- Home

- Views On News

- Oct 18, 2021 - Gold is Falling Behind. Here's How to Play it this Festive Season...

Gold is Falling Behind. Here's How to Play it this Festive Season...

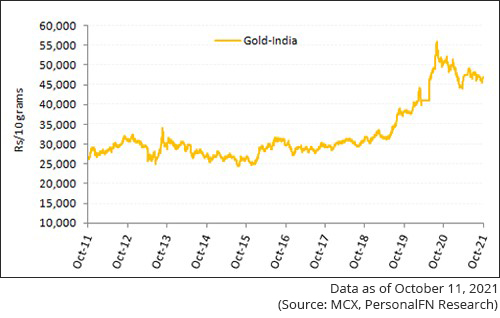

Since the peak of August 2020, gold prices have corrected around 15%. The price of gold has fallen around 6% year to date (YTD).

With the festive season upon us, experts suggest the yellow metal will recover its losses.

The recovery has already begun. Prices have been rising continuously for the last few days.

The demand for gold strengthens during the wedding and festive season as this period is considered the best time to buy gold in India.

But the trend has changed now. After the pandemic broke out, there has been a steady shift towards digital gold.

More people are buying digital gold than physical.

As online gold sales saw a significant uptick after the pandemic, traditional jewellers have moved online.

They have already started selling gold online for as low as Rs 100 to boost sales.

Stocks involved in online business of selling gold have rallied. Take the example of one such stock - Thangamayil Jewellery.

Thangamayil Jewellery is a two decade old jewellery firm based in Tamil Nadu. It has 33 stores and an online business selling gold, silver, and diamonds.

From the lows of Rs 220 in March 2020, the stock has rallied to the highs of Rs 1,400 today.

As long as crude oil prices continue to rise, the rupee remains weak against the US dollar, and global inflationary concerns prevail, gold prices will find support.

There's also the possibility of a third wave of covid. People who are sceptical about the third wave are also investing in gold as a hedge.

Also, the gold is still off about Rs 8,000 away from its all-time high. This provides a margin of safety.

Thus, it's an attractive opportunity to buy gold this festive season.

The question is if it would translate into a good investment. This depends solely on how much you buy and how long you expect to hold onto it.

For example, people may invest with a short-term view, say one or two months, in the hope of making 8%-10% returns. After all, experts are claiming prices will rebound this festive season.

But the normal trend has been investing from a long-term perspective. This is because gold has delivered much more in the long run.

Gold Displays Lustre in the Long-Term

Holding gold in physical form of jewellery or coins or bars is the conventional way. But it comes at a price.

The unconventional way of buying gold facilitates to invest in gold in a non-physical form and offers much more advantages.

Here are the smart ways to invest in gold...

Gold Exchange Traded Funds (Gold ETFs)

Gold ETFs are open-ended exchange-traded funds (offered by mutual funds) which tracks the price of gold.

Each unit of an ETF represents ownership of the underlying gold asset. Each unit in the gold ETF is equal to 1 gram of gold (some mutual fund houses also offer 1 unit at 0.5 gram of gold).

When you buy a gold ETF, you get a contract indicating your ownership in gold equivalent to the rupee amount of your investment.

The investment objective is to generate returns broadly in line with the domestic price of gold.

You can purchase units of gold ETF on the stock exchanges. A demat account and share trading account are necessary.

Gold ETFs are already gaining traction. They attracted Rs 4.5 bn worth investments in September 2021. This is sharply higher from just Rs 240 m recorded in the previous month.

While in July, gold ETFs saw a net withdrawal of Rs 6.2 bn.

The inflows may continue in coming months as strong demand is expected during the festive season.

India's #1 trader Vijay Bhambwani had recorded a video back in December 2020 on his top 5 gold ETFs.

Gold Saving Funds

This is an open-ended Fund of Fund scheme (offered by mutual fund houses) investing its corpus into an underlying Gold ETF, which benchmarks its performance against prices of physical gold.

Thus, the investment objective is to generate returns that closely correspond to returns generated by the underlying Gold ETF.

The application for purchase needs to be made to the respective mutual fund house. A demat account is not necessary. The units allotted reflect in your mutual fund account statement. The units are purchased/sold at the NAV declared by the mutual fund house.

Investment in a Gold Savings Fund can be done lump sum or through SIP (Systematic Investment Plan).

Other ways you can play gold this season is by investing in sovereign gold bonds (SGBs).

SGBs are government securities denominated in grams of gold. They are substitutes for holding physical gold.

Investing in gold 'the smart way'

Investing in a paper form is the most suitable option and a good proxy for gold prices.

The primary advantage which you'll derive by holding gold in non-physical form is that you'll do away with the physical holding of gold. Therefore you will not incur holding costs.

You also won't have to worry about the quality of the gold which you hold.

So this festive season, instead of buying physical gold, you may consider investing in gold 'the smart way'.

Equitymaster's Take on Gold

Gold has been one of the most stable assets from a volatility perspective during the pandemic and during the subsequent rebound, giving additional credence to its role as a portfolio diversifier.

However, as with any investment, if you plan to invest in gold, it's important to consider the time frame of the investment. Also, study the market to gauge an understanding of how markets are expected to perform.

Gold is not a fool proof investment. Like stocks and bonds, its price fluctuates depending on a multitude of factors in the global economy.

Gold's increased sensitivity to changes in interest rates means any shift in sentiment could result in a short-term headwind.

On the other hand, concerns about inflation and currency debasement could prove to be a tailwind and support gold prices in the months to come.

To know more about gold, check out our article on how to invest in gold here: How to Invest in Gold?

Happy Gold Investing!

Here are Links to Some Very Insightful Equitymaster Articles and Videos on Gold:

- Why is Gold Falling?

- It's a Great Time to Buy Gold

- Is Gold Headed to Rs 65,000?

- What you should know to invest in gold

- I Combined Stocks & Gold and Saw the Magic Happen

- Key facts to remember about gold

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

Yash Vora is a financial writer with the Microcap Millionaires team at Equitymaster. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

Equitymaster requests your view! Post a comment on "Gold is Falling Behind. Here's How to Play it this Festive Season...". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!