- Home

- Views On News

- Jul 31, 2021 - Devyani International IPO: Key Points to Consider

Devyani International IPO: Key Points to Consider

The most recent IPOs of Zomato and Tatva Chintan Pharma delivering stellar returns on listing day has caught the fancy of retail participants as they look to make quick returns.

The public offer of Glenmark Life Sciences, which closed on Thursday, also saw good response. It was subscribed 45.1 times. Even the retail portion was subscribed 15 times.

There's a strong line-up in the IPO market next week with four IPOs hitting the primary markets on the same day - Devyani International, Exxaro Tiles, Krsnaa Diagnostics, and Windlas Biotech.

Among the four, Devyani International's public offer is the biggest.

Devyani's IPO will make it the third restaurant chain to raise funds through an IPO in recent time, after the successful listing of Burger King India and Barbeque Nation Hospitality.

Here are some details about this IPO.

Issue period: 4 August 2021 to 6 August 2021

IPO Size: Rs 18.4 bn (fresh issue worth Rs 4.4 bn and offer for sale (OFS) worth 14 bn)

Price band: Rs 86 to Rs 90 per equity share

Bid lot: 165 shares and in multiples thereof

Face value: Rs 1 per equity share

Object of the issue: The object of the issue is to repay and/or prepay borrowings and general corporate purpose.

75% of the entire issue will be reserved for qualified institutional buyers (QIB), while 15% will be kept for non-institutional investors (NII), and 10% for retail investors.

The stock will get listed on exchanges by 16 August.

About the company

Devyani International is the largest franchisee of Yum Brands and among the largest quick-service restaurants (QSR) chain operators in India with 655 stores across 155 cities all over the country.

Yum Brands operates many fast food brands including Pizza Hut, KFC, and Taco Bell brands.

Incorporated in 1991, the company operates in three business verticals.

- Core Brands which include KFC, Pizza Hut, and Costa Coffee stores in India.

- International business which includes stores in foreign countries (Nepal and Nigeria).

- Other businesses including own branded stores. (Vaango, Food Street, Masala Twist, Ile Bar, Amreli, and Ckrussh Juice Bar).

Devyani is the single largest QSR company in India to be listed on Swiggy and was among the largest QSR companies in India to be listed on the Zomato platform in 2019 and 2020.

As of March 2021, the company had an employee base of 9,356 employees, of which 8,833 employees were in India, and 523 were outside India.

Arguments in favour of the business

Strong brands with strong presence

It's the largest franchisee of Yum Brands, which operates brands such as KFC, Pizza Hut, and Taco Bell. The company has presence globally with more than 50,000 restaurants in over 150 countries.

KFC alone has over 25,000 restaurants while Pizza Hut has 17,639 restaurants.

In India, it has strong presence in key metro regions of Delhi NCR, Bengaluru, Kolkata, Mumbai, and Hyderabad.

The company earned around 94% of its revenue from core brands business (KFC, Pizza Hut, and Costa Coffee), together with international business in fiscal 2021.

Continuing store expansion

In the last six months alone, the company has opened 109 stores across its core brand business.

Stores in Devyani's core brands business grew at a CAGR of 13.6% from 469 stores as of March 2019 to 605 stores as of March 2021. This despite the fact that the world was severely impacted by the Covid-19 pandemic.

What works for the company is that its stores are situated in locations that have significant footfalls such as high street locations, shopping malls, food courts, airports, hospitals, business hubs, and transit areas.

The brand name takes care of the rest.

Risk factors

Covid impact

After more than fifteen months, Covid-19 pandemic, as we all know, still remains a key concern for all the companies.

In case of Devyani International, store closures and reduced store-level operations was a huge blow. It permanently closed 61 stores under the core brands business in fiscal 2021 due to significant decline in footfalls.

Revenues took a hit due significant decline in in-store dining due to lockdowns. Revenue generated from in-store dining amounted to Rs 5,416 m and represented 48.9% of the total revenue from operations of core brands business in fiscal 2020.

This declined to Rs 2,842 m, representing 29.8% of total revenue from operations in fiscal 2021. Total revenue also declined by 25.2% from Rs 15,164 m in fiscal 2020 to Rs 11,348 m in fiscal 2021.

Reliability on Yum brands

Revenue from KFC and Pizza Hut stores together represented 76.1%, 77.5%, and 92.3% of its total revenues, in fiscals 2019, 2020, and 2021, respectively.

The company relies on arrangements with Yum for KFC and Pizza Hut stores, which comprise the majority of business.

