- Home

- Views On News

- Mar 21, 2023 - Top 5 High Quality Penny Stocks to Add to Your Watchlist

Top 5 High Quality Penny Stocks to Add to Your Watchlist

For many investors, penny stocks are an attractive option due to their potential for high returns with a low initial investment.

However, it can be challenging to find high-quality penny stocks that are worth adding to your portfolio.

What do we mean by high quality penny stocks?

Imagine companies with decent sales and profit growth over the past 10 years. Companies which have good return ratios and have shown consistency in their dividend payouts.

You want to see a company that has been around for a while and has a history of earnings growth, as well as decent profit margins.

So, keeping that in mind, we highlight the top five high quality penny stocks in India.

These stocks are shortlisted using Equitymaster powerful Indian stock screener.

#1 HUDCO

First on the list is HUDCO.

Housing & Urban Development Corporation (HUDCO) is a public limited company (Government of India undertaking). Being majorly owned by the centre, the company receives support in terms of board representation and access to low-cost funds.

The company is primarily engaged in the business of financing housing and urban development activities in the country.

Over the years, HUDCO has played a significant role in the implementation of its various initiatives in urban infrastructure and social housing projects.

The company's exposure to urban infrastructure is rising in line with the government's increased focus towards infrastructure development. This is a big plus for HUDCO, which sanctions loans under various infrastructure schemes.

Coming to its financials, for the year ended March 2022, HUDCO reported a standalone profit after tax of Rs 17,166 million (m). This compares with 2021's profit of Rs 15,786 m.

HUDCO's profitability was impacted in Covid years (2020 and 2021) but it improved in 2022 and reached pre-Covid levels.

For the nine months ended December 2022, HUDCO has reported a profit of Rs 10,624 m.

Have a look at the table below which shows the company's financial performance for the past five years.

HUDCO Financial Snapshot (2018-2022)

| Rs m, standalone | FY18 | FY19 | FY20 | FY21 | FY22 |

|---|---|---|---|---|---|

| Revenue | 41,714 | 55,559 | 75,321 | 72,355 | 69,544 |

| Growth (%) | 18% | 33% | 36% | -4% | -4% |

| Operating Profit | 37,089 | 49,390 | 70,281 | 70,004 | 68,864 |

| OPM (%) | 89% | 89% | 93% | 97% | 99% |

| Net Profit | 10,102 | 11,802 | 17,084 | 15,786 | 17,166 |

| NPM (%) | 24% | 21% | 23% | 22% | 25% |

| Debt to Equity (x) | 3.65 | 5.45 | 4.98 | 4.62 | 4.25 |

| ROE (%) | 10.57 | 11.29 | 14.67 | 12.37 | 12.41 |

| ROCE (%) | 8.86 | 8.44 | 9.72 | 9.45 | 9.16 |

In March 2023, the company's board announced plans to raise Rs 180 billion (bn) as part of its fundraising exercise.

The company is also known for rewarding its shareholders by making large dividend payouts. HUDCO boasts of a high dividend yield of 7.9% on its current market price.

Since listing on the bourses in May 2017, HUDCO share price has fallen 38%.

#2 PTC India

Next on the list is PTC India.

The company is regarded as a pioneer in developing power trading in India.

Over the years, the company has diversified its service offerings. It has recently forayed into the wind energy business by setting up a new company - PTC Energy Limited.

It is also exploring opportunities in green hydrogen, and battery energy storage systems.

Coming to its financials, PTC India has reported decent numbers over the years, despite growing competition within the sector.

PTC India Financial Snapshot (2018-2022)

| Rs m, consolidated | FY18 | FY19 | FY20 | FY21 | FY22 |

|---|---|---|---|---|---|

| Revenue | 1,96,394 | 1,51,551 | 1,81,008 | 1,83,455 | 1,68,564 |

| Growth (%) | 28% | -23% | 19% | 1% | -8% |

| Operating Profit | 13,014 | 20,838 | 18,485 | 17,250 | 16,042 |

| OPM (%) | 7% | 14% | 10% | 9% | 10% |

| Net Profit | 2,000 | 4,253 | 3,676 | 4,487 | 5,062 |

| NPM (%) | 1% | 3% | 2% | 2% | 3% |

| Debt to Equity (x) | 3.3 | 3.4 | 2.7 | 2.6 | 2.1 |

| ROE (%) | 4.4 | 12.8 | 10 | 10.6 | 12.1 |

| ROCE (%) | 8.1 | 11.9 | 10.6 | 10.2 | 9.9 |

The company has been consistently paying dividends since 2002. The stock's current dividend yield stands at 8.8%. This means that for every Rs 100 invested in the company you earn a dividend of Rs 8.8.

The consistency in dividend payments is on the back of PTC India's healthy cash & cash equivalents.

