- Home

- Views On News

- Jan 24, 2023 - Stocks for Long Term? Here are 10 for Your Watchlist

Stocks for Long Term? Here are 10 for Your Watchlist

Editor's note: Investing in stocks for the long term can be a great way to earn life-changing wealth in the stock market.

The key, of course, is to know which growth stocks to buy, and when.

As ever changing interest rates and inflation levels continue to swing the markets, a long term investing strategy comes in handy.

So instead of trying to time the market, which we believe is a futile exercise, look at these ten stocks for the long term.

Stocks for Long Term? Here are 10 for Your Watchlist

Warren Buffett's approach to investing was more about not trying to time the market but the time spent in the market.

In other words, investing in stocks for the long term.

This stock market adage is a cardinal rule which you would find in almost all investing books.

There is no better advocate of long term investing in stocks today other than the Oracle of Omaha - Warren Buffett.

The strategy behind long term investing is to hold on to the stock for a period of more than three years, or possibly more than five years.

Three years or five years sounds like a long period when one dives into the stock market. That's because most investors are looking to make a killing in the short term.

But that's the difference between a trader and an investor.

There are retail investors who choose to invest in fundamentally strong stocks and remain invested for the long haul. This can even mean a period of 3, 5, 10 or more years.

You have to do your due diligence when looking at the best long term stocks to buy in India.

Everything boils down to data that can answer your question on 'what' stock to purchase and 'why' it is best suited for the long term.

The critical question that needs answering is 'when' you should buy these stocks.

Is it a good time to take the plunge when the markets are down? There are high chances of getting your hands on some premium shares which may have become undervalued stocks at that time.

There is still a lot of debate on this among experts.

Irrespective of how you approach the investment process, it is vital to evaluate the stock for its long term potential before you invest.

We did a little bit of the legwork for you using the Equitymaster's powerful stock screener.

Here are the top 6 stocks for the long term to add to your 2022 watchlist.

These stocks are results of Tanushree Banerjee's stock screener for quality bluechips and midcap stocks.

It takes into consideration different parameters such as ROE, P/E, debt to equity, dividend yield, among other things.

Let's get started...

#1 Tata Steel

Tata Steel was founded in 1907 and is Asia's first integrated private steel company and one of the leading manufacturers of steel in the world.

With a total crude steel capacity is 34 MTPA, the company offers a widespread portfolio of steel products like hot rolled, cold rolled, coated steel, rebars, wire rods, tubes, wires, etc.

In the financial year 2021-22, the company reported revenue of Rs 24.4 tn. This is a 55.9% year on year (YoY) growth. Across the last ten years, the company's revenues have increased at a CAGR of 6%.

Servicing existing debt had been a top priority for Tata Steel. This has led to the company delivering its highest ever earnings before interest, taxes, depreciation, and amortisation (EBITDA) at Rs 638.3 bn and a profit after tax (PAT) of Rs 417.9 bn respectively.

The company's profits have shown a healthy 29% CAGR growth over the last 10 years.

Tata Steel executed a stock split on 28 July to add liquidity of shares in the market.

The company has a history of strong and steady profit growth. This puts the company in a strategic position to finance its expansion plans whilst ensuring that its shareholders are well rewarded at the same time.

To know more about Tata Steel, check out its factsheet.

#2 Infosys

With a journey spanning over 40 years, Infosys is India's second-largest information technology (IT) services provider and a global leader in emerging digital services and consulting with clients across 50+ countries.

Infosys has forayed into next generation technologies like artificial intelligence (AI), machine learning (ML), blockchain, cloud computing, and the metaverse, Internet of Things (IoT), security and data analytics solutions over the last few years. These have been the key growth drivers for the company.

The turnover for the company in the financial year 2021-22 was Rs 1,216.4 bn. The order book remains strong in the backdrop of rapid digitisation in the technology, energy, and utility sectors.

Infosys' sales on a CAGR basis in the last ten years is a healthy 14%.

The CAGR for Infosys stock price has been a healthy 19% and the average return on equity (ROE) has been at steady 25% over the last decade.

The company has no debt and continues to maintain a strong liquidity position. To know more about Infosys, check out its factsheet.

