- Home

- Views On News

- Sep 2, 2022 - The Auto Stock Rally is Just Getting Started. Here's How to Pick the Winners of 2023

The Auto Stock Rally is Just Getting Started. Here's How to Pick the Winners of 2023

The Indian auto industry has picked up steam in India and is all set for a bull run.

The industry in India is divided into four broad segments: passenger vehicles, commercial vehicles, two-wheelers, and heavy vehicles.

Out of the four segments, two-wheelers and passenger vehicles dominate the Indian automobile market. They account for 81% and 13% of total unit sales.

On the other hand, commercial vehicles, and heavy vehicles constitute 1% and 4% of total vehicle sales, respectively.

With affordable car loans flooding the market, and record sales of electric vehicles, it is no wonder that this is one of the fastest-growing industries in India.

Due to the rising demand for vehicles, the demand for auto components is also booming.

This has led to a surge in auto stocks.

Auto and auto ancillary stocks have been in the slow lane for some time now. New regulations and then the pandemic both hurt demand, and the supply of components.

But things have started to change now. There is pent up demand for autos. The supply chain is improving. And of course, with the prospect of strong economic growth, commercial vehicles are starting to see some traction too.

In fact, so strong is the sentiment that when broader markets experienced a correction, the BSE auto index hit an all-time high.

Here are the factors driving the rally -

Commodity Prices

Steel accounts for 55% of the average weight of a vehicle. Over two years, it has been on an uptrend. However, it has seen more than a 20% correction in the past three months.

Resolution of Supply Chain Problems

Semiconductor issues have been persistently disrupting the auto industry. However, it has started to normalise.

Favourable Government Policies Prices

To boost domestic manufacturing of advanced automotive technology products, the government announced the Production Linked Incentive (PLI). It proposes financial incentives of 18%. The scheme is expected to provide a boost to the industry to invest in cutting-edge technologies.

Additionally, rising disposable income, rapid urbanisation, and favorable government initiatives, will influence the market in 2023.

Amid all this good news, the question that arises is this...

What are the best auto stock picks?

Well, to make it easier for you to find the answer to that, here's is how you can pick the winners of 2023.

#1 Profitability

Profitability is key for every business. It helps to evaluate the ability of a company to generate income compared to its expenses.

Due to rising commodity prices, the operating profit margin of auto companies had fallen. However, as commodities prices of steel are experiencing correction, the operating profit margins for the year 2023 will grow.

This makes operating margin of the company a major factor for selection.

Also look for companies that are innovating features are essential to remaining competitive in the market. This will drive profit margins in the coming years.

Several Indian companies such as Mahindra & Mahindra and Tata Elxsi are riding this trend.

#2 Pricing Power

One of the most crucial factors to evaluate a business is pricing power. It is the ability to pass on the increased cost to the customer without reducing demand.

During the high commodity prices many auto companies like Maruti Suzuki and Eicher Motors carried out price hikes.

While steel prices are still fluctuating, it is crucial to select a company with pricing power.

#3 EV Megatrend

The Electric Vehicle revolution has taken the auto sector by storm.

This makes it the most obvious choice to select automobile companies that are manufacturing electric vehicles.

The increasing awareness about environmentally friendly transport has increased the demand for EVs.

As per industry statistics, in India, EV sales hit their highest at 429,217 units in the financial year 2022, up 218% YoY from 134,821 units in the financial year 2021. This was also 155% higher than 168,300 units sold in 2020.

With the state government tenders to buy electric buses, the company's manufacturing EVs in commercial vehicles are at benefit. It will push the order book of Tata Motors, Eicher Motors, and JBM auto.

The two and four-wheelers are on the way to capturing a reasonable market share. It makes the passenger vehicles and two-wheeler segments among the top opportunities for 2023.

Stocks to watch out for in 2023

From the commercial vehicle and passenger vehicle space...

Tata Motors

Tata Motors is a part of the prestigious Tata Group. It is the largest commercial vehicle manufacturer with the largest market share in the domestic commercial vehicle segment.

It also offers passenger, multi-purpose vehicles and electric vehicles to over sixty countries. Tata Motors also has a presence in the luxury car market through Jaguar Land Rover.

Tata Motors is at the forefront of India's EV revolution. It has a market share of 71% in the EV market. It has a portfolio of commercial and passenger vehicles.

For the financial year 2022, the company saw its revenue grow 10.7% YoY to Rs 28.2 tn. The net profit for the year saw a de-growth of 13% YoY to Rs 112 bn. The rise in total revenue was due to growth in sales volume.

