- Home

- Views On News

- Aug 11, 2021 - Zomato's Strong Topline and Key Parameters Send Stock Soaring 5%

Zomato's Strong Topline and Key Parameters Send Stock Soaring 5%

Before Zomato's IPO, there was much hype about how the company would become profitable as food delivery is booming during the pandemic.

But the company's June quarter results say otherwise. Zomato's net loss widened in the June quarter.

Yesterday, the online food delivery platform reported a consolidated net loss of Rs 3.6 bn for the quarter ended June 2021. This compared with a net loss of Rs 1 bn in the year-ago quarter.

The loss for the June quarter was largely on account of non-cash employee stock option programme (ESOP) expenses, which increased meaningfully due to significant ESOP grants made in the quarter pursuant to creation of a new scheme.

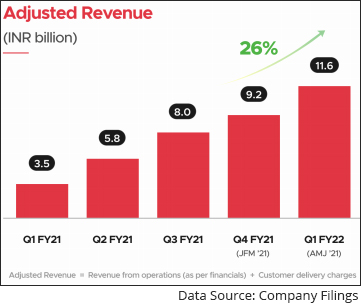

The company reported adjusted sales growth of 26% year on year (YoY) to Rs 11.6 bn for the quarter under review.

Zomato considers adjusted sales as sum of revenue from operations plus customer delivery charges.

It must be noted that the YoY growth in adjusted sales is irrelevant as the year-ago quarter was adversely affected by the national lockdown to contain the spread of the Covid.

Adjusted Revenues

Gradual recovery in economic activities is expected to accelerate Zomato's topline growth in the coming quarters.

The company's total expenses in the June quarter stood at Rs 12.6 bn compared to Rs 3.8 bn in the corresponding quarter last year.

On the operational front, its adjusted earnings before interest, tax, depreciation, and amortisation (EBITDA) rose to Rs 1.7 bn from Rs 1.2 bn in the previous quarter.

Employee expenses rose by 113%.

Here's a table comparing Zomato's results on key parameters.

Financial Snapshot

| (Rs m) | 21-Jun | 21-Mar | 20-Jun |

|---|---|---|---|

| Revenue from operations | 8,444 | 6,924 | 2,660 |

| Total expenses | 12,597 | 8,850 | 3,833 |

| Exceptional items | 1.6 | - | - |

| Loss before tax | -3,590 | -1,342 | -998 |

| Tax | 17 | - | - |

| Loss after tax | -3,607 | -1,342 | -998 |

Robust Indian food delivery business; dining-out suffers

Zomato's Indian food delivery business showed strength during the quarter as the company recorded its highest-ever gross order value, number of orders, transacting users and active delivery partners in its history.

The gross order value of the Indian food delivery business grew more than four-fold YoY to Rs 45.4 bn in the reported quarter. Sequentially, the growth was 37%.

Zomato's core food delivery business continued to grow despite the severe second wave starting April.

Zomato's dining-out business suffered in the June quarter because of the second wave and localised lockdowns.

New milestone

Zomato delivered its billionth order last week, its co-founder and chief executive officer Deepinder Goyal said.

- It took us six years to get to this milestone and we hope it takes us much less time to deliver the next billion.

The fact that 10% plus of these billion orders were delivered only in the last three months makes us confident about getting to the next billion much sooner.

Despite the company delivering its billionth order, Zomato's net loss widened.

Zomato has improved its pay structure during the course of the year. The company claims that the top 20% of its delivery partners who deliver on bikes and put in more than 40 hours a week received a payout of more than Rs 27,000 per month. It had 310,000 active delivery partners in July.

How the stock markets reacted to Zomato's results

Ahead of the results announcement, Zomato share price declined 4.2% to settle at Rs 124.95 apiece on the BSE yesterday.

Today, shares of the company opened 1% lower at Rs 122 on the BSE against its previous close.

Shares recovered as the session progressed and rallied as much as 5% to Rs 131.75.

Despite the company posting huge losses, shares climbed. This is because Zomato's topline is strong and its key parameters also showed signs of demand revival.

The huge demand for loss-making Zomato shows that investors have an appetite and patience for long-term stories.

On 23 July, Zomato got listed on the bourses and achieved a market capitalisation of Rs 1.08 lakh crore on the BSE, making it one of the few listed entities to enter the Rs 1 lakh crore marketcap club upon market debut.

It delivered significant gains on debut from its offer price of Rs 76.

About Zomato

Zomato was incorporated in the year 2010. The company, during its initial stages, started off as a restaurant finder.

Following in the footsteps of its competitor, Swiggy, the company formally launched its food delivery service in India in the year 2015.

By 2020, Zomato expanded its food delivery business to over 500 cities, facing stiff competition from both Swiggy and Uber Eats.

However, during the same year, the company acquired Uber Eats to consolidate its position in the food delivery space.

Based in Gurugram, the company generates most of its revenue from food delivery and related fees it charges restaurants. It also allows users to book tables online, leave reviews, and avail special discounts while eating at select restaurants.

Together with SoftBank-backed startup Swiggy, Zomato has come to dominate an Indian delivery market that benefited from the pandemic as people stayed in and turned to online ordering.

For more details, check out Zomato company fact sheet and quarterly results.

And to know what's moving the Indian stock markets today, check out the most recent share market updates here.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

Yash Vora is a financial writer with the Microcap Millionaires team at Equitymaster. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

Equitymaster requests your view! Post a comment on "Zomato's Strong Topline and Key Parameters Send Stock Soaring 5%". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!