Consistent Dividends at a Growing Rate

| Year Ending | Dividend Per Share (Rs) | Dividend Yield (%) |

|---|---|---|

| 31-Mar-22 | 7.8 | 9.47 |

| 31-Mar-21 | 7.5 | 9.61 |

| 31-Mar-20 | 5.5 | 14.25 |

| 31-Mar-19 | 4 | 5.44 |

| 31-Mar-18 | 4 | 4.59 |

| 31-Mar-17 | 3 | 3.23 |

| 31-Mar-16 | 2.5 | 3.92 |

| 31-Mar-15 | 2.2 | 2.72 |

| 31-Mar-14 | 2 | 2.96 |

| 31-Mar-13 | 1.6 | 2.69 |

Dividend yield as per 31 March 2022

In March 2023, the company announced its collaboration with a Belgium based company to develop predictive solution for the Indian power market.

Since listing on the bourses in April 2004, shares of the company have gained 104%. In 2023 so far, PTC India shares are up 12%.

#3 Jagran Prakashan

Third on the list is Jagran Prakashan, a media conglomerate.

Jagran Prakashan initially started its business with printing and publishing newspapers and magazines. However, it has expanded its portfolio in the last few years to FM radio, outdoor and digital advertising, event management, and promotional marketing.

A few of the company's popular brands include Dainik Jagran, Mid-day, The Inquilab, and Radio City, among others.

As per the last available readership survey data, Dainik Jagran had total readership of over 69 m, which is the highest amongst all newspapers in India.

After reeling under pressure in pandemic year, Jagran Prakashan's financial performance has significantly improved.

Financial Snapshot of Jagran Prakashan

| Rs m, consolidated | FY18 | FY19 | FY20 | FY21 | FY22 |

|---|---|---|---|---|---|

| Revenues | 23,040 | 23,627 | 20,973 | 12,892 | 16,160 |

| Growth (%) | 1% | 3% | -11% | -39% | 25% |

| Operating Profit | 6,298 | 5,745 | 4,649 | 2,798 | 4,264 |

| OPM (%) | 27% | 24% | 22% | 22% | 26% |

| Net Profit | 3,110 | 2,742 | 2,809 | 783 | 2,169 |

| NPM (%) | 13% | 12% | 13% | 6% | 13% |

| Total debt | 1,478 | 4,064 | 2,252 | 2,683 | 2,770 |

| Debt to Equity (x) | 0.07 | 0.22 | 0.12 | 0.13 | 0.13 |

If we go back to the pandemic days, it was clear the already affected print media industry had suffered a big blow due to lockdowns. Newspapers struggled as readership reduced along with advertisement revenues.

Along with this, the threat of digitisation was accelerating.

But big players like Jagran Prakashan took serious cost-cutting measures and hiked cover prices, among other initiatives. This cushioned the pandemic blow to some extent.

For the nine months ended December 2022, Jagran Prakashan has reported a profit of Rs 1,733 m. Going by the trend, Jagran is set to surpass last year's revenue and profit figures.

However, a big challenge for Jagran right now is soaring newsprint prices and high inflation. Newsprints account for around 30-35% of operational cost for some print media companies. In some cases, it's 50%!

Coming to distribution to shareholders, Jagran didn't pay dividend in the years 2020, 2021 and 2022. For financial year ending March 2023, it paid an interim dividend of Rs 4 per share in August 2022.

Instead of dividend, Jagran Prakashan focuses on buybacks as it is one of the companies which have conducted repeat buybacks.

Since listing on the bourses in February 2006, Jagran Prakashan shares have rallied 60%.

#4 Gujarat Industries Power

Fourth on the list is Gujarat Industries Power (GIPCL).

The Vadodara-based public limited company is engaged in the business of power generation. It was incorporated in 1985 and is promoted by three leading Gujarat PSUs viz. GUVNL, Gujarat Alkalies, and Gujarat State Fertilisers.

It has a diversified portfolio of thermal (gas and lignite), wind and solar power plant assets in the state of Gujarat.

The company also offers operation and maintenance (O&M) services, such as power plant services, and emineralization (DM) water supply and laboratory testing services.

Coming to the company's financials, due to non-operation of its gas power plant, the company reported muted numbers for 2022.

Even for 2023, the company has guided for flat growth due to capacity addition.

Gujarat Industries Power Financial Snapshot (2018-2022)

| Rs m, standalone | FY18 | FY19 | FY20 | FY21 | FY22 |

|---|---|---|---|---|---|

| Revenue | 13,538 | 14,074 | 13,788 | 13,353 | 11,724 |

| Growth (%) | 3% | 4% | -2% | -3% | -12% |

| Operating Profit | 5,320 | 6,651 | 5,469 | 4,546 | 4,270 |

| OPM (%) | 39% | 47% | 40% | 34% | 36% |

| Net Profit | 2,445 | 1,764 | 2,480 | 1,798 | 1,713 |

| NPM (%) | 18% | 13% | 18% | 13% | 15% |

| Debt to Equity (x) | 0.3 | 0.2 | 0.2 | 0.2 | 0.2 |

| ROE (%) | 10.4 | 7 | 9.3 | 6.4 | 5.8 |

| ROCE (%) | 13.1 | 9 | 11.2 | 9.2 | 8 |

Coming to dividends, GIPCL has consistently declared dividends since 1997.

Going forward however, the company's dividend payout might get reduced as it has a significant capex plan.

The company is developing the Khavda project in four phases. Capex for this is around Rs 1-1.2 bn for 2023 and around Rs 4-5 bn planned for next year.