#3 Balkrishna Industries

For over 30 years, Balkrishna Industries has been a force to be reckoned with in the Indian tyre sector.

Established in 1987, the company produces off-highway tyres. It's a leading player in niche segments like mining, earthmoving, agriculture, and gardening.

Balkrishna Industries sells its tyres in 160+ countries and boasts of a client list that includes the likes of New Holland, John Deere, AGCO, CLASS, JCB, CAT, Sakai, Goldoni, TEREX, Turk Traktor, and CNH Industrial.

Boasting of high promoter holding of 58.3%, the company's performance in the financial year 2021-22 has demonstrated its capitalisation of the long term strategy to increase scale and maintain business agility.

With a volume of 2.9 m MTPA, Balkrishna Industries reported revenues of Rs 87 bn in the financial year 2021-22. This is a jump of 46% YoY. The company accounts for 83% of its sales from exports to the US and Europe.

The CAGR for sales in the last 10 years is a healthy 11%.

Profit CAGR for Balkrishna Industries stands at a healthy 18% over the last decade.

Balkrishna Industries has made significant progress with its capex plan that is focused on ramping up capacity to 3.6 m MTP. This is expected to translate into higher revenues for the company in the foreseeable future.

To know more about Balkrishna Industries, check out its factsheet.

#4 Gujarat Gas

Incorporated in 1980, Gujarat Gas is a subsidiary of the state-owned Gujarat State Petroleum Corporation.

It is India's largest city natural gas distribution company with coverage of 169,700 square km of the licensed area under its umbrella. It caters to the needs of both domestic and commercial consumers.

The company has licenses to distribute across 43 districts in 6 states of Maharashtra, Gujarat, Rajasthan, Punjab, Haryana, and Madhya Pradesh as well as one union territory of Dadra & Nagar Haveli.

Revenues for Gujarat Gas went up from Rs 98.5 bn to Rs 164.6 bn in the financial year 2021-22. This is a 67.1% growth YoY.

The company has delivered good profit growth of 41.7% CAGR over the last 5 years.

Despite the robust growth in sales, the stock of Gujarat based public sector undertaking (PSU) declined more than 35% in 2022. Over the last 12 months, the stock price is down 37%.

Gujarat Gas has ambitious growth plans that involves adding 130-150 CNG stations yearly. This is about three times of earlier targeted levels. 50% of these would be controlled by the company directly. 75% will cater to new geographies.

To know more about Gujarat Gas, check out its factsheet.

#5 ICICI Securities

ICICI Securities is one of the largest broking firms in the country. It's a subsidiary of ICICI Bank that began operations in 1995. It has steadily built a loyal client base in India over 28 years in business.

The company offers a massive portfolio of investment services. This includes broking, distribution of financial products, wealth management, and investment banking. It is also the second largest distributor of mutual funds among non-banks.

ICICI Securities currently has a market share of 8.9% in the equities segment and 3.2% in the derivatives segment. It also has a 7% share in incremental demat accounts opened.

The stock has been facing some severe headwinds lately. The share price hit a 52 week high of Rs 895 in 2021 and then came tumbling down to its 52 week low of Rs 409 as recently as the end of May 2022.

The reason for this swing is due to market correction. Also, brokerage companies get affected when the participation of new investors slows down and that's exactly what happened of late.

For the financial year 2021-22, ICICI Securities reported a total income of Rs 34.4 bn. This was 33% higher compared to the previous year's income.

Profitability also jumped 29% YoY. The company has delivered good profit growth of 32.5% CAGR over the last 5 years.

To know more about ICICI Securities, check out its factsheet.

#6 Mindtree

Incorporated in 1999, Mindtree is a midcap information technology (IT) solutions provider. It's a wholly owned subsidiary of Larson & Toubro Group of companies.

This midcap IT company specialises in end to end digital solutions. It's a trusted partner to some of the leading companies in the world in a many of industries.

The company generated revenues to the tune of Rs 105.3 bn in the financial year 2021-22. This was a massive jump of 32.1% YoY. The revenue CAGR for the last 5 years stands at a healthy 17.8%.

Despite headwinds due to supply-side challenges, Mindtree continued to grow across all dimensions of its business. It delivered a strong earnings before interest, taxes, and amortisation (EBITDA) margin of 20.9%.

