- Home

- Archives

Archives... Don't Miss Anything, Ever!

Here you will find all the research and views that we post on Equitymaster. Use the tools to customize the results to suit your preference!

Why Tejas Networks Share Price is Rising

Why Tejas Networks Share Price is Rising

Apr 23, 2024

Tejas Networks Zooms nearly 40% in two days, hits 52-week high. What next for this Tata stock?

Space Stock Locked in Upper Circuit After Ashish Kacholia Buys 17,54,385 Shares

Space Stock Locked in Upper Circuit After Ashish Kacholia Buys 17,54,385 Shares

Apr 23, 2024

This company was behind the manufacturing, delivery and assembly of core equipment for the first ultrasonic wind tunnel for ISRO.

Can Your Stocks Benefit from Higher Inflation?

Can Your Stocks Benefit from Higher Inflation?

Apr 23, 2024

Higher Inflation is good for these companies.

Why Union Bank of India Share Price is Rising

Why Union Bank of India Share Price is Rising

Apr 23, 2024

With NPAs on the decline, Union Bank is optimistic about robust growth and it's well-placed to capitalise on the pickup in corporate credit cycle.

Best Travel Stock: Thomas Cook vs Easy Trip Planners

Best Travel Stock: Thomas Cook vs Easy Trip Planners

Apr 23, 2024

This online travel aggregator is buckling up to take off to new heights by going the extra mile to deliver customised experiences.

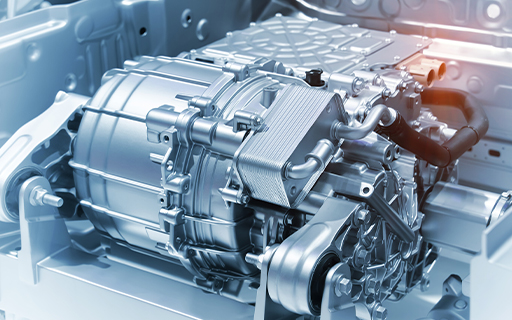

Multibagger Midcap Stock Secures Big Contract to Supply Critical Components to Tesla

Multibagger Midcap Stock Secures Big Contract to Supply Critical Components to Tesla

Apr 22, 2024

Tesla diversifies its supply chain with second Indian EV partnership. What next?

Why GSPL Share Price is Falling

Why GSPL Share Price is Falling

Apr 22, 2024

Shares of the company crashed 20% following a big tariff reduction by the regulator. What next?

Hidden Potential: Can This Mid-cap Stock Double Your Money?

Hidden Potential: Can This Mid-cap Stock Double Your Money?

Apr 22, 2024

This mid-cap stock could soar if things go right.

Will HDFC Bank Share Price Revive Post Q4 Results?

Will HDFC Bank Share Price Revive Post Q4 Results?

Apr 22, 2024

During the quarter, HDFC Bank sold its stake in HDFC Credilla for a gain of Rs 55.3 billion and made a floating provision of Rs 109 billion.

3 Indian Blockchain Stocks at the Centre of India's Deep Tech Revolution

3 Indian Blockchain Stocks at the Centre of India's Deep Tech Revolution

Apr 21, 2024

An analysis of the factors driving India's blockchain rise, and what investors need to consider before diving in.

Best Footwear Stock: Bata India vs Relaxo Footwear

Best Footwear Stock: Bata India vs Relaxo Footwear

Apr 21, 2024

Urbanisation, rising disposable income, and growing preference towards branded footwear are driving the growth of these two companies.

Vijay Kedia Buys 4,000,000 Shares of Reliance Infrastructure. Here's Why

Vijay Kedia Buys 4,000,000 Shares of Reliance Infrastructure. Here's Why

Apr 20, 2024

Data shows that Kedia now holds 1.01% stake in Reliance Infrastructure worth Rs 755 million.

Why Axis Bank Share Price is Falling

Why Axis Bank Share Price is Falling

Apr 20, 2024

The stock is down 5% in the last five days.

8 Best Railway Stocks to Watch Out as Modi 3.0 Amps up Rs 12 Trillion Investment

8 Best Railway Stocks to Watch Out as Modi 3.0 Amps up Rs 12 Trillion Investment

Apr 20, 2024

The Indian railways is gearing up next big leap with Rs 10 trillion modernisation plan, with high speed home built bullet train. Is it the right time to invest?

Tata Stock that Outran Tata Elxsi

Tata Stock that Outran Tata Elxsi

Apr 19, 2024

Do more unknown companies from Tata group have TCS or Tata Elxsi like prospects?

Why Nestle Share Price is Falling

Why Nestle Share Price is Falling

Apr 19, 2024

Nestle stumbles 5% after baby food sugar controversy surfaces. Will the slide continue if found guilty?

Bajaj Auto Posts Big Profit on Strong 2-Wheeler Sales; Big Dividend Declared

Bajaj Auto Posts Big Profit on Strong 2-Wheeler Sales; Big Dividend Declared

Apr 19, 2024

The company is expected to benefit from a revival in rural and export demand, going forward.

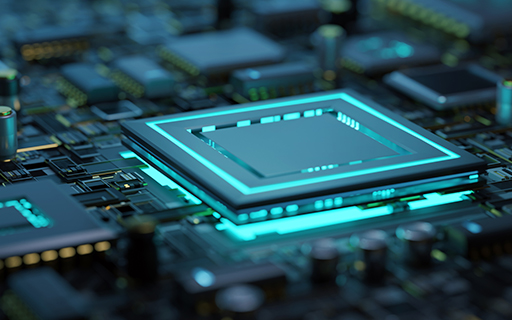

Semiconductor Stocks for Your Watchlist

Semiconductor Stocks for Your Watchlist

Apr 19, 2024

These companies are riding India's semiconductor boom.

Will PSU Stocks Rule Once Again in 2024? Top 5 PSU Companies to Watch out...

Will PSU Stocks Rule Once Again in 2024? Top 5 PSU Companies to Watch out...

Apr 19, 2024

Select PSU stocks are well positioned for growth as the Indian government amps up its capital expenditure.

Bharti Hexacom Share : A Promising Play on India's Booming Telecom Market

Bharti Hexacom Share : A Promising Play on India's Booming Telecom Market

Apr 18, 2024

Facing established players head-on, Bharti Hexacom takes a distinct approach, establishing a strong regional foothold.