Why Warren Buffett Didn't Want to Buy a House to Live In

- In this issue:

- » FY16 not turning out to be great year for the auto industry

- » US Fed decides to keep interest rates unchanged

- » ...and more!

It was 1955.

Warren Buffett was 25 and just starting a family. One of the first instincts of a young family is to buy a house.

But not Buffett:

- In Omaha, I rented a house at 5202 Underwood for $175 a month. I told my wife, 'I'd be glad to buy a house, but that's like a carpenter selling his toolkit.' I didn't want to use up my capital.

So, it's not like Buffett didn't have the money to buy it. By that time, he already had US$127,000 - quite a large sum for the time. A good house would have cost about a fifth of that. But he still didn't bite.

His reasoning was unconventional. But the pure logic of it is striking - a completely rational calculation of what would lead to a better financial result. It's void of all emotion and pre-conceived notions.

Buffett reflected on his situation at the time. He knew he had the skills to multiply money at a lucrative rate. Given that, he didn't see the sense in blocking a big part of his capital in a house. He reckoned it would be wiser to rent a house instead, and use the money he saved to invest.

You might be wondering how Buffett's decision and his situation sixty years ago is even remotely relevant to you today.

They very much are.

You see, residential rental yields back here in India are among the lowest in the world. They stand at a measly 2% or so. That is the amount of rent you pay per year relative to the market value of that property. So, even if you had the money to buy a house, should you?

Looked at another way, renting a house is the equivalent of taking a loan at an interest rate of 2% per annum. For just Rs 2 every year, you get to use an asset worth Rs 100. You could use it to invest. Agreed that you probably don't have Buffett's skills and wouldn't be able earn the kind of return he did on that money.

But even a simple bank fixed deposit earns close to 8% today. Subtract the 2% rent you pay and that leaves you with a 6% surplus accruing to you every single year.

And if you are able to make investments that safely earn an even higher rate of return, your edge would be even larger than that 6%. Over the years, this edge can make a mammoth difference to your wealth.

Yes, when you rent, you may miss out on any property price appreciation that happens along the way. But relying on such appreciation for wealth creation is tricky. Who knows at what rate house prices will go up in the coming years? It could be a fabulous return, it could be mediocre, it could be nothing, or it could even be negative (yes, this too is a possibility).

Do note - my point of telling you all this is not to advise you on whether you should buy a house or not. Instead, it is to get you to be more thoughtful about this decision. For most, it's an emotional and automatic decision. It doesn't need to be.

Few make their decisions - including such personal ones - in the purely rational manner of Buffett. Is it a surprise that few achieve Buffett-like results?

What do you think are the factors to consider when deciding whether to buy or rent a house to live in? Let us know your comments or share your views in the Equitymaster Club.

P.S.: Buffett eventually did buy a house a few years later, which he lives in it to this day. Perhaps once he reached a point where the cost of a house would be a much smaller proportion of his networth, he became more willing to give in to the temptation. But doesn't stop him from ruing that decision even now: 'I would have made far more money had I instead rented and used the purchase money to buy stocks.'

2.42 Chart of the day

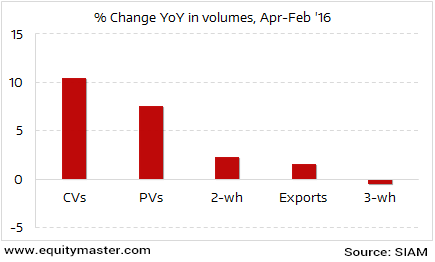

The auto industry is one of the many indicators of the health of the Indian economy. And if one were to look at the data for the eleven months of FY16, things do not look too good. Barring commercial vehicles (CVs), most auto segments saw tepid growth in volumes.

Growth in CVs was led by the medium and heavy CV segment (MHCV). Better freight rates and improvement in operations of fleet operators meant that they had more funds at their disposal to purchase MHCVs. Growth of light CVs (LCVs), however, remained sluggish.

The next best performer was passenger vehicles (PVs) and growth for this segment was largely attributed to new product launches by many players.

Two-wheelers struggled this year. The rural economy is a big market for two-wheelers. Thus, as poor monsoons wreaked havoc on crop production, farm incomes reduced and rural demand took a hit. And this impacted volume growth for two-wheeler players.

Exports growth was also subdued because of currency problems in certain markets of Africa and Asia. All in all, it was not particularly a great year for the auto industry.

Clearly, once the Indian economy picks up pace, volumes for most of the major auto companies are expected to ramp up.

