- Home

- Views On News

- Sep 6, 2021 - 4 Ways to Play the EV Opportunity

4 Ways to Play the EV Opportunity

Electric vehicles (EVs) are the next big thing.

As the cost and affordability of EVs drops in the coming years, we are not far from when most vehicles will be electric.

Even Tesla's CEO Elon Musk wants to make cars affordable within 3 years.

In this ongoing EV revolution, it is important that you find good quality companies which are involved in this space because not every EV stock will turn out to be a Tesla.

Here are four ways to play the EV opportunity in India.

#1 Buying EV makers

The most obvious choice would be to select automobile companies which are manufacturing electric vehicles.

Being at its nascent stage, the Indian EV industry does not have an established market leader in all vehicle types.

The 4-wheeler segment includes prominent players such as Mahindra & Mahindra (M&M), Tata Motors, and Maruti Suzuki among others.

But there are several gaps in the 4-wheeler EV space such as limited number of products, high prices, insufficient batteries, etc.

Tata Motors' Tata Tigor EV is the cheapest one on the market while the Mercedes-Benz EQC is the most expensive electric car in India.

The 2-wheeler segment has players such as Hero MotoCorp, TVS Motors, Greaves Cotton, and Bajaj Auto.

The Indian car market is governed by two-wheeled vehicles, which account for 75% of the total number of vehicles sold in the country.

This is an interesting data point as India's homegrown two-wheeler majors are fast-tracking their EV plans to capture reasonable market share in the coming years.

Companies involved in the 3-wheeler segment include Atul Auto, Scooters India among others. This segment also included 4 and 2-wheeler manufacturers Bajaj Auto, TVS Motors, and M&M.

Murugappa group's Tube Investments India has also partnered with a Korean firm to design electric three wheelers.

One major unlisted company in the 3-wheeler segment is Terra Motors.

Apart from the above, there's also Ashok Leyland, the world's 4th largest bus manufacturer and a market leader for trucks in India.

Ashok Leyland designs electric variants specifically for Indian conditions and has also introduced battery swapping in electric buses to address e-mobility needs in the country. It has launched multiple electric bus variants.

#2 Buying battery makers

Lithium-ion (Li-ion) cells are the heart of electric vehicles. These batteries are the most expensive component in EVs, accounting for 40-50% of its cost.

The rapid penetration of electric vehicles in India will drive the need for lithium ion battery manufacturing in the country.

Currently, most electric vehicle makers import cells and batteries from China, the world's top producer of lithium-ion cells.

However, companies are now accelerating plans to produce lithium-ion cells in the country, hoping to take advantage of Rs 180 bn worth of government subsidies.

Here are the top companies involved in this segment.

- Amara Raja Batteries

- Exide Industries

- Hero MotoCorp

- Maruti Suzuki

- Tata Chemicals

In addition to these, there are also government companies engaging in battery manufacturing.

BHEL and Libcoin are planning to form a consortium to initially build a 1GWh lithium-ion battery plant in India.

New Jersey-based electric car maker Triton has roped in state-owned Bharat Electronics to make batteries. Triton will provide the know-how and Bharat Electronics will make them.

Back in 2019, ISRO chose 10 companies to transfer its indigenously developed low-cost Li-ion cell technology. These companies included Carborundum Universal, Thermax, NALCO, and GOCL among others.

Companies are looking to venture into this space by investing in startups involved in battery manufacturing space.

#3 Buying charging infrastructure providers

Like lithium-ion batteries are the heart of electric vehicles, charging points are the next important thing.

EV manufacturing companies are spending tonnes of capital and energy on charging station infrastructure.

By the year 2027, the business of EV charging stations can reach an estimated US$29.7 bn, at a CAGR of approximately 40% between 2020-2027.

Some known listed companies involved in this space include:

- Tata Power

- Indian Oil Corporation (IOC)

- NTPC

- Power Grid Corporation

- Reliance Infrastructure

- Vakrangee

- ABB India

#4 Metals

Silver's growing role in electric vehicles keeps on increasing.

Due to the superior conductivity and corrosion resistance, silver is extensively used in many electronics, and also extends its reach to electric vehicles.

So being a superb conductor of electricity, it's basically been declared as an electrically critical element by the electric and electronic industry. Therefore, silver consumption is likely to jump by leaps and bounds.

