- Home

- Views On News

- Oct 29, 2021 - Renewable Energy is the Future. Here are 5 Ways to Play this Opportunity...

Renewable Energy is the Future. Here are 5 Ways to Play this Opportunity...

We're witnessing a disruptive shift in the energy landscape given the market's newfound love for all things 'green'.

Investors are falling head over heels whenever they're hearing the term 'green energy'.

And rightly so.

India's investments in renewable energy have accelerated in recent years.

Traditional energy sources like hydrocarbon-based energy are being replaced by green energy like solar, wind, and green hydrogen.

The impact may be slow but we're not far away from big a disruption.

In this seismic shift, it's important that you find good quality stocks in this space because not every stock will make the cut.

Given the massive scope, how can you benefit from this opportunity?

Here are five ways to play this opportunity in India...

#1 Buy stocks of companies investing in green energy

The obvious choice would be to select strong renewable energy companies at attractive valuations.

Companies across industries are trying to grab a share of this sunrise industry. So it's important you do your due diligence before investing in any of them.

Some companies from this space with good balance sheets are...

Currently, India is a laggard when it comes to green energy. We still get more than half of the power from domestic coal.

But big corporates like Tata and Reliance have ambitious targets and will make huge investments.

The Adani group has committed to invest US$20 bn in green energy of which a considerable amount will be diverted towards hydrogen production. Meanwhile, Reliance will be setting aside US$10 bn for similar investments in the next few years.

So it won't be long before the disruption happens. If you invest in the right stocks, at the right valuations, you can ride this huge opportunity for a long time.

#2 Buy stocks of battery storage companies

We can't get energy from the sun and wind all the time because the wind does not always blow and sun does not shine all day.

So renewable energy needs to be stored. We need a storage element like batteries to help fill the gaps.

From powering your phones to powering your home, batteries do it all.

Battery energy storage systems (BESS) are emerging as one of the key solutions to effectively integrate high shares of solar and wind renewables in power systems worldwide.

This niche vertical is turning out to be a game changer for many companies.

As the impact of climate change increases, batteries are key to a transition to a renewable-fueled world.

The Indian government has invited an expression of interest for the installation of 1,000 MWh BESS as a pilot project.

Companies are looking to grab a share of this pie. A Reliance Industries' unit had announced a US$50 m investment in US-based energy storage startup Ambri.

Tata Power is setting up India's first large-scale 50 MWh battery storage system along with Swiss firm Energy Vault, which is working on an alternative to traditional gravity-based pumped hydro projects that rely on gravity and the movement of water to store and discharge electricity.

Amara Raja Batteries has invested US$5 m in Log 9 Materials, a Bengaluru-headquartered advanced battery-tech start-up.

These deals are just the first in a series of very interesting developments about to happen in this space.

Batteries could be a great way to play the renewal energy theme. But you need to be sure you find the right stock, and that too at the right price.

#3 Buy stocks of the 'suppliers' to green energy companies

A different way to play this megatrend is to invest in in companies supplying to green energy companies.

Renewable energy is the energy from sources that are naturally replenishing but flow-limited, i.e. resources which are virtually inexhaustible in duration but limited in the amount of energy that is available per unit of time. Think solar or wind, which are not available 24x7.

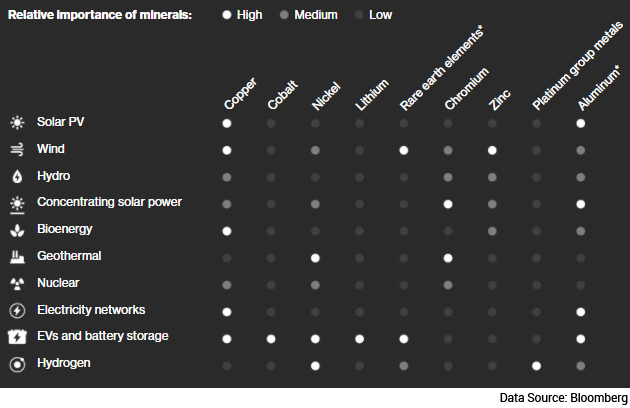

Aluminium, copper, and nickel are all widely used in generating solar power, and have other uses too.

For instance, there is the need for battery energy storage systems (BESS) by renewal energy companies so that they can service their customers all the time.

To manufacture these batteries, you need lithium and cobalt. As demand for storage grows, so will the demand for these minerals.

Mineral Needs Across Renewable Energy

All in all, the need for structural materials will increase.

#4 Buy mutual funds

Another way to play this opportunity is to invest in renewable energy mutual funds in India.

The investment rationale of these funds is to invest in companies which are involved in the discovery, development, production, or distribution of natural resources and alternative energy and energy technology sectors.

Some of these funds are:

- DSP Natural Resources & New Energy Fund

- Nippon India Power & Infra Fund

- Tata Resources & Energy Fund

In the months and years to come there will be many more choices available.

Select wisely.

#5 Buy international stocks and funds

The US and China have an edge over India, in renewable technology and in electric vehicles (EVs).

So it makes sense to invest in the green energy sector in these markets. The US market is the largest in the world. It offers huge opportunities for investors.

Unlike the Indian stock market, where there are only select stocks in this sector, international markets will have bigger and established companies involved in this space.

There's also an easier way to tap this opportunity: mutual funds. Rather than studying and investing in individual stocks, you can choose from a basket of ESG funds.

These funds track the strong companies involved in the sector.

Looking ahead...

The ongoing climate change debate has forced governments around the world to introduce more ways to use renewable energy.

Spending has increased, new policies have been implemented, and incentives have been added to drive growth in this space.

Just last week, to increase investments, the Indian government announced two new rules to ensure renewable utilities recover generation costs on time and are assured of regular energy purchase by states and power distribution companies.

As the sector grows, there's massive scope of technological progress within the industry.

It's expected that by 2040, around 49% of the total electricity will be generated by renewable energy as more efficient batteries will be used to store electricity, which will further cut the solar energy cost by 66% as compared to the current cost.

The green energy revolution will indeed turn on the lights for many companies.

Investors hoping to profit from India's renewable growth should look into the financials, management, business strategy, and all other fundamental factors of the companies before investing in them.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

Yash Vora is a financial writer with the Microcap Millionaires team at Equitymaster. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

Equitymaster requests your view! Post a comment on "Renewable Energy is the Future. Here are 5 Ways to Play this Opportunity...". Click here!

1 Responses to "Renewable Energy is the Future. Here are 5 Ways to Play this Opportunity..."

krishnamurthy Lakshminarasaiah

Oct 8, 2023I WOULD LIKE TO BE UPDATED ON DIFFERENT METHODS WAYS OF PRODUCTION OF bio fuel from bio mass The industry perspective

Substitute for import of crude oilimports saving in foreign exchange the benefits which acres the farmer community and the Govt Policy in making these projects viable and wealth creators for consumer farmer and the exchequer and government