It's planning to double its electric vehicle sales to 50,000 units in the financial year 2023.

To know more, check out Tata Motors news and analysis.

From the two-wheeler space...Hero MotoCorp

Hero MotoCorp is India's largest manufacturers of motorcycles. In India, it has a market share of about 46% in the two-wheeler category. The company stands to be a big beneficiary of growing EV market.

It holds a 38% stake in Ather Energy. Ather Energy is one of the leading manufacturers of electric 2-wheelers in India.

The company is also betting on battery swapping technology. Apart from this company is also in the manufacturing of lithium-ion battery.

For the financial year 2022, the revenue showed a de-growth of 4.5% YoY to Rs 301 bn. The net profit also saw de-growth of 20.6% to Rs 25 bn. This was due to the low demand pick-up in the first half of the quarter and higher input costs.

The company in August 2022 partnered with Accenture. However, this partnership is for cost optimisation in supply chain and development of an end-to-end digital supply chain.

The company in the filing on 22 June 2022, said it will bring in Euro-5 compliant variants of its globally popular products in Turkiye. Introducing these strong variants in Turkiye will put the company on a stronger footing in Turkiye.

The introduction of Euro 5 in Turkiye is expected to boost the sales of the company.

To know more, check out Hero MotoCorp's news and analysis.

Stocks to watch out for from Auto ancillary space

Jamna Auto

Jamna Auto Industries is largest manufacturer of Tapered Leaf and Parabolic Springs for Commercial Vehicles (CVs) in India.

The company is fast expanding its presence in new-generation products, like air suspension and lift axle. It has tied up with Ridewell Corporation to bring the latest technology in the air suspension system.

It is the sole supplier to Ashok Leyland and a major supplier to Tata Motors.

For the financial year 2022, the revenue rose by 58% YoY to Rs 17 bn. The net profit rose by 92% to Rs 1.4 bn. It was on the back of a 59% YoY increase in sales.

For the coming year, it is planning to expand its production capacity.

To know more, check out Jama Auto's news and analysis.Sona Comstar

Sona Comstar is leading manufacturers and suppliers of automotive systems and components in India.

The company's products find application in all vehicle categories, including electric cars, electric two and three-wheelers, electric light commercial vehicles, and conventional vehicles.

It is one of the few companies that can design high-power-density EV systems. It also manufactures motors for hybrid passenger vehicles, enabling fuel savings and EV traction motors for electric vehicles. For the financial year 2022, the revenue rose by 37% YoY to Rs 21 bn. The net profit rose by 67% YoY to Rs 3 bn for financial year 2022.

It has bagged two new projects from a European passenger vehicle maker to supply final drive differential assemblies for their upcoming EV models.

To know more, check out Sona Comstar's news and analysis.

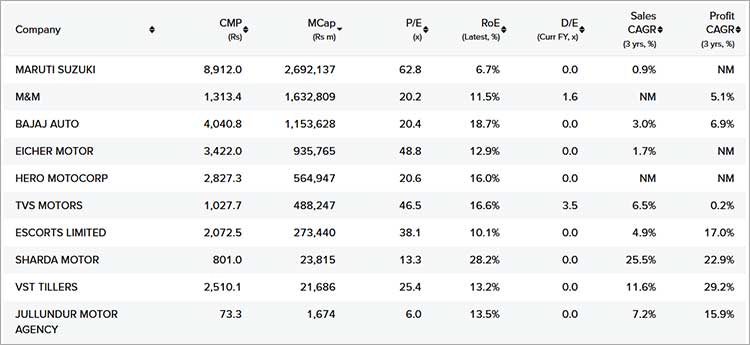

Snapshot of auto stocks from Equitymaster's stock screener

Here is a quick view at the above-mentioned companies based on some crucial financial parameters.

These parameters can be changed according to your selection criteria.

To conclude

It is almost certain that the auto industry in India will become much more competitive as time goes on. There have already been massive waves of consolidation that have shaped the landscape, but there will be more to come.

The Indian automobile sector is one of the fastest-growing sectors in India.

Looking at its performance and data indicate that these stocks are most likely to perform great in the coming years.

Investing in auto stocks is a long-term investing strategy. Hence, do not expect overnight gains.

However, to select the right stocks, you should consider the quantitative and qualitative analysis in conjunction with detailed research. You cannot consider any of them in isolation. Every ratio and parameter have its significance in evaluating the company's business.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

Equitymaster requests your view! Post a comment on "The Auto Stock Rally is Just Getting Started. Here's How to Pick the Winners of 2023". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!