Commercial vehicles shine in FY16

After the US Fed raised rates in December last year, all eyes were on the central bank and what it would do in the next monetary policy. Well, we now have the answer. The Fed has decided to keep interest rates unchanged. Not just that. An article on BBC highlighted the Fed originally expected to raise rates four times in 2016. Now it expects to raise it twice this year. We will not be surprised, however, if this too changes as the year progresses.

What it essentially highlights is this - The US economy is still sluggish and will take time to recover. A lot will depend upon whether is a significant improvement in the job market. Plus, global factors such as the health of Europe, China and the like will also influence the Fed's decision in the coming months.

What is difficult to take a call on how this will impact Indian stock markets. There is every possibility of fund flows remaining volatile. For the Indian investor though all this should not really matter much in terms of his investment decisions. Stock selection should be more a function of the inherent strengths of the business and healthy financials. Thus, volatility in the stock markets will be nothing but an opportunity to pick up quality stocks at attractive prices.

The Indian markets traded firm for the larger part of the trading session today led by sustained buying activity across index heavyweights. At the time of writing, BSE Sensex was trading higher by around 75 points. Buying was largely seen in oil & gas, IT, and metals stocks. The BSE Midcap and BSE Smallcap also did well to notch gains of 1% each.

4:56 Investment mantra of the day

"Some people seem to think there's no trouble just because it hasn't happened yet. If you jump out the window at the 42nd floor and you're still doing fine as you pass the 27th floor, that doesn't mean you don't have a serious problem. I would want to address the problem right now." - Charlie Munger

This edition of The 5 Minute WrapUp is authored by Rahul Shah (Research Analyst) and Radhika Pandit (Research Analyst).Today's Premium Edition.

Fixed combination drugs - A new challenge for the Pharma companies

New regulations in the Healthcare sector to hit pharma companies.

Read On...

| Get Access

Recent Articles

- All Good Things Come to an End... April 8, 2020

- Why your favourite e-letter won't reach you every week day.

- A Safe Stock to Lockdown Now April 2, 2020

- The market crashc has made strong, established brands attractive. Here's a stock to make the most of this opportunity...

- Sorry Warren Buffett, I'm Following This Man Instead of You in 2020 March 30, 2020

- This man warned of an impending market correction while everyone else was celebrating the renewed optimism in early 2020...

- China Had Its Brawn. It's Time for India's Brain March 23, 2020

- The post coronavirus economic boom won't be led by China.

Equitymaster requests your view! Post a comment on "Why Warren Buffett Didn't Want to Buy a House to Live In". Click here!

13 Responses to "Why Warren Buffett Didn't Want to Buy a House to Live In"

Vipul Jasani

Mar 17, 2016Hi,

I am working in warren Buffett company. There are following differences between USA and India.

1. There is no black money in USA. If at all it is there, it must be very negligible when compared to India.

2. The rise in property prices are due to demand of property from investors who have black money. which asset class is safer than property that can absorb any amount of black money???!!!!

3. Over and above, Govt. policies supports parking of black money in property by giving unlimited Income tax benefits!!!!

Warren Buffett is absolutely right and can be proved right even in India, if Govt. just withdraw its support in terms of tax benefits as under.

a. Only home owners of self occuied homes made eligible for home loans @ say interest rate of 9%. The homes purchased by taking home loan can not be sold for 30 years.

b. Increase Stamp duty and taxes on every transaction.

c. Ready reckoner prices should be higher than prevailing market rate and agreement value can not be lower than ready reckoner price.

d. No home loan should be given for investment purpose.

Unfortunately construction is wrongly identified as key sector for economic growth and that is where most problems lies.

There are numerous ways of generating employment and does not require so much support to construction sector.

tirtharaj khot

Mar 17, 2016I agree to the concept but in a little different way. One must buy his first house. Pay EMIs and take home loan interest and pay off the loan. By that time the property value goes up and now can be utilized for using the incremental increase value of the property.

PRADEEP MEHTA

Mar 17, 2016It is a tricky situation, which we all face at some point in our life. Financially, it makes sense to rent a house for the obvious reasons. However, owning a house is an emotional and also a practical need. One does not feel 'settled' until and unless you own your space. Moreover, the pain of changing house every eleventh month or two years is enormous. I have changed thirteen houses in the last thirty years and believe me, the pain is not worth taking. In a highly bureaucratic country like ours, it takes between six and twelve months to complete 'change of address' exercise. In a country, where virtually no institutionalized safety net is available,my personal advise is to buy a house and an insurance policy first before you venture into the wonderful world of investment.