- Home

- Views On News

- Jul 23, 2021 - UltraTech Delivers Strong Results. Will the Stock Continue to Rise?

UltraTech Delivers Strong Results. Will the Stock Continue to Rise?

On Thursday during market hours, UltraTech Cement reported a steep 114% jump in its consolidated net profit for the quarter ended June 2021.

Owing to this, shares of the company rose 2% yesterday to Rs 7,545 on the BSE, scaling fresh 52-week high.

Today, shares further extended gains and opened 1.5% higher to surpass yesterday's highs.

Earnings above estimates

Net profit came in at Rs 17 bn as compared to Rs 7.9 bn reported in the year-ago period. The net profit figures beat estimates of Rs 14.3 bn.

If compared sequentially, Ultratech's profit declined 4% on lower revenue and higher costs.

The company's consolidated revenue in the June quarter rose 54.2% to Rs 118.3 bn as against Rs 76.7 bn, YoY. Sales volumes grew 47.3% YoY to 20.53 MT.

EBITDA increased 59.2% to Rs 33.1 bn from Rs 20.8 bn. EBITDA margin improved to 28% from 27.1%, YoY.

UltraTech's operational profit was impacted by a sequential rise in power and fuel expenses at 20.5% of net sales compared with 18.8% in the preceding quarter.

In a regulatory filing, the company said,

- After a rapid recovery from the Covid-19 led disruptions during FY21, the economy was hit by an unexpectedly virulent second wave, which also marginally impacted cement demand.

Ultratech is monitoring the impact of the second wave of the pandemic on its operations.

Here's a table comparing UltraTech's financials on key parameters.

Financial Snapshot

| (Rs bn) | 31-Jun-21 | 31-Jun-20 | YoY (%) |

|---|---|---|---|

| Revenue | 118.3 | 76.7 | 54% |

| Raw Materials Consumed | 15.5 | 8.4 | 85% |

| Power and Fuel | 24.3 | 13.8 | 76% |

| Total Expenses | 95.1 | 117.9 | -19% |

| EBITDA | 33.1 | 20.8 | 59% |

| PAT | 17.0 | 7.9 | 114% |

Capacity expansion on track

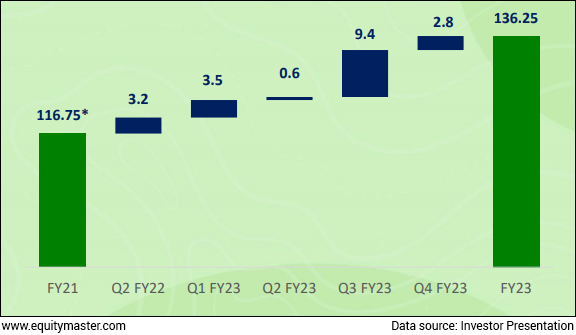

Ultratech's 19.5 m tonnes per year capacity expansion programme is on track and is estimated to be completed by the end of fiscal 2023. That will take its total capacity to 136.25 MTPA.

Cement Capacity (MTPA)

Disruptions due to covid have caused some delays due to labour shortages and lockdowns.

Sales volume stood at 21.5 m tonnes, rising 46.9% YoY on a low base, but declining 22.5% if compared sequentially.

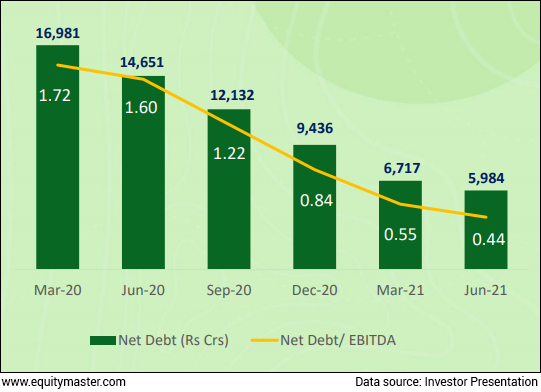

Net debt stood at Rs 59.8 bn as of June 2021 against Rs 67.2 bn as of March 2021.

