From Multi-Baggers to Filthy Beggars!

- In this issue:

- » Time to get rich investing in IPOs?

- » NCDs could offer you higher yields than FDs, but be careful!

- » Market roundup

- » ...and more!

The share market loves stories. Take the story of the dot-com boom...the real estate boom...the commodity recovery cycle...the list goes on. Now we have the story of a better monsoon and the recovery of rural India. And it wasn't long ago that we had the story of ecommerce. Rest assured, tomorrow will bring new story of another exciting prospect.

The 'story' is the front cover. It is nothing but a theme, an Idea, a scheme, or a thesis created to gain attention. So one asks a question: How can I benefit from this story? Well, the people who have created the story have an answer...

They say, look, this particular stock is a perfect fit to ride this (insert story name) story. The picture they paint is forward looking. The historic return ratios of the company are not great, the margins are unattractive, and there is no real competitive advantage. However, the story will take care of everything.

Eventually, the story creates a multi-bagger. Stock XYZ up 10x in two years...581% in less than one year...and so on. It is important to note that, during this time, these companies do not post an extraordinary performance. It is all hype and buildup.

Stories That Went from Multi-Bagger to Big Losers...

| Company Name | Theme/Story (Period) | Price to Earnings at the peak | Peak Returns | Current Status (from the peak level) |

|---|---|---|---|---|

| Unitech | Real Estate Boom (2006-08) | 72 | 6425% | Down 99% |

| Indiabulls Real Estate | Real Estate Boom (2006-08) | 53 | 151% | Down 89% |

| JP Associates | The next L&T (2006-2008) | 102 | 537% | Down 96% |

| Educomp Solution | Opportunities in school education (2007-2010) | 331 | 444% | Down 99% |

| Bhushan Steel | Metal Receovery with capacity expansion and backward integration (2009-2011) and (2012-2014) | 174 | 608% | Down 90% |

| Gitanjali Gems | A play on gold prices and presence in high margin Jewellery segment (2010-2013) | 22 | 409% | Down 93% |

| Gati | E-commerce as a revenue driver (2014-2015) | 77 | 638% | Down 47% |

Take the ecommerce story. Back in 2013-14, ecommerce companies were growing tremendously. Venture capital firms were queuing up to provide funding. The ecommerce companies were expanding their operations and hiring top brass from the industry.

We saw full-page advertisements on the front page of the newspapers from these companies offering products at a discount cashback deals. It looked like a real game changer. The way we buy our stuff...the way we shop...now a virtual experience at the click of a button. It was the story of this decade!

Guess what... To ride this story, we had logistic sector, specifically courier companies. This sector was ready to capture the growth of ecommerce. After all, these ecommerce companies have to send packages to their customers. Sales growth at ecommerce companies would lead to more packages and increased revenues for courier companies.

But the market was too taken with the story and overestimated the growth of ecommerce.

Now, courier companies did ride this story. Stock prices went through the roof...despite no visible improvement in their performance. But the story had the power to keep the stock prices rising.

But these stories don't hold up. After the recent valuation markdowns, people are losing confidence in the ecommerce story. Venture-capital firms are finally realising that valuations are ahead of reality. With this story not playing out as initially thought - not to mention the depressed earnings growth of courier companies - the stock crashed. All the hype around the sector has vanished.

So is there a better way to go about picking multibaggers? I posed this question to Richa Agarwal, our in-house small-cap specialist, who has a solid track record of

- Well, I think the term 'multibagger' has become a scam. Everybody talks about it. Everybody wants to ride multibaggers. But the truth is that it is practically impossible to predict that a so-and-so stock will go up 10 times...20 times...30 times...

So, when I scour the small-cap universe, I don't ask myself if this stock could go up X times. Instead, I look for small businesses that have huge headroom for growth. But when I say growth, I mean profitable growth...growth that delivers a good return on capital...growth that creates wealth for shareholders.

To be honest, small caps are a risky lot. Not every promising small cap will turn out to be a multibagger. Occasionally, you will also bump into some value traps and wealth destroyers.

But if you have a sound stock-picking strategy, you will come across a solid stock once in a while that will give your stock portfolio a strong jump.

