- Home

- Views On News

- Feb 21, 2022 - LIC IPO: Will Retail Investors Dive in? Our Poll Suggests...

LIC IPO: Will Retail Investors Dive in? Our Poll Suggests...

By now, everyone has heard about the upcoming LIC IPO.

Life Insurance Corporation (LIC) has over 64% share of total insurance premiums in India, in financial year 2021, as per Statista. This is much higher than the share of premiums held by private life insurers.

LIC's assets under management (AUM) was Rs 38 tn as of September 2021, compared to Rs 37 tn in March 2021. This is almost 3x the AUM of all the private life insurers in India and over 15x more than the AUM of the second largest life insurer, SBI Life Insurance Company.

All these facts alone make the IPO very enticing apart from its potential size.

The state-owned behemoth is expecting at least one seventh of India's investing population (around 7.5-10 m retail investors), including its policy holders, to participate in the mega IPO.

It seems like an army of retail investors is sitting on the sidelines, just waiting to pour their money into the initial public offer (IPO).

So the big question is...will you apply for the IPO or wait on the sidelines?

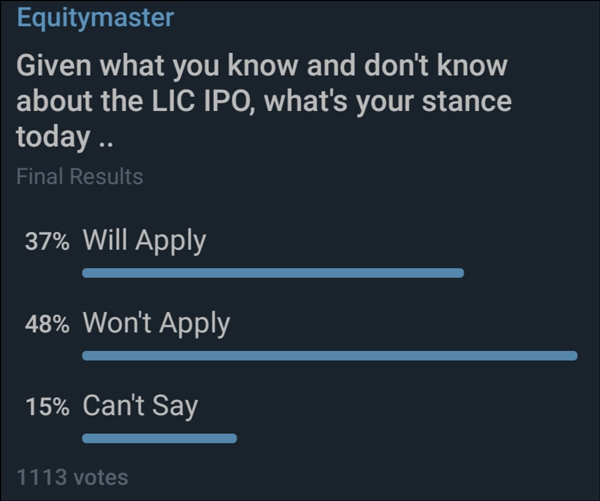

To understanding what our readers are thinking, we ran a poll on Equitymaster's Telegram Channel over the weekend.

Here's what we asked our readers...

Given what you know and don't know about the LIC IPO, what's your stance today...

- Will Apply

- Won't Apply

- Can't Say

With a response from over 1,100 participants, here is the final result:

48% say they will stay away from the LIC IPO.

Surprising, isn't it? Talk about pessimism...

LIC has sold 70% of India's total policies. Its assets exceed the GDP of several economies. Given its dominance you might have expected a majority it to be in favor of applying.

But the fact that people are considering staying away from LIC's IPO shows that there's some rationality left out there after all!

35% of the entire IPO is reserved for retail investors, so that's a huge task for the government. To make sure things go as planned, brokers, bankers, and LIC agents are driving efforts to ensure maximum retail participation.

37% people said they will participate in the IPO.

LIC's IPO is termed as India's Aramco moment, so it would require huge commitment from retail investors.

Prior to this, Paytm, Coal India, and Reliance Power were the three biggest IPOs in India.

Paytm's IPO managed to book its retail portion 1.7 times. Coal India saw just over 2 times subscription from retail investors.

Meanwhile, Reliance Power received a massive 14.9 times subscription from retail investors. This IPO was launched at a time similar to today. Demat account openings were at a high and people poured their money to invest in the IPO.

Due to the efforts that LIC agents, we know there's a lot of anticipation for the LIC IPO.

The lowest percentage, 15%, said they're not sure what to make of the situation.

They are sitting on the sidelines. They're observing how the market situation unfolds amid the Russia-Ukraine tensions. Sustained FII outflows has added to the nervousness.

Now getting back to our question...

We don't know if LIC's public issue will be successful or not. But the enthusiasm is strong due to many initiatives taken by government.

The IPO is crucial for the markets as it will help the government narrow its fiscal deficit.

Due to its massive size, a few companies are deferring their plans to launch their IPOs. They don't want to clash with LIC's mammoth issue. Rough calculations suggest that around US$10 bn will be sucked out of the system once the IPO is launched.

It remains to be seen how the IPO sails through once its price band, valuation and other key details are announced.

No matter what happens, LIC's IPO will be the defining market event of 2022. It will be a test of retail investors' appetite.

Watch the video below in which Co-head of Research at Equitymaster and Editor of Forever Stocks, Tanushree Banerjee, explains how you should evaluate the LIC IPO.

Insurance is not an easy sector for investors to figure out. The financial statements are full of jargon. In fact, they don't resemble financials of any other sector.

Watch the below video before you consider applying for LIC's IPO.

Happy Investing!

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

Yash Vora is a financial writer with the Microcap Millionaires team at Equitymaster. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

Equitymaster requests your view! Post a comment on "LIC IPO: Will Retail Investors Dive in? Our Poll Suggests...". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!