The company said it paid long-term loans amounting to Rs 50 bn in advance, adding the repayments were made through free cash flows.

In the past one year, UltraTech has reduced more than half of its debt which stood at Rs 146.5 bn in June 2020.

Consistently Reducing Debt

Equitymaster's technical view on the cement sector

We reached out to Brijesh Bhatia, Research Analyst at Equitymaster, and editor of the premium monthly recommendation service Fast Profits Report, for his technical view on the cement sector.

Here's what he has to say...

- The financial market was hit in March 2020 by lockdown and by March 2021, they are up by 100% from the lows.

Cement sector outperformed and most of the cement stocks are up by 100% from the lows.

The demand in cement is largely lead by government spending on infrastructure and real estate.

The commercial office been vacant with work-from-home culture and new housing projects been stalled, can still the cement sector rally from current levels?

We created an Equal Weighted Cement Index (EWCI) chart using cements stocks with market cap over 10,000 crores and compared it with Nifty Realty Index.

- Since the lows in March 2020, EWCI and realty index rallied in a same manner.

But since March 2021, we are witnessing divergence between the two sectors (marked red) where cement stocks are trading near high and realty stocks are underperforming against cement stocks.

To check the future outperformance of cement stocks, we compared EWCI with Nifty.

- The ratio chart of EWCI Index vs Nifty above is indicating profit bookings can be on cards for cement stocks and it has reversed from the similar highs made in June 2020.

The negative crossover of averages on Moving Average Convergence Divergence (MACD) supports an underperformance of EWCI over Nifty.

How the stock markets reacted to UltraTech Cement's earnings

UltraTech Cement share price opened the day at Rs 7,590, up 1.5% on the BSE.

It further extended gains as the session progressed and touched a 52-week high of Rs 7,630.

Cement stocks are trading on a mixed note today with shares of Birla Corp and ACC leading with gains.

Shares of UltraTech Cement have been on an uptrend in the year gone by, gaining a whopping 93%.

At the current price of Rs 7,540, UltraTech Cement commands a marketcap of Rs 2,176.5 bn.

Note that cement stocks have made considerable gains in recent months on expectation of the profitability remaining intact despite the cost rise.

Demand has recovered on the back of gradual relaxations in lockdowns, expectations of construction activities gaining momentum post-monsoon, the low base of the last two years, government's focus on infrastructure spends, and a strong June 2021 quarter.

Cement production demand and growth was primarily driven by the housing sector during the first two months of the financial year 2022.

During the months of April and May, the cement production was recorded at 54 m tonnes, which is almost a 100% increase in the production of cement during April-May 2020.

About UltraTech Cement

UltraTech Cement is the cement flagship company of the Aditya Birla group.

A US$5.9 bn building solutions powerhouse, UltraTech is the largest manufacturer of grey cement, ready mix concrete (RMC) and white cement in India.

It's the third largest cement producer in the world, excluding China. UltraTech is the only cement company globally (outside of China) to have 100+ MTPA of cement manufacturing capacity in a single country.

The company's business operations span in UAE, Bahrain, Sri Lanka, and India.

It has 23 integrated plants and grinding units, 6 bulk terminals, 2 white cement and putty plants, and over 100 ready mix concrete plants spread across the country.

To know more about the company, check out Ultratech Cement company fact sheet and UltraTech Cement quarterly results.

For a sector overview, read our cement sector report.

You can also compare UltraTech Cement with its peers.

UltraTech Cement vs Ambuja Cement

UltraTech Cement vs Shree Cement

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

Yash Vora is a financial writer with the Microcap Millionaires team at Equitymaster. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

Equitymaster requests your view! Post a comment on "UltraTech Delivers Strong Results. Will the Stock Continue to Rise?". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!