What's your take on multibaggers? What is your experience with finding and riding multibagger stocks? Let us know or post your comments on Equitymaster Club.

02:50 Chart of the day

I bumped into an old family friend a week ago. After exchanging pleasantries, the subject immediately switched to IPOs. I could see the enthusiastic spark in his eyes.

He asked me about a recent IPO. But his question was empty of curiosity. He had already applied for it. And was just seeking reassurance from me.

His confidence (or shall I call overconfidence?) stemmed from a successful streak at the IPO box office in recent months. He beamed with pride as he recounted some of the big listing gains he had made.

It was obvious to me that he was driven to investing in IPOs with the single-minded motive of making some quick buck on the listing day. He didn't care about fundamentals, or valuations. He was simply counting on the positive trend.

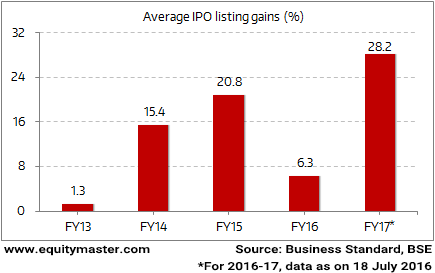

As today's chart of the day shows, the ongoing financial year 2016-17 has delivered the best average listing gains in the last five years.

I have some questions for IPO enthusiasts...

Can IPOs really make you wealthy? I understand that some of the IPOs in the past year have been quite rewarding. But tell me, what was the quantum of money that you were you able to invest in these IPOs? And how much was the absolute gain that you made? How materially did it increase the value of your stock portfolio?

In my view, chasing listing day gains is not the recipe for wealth creation. The safest and the best way to make real, big money in stock markets is to have a sound long-term investing strategy.

Time to Get Rich Investing in IPOs?

Are you disappointed with the declining interest rates on your fixed deposits? Are you looking for other fixed income instruments that could offer you higher yields? If your answer is yes, then non-convertible debentures (NCD) could be the right solution for you. As per an article in The Economic Times, India Inc is set to launch non-convertible debentures worth Rs 253 billion in the coming months.

Tata Steel alone is expected to raise Rs 100 billion from the debt market. Some of the other names include HDFC, Air India, Capital First, Kalpataru Power, PVR, Tata Motors, UltraTech Cement, Manappuram, Sintex, and Piramal Enterprises.

These NCDs could offer you higher yields than what your bank offers you. But let me warn you. Do not give in to the lure of high yield blindly. While these NCDs are investment grade debt instruments, they may not be as safe as your bank fixed deposits. Some of the companies issuing the NCDs have very high debt on their balance sheets. So, be very careful. Carry out some fundamental checks before investing in these NCDs. What is the purpose of the NCD issue? Is the company in a debt spiral - taking on more debt to repay old debt? Is the company's business model sustainable? If there is any doubt about the company's capacity to repay its obligations, avoid such NCDs irrespective of the higher yields on offer.

After starting on a positive note, the Indians stock markets have pared their gains. The BSE Sensex was trading flat at the time of writing. Telecom, capital goods and banking sector stocks were the leading gainers. However, healthcare and FMCG sector stocks were trading weak. Mid cap and small cap indices were trading marginally higher.

04:50 Today's investing Mantra

"The basic story remains simple and never-ending. Stocks aren't lottery tickets. There's a company attached to every share." - Peter Lynch

Today's Premium Edition.

AGM Season Is Here... Focus on the Right Stuff

The factors shareholders should focus on at company annual general meetings.

Read On...

| Get Access

Recent Articles

- All Good Things Come to an End... April 8, 2020

- Why your favourite e-letter won't reach you every week day.

- A Safe Stock to Lockdown Now April 2, 2020

- The market crashc has made strong, established brands attractive. Here's a stock to make the most of this opportunity...

- Sorry Warren Buffett, I'm Following This Man Instead of You in 2020 March 30, 2020

- This man warned of an impending market correction while everyone else was celebrating the renewed optimism in early 2020...

- China Had Its Brawn. It's Time for India's Brain March 23, 2020

- The post coronavirus economic boom won't be led by China.

Equitymaster requests your view! Post a comment on "From Multi-Baggers to Filthy Beggars!". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!