Net profit for the year increased 48.8%. Mindtree delivered industry leading profitable growth. The net profit margin stood at 15.7%. The company recorded a profit CAGR of 30.5% in the last 5 years.

According to the latest company presentation, the company is on the verge of a merger with Larsen & Toubro Infotech, a global technology consulting and digital solutions company.

The new entity will be rechristened as LTIMindtree subject to approvals from the board of directors.

LTIMindtree, is right at the cusp of becoming India's fifth largest IT services firm by market capitalisation and sixth in terms of revenue. This will position the company to participate in larger deals and strengthen partnerships going forward.

To know more about Mindtree, check out its factsheet.

#7 Supreme Industries

Supreme Industries, established in 1942, is the undisputed king of the plastics industry in India.

With seven business divisions, the company handles over 350,000 tonnes of polymers every year making it one of the country's largest plastic processors.

The king of plastic offers a wide and comprehensive range of plastic products in India that are manufactured across 25 of their facilities spread across the country.

The revenues of Supreme Industries stood at Rs 77.9 bn in financial year 2021-22. It was up 22.3% compared to Rs 63.7 bn in the fiscal year 2020-21. Over the past 5 years, the revenue has grown at a CAGR of 12.6%.

Profit has also seen steady growth at 18% CAGR over the last 5 years.

The company has significantly decreased its debt by Rs 4,103.3 m and is virtually debt free.

The company has ambitious expansion plans. It intends to launch a line of value added products and increase exports significantly over the next 5 years.

Going forward, the company is expected to see some major demand tailwinds in the pipe market. This will be on the back of a strong housing and agriculture market.

To know more about Supreme Industries, check out its factsheet.

#8 Laurus Labs

Laurus Labs is one of India's top tier innovative and research-driven pharmaceutical and biotechnology companies. It offers a broad, integrated portfolio of products and services to the global pharmaceutical industry.

The company holds a leadership position in the Active Pharmaceutical Ingredients (APIs) segment. It sells its APIs in more than 56 countries. Other key business divisions include Generic Formulation (FDF), CDMO-Synthesis, and Laurus Bio.

The company has grown from one-product company in 2010 to 60+ commercial products in 2020 and holds over 100 patents.

Laurus Lab's revenue has grown from Rs 20.7 bn in the financial year 2017-18 to Rs 49.5 bn in the fiscal year 2021-22. Over the past 5 years, the revenue of the company has grown at a CAGR of 24.3%.

The company has maintained a high net profit CAGR of 49.3% over the last 5 years. It has maintained an average operating margin of 21.9% in the last 5 years.

Laurus Labs currently trades around Rs 550 per share, nearing its 52-week low.

Laurus Labs has a good growth story in place. Itis currently focusing on margins due to cost pressures. It has an evolving product mix and is in a great position to offset the cost pressures.

To know more about Laurus Labs, check out its factsheet.

#9 Vedanta

An Indian multinational company in the mining industry, Vedanta is a diversified natural resource group. It's engaged in exploring, extracting and processing minerals and oil & gas.

Vedanta has a significant global footprint across India, South Africa, Namibia, Ireland, Liberia, and the UAE.

The company's other business verticals include commercial power generation, steel manufacturing, and port operations in India as well as manufacturing of glass substrate in South Korea and Taiwan.

The revenues of Vedanta stood at Rs 13.5 tn in the financial year 2021-22, which was up 48.0% compared to the fiscal year 2020-21. Over the past 5 years, the company's revenue has grown at a CAGR of 9.5%.

Its net profit increased by 57.7% year-on-year (YoY). The company has delivered good profit growth of 28.8% CAGR over the last 5 years.

Amid a highly volatile market and negative global cues surrounding metal stocks, shares of Vedanta dipped almost 45% in mid July 2022. It is currently trading at around Rs 250 per share.

Going forward, one key aspect to track will be Vedanta's semiconductor business as it expects US$ 3 bn in business annually.

Vedanta is among the top semiconductor companies in India to watch out for.

To know more about Vedanta, check out its factsheet.

#10 Deepak Nitrite

Deepak Nitrite is a chemical manufacturing company and a leading manufacturer of organic, inorganic, fine, and speciality chemicals.

