- Home

- Views On News

- Sep 30, 2022 - Tata Group vs Adani Group: 10 Interesting Facts

Tata Group vs Adani Group: 10 Interesting Facts

A fox and a wolf were fighting over who is stronger. Meanwhile, an elephant just walked by them.

People noticed the tussle between the fox and the wolf because they are loud but no one thought about comparing them with the mighty elephant.

That appears to be the case for what's happening in corporate India right now.

The markets are busy comparing the two big Gujarati business houses while a Parsi business house is progressing at its own pace, silently.

It would not be an understatement to say that the top three business houses - Adani, Ambani, and Tatas rule the Indian corporate world. Together they have the largest income, generate the highest employment, and also grab the largest share of India's marketcap.

Hence, comparing and contrasting them becomes important as these groups are betting big on India. All three houses have plans to pour in billions of dollars to push India into becoming a superpower.

Today, we take a look at ten interesting comparison points between India's top two business houses - Adani and Tata.

#1 Sectors Tata and Adani Dominate...or Plan to Dominate

Operating with the motto of 'growth with goodness', the Adani group is operating in various segments. It started with iron ore and coal mining, then moved to port services, and from there, it has been betting heavily on growth sectors.

It has a total of nine companies under its roof after the addition of ACC and Ambuja Cements.

Currently, apart from the former sectors, the Adani group operates in the power, renewable energy, oil and gas, agriculture, airports, roads. water management, defence and aerospace, cement, etc.

Adani group plans to foray into steel too. It has brought 5G spectrum that supports broadband services. Hence in the future it might also foray into telecom.

Running on 'leadership with trust', the behemoth Tata group started by entering the steel sector, and now it operates in chemicals, IT, FMCG, solar energy, auto, power, travel and tourism, telecom, etc. It has a total of 29 companies under its roof.

Tata is adopting the 'One Tata' approach where it is planning to halve the number of companies under its roof by combining its group companies. It has already started working on said approach by combining 7 subsidiaries operating in the steel, metals and metal products area with its founding company - Tata Steel.

While Adani mostly operates in the business-to-business sectors, Tata group has a fair share of front customers-to-business sectors. Beginning from jewellery, beverages, salt, hotels, power, and vehicles, we are surrounded by brands of Tata group.

#2 Tata vs Adani on the Bourses

Since April 2022, Gautam Adani has been on the list of the five richest men in the world, but one cannot see Ratan Tata or N Chandrasekharan, Chairman of Tata Group, on the list of the richest people in the world.

However, this is a representation of individual wealth only. If we compare the total wealth of the groups, the Tata group, until recently, was ahead of the Adani group.

It was only on 16 September 2022, that Adani group took over the Tata group in terms of total marketcap as a result of the acquisition of ACC and Ambuja Cements from the Holcim group.

On 16 September, Adani group's total marketcap stood at Rs 22.7 tn, while Tata Group's total marketcap was Rs 20.7 tn.

But as you know, the stock markets are fickle.

As of 28 September 2022, Adani Group continues to be the largest business house in terms of marketcap.

Market cap of Tata group and Adani group

| Particulars (Rs in tn) | 15-Sep-2022 | 16-Sep-2022 | 28-Sep-2022 |

|---|---|---|---|

| Adani Group | 21.1 | 22.3* | 20.7* |

| Tata Group | 21.8 | 20.7 | 20.3 |

*including the market cap of Ambuja Cement and ACC Cement.

Adani group's total marketcap is distributed. Its flagship company Adani Enterprises forms around 20% of the total marketcap.

Tata group's marketcap is concentrated. Tata Consultancy Services' marketcap forms around 55% of the total marketcap of the group. However, apart from that, all other companies have a relatively small contribution to the total marketcap.

The next highest in line is Titan, which forms around 11% of the total marketcap. The other companies form less than 10% of the total marketcap.

#3 Tata vs Adani in terms of sheer business size and profitability

For the year ended March 2022, Adani group reported net revenue of Rs 1.3 tn and a net profit after tax of Rs 59.3 bn. For the same period, Tata group reported net revenue of Rs 4.5 tn and a net profit after tax of Rs 819.8 bn.

Thus, Tata group's revenue and net profit are quite higher than Adani group. In fact, the total revenues of all seven Adani group listed companies are only 61% of the revenues of just one Tata group company, TCS!

In a Forbes Global CEO Conference held in Singapore on 26 September 2022, Gautam Adani announced the groups plan to invest more than US$ 100 bn in the next decade. 70% of this investment shall flow into the energy transition sector.

Reportedly, Tata group is planning to invest a huge amount of US$ 90 bn in new industries like electric vehicles, batteries, mobile components, semiconductors, renewables energy, and e-commerce by 2027.

Hence both the companies have huge plans for the future. Tata group is clearly beating the Adani group in revenues and profit, but Adani group is just getting started. Hence it has higher potential and a faster ability to grow. However, Tata group is known to grow slowly but surely.

Hence this will be an interesting race. Investors will have to hold their seats tight to watch how Alluring Adani competes Trustworthy Tata.