From battery management systems to wireless charging to GPS system to deployment system in airbags, and automated braking systems, every electrical connection in an EV uses silver.

An internal combustion engine running on patrol and diesel consumes up to 28 grams of silver per vehicle. Hybrids, which are vehicles that consume petrol, diesel, or even CNG or maybe even electric battery power, consume up to 34 grams of silver onboard per vehicle.

Reportedly, over 55 m ounces of silver was used in vehicle production in 2020. That amount is expected to increase to over 90 m ounces by 2025.

In India, there are no ETFs for silver, and electronic delivery is also not there. You will basically have to buy physical silver.

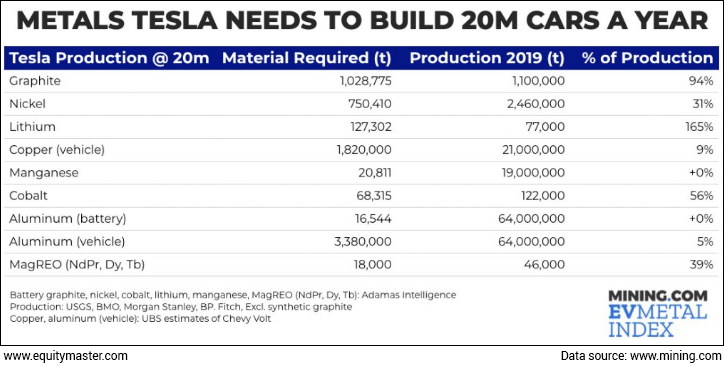

Other metals include copper, nickel, cobalt, and lithium which are the key metals for EV battery production.

Note that demand from the EV industry for key metals is on an upward trajectory. Reportedly, demand growth for nickel from EVs is expected to increase 14 times between 2019-2030. For lithium and copper, it is expected to grow 9-10x.

There is about five times more copper in an electric vehicle than in an internal combustion engine (ICE) vehicle.

As demand for these metals rises, prices will rise which will be beneficial for companies involved in this segment.

Just consider a scenario where 100% of vehicles are EVs. Imagine the demand for those metals.

Have a look at the image below which shows the metal materials which Tesla will need to build 20 m cars a year.

As India adopts EV revolution, mining and metals companies will be at the centerstage which will need increased supply for their production.

India's #1 trader Vijay Bhambwani has time and again mentioned the scope for metals and silver in many of his videos.

In fact, just last month, Vijay was live on YouTube discussing electric vehicles stocks and how they present the next big trading opportunity.

To conclude...

India's electric vehicle revolution is just getting started. As this economic boom kicks into high gear, it will create many beneficiaries.

You too can profit from this megatrend in the stock market.

Amid this euphoria in the EV space, it is crucial to find quality companies which have strong sustainable earnings potential.

Equitymaster's Co-Head of Research, Tanushree Banerjee, has been watching the EV space closely and has identified the key to profit from this revolution.

To know more, check out her article on the Key to Profit from India's EV Revolution.

If you would like to invest in the EV space, Richa Agarwal, editor of the smallcap recommendation service, Hidden Treasure, has recommended a proxy play on India's EV revolution.

Subscribers can read the report here (requires subscription).

If you are not a subscriber, here's where you can sign up.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

Safe Stocks to Ride India's Lithium Megatrend

Lithium is the new oil. It is the key component of electric batteries.

There is a huge demand for electric batteries coming from the EV industry, large data centres, telecom companies, railways, power grid companies, and many other places.

So, in the coming years and decades, we could possibly see a sharp rally in the stocks of electric battery making companies.

If you're an investor, then you simply cannot ignore this opportunity.

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.comHere are Links to Some Very Insightful Equitymaster Articles on Electric vehicles:

- How to Find the Best EV Battery Stocks

- How to Play the EV Story without Actually Playing the EV Story

- A 100 Year Old Lesson to Create Wealth in Indian Electric Vehicle Stocks

- Investing in EV Stocks? Don't be Ahead of the Curve

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

Yash Vora is a financial writer with the Microcap Millionaires team at Equitymaster. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

Equitymaster requests your view! Post a comment on "4 Ways to Play the EV Opportunity". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!