Sensex 40,000: Your Chance to Profit

- In this issue:

- » FY16 sees mixed hiring plans for IT majors

- » PSUs to become better capital allocators?

- » Today's market...

- » ...and more!

In the lead up to the March 2016 results season, India Inc braced itself for a weak quarter. And very rightly so. From the results declared so far, performance has been mixed. While some companies managed to have a strong fourth quarter, most others have not. The overall mood this quarter is not upbeat.

There are two major reasons for this. One is the weakness in the Indian and global economies. The other is two consecutive years of sub-par monsoons, which has taken its toll on rural demand.

Take rural demand for instance. The management of Hero Motocorp in its recent conference call stated that it expects the rural economy to pick up in the second half of the current fiscal. But this is based on the assumption that will have the robust monsoon season the IMD says we will. The company does not expect great results in the quarters prior to that.

India Inc's performance has been tepid for quite a few quarters now, and the March quarter is no exception. This explains why the Sensex has lost steam. It's a far cry from the period May 2014-January 2015 when the Sensex gained around 33%. A lot was expected from the Modi government that did not really play out.

So where do we stand now?

The general feeling is that a substantial pick up in the economy will take place in the second half of the fiscal.

But to us, this is a myopic way of looking at things. We are not into predicting the monsoons and the impact they will have on our estimates.

We are more interested in the longer-term trend, if you will.

In this regard, Co-Head of Research Rahul Shah not long ago wrote about the very real possibility of a 70% upside in the Sensex. That number wasn't just pulled out from a hat. It comes from constantly tracking the performance of hundreds of listed companies versus their long-term track record.

Here's Rahul:

- The aggregate data we have pulled for Nifty companies suggests that profit margins were at a ten-year low at the end of FY15. Even if they were to rise to the average of the last ten years, not immediately, but three years out, the upside would close to 70%.

Put differently, markets will go up 70% over the next three years if profit margins revert to the mean.

Tanushree Banerjee, editor of StockSelect, agrees. As you know, StockSelect aims to help you build a portfolio of solid, safe, and profitable blue-chip stocks.

Tanushree believes the current weakness in the Sensex is an opportunity to scoop up some strong blue chips that will benefit investors immensely as the Sensex hits 40,000.

Which is why she and team are releasing a special report for StockSelect subscribers very soon. It's called:

- Sensex 40,000: Four Stocks to Profit from the Coming Stock Market Wave

There are barely few hours left for subscribers to grab an opportunity to access the report.

So don't let go of this chance to profit from Sensex 40,000

2:50 Chart of the Day

Engineering and construction major L&T's subsidiary L&T Infotech was in the news today for withdrawing 1,500 offer letters from students in south India. As per Business Standard, these students were benched for about eighteen months, after which they were asked to give an online test in which about 90% of them failed - thus coming to the conclusion that the intention was not to hire them in the first place. And thus, overestimation of future business is cited as the key reason behind this matter.

IT Hiring: A Mixed Bag...

Being a relatively smaller player, this just goes on to show the kind of issues the company could be facing. Especially, those related to the business and growth front. However, as we have written in the past, one point to also take note of is the increasing dependency on automation. India's large IT firms are no longer hiring employees the way they were five years ago.

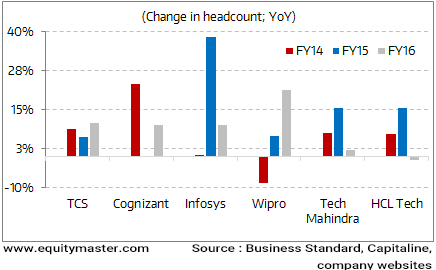

Today's chart of the day also gives an idea of the change in headcount. The average headcount increase for the large companies has been in mid-single to low double-digit regions in FY16. For the top-5 listed players, the combined figure came in at 10% for FY16.

We expect this trend to continue. Software firms no longer require human resources in large numbers to drive topline growth. The focus is on automation to drive productivity. The dependence on the old linear model of growing revenues along with number of employees has ended. This is the most important aspect that long term investors in IT stocks must keep their eyes on.

The government is out to tighten the screws on the public sector undertakings (PSUs). This development coincides with the resource crunch phase that the government is going through. As per The Hindu Business Line 'the Centre has moved to framing a set of comprehensive guidelines on crucial areas of capital restructuring to spur economic growth.'

Not only are the cash rich PSUs expected to fork out dividends to the tune of 30% of profits or 5% of net worth - whichever is higher - but also has put in guidelines on when to announce buybacks, splits and bonus shares.

