- Home

- Views On News

- Jul 30, 2022 - Meet the Lalit Modis of the Stock Market: Tata Power, Tata Steel, and Tata Motors

Meet the Lalit Modis of the Stock Market: Tata Power, Tata Steel, and Tata Motors

A tweet by Lalit Modi announcing that he is dating former Miss Universe, Sushmita Sen broke the internet recently.

As soon as Modi made his relationship official, netizens took to twitter and started a hilarious meme fest.

Among these memes, there was one that particularly caught my eye...

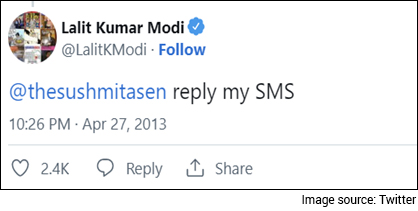

Coincidentally, nine years ago, Lalit Modi had tweeted asking Sushmita Sen to reply to his SMS.

And very soon, there was a barrage of jokes. Some were quick to praise Modi's perseverance over the course of nine long years. They made light of the fact that he had finally succeeded in moving from the "seen-zone" to the "Sen-zone."

For all of Lalit Modi's faults, we must hand him one thing. He has a knack of being in the limelight every once in a while. Good or bad, something interesting is always up with him.

The money helps, of course. Dating a former Miss Universe at the age of 58 is easier when you are a billionaire!

History is replete with stories of the meteoric rise in stocks and sharp fall of many companies, stocks and businessmen.

And then there are others. They come into the limelight every once in a while and then simply fade away until favourable conditions emerge again.

Lalit Modi's re-emergence made me reminisce about three stocks I have seen over the years come into the limelight every once in a while, before falling out of favour.

Here are the 3 stocks I call the 'Lalit Modis' of the stock market.

Tata Power Company Ltd

Growing up, I remember hearing my grandpa often say, "Tata Power betrayed me."

Well, the story goes like this...

In 1991, my grandfather invested part of his retirement money in shares of Tata Power when the price was in single digits.

And immediately after, the stock was in the limelight. The price shot up from under Rs 10 all the way up to a high of Rs 33 within a year, a gain of 274%.

Grandpa believed Tata Power would be a multibagger stock for next 10 years.

He held on hoping for more gains.

Unfortunately for him, from 1992 right up to the end of 2003, the stock went into hibernation. It averaged around Rs 12 for eleven long years.

During that time, the stock plunged to a life time low of just over Rs 4 in the summer of 2000. In fact, it finally crossed its high of 1992 only in 2004.

Through it all, grandpa held on to his shares promising himself that he would exit his holding the next time the stock had a break out.

Sure enough, the stock was back in the limelight in 2008. It jumped up by 228% between April 2007 and January 2008. It hit at a life time high of Rs 157.

Everyone was excited about the stock and his broker was confident that as a fundamentally strong stock, it would easily cross Rs 200. So grandpa held on a little longer. Only just a little...

He shouldn't have.

Over the next six months, the stock crashed 65% making grandpa harbour a feeling of betrayal by the stock.

Over the next eleven years, once again the stock went nowhere. It traded at an average price of just Rs 88 from 2009 right up to May, 2020.

And then all hell broke loose. The stock of Tata Power rallied an astonishing 960% from a low of Rs 27 on 11 May 2020 to a life time high of Rs 289.8 on 6 April 2022.

Investors lapped up its shares as it was among the top picks on the Tata penny stocks list of 2020.

The company benefited strongly as increased economic activity after the second wave of the coronavirus drove up electricity demand. Other reasons included Tata Power's strong investment in EV charging stations, solar infrastructure, and other expansions.

Sadly, grandpa never got to ride the rally. He passed away in 2019.

Tata Steel Ltd

Do you know what your return would be if you bought shares of Tata Steel in 1993 and held on for the next 10 years?

0.0%.

Oh, and it's a lot worse if you consider an average inflation rate of 7% between 1993 and 2003.

Luckily, I wasn't holding any shares of Tata Steel back then. My story starts a little later. I'll let you decide if this was fortunate or not.

31 January 2007. This date is etched in my memory. Tata Steel had just announced the acquisition of Corus for an eye-watering US$ 13.1 bn after winning a dramatic head-to-head bid battle against a Brazilian rival.

Stock investors were not happy with Tata Steel's aggressive bidding and the same day the stock fell 11%.

This was back when Ratan Tata took the lead in global acquisitions and changed the mindset of India's business leaders by going global.

At the time, Ratan Tata said the market would come round.

- "Quite frankly I do feel it is both taking a short-term and harsh view. In the future somebody will look back and say we did the right thing," he told reporters in Mumbai.

I was impressed and buoyed by national pride. It was 'reverse colonialism'. An Indian company taking over a British company four times its size.

The very next day, I bought shares of the company believing like Mr. Tata that in the future, I would look back and think I did the right thing!

Over the next two years, the stock was constantly in the news as there was national debate about whether Tata Steel had overpaid for the Corus acquisition.However, the global broad-based commodity rally helped and the stock had rallied over 100% by May 2008.

The rally ended in September when the bankruptcy of Lehman Brothers sparked the global financial crisis sending steel prices tumbling.

The damage was compounded by China dumping cheaper steel in Europe after other large markets including US and India increased tariff barriers.

The stock lost over three fourths of its value by the end of the year.

Post that shot at fame, for eleven long years, the stock stayed range bound averaging just around my cost price.

In 2021 the stock was once again the star of the market. Within a span of just 10 months, the stock zoomed 350% as steel prices surged during the post pandemic recovery and supply struggled to keep up with demand.

Thanks to a big surge in its margins and net profit in Q2FY22, Tata Steel overtook Tata Consultancy Services (TCS) to become the most profitable company in the Tata Group.

