Demonetisation: The Biggest Failed Economic Experiment in Indian History?

- In this issue:

- » PM Modi's Digital ambitions could be nightmare for common man

- » Italy votes 'No': Why should Indian investors be concerned?

- » Market roundup

- » ...and more!

Soon, it will be a month since we heard the term demonetization after a gap of thirty eight years. The intent was to target black money. And to check terrorist funding. So far so good.

But the planning and execution has certainly left a lot to be desired. As we wrote recently, of the Rs 15.4 trillion of black money in circulation before the move, Rs 15 trillion is likely to return to the banking system. The much-hyped revolution could at last turn out to be much ado about nothing...

Until you take note of the casualties.

Namely: money, time, and resources

Printing new currency...people in queues rather than at work...loss of lives and livelihoods...abandoned projects - a lot has been sacrificed for the failing experiment.

The biggest blow has been to the rural economy and the small players in the unorganised sector. The informal sector runs mostly on cash and accounts for 48% of India's total output and 80% of employment.

The GDP growth rate comes next. And we believe that the pain will be worse and more prolonged than predicted. The move could even delay the implementation of GST. Low deposit rates for savers are already a reality.

One can gauge the government's confidence by the turn the narrative has taken in last one month - from demonetisation to a cashless economy.

Parts of India have indeed been rendered cashless...and helpless. And the elephant in the room is political funding that happens mostly in cash and is unaccounted.

Meanwhile, a new twist emerges...

Thanks to the latest amnesty scheme, the crooked will be allowed to come clean if they declare their unaccounted income and pay a penalty of 50%...and then keep the other 50%. If they had the sense to invest this unaccounted income in assets, even better. The honest taxpayer is made to look like a fool.

From threats of tax plus 200% penalty on deposits, Jan dhan account holders who helped convert black money into white for a 'cut 'are now being openly encouraged by Mr Modi (as suggested by his speech in 'Parivartan' rally in Moradabad, Uttar Pradesh). Those who weren't a part of this laundering scheme must be wondering how they can get in on the action.

No one is asking what happened to the pre-election claims of bringing back black money stashed abroad. Nor is anybody asking what demonetization does to target black money stored not in cash but in assets such as real estate and gold. And how about preventing the creation of black money in the future?

- 'It's easier to fool people than to convince them that they have been fooled.' - Mark Twain

Failed execution of demonetization could have long lasting impact on the lives of people and businesses. So far, the economic logic of the initiative has gone for a toss. We could go on counting the troubles. But that will not help you tread through the crisis.

- 'Only when the tide goes out do you discover who's been swimming naked.' - Warren Buffett

But you can't wait for the tide to turn; it could be far too late by then. That's why Tanushree and her team have developed a system to help you weed out the companies that could crumble under demonetisation. It's vital to test the safety of your stocks and hold on to the ones that will tide the temporary chaos and gain from the earnings upside in the long term.

|

--- Advertisement ---

A Legal Way To Earn 'White Money'... Will demonetisation actually have any impact on the black money? Well, we think we'll have to wait to get the answer to that question... However, if you're looking for ways to earn 'white money'... We do believe that investing in the stock market is one of the best legal ways to create long-term wealth. However, that doesn't mean you should start investing in any stock. To find out which stocks are worth your money... Just click here. ------------------------------ |

03:00 Chart of the day

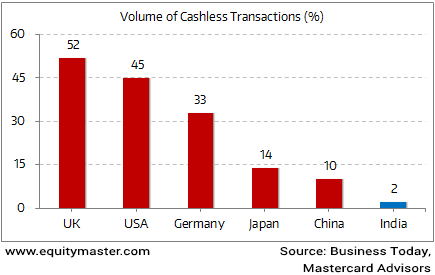

One of the major offshoots of the demonetisation drive is a push towards a cashless, digital economy. In today's chart of the day, we have presented the quantum of cashless transactions in some of the major economies of the world...and how far India has to go to become a cashless economy.

The statistics are startling. Just about 2% of the volume of economic transactions in India are cashless.

Is India Ready to Go Digital?

Less cash would mean less black money...less corruption...and more transparency.

But is India really ready to go digital?

We don't think so. In our view, digital India is a way distant dream...particularly for rural India.

Consider the following statistics...

As per Newslaundry.com, there were 5.3 bank branches per one lakh Indians in rural India 15 years ago. Today the figure stands at 7.8 bank branches per one lakh Indians. This shows that a majority of rural India has very little access to banks and the organized financial sector. They rely heavily on cash and the informal credit system.

Then, we have just 2.2 lakh ATMs in the country. For a population of over 1.2 billion people, that's a very small number. And guess what? A majority of ATMs are concentrated in metros and cities. For instance, Delhi has more ATMs than the entire state of Rajasthan.

Given the poor penetration of banks and formal sector financial services in rural India, we believe that Modi's cashless economy ambitions are a distant dream.

