- Home

- Views On News

- May 30, 2023 - The Top 5 Fastest Growing Midcap Stocks to Watch Out in 2023

The Top 5 Fastest Growing Midcap Stocks to Watch Out in 2023

As per the Indian market regulator, mid-cap stocks rank between 101 to 250 in terms of market capitalisation.

They are sandwiched between large-cap and small-cap stocks. Large-cap stocks are mature, well-established, and offer steady returns over a long horizon. Small-cap stocks, on the other hand, sometimes offer quick and exponential returns due to their high growth potential.

With combination of both, mid-cap stocks strike a perfect balance between growth and stability.

Here's a list of the top five fastest-growing mid-cap stocks in the market right now.

#1 KPIT Technologies

First on the list is KPIT Technologies.

It's a global software solutions company helping the automobile industry to progress towards an autonomous, clean, smart, and connected future.

KPIT Technologies is the only embedded software company with deep domain expertise across CASE (Connected, Autonomous, Shared, and Electrified) domains.

It offers software IP, software integration, feature development, and verification and validation services to global OEMs (original equipment manufacturers) and tier-I suppliers.

The company works with leaders in the automotive and mobility industry, such as BMW, GM, Renault, Honda, and Hyundai.

It has a worldwide footprint with a direct presence in Germany, America, China, Korea, and Japan.

Being a technology-intensive company, KPIT invests heavily in research and development (R&D) and innovates continuously.

It has also developed a cloud-based test automation platform for end-to-end integrated testing, which OEMs use across large programs.

Currently, the company has 51 patents, of which six were granted in the financial year 2023.

The company has experienced significant growth in recent years on the back of growing demand for electric vehicles (EV) and increasing investment in R&D by OEMs.

With increased demand, KPIT Technologies plans to address its clients' problems by developing innovative technological solutions.

In the last five years, the company's revenue has grown at a compound annual growth rate (CAGR) of 28.9%, led by new deal wins across all geographies. It has also won several long-term deals to develop software for its top clients.

Its net profit has grown at a CAGR of 38.1%, driven by operational efficiency and cost optimisation measures.

Return rations have also remained strong with return on equity (RoE) and return on capital employed (RoCE) coming in at 21.4% and 28.2%, respectively.

To add to this, the company is a consistent dividend payer. Ever since its listing in 2019, the company has maintained a dividend payout of around 30%.

KPIT Technologies Financial Snapshot (2019-2022)

| Particulars (Rs m) | FY19 | FY20 | FY21 | FY22 |

|---|---|---|---|---|

| Total Revenue | 6,973 | 21,868 | 20,515 | 24,772 |

| Growth | NA | 213.60% | -6.20% | 20.80% |

| Operating Profit | 368 | 2,778 | 3,123 | 4,385 |

| Operating Profit Margin | 5.70% | 12.90% | 15.30% | 18.00% |

| Net Profit | 550 | 1,478 | 1,471 | 2,760 |

| Net Profit Margin | 8.60% | 6.90% | 7.20% | 11.3% |

Going forward, the company's expansion plans and growing demand for EVs and autonomous vehicles will drive its revenue and profit growth.

To know more, checkout KPIT Technologies' financial factsheet and latest quarterly results.

#2 Sona BLW Precision Forgings

Second on the list is Sona PLW Precision Forgings (Sona Comstar).

The company designs, manufactures, and supplies engineered automotive systems and components.

It has a diversified product portfolio which is primarily divided into driveline parts and motors segments.

Under driveline parts, the company manufactures differential assemblies and precision-forged differential bevel gears. The motors segments include conventional micro-hybrid motors and EV traction motors.

Sona Comstar designs its products across all vehicle categories, but with the EV revolution picking up pace, the company has ventured into electric and hybrid categories as well.

The company has ten manufacturing facilities and eight warehouses in India, China, the USA, Belgium, and Mexico.

Its client base includes reputed automotive companies such as Ashok Leyland, Daimler, Escorts, Maruti Suzuki, Volvo, and Mahindra Electric.

In the last five years, the company's revenue has grown at a CAGR of 28%, driven by a healthy order book. The net profit has grown at a CAGR of 36.5% due to the increasing contribution of high-margin EV-related products.