It has a 70% market share in sodium nitrite, sodium nitrate and NitroToluenes in India. The company caters to a global client base like BASF, Biocon, Reliance and Syngenta, across 6 continents with its 100+ product portfolio.

Over the last year, the share price of Deepak Nitrite has moved up from Rs 386.6 to Rs 1,657.0, registering a gain of Rs 1,270.4 or around 328.6%. This has made it one of the fastest growing companies in India and a big multibagger stock.

Analysts are of the opinion that Deepak Nitrite's robust cash flows are feeding into a higher share value.

Overall, the company has delivered good profit growth of 87% CAGR over the last 5 years.

To know more about Deepak Nitrite, check out its factsheet.

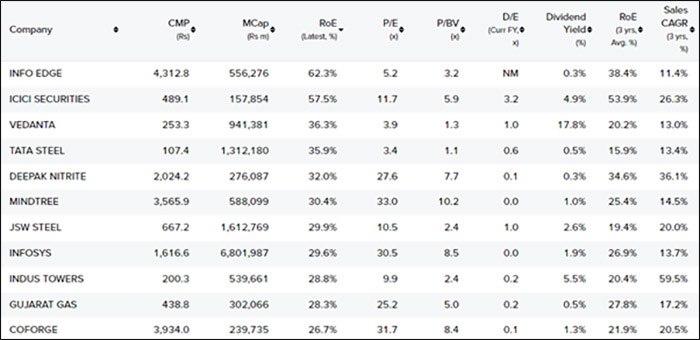

Snapshot of High Quality Stocks from Equitymaster's Stock Screener

Here's a snapshot of the above companies along with crucial parameters to watch out for.

Why it Makes Sense to Invest for the Long-Term...

If you are a Warren Buffett follower, you won't need any convincing when it comes to investing in stocks for the long haul.

He says that his favourite holding period for a stock is 'FOREVER'.

Long term stocks are ideal instruments to compound wealth that could last you for generations.

For this, you need to buy great companies at a reasonable price and hold on to them 'forever'.

Asian Paints is a classic example that embodies the true spirit of a 'Forever Stock'. Had anyone invested Rs 500 in the company when it went public in 1982, the value of the holding would be as much as Rs 10 m today.

Since 1982, the value of its shares has gone up 20,000 times creating phenomenal wealth for its shareholders who were smart enough to hold on to this forever stock for almost four decades.

Investing in long term stocks requires patience that will generate massive returns for you in the future and leave a legacy for your children.

So, why settle for average short term gains when there's more money to be made in forever stocks through a slow but sure way?

To know more about Forever Stocks, be sure to check out the below video by Tanushree Banerjee, where she reveals some of the potential long term stocks that you can buy and forget.

Happy Long-Term Investing!

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

FAQs on Long Term Stocks

1) How long should we hold stocks?

The strategy behind long term investing is to hold on to stocks for a period of more than three years, or possibly more than five years.

Three years or five years sounds like a long period when one dives into the stock market. That's because most investors are looking to make a killing in the short term.

But that's the difference between a trader and an investor.

There are retail investors who choose to invest in fundamentally strong stocks and remain invested for the long haul. This can even mean a period of 3, 5, 10 or more years.

2) Which are the best long-term stocks?

The best long-term stocks are those that compound wealth that could last you for generations.

For this, you need to buy great companies at a reasonable price and hold on to them 'forever'.

Asian Paints is a classic example that embodies the true spirit of a 'Forever Stock'. Had anyone invested Rs 500 in the company when it went public in 1982, the value of the holding would be as much as Rs 10 m today.

To know about more such companies, check out our recommendation service - Forever Stocks.

3) How to find penny stocks for the long term?

If you're looking for penny stocks to buy for the long term, apply the following fundamental filters:

- Last 10-years sales and profit growth greater that 10%

- Cash on the books greater than total debt

- Current ratio greater than 1. Ideally greater than 2

- Return on Equity greater than 12%

This framework is one of the easiest ways to filter penny stocks for the long term.

You should use the Equitymaster Indian Stock Screener to filter such stocks...

Equitymaster requests your view! Post a comment on "Stocks for Long Term? Here are 10 for Your Watchlist". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!