- Home

- Views On News

- Mar 6, 2023 - 3 Charts that Explain the Rally in Momentum Stocks

3 Charts that Explain the Rally in Momentum Stocks

We've just entered March 2023 and the month has already seen some major events unfold.

Volatile crude and natural gas prices, SEBI clamping down on YouTube influencers who manipulated stock prices, and of course the volatility in Adani group stocks.

There's also a change in market sentiment. The overall mood in the markets is looking up, all thanks to the sharp rebound in markets on Friday last week.

The BSE Sensex today regained the 60,000-mark. Mid and small cap indices have also started rallying and are up quite a bit from their recent lows.

But what about the future?

With markets rising on one hand and volatility surrounding the Adani group stocks on other, will this trend continue? Should you adopt a wait and watch policy or take the plunge and enter the markets now before it's too late?

Let's go through some data and past evidence before we get back to this question.

Starting from January 2022, from peak to trough, the BSE Smallcap index has fallen around 13% in 13 months.

However, if you have bought mid and small caps recently, things could be very different for you. In the past one week, the BSE Smallcap index is up 3%.

If we have to take cues from history, something similar has above happened in 2013. Back then, investors exited mid and small caps in huge numbers. At that time, there was also uncertainty surrounding general elections of 2014.

The consensus among investors was to adopt a wait and watch approach and buy stocks after the outcome of the elections.

How did this speculation work out? Between January 2013 to August 2013, the BSE mid and small cap index were down 29% and 33%, respectively.

But in the next one year, they shot up massively. The BSE midcap was up 78% and the smallcap index was up almost 100%.

Needless to say, people who would have adopted a wait and watch policy till the elections, would have missed out on a huge portion of the gains.

Even if we take the recent example of Covid crash in March 2020, between February 2020 and March 2020, the Sensex cracked more than 30% in one month flat. It was a scary time to be in the markets back then.

Investors who sold at the bottom in the Covid crash missed out on multibagger returns...as majority of stocks charted a strong rebound within the next couple of months.

Indeed, markets are unpredictable and it's futile to time them. The time to get into stocks is a difficult one to get right.

Now, momentum investing involves taking advantage of market trends and sentiment. As things are now, there is a change in market sentiments and the overall mood in the markets is looking up.

Keeping that in mind, let's take a look at stocks trading near their 52-week high and riding high on the momentum trend.

Remember that 2023 is a crucial year for India as the country takes strides towards achieving its renewable energy targets, building more roads, and also making the most of the China plus one megatrend. So the general sentiment should be positive as the government won't let anything go bad before the general elections next year, right?

Now, let's take a look at the stocks...

#1 Kirloskar Ferrous Industries

At a time when there's a feud among Kirloskar family promoters and insiders of the company have started to sell their holding in the company gradually, Kirloskar Ferrous Industries has defied the general market trend and scaled new highs in 2023.

In the past five years, shares of the company have multiplied investor wealth over 4 times.

After trading in a range between March 2018 to early 2020, the stock touched a multi-year low of Rs 42 in March 2020. It's been a one way rally since then.

Select foreign investors have not missed the rally in the stock as FII holding has gone up from 0.09% in March 2021 to 1.15% at present.

Kirloskar Ferrous is a part of the Pune-based Kirloskar group, which manufactures pig iron and ferrous castings such as cylinder blocks, cylinder heads, transmission parts and different types of housings required by automobile, tractor, and diesel engine industries.

In March 2022, the company acquired a controlling stake in ISMT to facilitate forward integration into seamless tubes.

Then in November 2022, the company decided to consolidate the entire undertaking business and operations of ISMT and merge it with itself.

According to the company's chairman, this merger will benefit Kirloskar Ferrous to diversify its product portfolio and also help in forward integration. ISMT is the largest integrated specialized seamless tube manufacturer in India. It is one of the most diversified manufacturers of specialized seamless tubes in the world.

In the past three years, Kirloskar Ferrous has commissioned a coke oven plant and a captive power plant. This has helped Kirloskar reduce its dependence on external coke purchases and external power requirement.

In just five years, the company's revenue has doubled while profits have grown 10 times.

Kirloskar Ferrous Financial Snapshot (2018-2022)

| Rs m, standalone | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|

| Revenues | 17,652 | 21,592 | 18,497 | 20,381 | 36,150 |

| Growth (%) | 38% | 22% | -14% | 10% | 77% |

| Operating Profit | 1,149 | 2,174 | 2,310 | 4,643 | 6,584 |

| OPM (%) | 7% | 10% | 12% | 23% | 18% |

| Net Profit | 380 | 981 | 1,124 | 3,021 | 4,061 |

| NPM (%) | 2% | 5% | 6% | 15% | 11% |

| Debt to Equity (x) | 0.1 | 0.2 | 0.4 | 0.3 | 0.9 |

If the company continues to service debt gradually and keeps the debt to equity well below the 1x mark, it should be smooth sailing going forward for Kirloskar Ferrous Industries.

#2 ION Exchange

Next on this list of momentum stocks is the flagship company of the ION Exchange group.

ION Exchange initially began as a company which manufactures ion-exchange resins and later diversified into chemical treatment of water. Currently, it operates in three key segments including engineering, chemicals, and consumer products.

Between March 2018 and March 2019, the company traded in a narrow range, hovering between Rs 450 to Rs 500.

The company went on to touch a high of Rs 1,000 in January 2020, just to fall back to Rs 500 by April 2020. The stock currently trades at Rs 3,500.

