Switch off the TV tomorrow and don't waste time on Bihar election results

In this issue:

» Difference between borrowings and rental yields is the highest in India

» Will geo-political risks increase?

» A round up on markets

» ... and more!

00:00 |

|

|

Dear Readers: Every once in a while we invite guests to write columns for us. In today's weekend edition of The 5 Minute Wrap up, we invited Vivek Kaul to share his views on the most talked about topic today - the Bihar elections. Many of you know Vivek as the India Editor of The Daily Reckoning. He is also the author of a trilogy on the history of money and the financial crisis titled Easy Money. Happy reading! - Devanshu Sampat

|

The irony in all this is that people sitting in television studios and writing editorials in newspapers, who have never visited Bihar, are perhaps the most confident on which way the election will go. Don't ask me how.

Nevertheless, there is some logic to it. Dan Gardner explains this in Future Babble-Why Expert Predictions Fail and Why We Believe Them Anyway: "There is a "confidence heuristic". If someone's confidence is high, we believe they are probably right: if they are less certain, we feel they are less reliable, this means we deem those who are dead certain the best forecasters."

As Gardner further writes: "Another problem with the confidence heuristic is that people may look and sound more confident than they really are. Con men do this deliberately. We all do, to some degree. Of course most of us don't do it brazenly as con men - one hopes - but we all sense intuitively that confidence is convincing. And so, when we are face to face with people we want to convince, we downplay our doubts, or bury them entirely."

So being confident and forceful about what you say makes for good television and great reading. And that explains why people sitting in studios in Delhi and Mumbai are making the most confident forecasts about who will win in Bihar.

Research also shows that when there is a competition to make forecasts, the forecasts people make get more and more confident as we go along.

What does this mean during election time? When every political analyst is busy making forecasts, if someone wants to standout then he has to make clear and confident forecasts. And that is precisely what has been playing out in television studios up until now.

You are likely to see more of that once election results start coming in and by 10AM tomorrow morning, it will be more or less clear who is likely to form the next government in Bihar-the Nitish Kumar led Grand Alliance-or the Narendra Modi led National Democratic Alliance (NDA).

Once the results are out political analysts will offer us explanations on why the results happened to turn out the way they have. If Narendra Modi led NDA wins, then we will hear stuff like the Modi magic is still at work, people have taken Modi's promise of a separate Rs 1.25 lakh crore development package for Bihar seriously and so on. Some cheeky analyst might also suggest that all the statements made by the "so-called" fringe elements in the ruling Bhartiya Janata Party (BJP), also helped bring in the votes.

If the Nitish Kumar led Grand Alliance wins, you will hear analysts stay stuff like there was no anti-incumbency at work. The development carried out by Nitish Kumar has worked. The women have come out in full force to vote for him given all the development projects targeted towards women Kumar carried out. And voters in state elections have once again shown that development gets you votes.

Given that it is Bihar election results that the analysts will be analysing, there is bound to be some analysis along caste lines. You are likely to hear stuff like the Muslims plus Yadavs, the base on which Lalu Prasad Yadav ruled Bihar for a long time, voted for the Grand Alliance en masse. Hence, all the statements made by the so-called fringe elements in BJP did not work.

So if the BJP wins we will be told that the statements by fringe elements may have added the icing on the cake. If it loses, we will be told it didn't work.

Long-story short, we will be told a lot of stories explaining why things happened the way they did. As Gardner writes: "People love stories, both the listening and the telling. It's a central part of human existence, found in every culture, in every place, in every time...For explanation-sharing to work, however, a story cannot conclude with "I don't know" or "The answer isn't clear."" The narrative should be complete. Incomplete stories do not work.

Hence, there will be no shortage of explanations and stories on why things happened the way they did in Bihar. Political analysts will come up with extremely coherent reasons on why things happened the way they did. You won't hear phrases like "I don't know" or words like "maybe" or "possibly". In fact, some analysts will even say stuff like "as I have been saying all along". In case of television channels the "I" will become "we".