#4 Both Tata and Adani are high on Debt

Adani and its increasing debt have been raising concerns for investors. But, if we look at the total debt of the group, Tata group has higher debt than Adani Group.

At the end of the financial year 2021-22, the total debt of Tata Group was Rs 1,216 bn. Whereas the total debt of Adani group was Rs 936 bn.

Late last month, CreditSights, a Fitch Group unit, issued a report that read 'Adani group, deeply overleveraged'. The report explained how the debt laden group may spiral into debt trap and possibly a default.

In response to this Adani group reached out to CreditSights highlighting its systemic capital management plan, improved net debt to operating profit ratio, and a diversified borrowing book to allay concerns of mounting debt.

After this, CreditSights had revised their report and removed the word deeply overleveraged. It specified that they had made some calculation errors.

Hence, Adani group is deep in debt but it is not deeply overleveraged.

#5 Debt repayment capacity of Adani and Tata

Tata group's total debt is higher than the Adani group, but Tata group also has higher cash flow to debt ratio.

A cash flow to debt ratio is a kind of coverage ratio. It indicates how much time would a company take to pay its existing debt at its existing level of cash flows.

It is unlikely that a company will pay its debt from its cash flows but, this ratio gives an overall idea of the financial health of the company.

At the end of the financial year 2021-22, the total cash flows of Tata Group were Rs 810.3 bn, whereas the total cash flows of Adani group were Rs 57.2 bn.

As per the cash flow to debt years, Adani group will take 16.4 years to repay its debt, whereas Tata group will take only 1.5 years to repay its debt.

However, it should be noted that the Adani group's debt is panned out over a longer tenure. Hence, its current cash flows will not be impacted.

Debt Coverage

| Particulars (Rs in bn) | Total debt | Total free cash flows | Cash flow to debt ratio | Repayment time |

|---|---|---|---|---|

| Adani group | 936.6 | 57.2 | 0.06 | 16.4 |

| Tata group | 1,216.6 | 810.3 | 0.67 | 1.5 |

#6 Which group is mutual fund's favourite?

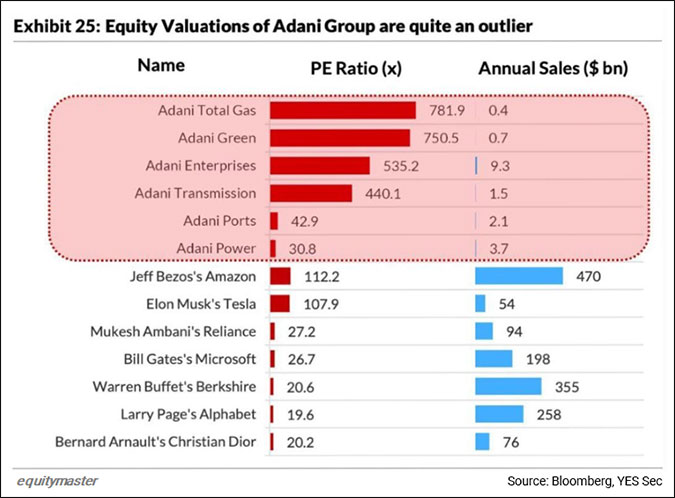

Adani group shares are trading at a high PE ratio. They are among the most overvalued stocks, not just in India but all over the world.

Owing to this and increasing debt concerns, Indian mutual funds are avoiding investing in Adani group stocks.

Even though Adani group companies have performed splendidly, mutual funds hold only 0.8% of the marketcap of the entire group. 22-28 mutual funds have invested funds in Adani Ports and Adani Enterprises, whereas in all other companies, mutual funds hold a negligible stake.

As of 31 August 2021, mutual funds hold an investment in 17 companies of the Tata group. In the past ten years, more than 5% of the total mutual fund's equity assets under management (AUM) is invested in Tata companies.

#7 Moving across the borders

Adani group has been slowly spreading its wings not only in domestic but also international markets. It has seen sharp jump in its growth figures but a very little portion of that came from foreign operations.

This is in stark contrast with the Tata group. Tata group and its globalisation story is very popular.

It was Ratan Tata who made Tata group truly international. In 2000, Tata Tea acquired Tetley and ever since, it has been on a shopping spree.

Tata group acquired 36 international companies in just 9 years. By 2012, almost 70% of the group's revenues came from its overseas operations. However, this strategy was criticised as the group lost focus in its domestic market.

However, with the Modi government bringing in the ease of doing business in India Tata group's focus had seen a slow shift from international to national.

Also the Covid-19 was a rude wake-up call for the Tata group as the lockdown on international borders hampered its business.

This made the Tata group realise that it's heavy dependence on foreign revenue may, in unfortunate circumstance cause the company to fall flat on its face.

To add insult to injury, return from foreign markets is very low. Return on capital employed in foreign countries is only 10%.

In the last few years, the share of revenue from domestic market has improved from 30% to close to 40% last year.

Hence Adani group is planning to fly around the world and Tata group is planning to come back home.

