- Home

- Archives

Archives... Don't Miss Anything, Ever!

Here you will find all the research and views that we post on Equitymaster. Use the tools to customize the results to suit your preference!

Is this Tata Stock a Ticking Time Bomb?

Is this Tata Stock a Ticking Time Bomb?

Apr 25, 2024

A critical look at a big Tata group stock

Mukul Agrawal's Top 5 Stock Picks in Q4

Mukul Agrawal's Top 5 Stock Picks in Q4

Apr 25, 2024

Ace investor broadens portfolio with five new Q4 picks.

Why SAIL Share Price is Rising

Why SAIL Share Price is Rising

Apr 25, 2024

Investors are fancying SAIL over peers Tata Steel and JSW owing to cheaper valuations. There's more to the story though...

Top Stocks in Amit Shah's Portfolio

Top Stocks in Amit Shah's Portfolio

Apr 25, 2024

One of the top politicians in the country has a widely diversified portfolio. Read more here...

A Rare Opportunity to Profit from Pharma Stocks

A Rare Opportunity to Profit from Pharma Stocks

Apr 25, 2024

This opportunity can create a lot of wealth. Keep an eye on it.

Can Asian Paints Repeat History of Multibagger Returns?

Can Asian Paints Repeat History of Multibagger Returns?

Apr 24, 2024

Whether the rough patch should be considered a permanent damage for Asian Paints.

Why Aditya Birla Group Stocks are Rising

Why Aditya Birla Group Stocks are Rising

Apr 24, 2024

Aditya Birla stocks rally up to 8%, with four stocks hitting 52-week high. Find out why.

FIIs are Buying into these 5 Adani Stocks. Take a look...

FIIs are Buying into these 5 Adani Stocks. Take a look...

Apr 24, 2024

FIIs raise stake in these Adani group companies. Do you own any?

Why Tata Teleservices Share Price is Rising

Why Tata Teleservices Share Price is Rising

Apr 24, 2024

Telecom stocks have shot up in recent trading sessions following VI's successful FPO and Bharti Hexacom's listing.

Why CE Info and Netweb Technologies Can Go Where NVIDIA Can't...

Why CE Info and Netweb Technologies Can Go Where NVIDIA Can't...

Apr 24, 2024

A 100-day programme will look for companies that can fortify India's deeptech foray.

Solar is Hot. It's About to Get Hotter with the Upcoming IPO of Premier Energies

Solar is Hot. It's About to Get Hotter with the Upcoming IPO of Premier Energies

Apr 24, 2024

From grey market premium to price band, here's everything you need to know about this solar cell maker's upcoming IPO.

Why Tejas Networks Share Price is Rising

Why Tejas Networks Share Price is Rising

Apr 23, 2024

Tejas Networks Zooms nearly 40% in two days, hits 52-week high. What next for this Tata stock?

Space Stock Locked in Upper Circuit After Ashish Kacholia Buys 17,54,385 Shares

Space Stock Locked in Upper Circuit After Ashish Kacholia Buys 17,54,385 Shares

Apr 23, 2024

This company was behind the manufacturing, delivery and assembly of core equipment for the first ultrasonic wind tunnel for ISRO.

Can Your Stocks Benefit from Higher Inflation?

Can Your Stocks Benefit from Higher Inflation?

Apr 23, 2024

Higher Inflation is good for these companies.

Why Union Bank of India Share Price is Rising

Why Union Bank of India Share Price is Rising

Apr 23, 2024

With NPAs on the decline, Union Bank is optimistic about robust growth and it's well-placed to capitalise on the pickup in corporate credit cycle.

Best Travel Stock: Thomas Cook vs Easy Trip Planners

Best Travel Stock: Thomas Cook vs Easy Trip Planners

Apr 23, 2024

This online travel aggregator is buckling up to take off to new heights by going the extra mile to deliver customised experiences.

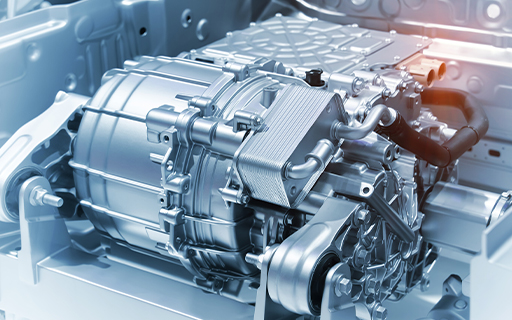

Multibagger Midcap Stock Secures Big Contract to Supply Critical Components to Tesla

Multibagger Midcap Stock Secures Big Contract to Supply Critical Components to Tesla

Apr 22, 2024

Tesla diversifies its supply chain with second Indian EV partnership. What next?

Why GSPL Share Price is Falling

Why GSPL Share Price is Falling

Apr 22, 2024

Shares of the company crashed 20% following a big tariff reduction by the regulator. What next?

Hidden Potential: Can This Mid-cap Stock Double Your Money?

Hidden Potential: Can This Mid-cap Stock Double Your Money?

Apr 22, 2024

This mid-cap stock could soar if things go right.

Will HDFC Bank Share Price Revive Post Q4 Results?

Will HDFC Bank Share Price Revive Post Q4 Results?

Apr 22, 2024

During the quarter, HDFC Bank sold its stake in HDFC Credilla for a gain of Rs 55.3 billion and made a floating provision of Rs 109 billion.