- Home

- Views On News

- Oct 18, 2022 - The Trillion Dollar Sector of 2025 - Chapter I: 5 Stocks to Watch Out For

The Trillion Dollar Sector of 2025 - Chapter I: 5 Stocks to Watch Out For

In September 2022, India overtook the UK to become the world's fifth-largest economy. If you consider that just a decade ago, India was at 11th position, this is no mean feat.

With the way India seems to be forging ahead, most experts have already predicted that India is on course to be the third largest economy by 2030, trailing only the US and China.

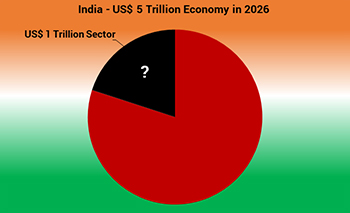

But if India is to become a US$ 5 tn dollar economy by 2026-27 as projected by India's chief economic advisor, Nageswaran, it means certain sectors will have to lead the charge and outperform.

Over the years, the services sector has been the engine of growth for India's economy. Even today, it contributes to over 50% of the GDP.

However, in recent times, manufacturing has emerged as one of the highest growth sectors in India.

The Government of India's initiatives like the National Manufacturing Policy aims to increase the share of manufacturing in GDP from the current 15% to 25% by 2025.

This translates into the manufacturing sector growing from approximately US$ 450 bn to over US$ 1 tn in the next five years.

This could be a huge opportunity for investors. Identifying a sector is one of the most profitable aspects of investing.

Any intelligent investor who has been tracking the latest developments in India's growth will agree that manufacturing is going to be the next big story.

If you ask them specifically how it might help them make money from this megatrend they would probably be clueless...

Anything related to the stock market is not as simple as we'd like it to be.

The manufacturing space is enormous encompassing so many different sub-sectors.

So how does one identify which of these sub sectors could benefit from this opportunity?

While analysing an industry, one must look at the market size of its sub-sectors and their expected growth rates.

Investing is not about the size of the fish. Rather, it is the size of the pond that matters. If the size of the pond is big, eventually the fish in it would also grow bigger in size.

Over the coming weeks, we are going to cover the top 3 sub-sectors and the best stocks within these sub-sectors that could be major contributors in helping the manufacturing sector grow to US$1 tn over the next 5 years.

Here is part one of the 3-part series. The first sub-sector we will cover is...

Chemicals

India is the sixth-largest producer of chemicals in the world and the total industry size stood at US$ 178 bn in 2019.

In recent times, the chemical sector has seen mammoth tailwinds due to initiatives being taken by western countries to avoid concentration of manufacturing activities in China.

The Indian chemical sector has been growing at a rate of 1.2 to 1.5 times the GDP. At present, 30% of India's chemical requirements are met by imports to meet its growing demands.

With demand expected to grow even further, it will create sizeable opportunities for development of large-scale capacities and infrastructure for manufacturing various products.

The chemical industry is one of the most significant contributors to the growth and development of any economy. For instance, did you know the industrial development of any country is measured based on consumption of sulphuric acid!

It's because sulphuric acid is practically used in every important industry and hence is a leading economic indicator.

More than 80,000 chemicals are manufactured in the country and are consumed in diverse end-use sectors including agriculture, packaging, pharmaceuticals, textiles, automobile, construction, and electronics.

India's chemical industry is expected to reach US$ 304 bn by 2025, clocking an annual growth rate of over 15%.

This means it could contribute to over 30% of the total manufacturing GDP of US$1 tn expected by 2025.

With global companies seeking to de-risk their supply chains, which are dependent on China, the chemical sector in India has the opportunity for significant growth. An investment of Rs 8,000 bn is anticipated in the sector by 2025.

With huge domestic consumption and superior manufacturing skills across the value chain, India could become the most attractive global chemical and petrochemical manufacturing hub after China.

Here are the top 5 chemical companies to watch out for.

Tata Chemicals Ltd

Tata Chemicals operates in both basic and speciality chemistry. The company has the largest saltworks in Asia, is the 3rd largest soda ash manufacturer in the world, and is the 6th largest sodium bicarbonate manufacturer in the world.

Tata Chemicals has 13 manufacturing plants across the globe with over 4,600 employees across 4 continents.

The company provides key ingredients to many of the world's leading brands for glass, detergents, pharma, biscuit manufacturing, bakeries, and other industries. Innovations in its Specialty Chemistry business have led to establishing Tata NQ - India's first and only nutritional science business.

Tata Chemicals is expected to contribute to the electric vehicle (EV) business of the Tata group by entering the lithium battery space. Through its subsidiary, Rallis India, the company is already in the agrochemicals business. This could give it an edge.

Over 50% of Tata Chemicals revenue comes from its key product, soda ash, which is in a sweet spot due to demand exceeding supply.