#8 Giving back what is earned from the society

Gautam Adani was in the headlines after he donated Rs 600 bn on his 60th birthday. In the financial year 2021, Gautam Adani and his family donated Rs 1.3 bn and were ranked eighth on the EdelGive Hurun India Philanthropy List 2021.

Gautam Adani and his family own a major stake in their companies, whereas 66% of Tata Sons' equity is held by Tata Trusts. The trusts are involved in a lot of charitable activities and the Tata family owns a very little stake in Tata Sons.

This shareholding pattern was established by the father of the Indian industry - Jamsetji Tata. Hence, Tata group has been donating around 2/3rd of its total income for over 150 years now.

Owing to that Jamsetji Tata is the first on the EdelGive Hurun India Philanthropy List 2021. He had donated around the US$ 102 bn.

Thus, the Tata group has paved an exemplary path for the corporate houses over the world. The group truly believes in giving back to the society. So far in 100 years no one has been able to overtake the Tata group in philanthropy.

Adani group took over the Tata group in marketcap but it's unlikely to do the same when it comes to charity.

#9 Tata or Adani - who creates more jobs?

Tata group is the 3rd largest employer in India. The top two employers are the Indian Armed Forces and Indian Railways, which makes Tata group the largest corporate employer in India.

As per the figures for 2021, Tata Group employs 935,000 people. Adani group is yet to make it to the list of largest employers in India.

#10 Tata or Adani - Who is likely to launch the next big IPO?

Adani group's latest venture, Adani Wilmar was listed on the bourses in February 2022. Hence Adani group's last IPO was very recent.

Tata group's last IPO came out 18 years ago. In 2004, Tata group came out with an initial public offering (IPO) of TCS.

However, the track record will change very soon it appears.

Reportedly, the Tata group plans to come out with an IPO of Tata Play very soon.

In conclusion

While comparing the Adani group and the Tata group, I cannot help but think about comparing a young man and an old man.

It does not take Sherlock Holmes to know that a young person can run faster than an old person.

Hence, when one talks about a young man, one sees infinite possibilities and speedy growth. When a person is in his prime youth, he has a high calibre to tap into opportunities and profit from them.

But there is a high probability that the young man could risk the race by following a wrong path in future, and may leave the race unfinished.

When one sees an old man, one thinks about wisdom and existing wealth. An old man might run slowly but he will finish the race. A fit old man will have better means and more experience to withstand any difficulties that he might face in the race.

Adani group is like the young man who has a lot of growth potential and high-risk opportunities.

Tata group is like the old man who has a lot of experience, deep pockets, loyal customer base but, low growth potential.

Hence a 34-year-old, port-to-power conglomerate is competing against a 154-year-old salt-to-software conglomerate. This race is going to be nail biting.

But the biggest plus point of this race is the benefit of India and the Indian economy as a whole. Cumulatively, both companies are boosting sales, employment, and development in India.

Adani group has become the world's largest solar player and it intends on being the same. In the renewable energy sector, Adani group has huge plans.

Tata group is not far behind. It has also been focusing actively on the solar sector. It has dived head first into the electric vehicle (EV) segment. Tata group is riding the EV opportunity in full force.

Thus both the companies are a big factor in helping India in reducing its carbon footprints, Both the business houses are also harbinger of new technology and rapid change.

People are now recognising the shares of Adani group are overpriced but did you know there are some shares of Tata group that are also in a bubble?

Rahul Shah, co-head of research at Equitymaster, talks about the Tata shares that are in a bubble. Tune into the video below to find out more about them.

Happy Investing!

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

FAQs

Which are the top Tata group stocks?

Based on marketcap, these are the top Tata group stocks:

- #1 TCS

- #2 TATA MOTORS

- #3 TITAN

- #4 TATA STEEL

- #5 TRENT

You can see the full list of Tata stocks here.

And for a fundamental analysis of the above companies, check out Equitymaster’s Indian stock screener which has a separate screen for top Tata group companies.

Which are the largest companies (by Sales) in the Tata Group?

Based on sales, these are the largest Tata group companies:

- #1 TATA MOTORS

- #2 TATA STEEL

- #3 TCS

- #4 TATA POWER

- #5 TITAN

These companies are sorted as per their sales for the latest financial year.

For a fundamental analysis of the above companies, check out Equitymaster’s Indian stock screener which has a separate screen for top Tata group companies.

Which are the top Adani group stocks?

Based on marketcap, these are the top Adani group stocks:

You can see the full list of Adani stocks here.

And for a fundamental analysis of the above companies, check out Equitymaster's Indian stock screener which has a separate screen for top Adani group companies.

Which companies in the Adani Group make the most profits?

Withing the Adani group, these companies make the most profits.

These companies are sorted as per their net profit for the latest financial year.

For a fundamental analysis of the above companies, check out Equitymaster's Indian stock screener which has a separate screen for top Adani group companies.

Equitymaster requests your view! Post a comment on "Tata Group vs Adani Group: 10 Interesting Facts". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!