Its RoE and RoCE currently stands at 18.1% and 22.1%, respectively.

Moreover, the company became debt free by the end of 2022.

Sona BLW Precision Forgings Financial Snapshot (2018-2022)

| Particulars (Rs m) | FY18 | FY19 | FY20 | FY21 | FY22 | Total Revenue | 6,259 | 8,152 | 10,438 | 15,686 | 21,507 |

|---|---|---|---|---|---|

| Growth | 30.20% | 28.00% | 50.30% | 37.10% | |

| Operating Profit | 1,904 | 3,127 | 4,743 | 4,271 | 5,724 |

| Operating Profit Margin | 30.50% | 38.50% | 45.70% | 27.30% | 26.90% |

| Net Profit | 764 | 1,730 | 3,603 | 2,152 | 3,615 |

| Net Profit Margin | 12.30% | 21.30% | 34.70% | 13.70% | 17.00% |

Sona Comstar's order book grew by 37% in the financial year 2023. By the end of FY23, its order book stood at Rs 215 billion (bn), out of which 77% is from the EV segment.

There are several reasons contributing to this growth. Sona Comstar designs one-of-a-kind high-power-density EV systems and manufactures EV traction motors. It also manufactures fuel-saving motors for hybrid passenger vehicles.

This has led to several deal wins, including one from a European passenger vehicle maker to supply final drive differential assemblies for their upcoming EV models. It also received 42 EV programs across 26 different customers by the end of March 2023.

The company added seven new customers and four new products, mostly in the EV space, in the financial year 2023. This has deepened its presence in the EV segment.

Given the growing popularity of EVs, the company has announced its strategy to capture this demand.

It plans to widen its EV product portfolio across personal and commercial vehicles.

In line with this goal, Sona Comstar has announced a capex of Rs 9-10 bn to be spent over the next two years focusing on light passenger and light commercial vehicles and electric buses.

The company also plans to increase the share of EVs in revenue from 29% to 50% in the next two years by penetrating new geographies and launching new products.

It recently acquired a 54% stake in Novelic for 40.5 million (m) Euros (about Rs 3,570.5 m).

Novelic adds the hardware and software capabilities to design integrated systems for autonomous driving, including AI and ML, as well as ASIC experience; it already has mechanical, electric and electronic abilities.

This acquisition will help Sona Comstar build its third business vertical of sensors and software.

Going forward, high demand for EVs, the company's growing order book, and new product launches will drive its revenue and profit growth in the medium term.

To know more, checkout Sona Comstar's financial factsheet and latest quarterly results.

#3 PI Industries

Next on the list is PI Industries, a leading player in the agrochemical space.

The company is engaged in manufacturing insecticides, fungicides, herbicides and speciality products, which are widely used in farms across the globe.

With a presence in the agrochemical space for over five decades, PI Industries have emerged to be a leading producer of generic molecules such as profenofos, ethion, and phorate in India.

It also forayed into the pharma business and successfully developed a Covid-19 drug intermediate.

The company has a global presence in over 30 countries, with a physical presence in India, Japan, China, and Germany.

It has four state-of-the-art manufacturing facilities which have five formulation facilities, and 13 multi-product plants.

The company also has an extensive distribution network with 10,000 active dealers/distributors and more than 100 thousand retailers spread across the country.

It maintains a strong research presence through its R&D facility in Udaipur, where it has a dedicated team of over 500+ researchers and scientists.

This helped the company launch four new products in the financial year 2023. It plans to launch five more products in FY24 and also has over 40 products at different stages of development.

The company is also in the process of expanding the depth of offerings in new market segments such as Taurus, a revolutionary nematicide and Tomatough, a unique biological product.

To cater to the growing demand for agrochemicals, PI Industries is focussing on scaling up the capacities of existing products. For this, the company spent Rs 3.3 bn in financial year 2023 and plans to spend another Rs 4 bn in the next year.

All these efforts have led to a healthy financial performance. The revenue has grown at a CAGR of 18.6%, driven by new product launches. The net profit has grown at a CAGR of 18.1% during the same time.

Despite investing heavily in capex, the company remains debt-free and has a healthy interest coverage ratio of 52.6x.

