- Home

- Views On News

- Jul 10, 2021 - Top 4 Companies that Are Strong Monopolies

Top 4 Companies that Are Strong Monopolies

With the absence of intense competition in an industry, a company is poised to do better and generate profits with strong cash flows.

Lower Competition = Higher Profits

However, it's not easy to find companies with these characteristics because high profitability always attracts new players.

Since this is the age of mega corporations, companies with dominant market position might become monopolies eliminating the benefits of competition.

Here's a look at four Indian listed companies which enjoy strong monopolies.

#1 IRCTC

Indian Railway Catering and Tourism Corp (IRCTC), which entered the primary markets by listing in October 2019, enjoys a strong monopoly.

It has 100% market share in rail network.

IRCTC is the only entity authorised by Indian Railways to offer online railway tickets. The company charges convenience fees in the range of Rs 15-30 per ticket.

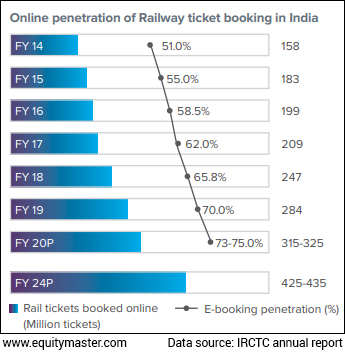

Online Penetration of Railway Ticket Booking

It's also the only entity authorised to manage catering services on trains and major static units at railway stations.

The company also enjoys a monopoly in packaged drinking water. It's the only entity authorised by the Ministry of Railways to manufacture and distribute packaged drinking water at all railway stations and trains under the 'Rail Neer' brand.

When it came out with its public offer, investors showed huge interest. Its IPO was oversubscribed 112 times - the highest for an IPO of a state-owned company.

The company has shown promising growth over the past 5 years.

Its revenues grew at 11.5% CAGR between fiscal 2016 and fiscal 2020. Earnings grew at a CAGR of 28% during the same period.

What's more is that the company is debt-free and has reserves of Rs 11.7 bn as of March 2020.

All these positives are largely reflected in its share price, which has risen as much as 5x since its initial public offering (IPO).

Here's what Tanushree Banerjee, Co-head of Research at Equitymaster, and editor of the premium recommendation service Forever Stocks, has to say about the company.

- Despite being a PSU, IRCTC has a wide moat that few other travel and tourism companies can claim to have.

E-tickets booked online through IRCTC's website and app accounted for 72.25% of the total reserved tickets over Indian Railways in financial year 2020. On an average, about 0.8 m tickets were booked daily through IRCTC's website and app during that year.

Also, the growth of the catering business seems on a strong footing. During the year, IRCTC managed on-board catering services in 19 Rajdhanis, 2 Tejas, 1 Gatiman, 1 Vande Bharat, 22 Shatabdis, 19 Durontos, and 296 Mail Express trains.

It remains to be seen how IRCTC shares perform in the coming months as rail services open gradually.

#2 IEX

Indian Energy Exchange (IEX) and Power Exchange of India (PXIL) are the two nodal power exchanges in the country.

IEX accounts for 95% of the short-term electricity contracts (i.e. contracts less than 1 year) traded over exchanges in India. A virtual monopoly.

It's important to understand the nature of the exchange market. Be it stock exchanges like NSE or BSE, or be it depositories CDSL or NSDL, exchanges are always characterised by a monopoly or duopoly.

Why is it so?

It's because of the network effect.

Think of it like this.

You are a buyer or seller and know that everyone is on an exchange. Why would you switch to any other new exchange?

The first mover advantage is big in such cases. IEX being the first has majority of the volumes on the exchange.

More participants mean more efficiency and better price discovery. New participants are always likely to prefer the leader in such cases.

#3 CAMS

If you have been an investor in mutual funds, you would have surely come across or accessed the account statements from CAMS.

Compute Age Management Services (CAMS) is a technology-driven financial infrastructure and services provider to mutual funds and other financial institutions since over two decades.