Soda Ash is mostly used as an ingredient in the manufacture of dyes and colouring agents, synthetic detergents, fertilisers, glass, and gum.

Demand for soda ash is being driven by rising construction in emerging economies, particularly India. It is widely used in the construction, paper, and textiles industry among others.

The chemical is also used for air purification and water softening as environmental concerns rise.

Supplies have been unable to keep pace as there is limited spare capacity. The global soda ash demand is estimated to exceed production by 3 million tonnes per annum till 2025-2026.

For the financial year ended March 2022, the company reported a 24% jump in revenue to Rs 40 bn. The net profit rose 67% to Rs 8 bn.

The stock has been on a tear since July 2022 rising from under Rs 800 to touch a high of Rs 1,200 recently. This after the company reported better-than-expected earnings for the quarter ended June 2022. Net profit increased 45% quarter on quarter. Operating margins have also improved from 34% in March 2022 to 45.6% in the June quarter.

The global demand environment continues to be positive across the company's products and their applications. This, coupled with the ongoing programs on driving cost reductions and efficiencies, will likely yield benefits in margins.

Tata Chemicals is well positioned to continue its growth journey.

BASF India Ltd

BASF SE is a Germanmultinational chemical company and the largest chemical producer in the world.

BASF India Limited, a subsidiary of BASF SE is a leading multinational company.

The business is organised into segments namely Chemicals, Industrial Solutions, Performance Products, Materials, Surface Technologies, and Agricultural Solutions.

The products manufactured cater to sectors including agriculture, automotive, pharmaceuticals, construction, consumer durables, consumer care, paper, and paints to mention a few.

These businesses have a strong technological support from the parent company, BASF SE.

The company's financial performance has improved significantly over the last few years even during the challenging pandemic years.

Revenue growth has come on the back of a combination increase in pricing and volumes. This is commendable. For instance, the company has significant exposure to automotive.

However, automotive production in India was stagnant and even worse in 2019 and 2020 because of the pandemic. Despite that, the company grew its business in the automotive sector as well as in the agriculture and chemicals segments.

Earlier, the agricultural segment was the major contributor to revenues but in recent years, the revenue mix has been well spread out across segments.

Over the last five years, revenues have grown at a CAGR of 24% from 2018 till 2022. This is an incredible feat considering the disruptions due to Covid 19 and the Russia-Ukraine conflict in terms of supply chain disruption, inflation, crude oil prices, etc.

Net profit has also jumped 146% from Rs 246 cr in 2019 to Rs 595 cr in 2022.

Even with the change in business model, the net working capital has not changed significantly. Hence, the ROCE which was at just 1.4% in 2019 has shot up to 35.8% in 2022.

On the other hand, the company has been repaying its debts including the over Rs 10 bn external commercial borrowing borrowed for the Dahej plant which has been fully repaid.

Hence, with fiscal prudence, the company is now debt free and in a very well managed capital situation.

With the current rising interest rate scenario, interest costs would not directly impact the company going forward at least for the time being.

The stock is off its yearly high of Rs 3,358 reached in August 2022 and is currently trading under Rs 3,000 levels.

PI Industries Ltd

Incorporated in 1947, PI Industries focuses on complex chemistry solutions in agri and pharma sciences.

PI Industries is the second largest agrichemical company in India and India's largest CRAMS company with majority revenue from patented products.

The company maintains a strong research presence through its R&D facility in Udaipur, where it has a dedicated team of over 400+ researchers and scientists.

PI Industries has 3 global locations - Japan for business development activities, China for sourcing, and Germany for knowledge management.

The company is focused on portfolio diversification with launch of novel offerings. Strong demand is expected for insecticides, fungicides, herbicides, and bio-nutrients in the future even as commodity prices remain robust owing to rising global demand.

The company has 5 new products scheduled to be launched in FY23 in addition to continued scale up in demand of some of the existing products.

Record food inflation, coupled with supply chain constraints, is expected to drive healthy agrochemicals consumption. PI is rapidly broadening its product offerings across agrochemicals, electronic chemicals, and pharma space.

The company's revenues have grown 120% from Rs 2,308.7 cr in 2018 to Rs 5,076.9 cr in the financial year ended March 2022.

Profit after tax on the other has jumped by 124% from Rs 366.5 cr to Rs 819.7 cr over the 5-year period.

Despite the constraints in operating environment such as supply chain disruptions, rising input cost, and unfavourable climatic conditions, PI's revenue growth for FY 2022 was powered by price increase and volume growth.

The company has been able to maintain EBITDA margins and ROCE of around 23% and 21% respectively over the last few years.

PI industries closed at 3,016.9 on 14 October 2022 and has given -1.2% returns since the beginning of the year.

Pidilite Industries Ltd

Since its inception in 1959, Pidilite Industries Limited has been a pioneer in consumer and specialities chemicals in India.