PI Industries Financial Snapshot (2018-2022)

| Particulars (Rs m) | FY18 | FY19 | FY20 | FY21 | FY22 | Total Revenue | 23,057 | 29,093 | 34,154 | 47,019 | 54,009 |

|---|---|---|---|---|---|

| Growth | 26.20% | 17.40% | 37.70% | 14.90% | |

| Operating Profit | 4,956 | 5,696 | 7,206 | 10,224 | 11,532 |

| Operating Profit Margin | 22.10% | 20.00% | 21.40% | 22.30% | 21.80% |

| Net Profit | 3,676 | 4,102 | 4,566 | 7,383 | 8,438 |

| Net Profit Margin | 16.40% | 14.40% | 13.60% | 16.10% | 15.90% |

Given the growing demand for agricultural inputs, growing population, the company's robust product pipeline, and capex investments, PI Industries is poised for growth in the medium term.

To know more, checkout PI Industries' financial factsheet and latest quarterly results.

#4 Polycab India

Fourth on the list is Polycab India.

The company is one of the largest manufacturers of cables, wires, and allied products.

It also forayed into fast-moving electrical goods (FMEG) such as fans, switches, LED lights, solar inverters, and pumps.

Polycab India has 25 manufacturing spread over seven locations in India. It has a strong distribution network of over 4,600 distributors covering over 200 thousand retail outlets in India.

Apart from a strong domestic presence, Polycab India also exports to over 60 countries.

In the last five years, the company's revenue has grown at a CAGR of 13%, driven by volume growth in the cables and FMEG segment.

The company's market share has improved from 18% in the financial year 2019 to 24% in 2023.

The net profit has grown at a CAGR of 18.8%, driven by backward integration measures taken by the company.

Its RoE and RoCE currently stand at 15.4% and 20.9%, respectively.

Due to its deleveraging strategy, the company's cashflows improved substantially, and its interest coverage ratio grew to 32.8x.

Polycab India Financial Snapshot (2018-2022)

| Particulars (Rs m) | FY18 | FY19 | FY20 | FY21 | FY22 | Total Revenue | 66,901 | 80,493 | 89,227 | 89,115 | 1,23,087 |

|---|---|---|---|---|---|

| Growth | 20.30% | 10.90% | -0.10% | 38.10% | |

| Operating Profit | 7,289 | 9,528 | 11,350 | 11,111 | 12,502 |

| Operating Profit Margin | 11.00% | 11.90% | 12.90% | 12.60% | 10.20% |

| Net Profit | 3,585 | 5,026 | 7,730 | 8,412 | 8,478 |

| Net Profit Margin | 5.40% | 6.30% | 8.80% | 9.60% | 6.90% |

So what exactly has worked for the company well? Apart from external factors such as urbanisation, the nuclearisation of families, make in India, product-linked incentive (PLI) scheme, and the Internet of Things (IoT), the company's 'Project LEAP' is driving the growth.

Through 'Project LEAP', Polycab India aims to achieve a revenue of Rs 200 bn by 2026 (a 13% CAGR growth in revenue in 4 years) by focusing on launching new products and expanding its distribution network and manufacturing capabilities.

It is also looking for opportunities to grow inorganically by acquiring companies with cutting-edge technology or strong regional distribution.

For this, the company plans to spend Rs 3 to 4 bn per annum for the next three years.

The company is set to benefit from the increasing demand for branded cables and wires due to urbanisation.

Going forward, the company's expansion plans and growing demand for cables and wires will drive its revenue and profit growth in the medium term.

To know more, checkout Polycab India's financial factsheet and latest quarterly results.

#5 Deepak Nitrite

Last on the list is Deepak Nitrite.

The company is engaged in manufacturing basic intermediates, fine and speciality chemicals, performance products, and phenolics.

It has an extensive product portfolio with over 100 products and a leading market share in many products.

In its five decades of existence, Deepak Nitrate emerged as a market leader for inorganic intermediates such as sodium nitrite, nitrotoluenes, and fuel additives.

It is also among the top three global players for xylidines, cumidines, and oximes.

The company's products are used in several industries, including pharmaceuticals, agrochemicals, adhesives, dyes and pigments, petrochemicals, and personal care.

