- Home

- Views On News

- Jun 23, 2023 - Adani Group and Hindenburg Research: Who Will have the Last Laugh?

Adani Group and Hindenburg Research: Who Will have the Last Laugh?

The US authorities have a story out this morning about the big Indian corporate house - the Adani group.

A Bloomberg reports says US authorities are looking into the presentations made by the Adani Group to its American investors following the Hindenburg report.

To put things into context and give you a gentle reminder to what happened in January this year, the short-seller firm Hindenburg had accused the Adani group of using offshore companies to secretly manipulate its share prices.

What followed was a steep decline in all Adani stocks, up to 70% in some cases! That's brutal.

This time again, the skeletons of the past are coming back to haunt Adani stocks. Most of the group companies have witnessed a serious correction in early trade today.

Performance of Adani Group Stocks on 23 June 2023

| Company | Change (%) |

|---|---|

| Adani Enterprises Ltd. | -10% |

| Adani Green Energy Ltd. | -4% |

| Adani Ports and Special Economic Zone Ltd. | -6% |

| Adani Power Ltd. | -6% |

| Adani Total Gas Ltd. | -4% |

| Adani Transmission Ltd. | -8% |

| Adani Wilmar Ltd. | -4% |

| NDTV | -5% |

| ACC | -3% |

| Ambuja Cement | -4% |

Let's understand the implications, and what could be the next course of action for Adani companies.

Why Adani group stocks are falling today

Following the reports about the US searching for more details on Adani's offshore entities, investors fretted and started dumping Adani shares in bulk.

The biggest loser was of course the group's flagship firm Adani Enterprises, which has got used to the fact with 20-30% up and down moves in a single day. Today, the stock fell 10%.

Other group companies Adani Ports, Adani Power, and Adani Transmission declined more than 5%. Adani Total Gas, Adani Green Energy, and Adani Wilmar plunged around 3%.

According to the Bloomberg report, the US Attorney's Office in Brooklyn, New York, has sent inquiries in recent months to institutional investors with large holdings in Adani group companies.

The requests for information were focused on what Adani Group told those investors. The Securities and Exchange Commission also has a similar probe underway.

Usually, when big information like this comes out, the stocks fall even more. We saw how Adani stocks collapsed when Hindenburg released the report.

The fall, however, was limited to an extent this time, because requests for information from US prosecutors don't necessarily mean that criminal or civil proceedings will be filed. Law enforcement agencies often open inquiries that don't lead to action.

Imagine what would happen if what happened in January 2023 were to happen this time. First, Adani stocks would be battered along with impacting the overall market sentiment, which has finally started to show signs of a bull market.

The probe in India

Not to add any shivers for Adani group shareholders but the group is already facing a probe in India.

The Indian market regulator is investigating the conglomerate after short seller Hindenburg Research said that the group was involved in 'stock market manipulation' and 'accounting frauds over the course of a decade.'

Here's what the Indian authorities have uncovered so far...

The regulator has found out that some entities have taken short positions prior to the publication of the Hindenburg report and have profited from squaring off their positions after the price crashed upon publication of the report.

However, after researching a lot and talking to many entities, the regulator said it cannot conclude whether there has been any regulatory failure on its part.

The Supreme Court has granted the Indian regulator time till 14 August 2023 to complete its investigation.

The impact of this probe is already factored in. Adani Enterprises' stock price has already doubled since the report while other group companies have also shown an uptrend.

What next?

The first course of action for Indian shareholders in Adani companies is to keep track of each and every development until August. By then, the Indian regulator would probably have more clarity on what all happened and who's in the right.

Now, there are a lot of stories about all Adani stocks that have transpired recently so I am going to share all of these divided into sections. Let's start with the group's re-financing.

Earlier this month, the Adani group was in talks with lenders to seek up to US$ 3.8 billion (bn) to refinance loan facility taken for its acquisition of Ambuja Cements.

Gautam Adani is now thinking whether to convert the original loan into debt with a longer maturity period. This is because high debt was the primary concern that Hindenburg (and others) had flagged.

The group had taken loans maturing in 2023 and 2024 from Mauritius-based Endeavour Trade & Investment. This deal may or may not happen, but it will still take about a quarter to prepay all of it.