Ever since the company has announced its foray into the carbon trading business, shares have been on a roll.

Moreover, water supply and treatment companies like Va Tech Wabag Ltd and ION Exchange will be instrumental in the implementation of this mission as the demand for water will only increase.

Interestingly, ace investor Sunil Singhania holds ION Exchange and it's one of the top 5 stocks in Singhania's portfolio.

In the past five years, the company's revenue and profit has grown at a CAGR of 8.5% and 32% respectively.

Financial Snapshot of ION Exchange (2018-2022)

| Rs m, consolidated | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|

| Revenues | 10,549 | 11,623 | 14,798 | 14,495 | 15,769 |

| Growth (%) | 1% | 10% | 27% | -2% | 9% |

| Operating Profit | 1,011 | 1,422 | 1,732 | 2,375 | 2,576 |

| OPM (%) | 10% | 12% | 12% | 16% | 16% |

| Net Profit | 402 | 653 | 936 | 1,439 | 1,628 |

| NPM (%) | 4% | 6% | 6% | 10% | 10% |

| Debt to Equity (x) | 0.8 | 0.4 | 0.3 | 0.1 | 0.1 |

The company is all set for its next leg of growth as the capex it took in the past two years, especially in the resin division, will increase capacity.

#3 WPIL

Third company on this list is WPIL. The company is engaged in the entire value chain of Pumps & Pumping Systems from concept to commissioning and execution of water supply projects on a turnkey basis for industrial units, power utilities, irrigation departments, etc.

The company has three core divisions - turnkey solutions, engineered pumps, and conventional water pumps.

Apart from commanding a strong position in the domestic markets, WPIL has gradually expanded its operations globally through acquisitions or forming joint ventures.

In the past five years, shares of the company are up 262%.

Between August 2018 and August 2022, shares of the company were in a range, hovering below the Rs 1,000 mark. WPIL touched a low of Rs 230 in the Covid crash.

The company has seen a sharp turnaround in share price since February 2022. Trading at Rs 1,100 on 3 February 2023, the stock is currently priced at Rs 2,242...over 100% gains in just one month!

The renewed interest in the engineering and water treatment company comes on the back of WPIL reporting stellar Q3 results and due to procurement of heavy orders, which provide visibility on the revenue front.

In the December 2022 quarter, WPIL reported a profit after tax (PAT) growth of 459% on a year-on-year (YoY) basis.

Recently, the company received 4 orders for executing turnkey projects worth Rs 12.3 bn. These orders will get executed in the next two years, making WPIL among the smallcap companies with strong order books.

In the past five years, the company has doubled its net profit while margins are also improving on a consistent basis.

WPIL Financial Snapshot (2018-2022)

| Rs m, consolidated | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|

| Revenues | 8,449 | 11,565 | 9,089 | 9,948 | 11,813 |

| Growth (%) | 19% | 37% | -21% | 9% | 19% |

| Operating Profit | 1,135 | 2,547 | 1,343 | 1,660 | 2,188 |

| OPM (%) | 13% | 22% | 15% | 17% | 19% |

| Net Profit | 401 | 1,257 | 562 | 842 | 973 |

| NPM (%) | 5% | 11% | 6% | 8% | 8% |

| Debt to Equity (x) | 0.6 | 0.3 | 0.8 | 0.5 | 0.4 |

With a healthy business outlook and an order book of Rs 33.4 bn as of December 2022, the company could possibly remain in an uptrend especially because of the increasing government focus on the Jal Jeevan Mission.

To keep up with expansion plan, WPIL aims to seize plans for a new reactor.

Which other stocks are trading very close to their 52-week high, and look set to breakout?

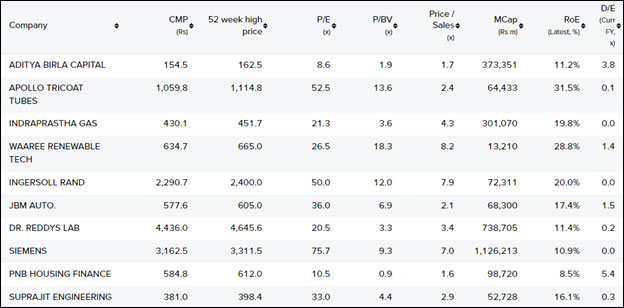

Below is the list of stocks trading close to their 52-week high:

Please note that these parameters can be changed according to your selection criteria.

This will help you identify and eliminate stocks not meeting your requirements and emphasise those stocks well inside the metrics.

The key takeaway

The best time to buy fundamentally strong stocks is when the market is down. But this is also the best time to get into momentum stocks.

It may sound counterintuitive but it's quite simple.

If there are stocks that are outperforming the market, even going up, when the market is falling, then think about how strongly investors believe in them. They are buying these stocks even when they are selling other stocks.

That shows the potential of keeping a close watch on momentum stocks. They can deliver significant outperformance.

Just as value investors invest in value stocks when no one else is interested, momentum investors should start looking for momentum stocks right now when the momentum is just starting to catch up...this way you can find momentum stocks in their upcycle.

Co-head of Research at Equitymaster Rahul Shah has created an investing system based on momentum stocks...and he will reveal all details about the same at an online special event on 13 March 2023.

Happy Investing.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

Yash Vora is a financial writer with the Microcap Millionaires team at Equitymaster. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

Equitymaster requests your view! Post a comment on "3 Charts that Explain the Rally in Momentum Stocks". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!