Inflation will Beat the Sensex! True or False?

- In this issue:

- » Tea Exports Realisation From UK to Fall

- » A Panel to Decide on Interest Rates in the Next Monetary Policy

- » ...and more!

The BSE Sensex has delivered about 16% annualised returns since inception. Not bad at all. But what does this number mean for you, the aam investor?

It means you would have beaten the market only if your portfolio has grown faster than 16%. But this is not the entire story.

Most people do not invest in stocks at one go and forget about them. But some people do.

Seasoned investors have seen many ups and downs. New investors have not.

Senior citizens tend to value dividends over growth. The opposite is true for young investors.

Some people invest directly in stocks. Others invest only through mutual fund SIPs. Many invest in both.

What does all this mean? This means there's no 'one size fits all' approach to measure returns from stocks.

What really matters is beating inflation.

A famous book was published in 1994: Stocks for the Long Run. The author, Jeremy Siegel, calculated returns from various assets in the US since 1802.

His conclusion was clear: Stocks are the best long-term investment. No other asset class could beat inflation over such a long period, not even gold.

Is this true about stocks in India as well? Does the Sensex beat inflation in the long-term?

You would think so. A 16% annualised return since 1979 (excluding dividends) is really good. Even over the last fifteen years, the markets have beaten inflation. But what about the recent past?

According to Business Standard, we shouldn't expect high returns from the index. Why? Because long-term returns from the index have been falling.

This is true, to an extent. Many people who invested after 2006 have not had a very good experience. Inflation has averaged about 8-9% over the last ten years. The Sensex has delivered 10% over this time. That's not worth celebrating.

So what should you do if the next ten years are similar to the last ten? Should you buy stocks today?

My answer is a big YES!

The reason lies in understanding why stocks are the best long-term investment. When you buy stocks, you buy ownership of a business. This is exactly why stocks are the place to be for long-term investors. Buy a good business and you will make good money.

A good business is one that earns a high return on invested capital, which most investors define as at least 15%. Let's say you buy this stock cheap - at ten times the profit earned in the last year. Then all you have to do is hold on. You can forget about inflation and the Sensex. You will easily beat them both.

At times, this is easy to forget. As the legendary mutual fund manager Peter Lynch said, 'Behind every stock is a business. Find out what it's doing.'

That's half the battle won. Of course you don't have to do this part. We'll identify good businesses and let you know if the stock price is right. The second part - holding on to it - is all you need to do.

Can this simple approach work for you? You bet it can. After all, it has worked wonders for us and our subscribers.

Consider the track record of StockSelect, our safe large-cap recommendation service. Following this simple approach since 2002, of all the stocks picked, eight out of ten have been winners! The StockSelect team doesn't worry about long-term inflation rates or Sensex returns. They have beaten both easily enough. You can too.

What is your strategy to secure yourself from inflation? Let us know your comments or share your views on the Equitymaster Club.

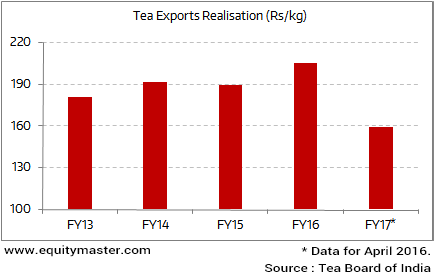

02:55 Chart of the Day

Britain's referendum to leave the European Union resulted in extreme volatility in the financial markets. The Indian tea exports industry will be impacted by the effects of currency in the short run. The Indian tea exporters have converted around 50 percent of their trade to dollars. However, rest of the trade is in pounds, which has weakened against the rupee. Thus an immediate impact of 7-8 percent on price realisations look very likely in the immediate scenario.

According to the Indian Tea Association, the forex impact is temporary and contracts between both buyers and sellers would not be affected. The contracts which come up for renewal would see an increase in prices.

India is the world's second biggest tea producer and also one of the largest consumers. The tea exports to European Union in the financial year 2016 was approximately 42 million kg, out of which 20 million kg was to the United Kingdom only. The European Union accounted for about 15 percent of the country's total tea exports.

India's Tea Exports Realisations to Drop Post Brexit

According to Morgan Stanley, the Indian economy will be least impacted in Asia by the UK's vote to exit the European union due to India's lower direct exposure in terms of exports to UK. However, the immediate impact would be visible through volatility in exchange rates and capital market flows.

The government has now initiated the process of constituting a monetary policy committee (MPC), which will take over the job of interest rate setting from the central bank. At present, the interest rates are decided by the governor, who in turn is advised by the technical advisory committee. The final decision to set rates lies with the governor. Spreading the responsibility will help reduce the immense pressure that falls on an individual.

The new monetary policy committee will comprise six members, headed by the governor. Three members, including the governor, will be from the Reserve Bank of India while other three will be nominated by the government and will be appointed for a period of four years. Each member will have one vote, with the governor having an additional vote in case of a tie. A committee based approach will add value and help bring in transparency to monetary policy decisions.

The monetary policy committee will have a mandate to bring inflation to a pre-set target. In addition, every six months, RBI will publish the Monetary Policy Report explaining sources of inflation and provide its forecast for the next six to eighteen months. If the RBI fails to meet inflation target, it will provide for steps to be taken and estimated time within which target will be achieved.

The Indian stock markets started on a positive note with the markets trying to hold on to the gains through the day. At the time of writing, the BSE-Sensex was trading higher by about 55 points (up 0.2%), while the NSE Nifty was trading up by 19 points up (up 0.2%). Most sectoral indices were trading slightly higher except the PSU banks which remained under pressure.

04.56 Today's Investing Mantra

"Behind every stock is a business. Find out what it's doing" - Peter Lynch

Today's Premium Edition.

Why Hero's Up, and Maruti Is Down...

Hero Motocorp has emerged as the top gainer in the first six months of 2016, while Maruti has lost the most.

Read On...

| Get Access

Recent Articles

- All Good Things Come to an End... April 8, 2020

- Why your favourite e-letter won't reach you every week day.

- A Safe Stock to Lockdown Now April 2, 2020

- The market crashc has made strong, established brands attractive. Here's a stock to make the most of this opportunity...

- Sorry Warren Buffett, I'm Following This Man Instead of You in 2020 March 30, 2020

- This man warned of an impending market correction while everyone else was celebrating the renewed optimism in early 2020...

- China Had Its Brawn. It's Time for India's Brain March 23, 2020

- The post coronavirus economic boom won't be led by China.

Equitymaster requests your view! Post a comment on "Inflation will Beat the Sensex! True or False?". Click here!

2 Responses to "Inflation will Beat the Sensex! True or False?"

Ganapathy Sastri

Jun 28, 2016If you want the true rate of inflation, ask the wife of RBI governor or wife of Finance Minister. Inflation in the last twenty years in real estate, wages and prices of food, rent has been truly MASSIVE and I for one do not expect stock market to give returns beating inflation. Valuation in the market is high considering returns one can get from debt. If one can get a return of 8% from debt, one should expect for higher risk a return of 12% from equity. PE ratio should then be 8.3 or lower. Unless inflation is brought down, it is difficult for stock market to meet the high expectations that you have.

N SANTHANAM IYER

Jun 28, 2016It is the prerogative of the government to appoint a committee to monitor/decide interest rate. The committee should also be made to take the responsibility to reign in inflation and whenever they fail, should be restructured. In the case of NPA the tax payer is made to pay for the deeds of the public sector banks thru re-capitalisation, while banks remunerations/dividend etc. are only hiked!