Now coming to the prepayment schedule, the Adani group has already completed its US$ 2.65 bn deleveraging program way ahead of its due date.

As we've said before too, the Adani-Hindenburg story is going to keep the markets busy for a long time to come.

In the meantime, you could quickly refer to both fundamentals and valuations of Adani group stocks on Equitymaster's Indian stock screener.

We recently added a new section in the screener where you can view the fundamentals of companies within a business group in one screen. This should help you get a better grip on fundamentals, business group wise.

Dig deeper into top Adani group stocks now.

Interestingly, Adani group stocks were experiencing a similar decline back in January 2023. And the reasons back then were different.

Continue reading...

Why Adani Group Stock Prices are Falling (January 2023)

Editor's note: Adani group stocks are the biggest movers in the stock market today. Most Adani group stocks have witnessed a steep selloff.

The selloff comes after Bloomberg reported a US activist firm Hindenburg Research LLC taking a short position on the group stocks.

Reportedly, Hindenburg has accused Adani group of market manipulation and accounting fraud. At the time of posting this, the Adani Group had yet to respond to these allegations.

Adani Group Stocks Performance on 25 Jan 2023

| Company | CMP (Rs) | Change (%) |

|---|---|---|

| Adani Enterprises | 3,366 | -2.50% |

| Adani Green Energy | 1,882 | -1.60% |

| Adani Total Gas | 3,749 | -3.70% |

| Adani Wilmar | 546 | -5.00% |

| Adani Ports | 720 | -5.80% |

| Adani Power | 262 | -4.40% |

| Adani Transmission | 2,665 | -3.30% |

| Ambuja Cement | 458 | -8.10% |

| ACC | 2,229 | -4.60% |

Note that this selloff comes at a time when the group has planned India's biggest every follow-on public offer (FPO).

What's more, the company has big IPOs coming up in the next few years. Adani Group's Chief Financial Officer recently stated that five of its subsidiaries will make market debuts between 2026 and 2028.

These allegations are not the only reasons dragging Adani group stocks lower. There could be other reasons too.

Back in October 2022, we wrote about those reasons and explained in detail why Adani stocks were falling.

Continue reading...

Why Adani Group Shares are Falling

Making sense of Adani group stocks is a dilemma on two aspects.

First, the group is diversified across so many sectors that it becomes difficult to understand which Adani group company will be the key beneficiary if the conglomerate makes a big announcement.

For instance, Adani Enterprises, the flagship company of the group, has exposure to sectors such as transport and logistics, energy & utility sectors, among others. The company is also leading a decarbonisation initiative of industries and mobility through Adani New Industries.

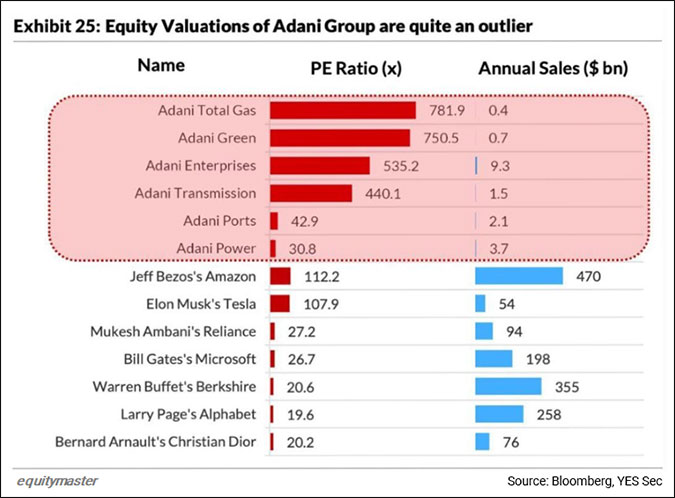

The other aspect is the meteoric rise of all Adani group stocks. Despite the group being saddled with debt, and all stocks from the group trading at astronomical valuations, they have seen a spectacular rise in their share price.

The sharp rally has also propelled Gautam Adani to claim the spot of second richest person in the world for a brief period.

On any given day, the group is making headlines for various reasons. Sometimes, it's the group's renewed focus in the green energy space or the group's ambitious plans to produce the cheapest green hydrogen.