Even those who get their forecast wrong (and believe me there will a lot of them) will revise their forecasts. As Jason Zweig writes in The Devil's Financial Dictionary: "Once you learn what did happen, your mind tricks you into believing that you always knew it would happen. Contrary to the popular cliche, hindsight is not 20/20; it is barely better than legally blind."

This tendency is referred to as hindsight bias.

Hindsight bias is also referred to as "I knew it all along effect". As Nassim Nicholas Taleb writes in Fooled by Randomness: "Our minds are not quite designed to understand how the world works, but, rather, to get out of trouble rapidly and have progeny...Psychologists call this overestimation of what one knew at the time of the event due to subsequent information...the "I knew it all along" effect."

The Nobel Prize winning psychologist Daniel Kahneman talks about this phenomenon in his book Thinking, Fast and Slow, in the context of the financial crisis which broke out in late 2008.

As he writes: "I have heard of too many people who "knew well before it happened that the 2008 financial crisis was inevitable." This sentence contains a highly objectionable word, which should be removed from our vocabulary in discussions of major events. This word is, of course, knew. Some people thought well in advance that there would be a crisis, but they did not know it. They now say they knew it because the crisis did in fact happen."

Something similar will play after the Bihar election results as well. Depending on the result, people will adjust their analysis and say "I knew this will happen". So if Nitish wins they will say, I knew this will happen, even if they had been predicting a Modi win earlier. And vice versa.

This is not a good thing. As Kahneman writes: "What is perverse about the use of know in this context is not that some individuals get credit for prescience that they do not deserve. It is that the language implies that the world is more knowable than it is. It helps perpetuate a pernicious illusion. The core of the illusion is that we believe we understand the past, which implies that the future also should be knowable, but in fact we understand the past less than we believe we do."

Given this, it's best not to waste time watching all the analysis that will pour in on Bihar elections, all through the day tomorrow and on Monday.

Switch off the television.

Take your kids out for a spin.

Buy some gold for your Mother. And your wife. Or your girl-friend (It's Dhanteras after all).

Or just pick up a good book and read.

Happy Diwali!

Editor's Note: Vivek's analysis of the election is spot on! And I am sure you agree with it. At least partially. Anyways, that's Vivek for you. His opinions and insights when it comes to politics and the economy are both deeply studied, and, like in this case, very sensible. It cuts through the noise out there and hands you something you can actually work with. If you would like to continue hearing from Vivek, just sign up (1-click only) for his free daily newsletter, The Daily Reckoning.

03:40 |

Chart of the day | |

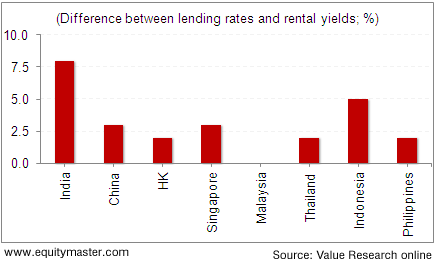

When compared to Asian markets, the Indian real estate sector stands out in one regard. As pointed out by Value Research, the difference between the borrowing costs and the rental yields is the highest in India - hovering around the 8% mark. In markets such as China, Hong Kong, and Singapore, the difference is around 2% to 3%.

Today's chart of the day puts things in perspective.

|

Gauging the outlook of the real estate sector becomes difficult given the various factors playing their parts. One of which includes the excess capacity building up, despite the number of new launches (in the premium segment) coming down. As such, there are expectations of prices coming down on the back of reducing affordability. Then, with builders getting access to funds through the non-traditional routes such as private equity investors, it does put a question mark around the question - 'Which way will prices move?'

Vivek Kaul had written about this matter in a recent edition of the Daily Reckoning. As per him, a key aspect is to gauge the demand for real estate, rather than supply. With real estate losing sheen as the preferred investment route in recent years, a big chunk of the 'investment demand' is expected to be taken out. An excerpt from the write up - "Homes in India have "not" always been bought "for their intrinsic worth" but they have also been bought "to sell on to others at a higher price". And that clearly is not happening anymore. Over the last few years you would have been better off letting your money sit idle in a savings bank account rather than investing in real estate. Given this, the interest in owning real estate has come down."

