- Home

- Views On News

- Feb 18, 2022 - Big Dividend Payouts Around the Corner. Watch Out for Dividend Stocks...

Big Dividend Payouts Around the Corner. Watch Out for Dividend Stocks...

There are two ways to make money in stocks.

There's the popular way - capital gains (i.e. growth) and there's the not so popular way - dividends (i.e. income).

Investors tend to get obsessed with capital gains. This is understandable. Who doesn't like capital gains? The more the better.

Dividend investing is different. Dividend investors don't seek growth. Of course, they'll take the growth if they can get it. But they don't actively look for it.

What do they look for?

Stability.

Investing in a stable dividend-paying company can let you sleep peacefully at night. The business will generate a steady passive income. The more stable the business, the higher the share of profits that can be distributed.

All else being equal, a company with a higher dividend payout is more stable that a similarly sized competitor with a lower dividend payout.

But that does not mean you should jump into stocks with the highest dividend payout ratio.

If a company pays out all its profits as dividends, it may not always be a good sign. It could imply that there's no chance of investing the profits back into the business at a decent return.

This is why it's better to look for a company with plenty of room to increase the dividend payout in the future.

A Dividend Bonanza is Around the Corner

Th financial year is coming to a close. And do you know what that means?

Companies will soon begin the process of distributing their annual dividends to shareholders.

In this volatile stock market, isn't it nice to get these neat little dividend payments that go straight to your bank accounts?

When the stock prices are not going up, dividends become not only a source of income but also a source of comfort.

Stocks offering high dividend yields are very tempting. After all, when fixed deposit rates are so low, high dividend yield stocks look great in comparison.

In fact, high dividend yields point to these stocks being bargain buys.

But you must remember something very important. Dividends are sustainable only to the extent that earnings are sustainable.

If earnings were to reduce, these high dividend yields of today will count for nothing. In such cases, not only will the dividends disappear, they also won't save you from the severe crash in the stock price that will follow the company's fall in earnings.

Also, the benefit of buying dividend stocks is that the uncertainty of returns becomes low because the company pays a dividend at regular intervals.

But before picking such stock in the hope of earning dividends, one should make it a point to go through its financial statements, look at its dividend payment history and check out its market reputation.

The moral of the story: Though high dividend yield stocks may be a great starting place to search for deep value bargains, never pick stocks on dividends alone.

The stock market has many potential wealth compounders with lucrative dividend yields. By picking the right ones, you could create a good income for yourself along with the capital appreciation over the long term.

Now with that out of the way, let's look at the top 3 dividend paying stocks in the market today.

# Coal India

Coal India is India's largest coal producer. It accounts for 82% of India's total coal production. Not just India, the company holds the distinction of being the largest coal producing company in the world.

India generates 55-60% of its energy through fossil fuels and a lot of it is through coal. Majority of thermal power plants in the country are powered by coal.

Coal India is one of India's 10 Maharatna public sector enterprises (PSEs) and comes under the Ministry of Coal. The Indian government owns 66.13% of the company and is the largest shareholder.

The company mines several types of coal that is supplied to power producers and steel manufacturers.

With its market leading position, the company sits on a huge pile of cash. It uses the cash reserve to pay dividends consistently.

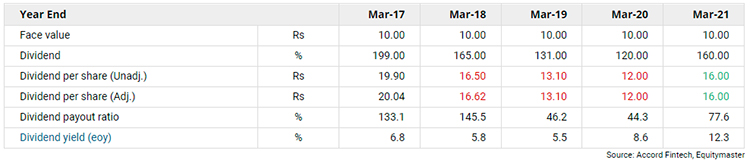

Coal India has paid 18 dividends (including interim dividends) in the last 10 years. Its average dividend payout ratio is more than 50%.

The company has already paid Rs 9 per share as interim dividend, more than 90% of its earnings in the first half. The final dividend could be even higher.

Coal India Dividend History

Though the company has been consistent with dividends, the stock hasn't performed well since it got listed. In fact, the stock is currently trading below its IPO issue price of Rs 245 per share.

Also, rapid adoption of renewable energy poses a major threat to Coal India's business which has dented investors sentiment.

For more details, check out Coal India's financial fact sheet and quarterly results.

# ITC

Established in 1910 as Indian tobacco company (ITC), the company has evolved into a large conglomerate with presence across several industries such as FMCG, packaging, hotels, and agriculture.

Though the company manufactures a range of products, it specialises in cigarettes. ITC has been making cigarettes for more than 100 years. It's the indisputable market leader in India.

ITC's cigarette segment falls under its FMCG division which accounts for 65% of its total revenue.

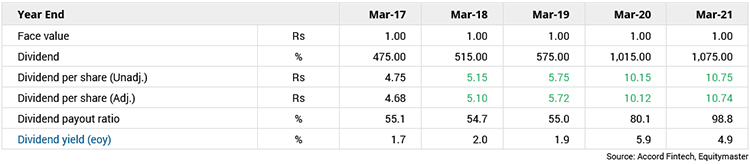

ITC finds a place in the portfolio of many fund managers as the company pays steady dividends to its shareholders. ITC's dividend payout averages at 69% for the last five years.

Investing in dividend paying stocks is a suitable option for those people who want a stable source of income and who want to stay away from stock price volatility.

For more details, check out ITC's financial fact sheet and quarterly results.

ITC Dividend History

# Ambuja Cement

Ambuja Cement is a part of the Holcim Group (formerly known as LafargeHolcim), a global leader in providing green building solutions in 70 markets across five continents.

Ambuja Cement's unique product portfolio is tailor made to suit Indian climatic conditions. The company is the industry leader in using both natural and man-made resources responsibly and has been awarded several accolades for the same.

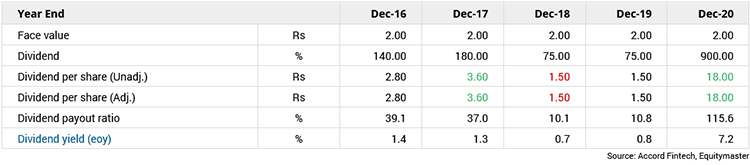

Ambuja Cement follows a calendar year format (ending 31 December) for reporting their financials.

So shareholders can expect the final dividend few months earlier than companies following the March year end.

The five-year average dividend payout ratio for Ambuja Cement is 42.5%. The five-year average dividend yield for Ambuja Cement is 2.5%.

For more details, check out Ambuja Cement's financial fact sheet and quarterly results.

Ambuja Cement Dividend History

Dividend Stocks on Equitymaster's Stock Screener

You can shortlist dividend paying stocks in just a few seconds using Equitymaster's powerful stock screener. It's a powerful and flexible tool which allows you to run your own custom queries.

High Dividend Yield Stocks

Here are some screens for dividends on Equitymaster's stock screener:

Equitymaster's smallcap guru, Richa Agarwal, recently recorded a video exploring the concept of dividend investing.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

Equitymaster requests your view! Post a comment on "Big Dividend Payouts Around the Corner. Watch Out for Dividend Stocks...". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!