- Home

- Views On News

- Oct 19, 2022 - Understanding Aarti Industries' Demerger

Understanding Aarti Industries' Demerger

Editor's note: Recently, the board of Aarti Industries approved the restructuring scheme where its pharma business and allied activities will be demerged into a separate entity.

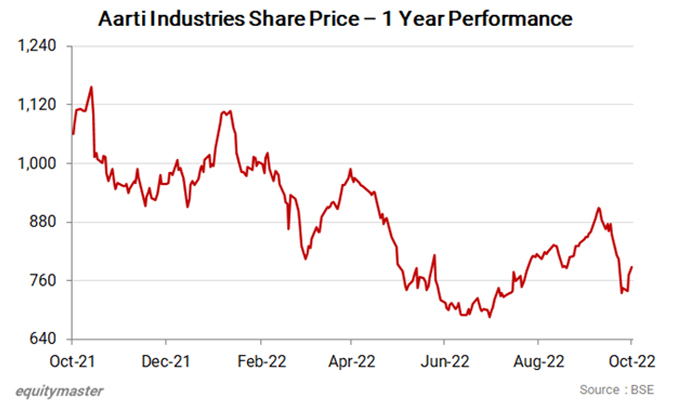

Aarti Industries, a specialty chemical company, has seen a sharp fall in its share price in 2022.

When the demerger was announced in 2021, investors and analysts were of the view that the demerger will unlock value and will be beneficial.

But that hasn't happened it appears. Aarti Industries share price has tumbled around 30% in 2022 so far.

As specialty chemical companies have multiple tailwinds backing them, we though it might be good to touch base upon the demerger and how it has progressed.

Continued reading the updated version of the editorial we covered in August 2021 to know more...

Update on Aarti Industries Demerger

The board of specialty chemical company Aarti Industries approved the demerger of its pharma unit on 19 August 2021.

This put its stock in focus, which fell 3% to Rs 921.65 on the BSE today.

This demerger will carve out Aarti Pharmalabs, which will house Aarti Industries' pharma business along with specialty chemicals related to the pharma sector.

Aarti Pharmalabs (erstwhile Aarti Organics) is a wholly-owned subsidiary company of Aarti Industries.

So what effect will this demerger have to the existing shareholders?

Shareholding Effect

Shareholders of Aarti Industries will get one share of Aarti Pharmalabs for every four shares they hold.

While the share entitlement ratio is announced, the record date for the scheme is yet to be announced.

The public and promoter shareholding for both the companies would remain the same.

At present, promoters hold 44.9% in Aarti Industries while public shareholders hold 55.1% stake.

Aarti Pharmalabs will list on BSE and NSE post the demerger.

Update: One year after the initial announcement, the board of Aarti Industries approved the restructuring.

The decision was taken by the board on 19 August.

Aarti Industries' pharma business and allied activities will be demerged into Aarti Pharmalabs.

The company's management is of the view that revenue and profit of the pharma business will deliver a growth of 15-20% in financial year 2023.

Here's an excerpt of what the company's MD said in an interview:

- The demerged entity will list around mid-December.

Note that Aarti Industries is the largest producer of benzene-based chemicals and derivatives, with a market share of 25-40% for various products. It enjoys high economies of scale and low cost of production.

This makes Aarti Industries one of the top 5 stocks to benefit from China plus one strategy, as companies globally move to Indian counterparts instead of Chinese companies.

Separate and dedicated business segments

As a result of this demerger, Aarti Industries and Aarti Pharmalabs will achieve operational efficiencies by streamlining of the relevant businesses.

Now, the company will have two separate business segments where they could focus more - the speciality chemical and pharma.

The demerger will enable Aarti Pharmalabs to expand its presence in the fast moving pharma business in India and abroad.

The demerger rules out the risk or overlapping of one business over the other.

So, will the demerger unlock value for shareholders?

This is not the first time Aarti is demerging its unit. The company announced demerger of its home & personal care division into a separate entity in June 2018 and it was completed in June 2019.

Companies usually demerge their businesses to focus on one core business.

Another reason companies opt to demerge is because that unit can be a loss making one, and it erodes valuation of the company.

Demerger also unlocks value for existing shareholders. Shareholders receive shares in the demerged companies on the basis of their holdings in the parent company.

For example, If you hold 10 shares in XYZ Ltd, then based on the valuation you may receive 3 shares in the demerged entity for every share that you hold in the parent company.

In this way, shareholders benefit by holding shares in two entities and can participate separately as well as collectively in the growth of the demerged entities.

Now, in case of Aarti Industries, market experts are saying that the share entitlement ratio is not very encouraging. Due to this, the stock saw a muted reaction to the demerger news and fell more.

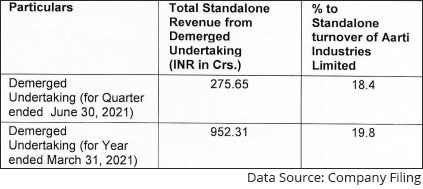

For the most recent quarter, Aarti Industries' chemical segment contributed to 84% of sales while pharma contributed the rest.

Segmental pharma sales grew 24% in the June 2021 quarter YoY. During its earnings call, the management said that they are confident of margin recovery and estimate sales CAGR of 17% between 2021-2023.

Here's a look at Aarti Pharmalabs contribution to turnover for the recent quarter and fiscal 2021.

How the stock of Aarti Industries has performed recently

Post demerger, share price of Aarti Industries has underperformed big time.

In 2022 so far, shares of Aarti Industries are down 32%.

Aarti Industries has a 52-week high quote of Rs 1,168 touched on 19 October 2021. The company touched a new 52-week low of Rs 642 today.

At the current price of Rs 685, the company commands a marketcap of Rs 248.9 bn.

About Aarti Industries

Aarti Industries, the flagship company of the Aarti group, manufactures organic and inorganic chemicals at its major facilities in Vapi, Jhagadia, Dahej and Kutch, in Gujarat.

It also manufactures active pharmaceutical ingredients (API) at its units in Tarapur and Dombivali in Maharashtra, and at Vapi.

The group has a strong market position in the NCB-based specialty chemicals segment.

Aarti Industries has carried out debt-funded capex of about Rs 42 bn during the five fiscals through 2021, including just over Rs 30 bn in the last three fiscals. The company also has a capex of Rs 45 bn planned over fiscals 2022 to 2024 in multiple value chains to increase market share.

To know more, check out Aarti Industries factsheet and quarterly results.

You can also compare Aarti Industries with its peers.

Aarti Industries vs Alkyl Amines

Aarti Industries vs Clariant Chemicals

Aarti Industries vs Pidilite Industries

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

Yash Vora is a financial writer with the Microcap Millionaires team at Equitymaster. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

Equitymaster requests your view! Post a comment on "Understanding Aarti Industries' Demerger". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!