But for the past one week, companies from the group are making headlines for their recent decline.

On Monday, when the Indian share market fell over 1%, Adani group stocks witnessed heavy selling and plunged up to 10%. Many even hit lower circuits.

Adani Stocks Witness Freefall on Monday

| Company | Fall on Monday | YTD Performance |

|---|---|---|

| Adani Enterprises | -9% | 85% |

| Adani Green Energy | -8% | 56% |

| Adani Ports | -4% | 8% |

| Adani Power | -5% | 256% |

| Adani Total Gas | -7% | 81% |

| Adani Transmission | -5% | 80% |

| Adani Wilmar | -5% | 171% |

Let's understand why this could have happened.

Why Adani Group Stocks are Under Pressure

Adani group stocks are considered as growth stocks, which have a combination of the highest growth in earnings vis-a-vis the share price, the highest growth in sales, and the best share price performance over a one-year period.

These stocks emerged as the best performing stocks since the March 2020 crash. Just to put things in perspective, consider this...

Even the worst performing Adani group stock - Adani Ports - outperformed the BSE Smallcap index and rallied 180% between March 2020 and June 2021.

The best performing group company - Adani Total Gas - managed to do in 1 year what the Sensex can perhaps achieve in 20. It went up an incredible 14.6x since the lows of March 2020.

All this was possible as the group cinched numerous deals and grew organically and inorganically.

But what has changed now? Why did these growth stocks come crashing down?

A simple answer to this is higher interest rates.

After years of easy money policies and low interest rates, inflation has started to rise. The US Fed has now embarked on a plan of series of interest rate hikes.

This in turn, could take the air out of growth stocks. We can already see the effect on Adani group companies.

Growth stocks are those spending big right now in order to get the benefits in the future. These companies may or may not be profitable now but hope to become so at some point down the line.

Cash flows for growth stocks are more far out in the future. So higher interest rates bring down the value of growth stocks.

That is why a rising interest rate environment like the current one is a bigger negative for growth stocks like Adani.

In such an environment, value stocks are considered over growth stocks.

Of course, there could be other reasons too as to why Adani stocks are falling.

The market could be factoring the high valuations of these companies. Take the top 5 most overvalued stocks in India and a couple of them will be from the Adani group for sure.

In conclusion

The sudden dip in Adani stocks can be a temporary effect. Or there could be a much bigger story here where higher interest rates bring down these stocks. No one knows for sure.

After plunging in the previous session, Adani group stocks recovered some ground yesterday in tandem with a sharp rise in benchmark indices.

This is the brilliant aspect of Adani group stocks. Investors are gung-ho about these companies as all of them have a very bright future.

Value investors would do well to stay away from all Adani stocks, at least for the time being, as the higher interest rate environment plays out.

If you are an investor in any Adani group company and facing a dilemma of holding or selling, check out Co-head of Research at Equitymaster Rahul Shah's video where he explains what to do with Adani group stocks.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

Yash Vora is a financial writer with the Microcap Millionaires team at Equitymaster. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

FAQs

Which are the top Adani group stocks?

Based on marketcap, these are the top Adani group stocks:

You can see the full list of Adani stocks here.

And for a fundamental analysis of the above companies, check out Equitymaster's Indian stock screener which has a separate screen for top Adani group companies.

In the Adani Group, which companies have the maximum promoter pledging of shares?

Within the Adani group, these companies have the maximum promoter pledging of shares.

For more information, check out the latest shareholding pattern of Adani group stocks.

Which are the most indebted companies in the Adani Group?

These are the high debt companies within the Adani group.

These companies are sorted as per their total debt and debt to equity ratio for the latest financial year.

For a fundamental analysis of the above companies, check out Equitymaster's Indian stock screener which has a separate screen for top Adani group companies.

Which are the top gainers and top losers within the Adani group today?

Within the Adani group, the top gainers were AMBUJA CEMENT (up 1.7%) and ADANI POWER (up 1.6%). On the other hand, ADANI ENTERPRISES (down 1.4%) and ADANI PORTS & SEZ (down 0.9%) were among the top losers.

Equitymaster requests your view! Post a comment on "Adani Group and Hindenburg Research: Who Will have the Last Laugh?". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!