Its clientele includes big names such as Bayer Corp, Indian Oil, Nirma, Reliance Industries, Unilever, and L'Oreal.

Deepak Nitrite has six fully integrated manufacturing facilities across five locations in India. In December 2021, the company doubled its production capacity through a brownfield expansion.

In the last five years, the company's revenue has grown at a CAGR of 33.1%, led by capacity expansion and a diversified product portfolio. The net profit has grown by a CAGR of 68.3% due to the backward and forward integration efforts.

As a result, the net margin expanded from 4.9% to 15.7% in the last five years.

Its RoE and RoCE have also improved and currently stand at 32% and 41.7%, respectively.

The company has significantly reduced its debt, and its current debt-to-equity ratio is 0.1x.

It also pays dividends consistently.

Deepak Nitrate Financial Snapshot (2018-2022)

| Particulars (Rs m) | FY18 | FY19 | FY20 | FY21 | FY22 | Total Revenue | 16,391 | 27,181 | 42,653 | 43,869 | 68,559 |

|---|---|---|---|---|---|

| Growth | 65.80% | 56.90% | 2.90% | 56.30% | |

| Operating Profit | 1,985 | 4,141 | 10,285 | 12,446 | 15,948 |

| Operating Profit Margin | 12.20% | 15.30% | 24.30% | 28.50% | 23.40% |

| Net Profit | 790 | 1,737 | 6,110 | 7,758 | 10,666 |

| Net Profit Margin | 4.90% | 6.40% | 14.40% | 17.80% | 15.70% |

The company's expansion plans have driven the growth all the way to the bank.

In financial years 2022 and 2023, the company spent over Rs 5 bn for capacity expansion, new product launches, and backward integration.

It plans to spend another Rs 26 bn in the next three years for regular maintenance, backward integration, and capacity expansion.

This capex also includes its investment in sodium nitrate plants in Oman to cater to the export market.

The company also plans to invest in a polycarbonate compounding facility to supply polycarbonate products.

With the ongoing expansion plans, growing demand for speciality chemicals, and the government's push-through initiatives such as PLI and Make in India, the company is all set to grow in the medium term.

To know more, checkout Deepak Nitrate's financial factsheet and latest quarterly results.

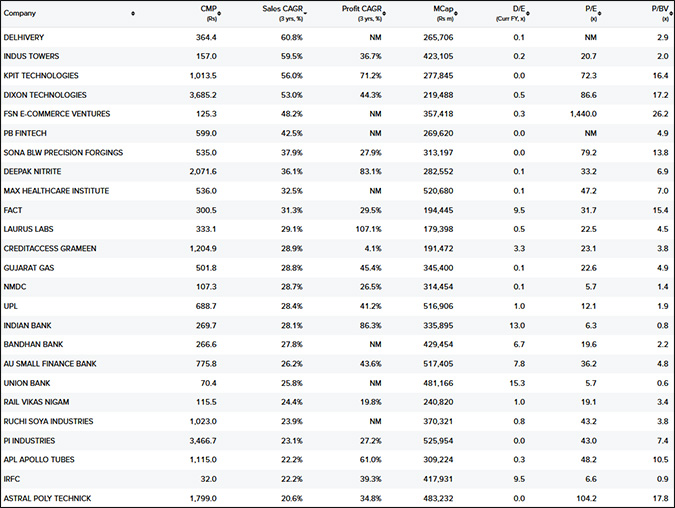

Snapshot of Fastest Growing Midcap Stocks on Equitymaster's Stock Screener

Here's a quick view of the above companies based on their financials.

Please note that these parameters can be changed according to your selection criteria.

This will help you identify and eliminate stocks not meeting your requirements and emphasise those stocks well inside the metrics.

Happy investing!

Safe Stocks to Ride India's Lithium Megatrend

Lithium is the new oil. It is the key component of electric batteries.

There is a huge demand for electric batteries coming from the EV industry, large data centres, telecom companies, railways, power grid companies, and many other places.

So, in the coming years and decades, we could possibly see a sharp rally in the stocks of electric battery making companies.

If you're an investor, then you simply cannot ignore this opportunity.

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.comDisclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

Equitymaster requests your view! Post a comment on "The Top 5 Fastest Growing Midcap Stocks to Watch Out in 2023". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!