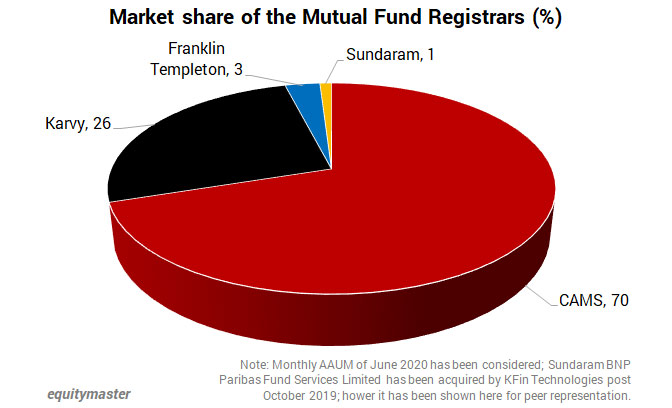

It is India's largest registrar and transfer agent of mutual funds with an aggregate market share of approximately 70% based on mutual fund average assets under management (AAUM) managed by its clients and serviced by them.

The second player, Karvy, is at a distant 26% market share.

Over the last five years, the company has grown its market share from approximately 61% during March 2015 to approximately 70% during December 2020, based on AAUM serviced.

Apart from being a registrar for mutual funds, CAMS also offers solutions for alternative investment funds and portfolio management services.

It has 40% market share as an insurance repository.

#4 CDSL

Central Depository Services (CDSL) is the only listed depository in India and a key beneficiary of structural growth in capital markets.

There are only two depositories in India, the other being NSDL which is not listed yet.

As a securities depository, CDSL facilitates holding of securities in digital form and enables securities transactions (including off-market transfer and pledge) to be processed by book entry.

It generates income from annual issuer charges (annuity nature of the income), transaction charges (market dependent), IPO/corporate activity charges, online data charges (through its subsidiary CDSL Ventures) and others.

The company's shares have rallied 250% in the past year. What's interesting to know is that before this, its share price was moving in a consolidated manner.

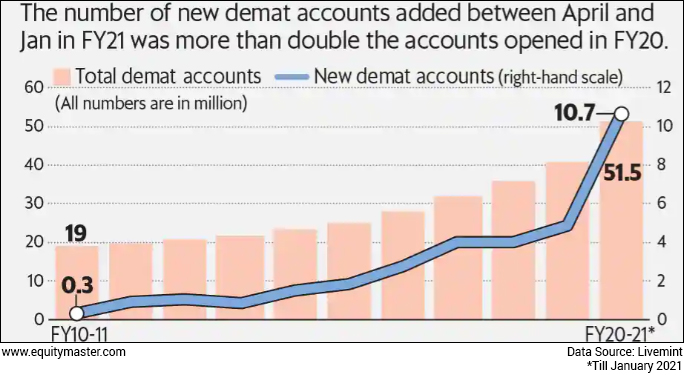

A primary reason behind the rally is the rise in demat accounts. The company's profit has increased since the Covid-19 pandemic.

New demat account additions rose to an all-time high of 10.7 m between April 2020 and January 2021. This is an increase of more than double the new accounts opened in fiscal 2020 at 4.7 m.

And CDSL earns a major chunk (approximately 60%) of its revenue directly or indirectly from demat accounts.

Investing in monopolies

While much has been said about investing in such companies, you must investigate if the company can remain profitable for the future.

Also, without the absence of government support, monopolies are difficult to establish and maintain.

Read our editorial on MTNL, the monopoly player back in 2002, and how it went from being debt-free to heavily indebted, and also lost 88% of its marketcap.

Legendary investor Warren Buffett has always discussed the idea of investing in companies with moats.

A moat in general is a deep, wide ditch surrounding a castle, fort, or town, typically filled with water and intended as a defence against attack.

In investing, it refers to a business's ability to maintain its competitive advantage over its peers to protect market share and ensure sustained profits.

The wider the moat, the stronger the business. If the moat is weak, ultimately, competition will spoil the game, erode returns, and take away market share and profits overtime.

Hence, a smart way to invest is to pick companies with strong moats.

Of course, one must also examine the company's valuations as well as its intrinsic value and margin of safety.

Happy Investing!

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

Yash Vora is a financial writer with the Microcap Millionaires team at Equitymaster. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

Equitymaster requests your view! Post a comment on "Top 4 Companies that Are Strong Monopolies". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!