point entirely -- the student who posed the question, Mr. Rajan, Mr. Dossani and Mr. Shah. The last time I checked, inflation was still a positive number, something like 4 or 5%, if anyone wants to believe those made-up numbers (but that's a story for another day). Now, as long a we have inflation, even if its 0.1%, why on earth will Dosa or any other price come down? They will come down only when we have deflation, i.e., negative inflation, when the CPI is actually less than zero. This is Econ 101. A simple explanation of why Dosa prices are not coming down. When the combination of Dal, Rice, Potatoes, Fuel and Labour becomes cheaper than its now, one can expect Dosa prices to come down.