In case of PSU buybacks, it is proposed that every PSU with net worth of more than Rs 20 billion and cash of Rs 10 billion will have to go in for a buyback. Other PSUs will have to take into consideration the cash utilization of the previous three years before taking such decisions.

As for bonus issues, the business daily has reported that 'PSUs with defined reserves and surplus of over five times their paid-up capital will be expected to look at issuing bonus shares. Issuing bonus shares will be mandatory if their defined reserves and surplus exceeds 10 times their paid-up capital.'

As for splits, it will be mandatory to split shares 'In case the market price or book value of a firm's share exceeds 50 times its face value, provided its existing face value is still more than Re 1.'

While these guidelines have been issued by the Department of Investment and Public Asset Management, with the aim to address resource management issues of PSUs, there are some aspects that we do not necessarily agree with - especially those related to the rules for issuing bonus shares and splitting shares with an aim to make them more 'affordable'.

As we have been saying for a long time, what makes a business attractive is the valuations and the long term prospects as compared to absolute share prices.

Markets have been volatile of late, and the prices for many PSU stocks have been beaten down. Their current valuations paint an interesting picture.

The 15 Largest PSUs and their Valuations

| Company Name | PBV | Dividend yield | TTM PE |

|---|---|---|---|

| Coal India Ltd. | 5.4 | 7.1 | 12.9 |

| Oil & Natural Gas Corporation Ltd. | 1.0 | 3.0 | 13.0 |

| NTPC Ltd. | 1.3 | 1.7 | 11.6 |

| Indian Oil Corporation Ltd. | 1.3 | 1.6 | 8.7 |

| Power Grid Corporation Of India Ltd. | 1.8 | 1.3 | 13.2 |

| Bharat Petroleum Corporation Ltd. | 2.6 | 2.3 | 9.0 |

| GAIL (India) Ltd. | 1.4 | 1.6 | 21.4 |

| NMDC Ltd. | 1.2 | 9.5 | 12.0 |

| Hindustan Petroleum Corporation Ltd. | 1.8 | 2.7 | 6.3 |

| Bharat Heavy Electricals Ltd. | 0.9 | 1.0 | - |

| Bharat Electronics Ltd. | 3.2 | 0.8 | 20.5 |

| Container Corporation Of India Ltd. | 3.5 | 0.9 | 35.7 |

| NHPC Ltd. | 0.8 | 2.6 | 9.3 |

| Power Finance Corporation Ltd. | 0.6 | 5.4 | 3.6 |

| Oil India Ltd. | 0.9 | 5.7 | 10.5 |

After opening the day on a positive note, the Indian indices moved below the dotted line post noon. At the time of writing, the Sensex was down by 0.2%. Sectoral indices were trading mixed with pharma and information technology stocks trading weak, while metal and realty stocks were in favour. The BSE Mid Cap and the BSE Small Cap indices were trading down by about 0.2% each.

4:50 Today's Investing Mantra

"Everyone has the brainpower to make money in stocks. Not everyone has the stomach. If you are susceptible to selling everything in a panic, you ought to avoid stocks and stock mutual funds altogether." - Peter Lynch

This edition of The 5 Minute WrapUp is authored by Radhika Pandit (Research Analyst) and Devanshu Sampat (Research Analyst).Today's Premium Edition.

IT Tops While Healthcare Struggles

In the first five months of 2016, the IT index has outperformed, while the healthcare index has languished.

Read On...

| Get Access

Recent Articles

- All Good Things Come to an End... April 8, 2020

- Why your favourite e-letter won't reach you every week day.

- A Safe Stock to Lockdown Now April 2, 2020

- The market crashc has made strong, established brands attractive. Here's a stock to make the most of this opportunity...

- Sorry Warren Buffett, I'm Following This Man Instead of You in 2020 March 30, 2020

- This man warned of an impending market correction while everyone else was celebrating the renewed optimism in early 2020...

- China Had Its Brawn. It's Time for India's Brain March 23, 2020

- The post coronavirus economic boom won't be led by China.

Equitymaster requests your view! Post a comment on "Sensex 40,000: Your Chance to Profit". Click here!

5 Responses to "Sensex 40,000: Your Chance to Profit"

Srivatsa

May 31, 2016Hi, with due respect to you, I have been hearing about your upcoming report on Sensex 40,000 for a millionth time already. Practically every other communication from you is contributing to this supposed run up to the Sensex 40,000 (or 70% gains as you alternatively call it).

It has got to a point that it is plain irritating to see Sensex at 40,000 or 70% higher and you just say it is coming and coming and coming.

Can we just stop making such a big song and dance about it and just get done with it?

V.Balasubramanian

Sep 7, 20169884723720

What are those 4 stocks? Longing for them pl