The company has a diverse product portfolio which includes adhesives, sealants, waterproofing solutions, construction chemicals, arts & crafts, industrial resins, and polymers.

The company operates some well-known brands like Fevicol, M-seal, Dr Fixit, WD 40, etc, which have a strong awareness in both consumer and industrial segments.

Its market dominance is also near-monopolistic in Fevicol and M seal brands which contribute a major portion of the revenue.

The company has 9 manufacturing facilities outside India and has operations in 71 countries across the globe.

The additional spending in Government programmes like rural employment schemes and higher capex spending emphasises the focus on infrastructure and increasing disposable income in the hands of common people.

This will act as a catalyst for the growth of the economy which will eventually create demand for the company's products.

The home improvement area offers significant opportunities for growth given the focus on affordable housing, new construction as well as renovation.

The management expects the company to grow at 2-4 times GDP. It seems logical with the economic growth happening all around in India, Pidilite would be bound to grow as its products are key ingredients to this mix.

The rural region contributes 33% to company's overall sales and Pidilite is looking towards increasing its rural penetration, over the next few years. As per reports, the company has increased its reach to 17,000 villages in the last six months.

Pidilite's annual revenue growth of 35.1% for FY 2022 outperformed its 3-year CAGR of 11.1%. Net profit also jumped by 17% to Rs 12.7 bn in FY 2022 from Rs 10.8 bn in the previous year.

The stock started off this year on a positive note at around Rs 2,500 levels but drifted lower over the next six months reaching a low of Rs 1,988 before rallying once more to gain 46% to Rs 2,916 in just 3 months. It currently trades at Rs 2,600 levels.

UPL Limited

Mumbai-based UPL, valued at around Rs 550 bn, is the fifth largest post-patent agrochemical company in the world.

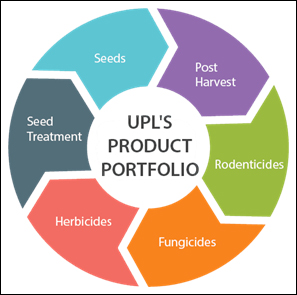

The company produces industrial chemicals, chemical intermediates and speciality chemicals and also offers crop protection solutions.

UPL offers a range of fertilisers and agricultural chemicals, including herbicides, insecticides, and seed treatments. It also sells other products used to stimulate plant growth, store crops, conserve water, and a line of disease-resistant seed varieties.

In 2018, UPL acquired Arysta LifeScience Inc. for US $4.2 bn in a deal that transformed the company into one of the world's largest generic agrochemicals firms.

With over 13 manufacturing units in India and 3,800+ employees the company is present in 122 countries across the world.

The company has outperformed guidance in FY22 led by a solid business model.

| FY 2022 Guidance | Actual Performance in 2022 | |

|---|---|---|

| Revenue Growth | 7%-10% | 19% |

| EBIDTA Growth | 12%-15% | 19% |

For FY 2023, the company has increased guidance for revenue growth to 10%+ while keeping EBIDTA growth at 12%-15%.

The company's share in global crop protection market is 8% currently, which is expected to increase to 9% to 11% by 2027.

Favourable market conditions such as high costs and reduced availability of fertilisers impacting yields, will favour the use of bio solutions and conventional crop protection. This could boost the company's revenues in the years to come.

In April, this year the company commenced a buy back from shareholders at an average price of Rs 813.9 a share. However, the stock plummeted over 24% within a month of the buyback to a yearly low of Rs 608.

The stock closed at Rs 678.3 on 14 October 2022 and has given -12% returns since the beginning of the year.

A long term approach to revive the manufacturing sector

With that we come to the end of our coverage of the first sub-sector which could potentially help the manufacturing sector reach the US$ 1 tn mark by 2025.

Hope you found this information useful. Stay tuned for the second part in our series to find out the next sub-sector and its stocks to watch out for.

You can also check out the video version of this editorial on Equitymaster's YouTube channel.

Happy Investing!

Safe Stocks to Ride India's Lithium Megatrend

Lithium is the new oil. It is the key component of electric batteries.

There is a huge demand for electric batteries coming from the EV industry, large data centres, telecom companies, railways, power grid companies, and many other places.

So, in the coming years and decades, we could possibly see a sharp rally in the stocks of electric battery making companies.

If you're an investor, then you simply cannot ignore this opportunity.

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.comDisclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

Yazad Pavri

Cool Dad, Biker Boy, Terrible Dancer, Financial writer

I am a Batman fan who also does some financial writing in that order. Traded in my first stock in my pre-teen years, got an IIM tag if that matters, spent 15 years running my own NBFC and now here I am... Writing is my passion. Also, other than writing, I'm completely unemployable!

Equitymaster requests your view! Post a comment on "The Trillion Dollar Sector of 2025 - Chapter I: 5 Stocks to Watch Out For". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!