- Home

- Views On News

- Aug 4, 2021 - Tata Consumer Results Review: Net Profit Dips 42% but Margins Expand

Tata Consumer Results Review: Net Profit Dips 42% but Margins Expand

Yesterday post market hours, Tata Consumer Products reported a decline of 42.1% in its consolidated net profit to Rs 2 bn for the quarter ended June 2021.

This compared with a net profit of Rs 3.5 bn in the April-June quarter a year ago.

The fall in bottomline is due to a one-time exceptional gain in the previous year.

The exceptional item for the corresponding quarter of the previous year represents a gain of Rs 840 m on the conversion of a joint venture (NourishCo Beverages) into a subsidiary and costs relating to the business integration of Rs 210 m.

Sequentially, net profit of the maker of Tata Tea and Tata Salt rose 243.5%.

Key financials

The Tata group company's revenue from operations in the quarter under review jumped 10.9% to Rs 30.1 bn.

This compared with Rs 27.1 bn in the year-ago period.

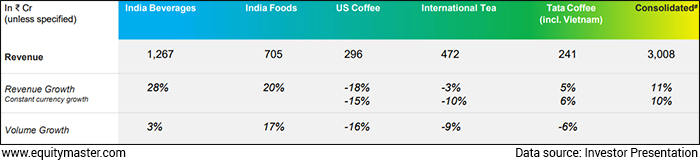

Revenue was driven by a growth of 28% in India Beverages business (including NourishCo) and 20% in India Foods business.

The company's total expenses stood at Rs 27 bn, a rise of 16.7% as against Rs 23.1 bn a year ago.

Here's a table comparing Tata Consumer results on key parameters.

Financial Snapshot

| (Rs bn) | Jun-21 | Jun-20 | (YoY) |

|---|---|---|---|

| Revenue from operations | 30.1 | 27.1 | 11% |

| Total expenses | 27.0 | 23.1 | 17% |

| EBITDA | 4.0 | 4.9 | -17% |

| Profit after tax | 2.0 | 3.5 | -42% |

Commenting on the performance, the company's CFO L Krishnakumar told,

- Despite the market disruption, we grew our India business.

Overall, it is a strong double-digit growth in spite of lockdown and other implications.

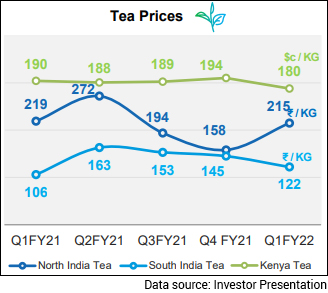

The profitability in India business was lower because tea cost in the latter part of the year went up significantly and now, it has started to come down, he added.

Commodity Price Trend

Krishnakumar also said the non-branded business, which is Tata Coffee plantation, also did well in this quarter.

Segmental performance

Revenue from its India-beverages segment was up 28.2% to Rs 12.7 bn on top of a 3% volume growth.

Its India food business jumped 19.6% to Rs 7 bn, compared with Rs 5.9 bn in the year ago period.

Despite a high base in the corresponding quarter, the company registered a 17% volume growth.

During the quarter, its e-commerce segment recorded a significant growth of 153% year on year (YoY) and contributed 7.3% of domestic sales.

Revenue from the international-beverages segment were lower by 12.7% as last year, the company benefitted from pandemic induced pantry shopping.

Key Businesses Snapshot

Pantry shopping was absent this year as it witnessed restricted store timings and disruptions to its last-mile logistics.

Tata Starbucks recorded revenue growth of 371% in June 2021 on a very low base of last year.

Despite this steep growth, revenue for the Tata Starbucks, a 50:50 joint venture between Tata Consumer and Starbucks Corporation, was lower compared to the same period in fiscal 2020.

During the quarter delivery contribution increased to 27%, driven by several focused initiatives to offset the decline in dine in.

Its US coffee volumes contracted 16% YoY. Tata Coffee, including Vietnam, witnessed 6% volume decline.

On its outlook, the company said second wave in India is now receding and there seems to be a V-shaped recovery since second half of June.

Its international markets (US, UK, Canada) are seeing a return to pre-Covid demand trends of packaged tea and coffee categories.

With increased mobility, Tata Consumer is expecting to see improving trend in Starbucks and further acceleration in NourishCo business.

Comparison with top companies' earnings

Among the top consumer goods companies which have so far announced earnings, Nestle India and Hindustan Unilever (HUL) saw their margin narrow over the preceding three months as commodity costs rose.

Nestle India highlighted rising commodity prices across oils and packaging materials.

Meanwhile, Britannia's margins remained steady. Britannia also witnessed an increase in the prices of palm oil and crude.

FMCG companies will need to navigate the next couple of quarters of very high inflation.

How the stock markets reacted to Tata Consumer's earnings

Tata Consumer Products share price opened the day up by 0.1% at Rs 769 on the BSE against its previous close of Rs 767.

Shares of the company slipped 1.4% to Rs 755 as the session progressed.

Tata Consumer shares have a 52-week high quote of Rs 787.60 touched last month on 27 July and a 52-week low quote of Rs 436.40 touched on 4 August 2020.

Over the past year, shares of the company have outperformed benchmark indices and gained 77%.

At the current price of Rs 761, the company commands a marketcap of Rs 701.9 bn.

About Tata Consumer Products

Tata Consumer Products is a focused consumer products company uniting the principal food and beverage interests of the Tata Group under one umbrella.

The company's portfolio of products includes tea, coffee, water, salt, pulses, spices, ready-to-cook offerings, breakfast cereals, snacks and mini meals.

Tata Consumer Products is the 2nd largest branded tea company in the world. Its key beverage brands include Tata Tea, Tetley, Eight O'Clock Coffee, Tata Coffee Grand, Himalayan Natural Mineral Water, Tata Water Plus, and Tata Gluco Plus. Its foods portfolio includes brands such as Tata Salt, Tata Sampann, and Soulfull.

In India, Tata Consumer Products has a reach of over 200 m households, giving it an unparalleled ability to leverage the Tata brand in consumer products.

To know more about the company, check out Tata Consumer Products company fact sheet and quarterly results.

For a sector overview, read our FMCG sector report.

You can also compare Tata Consumer with its peers.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

Yash Vora is a financial writer with the Microcap Millionaires team at Equitymaster. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

Equitymaster requests your view! Post a comment on "Tata Consumer Results Review: Net Profit Dips 42% but Margins Expand". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!