How did I do with my investment of 2007? At the current market price of just over Rs 100 (the stock was split from FV of Rs 10 to Rs 1 recently) the CAGR works out to 5.1%.

In terms of real returns considering inflation, that works out to a return of -2.0%.

Twelve years after it made the ambitious acquisition of Corus, the company acknowledged it bet on the wrong market, at the wrong time.

It finalised the joint venture with Thyssenkrup AG in 2018 marking the end of a long, painful chapter in Tata Steel Ltd's contemporary history.

With all due respect to Mr. Ratan Tata, looking back 16 years later, I often wonder, "Did I do the right thing by investing in the stock when it was in the limelight?"

Tata Motors Ltd

It was the day of the cricket world cup final in 2003. My friends Zara, Vikram, and I sat huddled watching the match together.

Zara and Vikram had made a friendly bet on the match with Zara rooting for Australia while Vikram was sure that India was going to clinch the game and the championship.

Well, we all know what happened next.

India's batting caved in under pressure as a rampaging Australia crushed them by 125 runs to lift the world cup.

As we sat there after the match listening to Zara gloat about picking the right team and winning the bet, I somehow managed to veer the conversation towards stocks.

The discussion turned deeper and more specifically towards undervalued stocks available at the time in the market.

Already triumphant, Zara declared that the auto sector would outperform over the next few years and was very bullish on Tata Motors.

Vikram, recently vanquished but not one to ever take something lying down, rebuked her suggestion citing the fact that Tata Motors shares had been 'asleep' for the last decade and he didn't expect the stock to move anywhere higher.

The heated debate reached a point wherein the two made a bet yet again, this time on the stock performance of Tata Motors.

Zara would buy the stock the following day and hold it for the next two years.

If the stock returned 100% or more in that period, Vikram would eat humble pie and acknowledge once and for all that Zara was better than him at identifying multibagger stocks.

Zara bought the stock as agreed upon and right out of the gate the stock galloped away. In less than six months the stock had doubled making Zara the undisputed expert punter among us.

Tata Motors was the market darling for the next few years. For the financial year ended 2004, the company posted its highest ever recorded net profit with a 315% rise in exports in the year.

The stock stayed in the limelight and rose 550% by May 2006.

After that, the stock took a breather right until it's mega acquisition of JLR from Ford Motor Company in 2008.

Although back in the spotlight, this time around things turned for worse. Soon after the deal, Tata Motors found itself loaded with a debt of Rs 21,900 cr and posted its first loss in 7 years.

Critics felt the timing of the acquisition couldn't have been worse and were apprehensive of the company's future.

The stock crashed and by November 2008 was down by a whopping 86%.

Over the next few years, the company had its ups and downs but it wasn't really until 2015 when the stock was back in the public-eye.

Tata Motors-owned Jaguar Land Rover posted its best ever annual sales performance in 2015. The stock price shot up to a life time high.

While the Corus acquisition had failed miserably, the JLR acquisition had been a huge success.

For the Tatas, this arc of its progress would be vindication of a brave and somewhat contrarian call made in 2008 to acquire JLR.

Moving ahead a few years, during the pandemic, the stock crashed to a multi-year low of Rs 65 in April, 2020.

However, shortly thereafter the stock found itself once more in the limelight.

As the economy opened up after the lockdowns, Tata Motors shares had a spectacular run on the bourses on the back of robust global numbers from Tata Motors and a record order book for Jaguar land Rover.

But more importantly, the company became the poster child of the EV revolution in India.

In October 2021, the company announced that it will raise Rs 75 bn in its passenger electric vehicle business from TPG Rise Climate at a valuation of up to US$ 9.1 bn.

The stock went berserk jumping 20% in a day and continued rising further. By November, 2021, the stock had risen over 700% since its 2020 lows.

Lights, Camera, Action!

We are halfway through 2022 and the stock market has been choppy since the beginning of the year.

After outperforming the broader markets over the last two years, Tata Power, Tata Steel and Tata Motors have cooled off from their highs this year.

Metal stocks are no longer a hot sector to be in and Tata Steel is trading 34% lower than its life time high of August, 2021.

Tata Motors is down 17% from its November 2021 highs. The street expects the company's operating margin to be under pressure due to higher raw material costs.

Tata Power seems to have lost at least some of its power this year. The stock is down 25% from its April 2022 high.

Most analysts believe the stock already factors in a much higher valuation for the renewable portfolio and don't see room for any significant gains going forward.

It seems like the lights have dimmed and our superstars are out of focus yet again.

But guess whose turn it is to shine once again.

Lalit Modi, the monarch of the Indian Premier League who lost his throne and has ever since been in exile in London has finally found himself back in the spotlight.

Will the 'just dating' status change to marriage soon? Will he script a comeback to Indian cricket? Or will he simply fade away once again.

Being in the spotlight sure is a lonely place to be. Being out of it, even more so.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

Yazad Pavri

Cool Dad, Biker Boy, Terrible Dancer, Financial writer

I am a Batman fan who also does some financial writing in that order. Traded in my first stock in my pre-teen years, got an IIM tag if that matters, spent 15 years running my own NBFC and now here I am... Writing is my passion. Also, other than writing, I'm completely unemployable!

Equitymaster requests your view! Post a comment on "Meet the Lalit Modis of the Stock Market: Tata Power, Tata Steel, and Tata Motors". Click here!

1 Responses to "Meet the Lalit Modis of the Stock Market: Tata Power, Tata Steel, and Tata Motors"

Aarav

Jul 30, 2022Wow! This is fabulous. I wait every week to read Yazads writings. The best writer you guys have got.

Keep up the good work!!!