A termination or inability to renew the arrangements will have an adverse effect on the company's business.

Loss making company

Devyani International has reported losses for consecutive years.

But that's not new. Even Zomato is a loss making company. Remember how it made its blockbuster debut recently?

Increases in costs, expenses and investments may further reduce margins and affect its financial condition.

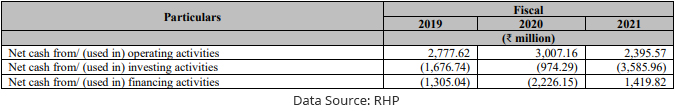

On top of losses, it has also had negative cash flows in the past.

The financials

As discussed above, Devyani International is a loss-making entity, reporting a net loss of Rs 630 m in fiscal 2021.

Here's a table comparing the company's financials over the past three years.

Financial Snapshot

| (Rs m) | FY19 | FY20 | FY21 |

|---|---|---|---|

| Revenues | 13,106 | 15,164 | 11,348 |

| Revenue Growth | - | 16% | -25% |

| Expenses | 13,948 | 16,465 | 13,382 |

| EBITDA | 2,790 | 2,555 | 2,269 |

| Net Loss | -941 | -1214 | -630 |

| Net Profit Margin (%) | -7% | -8% | -6% |

| Net Worth | -1,212 | -2,282 | 719 |

Peer comparison

Devyani International competes within the food service industry and the QSR sector not only for customers, but also for personnel and suitable sites for their restaurants.

Their competitors include international QSR chains operating in India, such as McDonalds, Domino's Pizza, Subway, Starbucks, and Burger King, as well as local restaurants in the QSR segment such as Cafe Coffee Day, and Chai Point.

They generally compete on the basis of product and service quality price, and location.

On listing, Devyani International will join peers such as Jubilant FoodWorks, Westlife Development, and Burger King India.

Comparative Analysis

| Company | Total Income | Net Profit | Return on Net Worth (%) |

|---|---|---|---|

| Devyani International | 11,989 | -630 | -48.5 |

| Jubilant FoodWorks | 33,850 | 2,320 | 16.2 |

| Westlife Development | 10,303 | -990 | -20.7 |

| Burger King India | 5,229 | -1,740 | -25.8 |

Figures in Rs m and as on 31 March 2021

For more details, check out Devyani International's RHP.

Evolving food industry

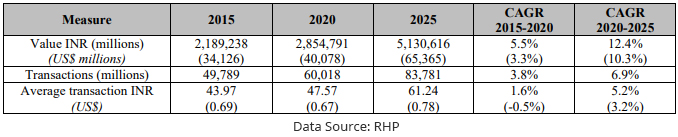

The Indian food services profit sector generated total revenues of Rs 83.7 bn in 2020, growing at a CAGR of 1.9% from Rs 76 bn in 2015, driven by transactions.

Increased deliveries and increased demand for eating out have led to growth of transactions, especially in 2020, due to the pandemic.

The number of transactions is expected to grow by an even higher rate of 6.9% in the period between 2020 and 2025.

Food delivery applications Zomato and Swiggy are expected to play an even more prominent role during the forecast period.

In 2020, the QSR channel made the largest contribution to the foodservice industry, with a sales share of 34.1%.

This was followed by pub, club, and bar, and full-service restaurants, with market shares of 27.1% and 15.5% respectively.

Growth of QSR Chains

Domino's Pizza Inc., Yum! Brands Inc., McDonald's Corporation, Doctor's Associates Inc., Restaurant Brands International are the key players in the Indian QSR industry.

Its raining IPOs! What should you do?

28 companies have already concluded their IPOs, raising over Rs 420 bn over the last seven months. 34 others have filed their offer documents with market regulator for approval.

Besides, there are over 50 more lined up with their IPOs this year. Prominent names include new-age technology based companies such as PhonePe, MobiKwik, Grofers, PolicyBazaar, and Delhivery among others.

Retail investors are showing huge anticipation for IPOs and for good reason. IPOs of Zomato and Tatva Chintan Pharma took less than two weeks to double investors' money.

As companies line up to raise funds from the market amid high valuations, investors need to consider numerous factors before investing their money in an IPO.

If you are investing in an IPO, weigh in all the positive and negative factors affecting the company.

Take a close look at the company's financials and valuations. It would give you a clear picture of what's brewing.

Happy Investing!

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

Yash Vora is a financial writer with the Microcap Millionaires team at Equitymaster. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

Equitymaster requests your view! Post a comment on "Devyani International IPO: Key Points to Consider". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!