04:45 |

|

|

The leader of OPEC has decided to maintain production at near record levels. This despite an oversupply situation of about 1 million barrels per day in the global oil market. This decision has already hammered the US shale industry. But it seems the Saudi's are not satisfied.

As per an article in Zero Hedge, the Saudi's have offered massive discounts to European nations. This would challenge the influence that Russia has over Europe. If a large number of European countries make the switch from Russian oil to Saudi oil, we believe geopolitical risks could increase.

Do keep in mind that the Russian economy is in the doldrums. The country has also entered the military conflict in Syria recently. Further pressure on its economy due to this move could have serious geopolitical consequences for the entire Middle East. This is something investors should watch out for.

05:25 |

|

|

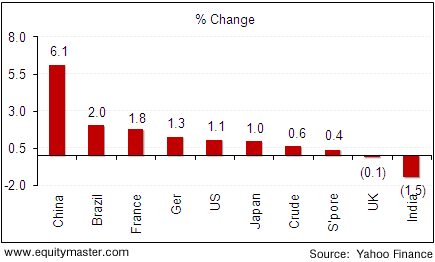

The US markets ended the week in gains even as markets fell on the last trading day as a stronger jobs report saw the increased possibility of the US Fed hiking interest rates in December. Even the unemployment rate hit a 7.5-year low of 5% adding strength to the economic recovery. Most of the European markets, except UK, ended the week in gains.

The Indian equity markets fell by 1.5% during the week after exit polls predicted a close fight for the Modi government in a race to win the Bihar elections. Even the earnings season continued to remain lack luster, which has added to the poor performance of stocks.

Barring a few, all sectors ended the week on a negative note. Stocks from the pharma and capital goods sectors were the biggest losers for the week.

|

06:10 |

Weekend investing mantra |

Today's Premium Edition.

Today being a Saturday, there is no Premium edition being published. But you can always read our most recent issue here...

Recent Articles

- All Good Things Come to an End... April 8, 2020

- Why your favourite e-letter won't reach you every week day.

- A Safe Stock to Lockdown Now April 2, 2020

- The market crashc has made strong, established brands attractive. Here's a stock to make the most of this opportunity...

- Sorry Warren Buffett, I'm Following This Man Instead of You in 2020 March 30, 2020

- This man warned of an impending market correction while everyone else was celebrating the renewed optimism in early 2020...

- China Had Its Brawn. It's Time for India's Brain March 23, 2020

- The post coronavirus economic boom won't be led by China.

Equitymaster requests your view! Post a comment on "Switch off the TV tomorrow and don't waste time on Bihar election results". Click here!

4 Responses to "Switch off the TV tomorrow and don't waste time on Bihar election results"

Subramanian m

Nov 7, 2015No doubt we should not waste watching the news channel which will again prove tongue has no bones but it is important from country's perspective that a defeat of BJP will encourage opposition to come toget her to over throw Modi and this would have an adverse effect on economy and investors confidence would definitely go down and no important bills would get passed. In the interest of the economy atleast we should get to know the result.

Abhishek

Nov 7, 2015Well articulated Vivek. Humans are notorious to justify their thoughts and actions even though they may be wrong.

Manish Shah

Nov 7, 2015Dear Editor sir, I couldn't agree more with you when you say that Vivek sirs opinions and insights cuts through all the noise and hands you something which you can work with. In fact it is written in such simple and understandable common every day language that one really enjoys reading it .There is no way you cannot be convinced by what he is saying.Very practical and down to earth. In fact i never miss reading his columns however busy i am and where ever i am. Vivek sir please keep it up. In this world of nonsense you opinions/insights are like whiff of fresh air or like oasis in desert!

krishnan vc

Nov 9, 2015CLAP! CLAP!