All this should bode well in the long term. GIPCL is also exploring new business opportunities including foraying into green hydrogen space.

Since listing in 2000, shares of the company have gained 72%.

#5 Skipper

Last on this list is Skipper, a leading engineering products manufacturing company.

It is known for manufacturing transmission and distribution structures like towers and poles.

The company also manufactures polymers such as pipes and fittings and is trusted to execute infrastructure EPC projects.

In the last three years, the company's revenue and net profit declined mainly due to Covid-19. However, it managed to have a positive net margin.

Skipper Financial Snapshot (2018-2022)

| Rs m, consolidated | FY18 | FY19 | FY20 | FY21 | FY22 |

|---|---|---|---|---|---|

| Revenue | 20,737 | 18,709 | 13,905 | 15,815 | 17,071 |

| Growth (%) | 25% | -10% | -26% | 14% | 8% |

| Operating Profit | 3,056 | 1,829 | 1,417 | 1,493 | 1,724 |

| OPM (%) | 15% | 10% | 10% | 9% | 10% |

| Net Profit | 1,178 | 312 | 413 | 214 | 251 |

| NPM (%) | 6% | 2% | 3% | 1% | 1% |

| Debt to Equity (x) | 0.8 | 0.8 | 0.7 | 0.6 | 0.8 |

| ROE (%) | 20.3 | 4.8 | 6.2 | 3 | 4 |

| ROCE (%) | 24.7 | 12.4 | 9 | 9.1 | 10.1 |

For the quarter ended December 2022, Skipper reported a revenue of Rs 4.4 bn, up 11.1% YoY. Operating profit declined 13.9% while net profit declined 15.8%.

The profitability was impacted by rupee depreciation, leading to a loss of Rs 44 m versus a gain of Rs 69 m (YoY).

As of December 2022, its order book stood at Rs 47 bn - the highest ever in company's history. As per the management, the bidding pipeline remains strong. The company is actively pursuing projects worth Rs 52 bn on international front and about Rs 31.2 bn on the domestic front.

Skipper recently secured its largest single order win from Bharat Sanchar Nigam Ltd (BSNL) for supply and erection of GBT Towers and subsequent O&M for 5 years, extendable to 5 more years.

Going forward, strong order book will drive revenue growth and the company is also expecting better profit margins.

The country's focus on renewable energy, roll out of 4G and 5G networks (that need massive telecom infra to be set up - India needs around 800,000 additional towers to address digital growth and 5G roll out) and China plus one, are some of the trends that are acting as tailwinds in company's favour at present.

The company has also been paying dividends consistently.

Since listing in July 2014, Skipper share price has rallied 167%.

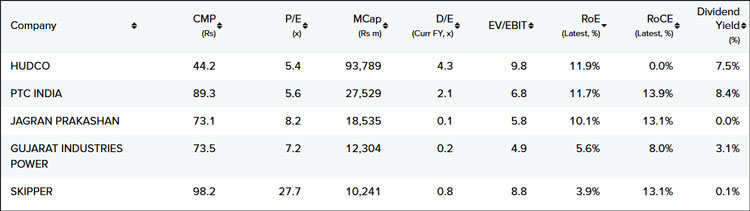

Snapshot of top high quality penny stocks from Equitymaster's Indian Stock Screener

Here's a quick view of the above companies based on their financials.

Please note that these parameters can be changed according to your selection criteria.

This will help you identify and eliminate stocks not meeting your requirements and emphasise those stocks well inside the metrics.

Before leaving, do watch the video below, where the Co-head of Research at Equitymaster shares his strategy for penny stock investing and three low-risk penny stocks for 2023.

Safe Stocks to Ride India's Lithium Megatrend

Lithium is the new oil. It is the key component of electric batteries.

There is a huge demand for electric batteries coming from the EV industry, large data centres, telecom companies, railways, power grid companies, and many other places.

So, in the coming years and decades, we could possibly see a sharp rally in the stocks of electric battery making companies.

If you're an investor, then you simply cannot ignore this opportunity.

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.comDisclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

Yash Vora is a financial writer with the Microcap Millionaires team at Equitymaster. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

FAQs

Which are high quality penny stocks in India right now?

As per Equitymaster's Stock Screener, here is a list of high quality penny stocks in India right now...

What are penny stocks?

Penny stocks are shares of listed companies priced below Rs 100. In the US market, these stocks trade for less than a dollar i.e. for pennies. Hence the name.

Penny stocks have the potential for above-average returns. However, they are extremely risky. Therefore, investing in them requires care and caution.

How should you go about investing in penny stocks?

Penny stocks are usually issued by new or very small companies. These companies often don't have a proven track record, which is why their shares are sold for so little.

Larger, more established companies may also have stocks trading under Rs 100 when they are facing financial trouble or approaching bankruptcy.

Since they carry a high amount of risk, one must have a proper strategy in place.

Check out our framework for investing in penny stocks. This strategy is the easiest one to make money from penny stocks.

Equitymaster requests your view! Post a comment on "Top 5 High Quality Penny Stocks to Add to Your Watchlist". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!