Then there are issues of related to security. In an earlier issue, we questioned if banks and other financial institutions were technologically competent to tackle the security issues associated with the shift towards a digital economy? This is what we wrote:

- Can the common man fully trust that his hard earned money in the financial system will be safe from hackers and fraudsters?

And the answer does not seem be a comforting one!

Recently a taxi driver in Punjab became a crorepati overnight.

Here we are not talking of the moolah that he earned from winning a lottery. But rather the bounty of Rs 98 billion that was transferred to his Jan Dhan account. The glaring mistake was due to a wrong entry by the bank official who accidentally entered the Banking General Ledger account number in the amount column. The mistake was rectified the very next day. But not all such stories end on a happy note.

There have been several instances of debit and credit cards being hacked and large sums of money fraudulently withdrawn from the accounts of hapless account holders. And with a large population still not financial literate, they remain gullible to falling prey to such frauds easily.

Therefore, unless the whole financial system is made more secure and fool proof, the shift towards a cashless economy can prove to be a financial nightmare for the common man.

Some important updates from the Eurozone...

Yesterday, Italy held a referendum over constitutional reforms. Prime Minister Matteo Renzi had stated that he would resign in case of a 'No' vote. Lo and behold, the people of Italy voted a big 'No'.

Now, why should Indian investors be concerned about the resignation of the Italian prime minister? In a recent edition of The 5 Minute WrapUp Premium, Rahul Shah explained the big-picture perspective behind Italy's referendum and Renzi's likely resignation:

- So why should the markets be worried?

The answer: Beppe Grillo. He's Italy's answer to Donald Trump.

Mr Grillo is a comedian (yes, a real comedian), who heads the popular 'Five Star Movement'. This party is opposed to Italy remaining in the Eurozone. Grillo has proposed a Brexit-style referendum if he comes to power. He has about 30% of the popular vote as per the latest polls. This is why markets are worried. In case Mr Renzi's reform proposals are defeated, he might have to step down. After a transition period, elections would be held. If Grillo wins that election, he will become the next Prime Minister of Italy. He could then call for an 'Italexit' referendum. If 'leave' prevails over 'remain', like it happened recently in England, then Italy will have to start the long drawn out process of leaving the Eurozone.

In short, there is a big crisis brewing within the Eurozone. And this is going to have major consequences for the global financial markets, including the Indian stock markets.

The latest issue of Vivek Kaul's Inner Circle presents an intriguing insight on Italexit from our global team of experts in London and other corners of the world. We strongly recommend you to read it.

After opening the day on a weak note, the Indian stock market indices are trading higher with marginal gains. FMCG and auto stocks are leading the sectoral gains.

The BSE Sensex is trading higher by 79 points (up 0.3%) and the NSE Nifty is trading higher 24 points (up 0.3%). The BSE Small Cap and BSE Mid Cap indices are trading higher by 0.1% and 0.5% respectively.

The euro dropped to a 20-month low in Asia as investors assessed the implications of the resignation of Italian Prime Minister Matteo Renzi after he suffered a humiliating defeat in a referendum over constitutional reforms. Consequently, most major Asian stock markets witnessed selling pressure. Major European stock markets have also opened in the red.

04:40 Investing mantra

"What you have to learn is to fold early when the odds are against you or if you have a big edge, back it heavily because you don't get a big edge often. Opportunity comes, but it doesn't come often, so seize it when it does come." - Charlie Munger

This edition of The 5 Minute WrapUp is authored by Richa Agarwal (Research Analyst).Today's Premium Edition.

A Preliminary Check of Earnings Quality

Important metrics to help you judge the quality of reported earnings.

Read On...

| Get Access

Recent Articles

- All Good Things Come to an End... April 8, 2020

- Why your favourite e-letter won't reach you every week day.

- A Safe Stock to Lockdown Now April 2, 2020

- The market crashc has made strong, established brands attractive. Here's a stock to make the most of this opportunity...

- Sorry Warren Buffett, I'm Following This Man Instead of You in 2020 March 30, 2020

- This man warned of an impending market correction while everyone else was celebrating the renewed optimism in early 2020...

- China Had Its Brawn. It's Time for India's Brain March 23, 2020

- The post coronavirus economic boom won't be led by China.

Equitymaster requests your view! Post a comment on "Demonetisation: The Biggest Failed Economic Experiment in Indian History?". Click here!

21 Responses to "Demonetisation: The Biggest Failed Economic Experiment in Indian History?"

K Mankad

Dec 6, 2016Absolutely surprised to read completely one sided and factually incorrect article. Not expected from EM. I strongly advise to focus on what you do best - analyse companies financials and advise your subsribers.

Surendranath

Dec 6, 2016AND I WONDER HOW YOU CAN PASS A JUDGEMENT AS "BIGGEST FAILED ECONOMIC EXPERIMENT"BARELY WITH IN A MONTH OF ITS INTRODUCTION...

DOES IT MAKE ANY SENSE OF WISDOM OR REVEAL ANY RESPONSIBILITY..

Surendranath

Dec 6, 2016I totally agree with Mr Narasimha Datta ..

RAHUL GOEL, THIS lS A WAKEUP CALL FOR YOU....

The write ups of late have been MORE POLITICAL than economic appraisal..

The above article does not give all facts and the writers in one column contradict others in other columns..

doubt whether Equity Master as an entity has some PERSPECTIVE or not..

The recent amendment proposes to tax 50% if the hoarders declare their money in the deposits or otherwise.. Then from the remaining 25% is transferred to Prime Ministers welfare fund for 4 years without any interest.. what is available to the black babus is only 25%..

BETTER YOU EDUCATE YOUR TEAM PROPERLY..

I sincerely feel EQUITY MASTER is gradually losing its steam..

Narasimha Datta

Dec 6, 2016I'm surprised by the contradictions between the catchline "Unbiased opinions on investing in India" and the sheer subjectivity in portions of this (and other previous) articles on demonetization. Has the team resorted to writing politically colored articles rather than sticking to the economics? We have heard enough noise in the print and television media about the wrongs being done by one person, as if the rest of the country has little or no role in fighting against black money or corruption. Please do not add to this cacophony; what we expect from a responsible and esteemed organization such as yours is truly unbiased and *positive* commentary on the situation. Suggest ways and means of improving the situation (if you think it's bad). Reach out to the government of India with your proposals. Educate your vast client-base of the good intentions of the move and how to carry it to a successful conclusion.

Any sweeping change of this magnitude in a country of India's size must necessarily go through short periods of pain and inconvenience, regardless of how many months or years of planning is done. It is curious and slightly amusing to note that many writers project things as if such a mammoth exercise involving thousands and millions of moving parts can be flawlessly executed and things change digitally overnight to a black-money-free economy. This is a step in the right direction and we should appreciate the boldness and courage required to even bring in such honest change (whether for electoral gains or otherwise).

Kannan Ramaseshan

Dec 5, 2016My view on the purpose of Demonetisation is stop the system to generate black market and money in future. The present blank money in the system is not allowing new entrepreneur to compete with the present black market businessman. Both the players is not having the same field to run the business with equal opportunities to compete. The present system forcing the new one also get along with black market due to risk of making losses.

Yes, we are suffering now but I am strongly believing that its temporary. We are the part this system and made it corrupt. Now we have the opportunity to clean. I am happy to do it even if I make some losses.

Once the new distribution of currency is ove, digital payment system in place and with GST, I believe we will leave a good future for the coming generation.

BHOLA SINGH

Dec 5, 2016The article written by Ms Richa Agarwal is factually one sided and does not give correct picture post demonetisation.

R.Thirumurthy

Dec 5, 2016May I suggest your team does a brainstorming session on how best all the challenges and failures of the re monetization scheme can be turned into opportunities and successes?

sundaravaradan S.

Dec 5, 20161. The Great Service by Govt bashers ..?

-So much of statistics (about ATM, Black Money, white Money, No.of person Died in Q (Dont ask why they died!),

-The failure of Digital economy. (Forget how many tech-companies have created Employment), Penetration of e-wallets (Paytm, Freecharge, Mobiquick etc..), UPI, UDDI for non-smart-old Mobiles in India.

-- How many wise-supporters have been made to look-like "fools" ?

---Will these people recall their statements in year 2018..??2020?

--How many people were scared by these? in spite of saying they are willing to suffer the pain...

---- What happened, when the whole country was SHOOK from the slumber....!!

---

---The entire Systems were shaken-up & were made to action..

---How many bankers & general public sacrificed, during this period...

--I have not much time... Bye...Let us see after 4,5 years...!

Salil Gupta

Dec 5, 2016Nice to see you sticking your neck out and pronouncing a judgement so early - it is not as bold a move as Demonetisation is, but bold it is!

ofcourse you can choose the defination of "failed"

So can I!!

To my mind - the kind of turblance it has created in minds of black money creators - it is already a success in that.

In future -

I will be glad to see you proven wrong - i guess so would you. :-)

Prasad Nageshkar

Dec 6, 2016Could you please elaborate what is meant by "Therefore, unless the whole financial system is made more secure and fool proof" ?

Most of my financial transactions have been online for the last several years :) No one in the world can guarantee you fool-proof security .. please consult some tech security expert. Do you have some numbers on the number of the hacks compared to the total number of transactions ? Also how many people have lost all their money as a result of the hacks ? Do you really think moving towards cashless economy is a nightmare for the common man ? What channels do you use today for accepting subscription payment ?

Everyone knows the entire nation will not become digital instantly , it will happen sooner than you think, though !