Why private equity cannot rescue real estate

Regular readers of The Daily Reckoning would know that I have been bearish on the real estate sector for a while now. There is no way that the current price level in real estate is sustainable. It has gone way beyond what most people can afford and hence needs to fall. That's the basic logic I offer in almost all the columns that I write on real estate.

In response to these columns I get different kind of feedback. Some people agree with me totally. Some grudgingly. Some are coming around to the idea. And some don't agree at all and ask me to revisit everything that I have been saying on real estate up until now.

The latest reason offered to me on why real estate prices will not crash is that the private equity firms are now investing in real estate. This will help real estate companies get the money they need. And in the process they won't cut prices.

|

|

|

| Advertisement | ||

| Real Estate: The (In)Complete Guide | ||

| (Claim You Free Copy Instantly) | ||

Are you thinking about buying a house?

Are you thinking about buying a house?

Do you have a property you are looking to sell? Is it a good time to buy Real Estate as an investment? Is it the right time for the "Tata Nanos" of Real Estate to emerge? What can Modi do to revive the sector? If any of these questions are on your mind, we have some great news for you! Introducing our Latest Special Guide... The (In)Complete Guide To Real Estate. Authored by Vivek Kaul, (A noted columnist and writer whose writings on the economy and money have appeared in several big publications like The Times of India, The Hindu, and Forbes India), this Special guide promises to give you rare insights into this relatively under-researched sector. A sector that almost every Indian wants to invest in... or is at least affected by. Right Now... You can Instantly Claim an Absolutely Free Copy of this guide! |

|

|

|

|

This logic doesn't hold on multiple counts. But before I get into explaining why, let me first talk about a term called "availability heuristic" from behavioural economics. As Jason Zweig writes in The Devil's Finance Dictionary: "Availability [is] essentially a mental shortcut, or HEURISTIC, that leads people to judge the frequency or probability of events by how easily examples spring to mind. The vividness of rare events can make them seem more common and likely to recur than they are."

Initial public offerings of companies in stock markets are a good example. As Zweig writes: "The vast majority of initial public offerings (IPOs) fail to outperform the market, but it takes only a few spectacular successes like Google to create the illusion that investing in IPOs is the road to riches."

Further, the availability heuristic leads to people making confident conclusions. As Dan Gardner writes in Future Babble-Why Expert Predictions Fail and Why We Believe Them Anyway: "The availability heuristic is a tool of the unconscious mind. It churns out conclusions automatically, without conscious effort. We experience these conclusions as intuitions. We don't know where they come from and we don't know how they are produced, they just feel right. Whether they are right is another matter."

Hence, how did the availability heuristic evolve is a question worth asking? As Gardner writes: "The availability heuristic is the product of the ancient environment in which our brains evolved. It worked well there. When your ancestor approached the watering hole, he may have thought, "Should I worry about crocodiles? Without any conscious effort, he would search his memory for examples of crocodiles eating people. If one came to mind easily, it made sense to conclude that, yes, he should watch out for crocodiles."

Nevertheless, the world has changed since then. But looks like our minds haven't and the availability heuristic instead of helping us, continues to trick us.

Getting back to the topic at hand, people who believe that the private equity money coming into real estate will lead to real estate prices not falling, have essentially become victims of the availability heuristic. These people, the smart lot, read business newspapers religiously every day. And in these newspapers they read that a lot of private equity money is being invested in Indian real estate companies. This leads them to conclude that the money problems of all Indian real estate companies are over and hence, real estate prices will not fall. Their "unconscious mind churns out conclusions automatically, without conscious effort."

Those who believe real estate prices will not fall because of private equity money can easily recall examples of private equity investment in real estate companies. These examples are very easy to recall given that the smart lot reads business newspapers regularly. But the business newspapers only report the news of real estate companies getting investment from private equity firms.

No newspaper talks about those real estate companies which have not received any private equity money and the situation that they are in. And that's simply because there is no news in it for them. The situation is similar to newspapers and the media talking about airplane crashes though no newspaper or media talks about the thousands of safe airplane landings that happen all over the world every day. This leads people to conclude that airplane travel is unsafe, though it is not. Along similar lines, the examples of real estate companies getting investment from private equity firms are fairly easy to recall. The opposite is not. The availability heuristic is at work. Hence, the idea that private equity firms are investing in real estate companies seems more common than it actually is.

Now the question is how many Indian real estate companies have actually seen investments from private equity firms? The real estate lobby the Confederation of Real Estate Developers' Associations of India (CREDAI) claims to have 11,500 real estate developers from 156 cities across 23 states as its members. Only a very small portion of these real estate companies have seen private equity investment. And those that have seen investments operate largely in the bigger cities.

So that was one part of the analysis. Now let's get to the second part with some numbers. Crisil has carried out an analysis of India's top 25 listed real estate companies which make up for 95% of the market capitalization of India's real estate sector. The analysis is titled The realty reality.

In this analysis Crisil points out that "Rs.35,000 crores or 50 per cent of their residential debt will continue to remain at high refinancing risk." "With the demand pick-up expected to remain tepid in the near term, developers are heavily dependent on refinancing their existing debt given their highly leveraged balance sheets."

What does this mean? It means that real estate companies that Crisil studied need to repay Rs 35,000 crore to banks soon. With real estate companies not being able to sell enough homes they are not earning enough to be able to repay these loans. Hence, they need to refinance these loans i.e. borrow more to repay these loans.

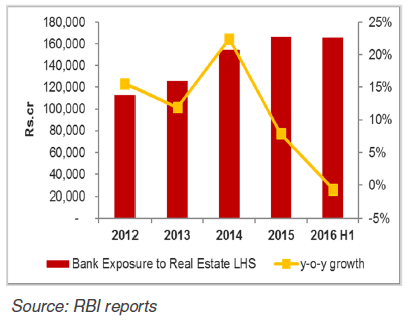

The question is with their highly stretched balance sheets will the banks be interested in lending more to developers? The monthly sectoral deployment of credit data released by the Reserve Bank of India (RBI) points out that the total bank lending to commercial real estate grew by a minuscule 2% between September 19, 2014 and September 18, 2015. This, when the overall lending by banks grew by 8.4%.

Now compare this to how things were in September 2014. Bank lending to commercial real estate between September 20, 2013 and September 19, 2014, had grown by a massive 20%. The overall bank lending by banks had grown by a similar 8.6%.

This clearly shows that the lending by banks to real estate companies has slowed down dramatically. Between September 2013 and September 2014 banks lent Rs 26,958 crore to real estate companies. This has crashed to Rs 3,157 crore between September 2014 and September 2015.

In fact, the overall lending to real estate companies by banks is down by 1% during the course of this financial year (actually between March 20, 2015 and September 2015, to be very precise).

And this is clearly reason for worry for real estate companies. As Crisil points out: "Traditionally, bank loans have been the primary source of funding, meeting ~90% of the requirements of India's top 25 developers. The net exposure of banks to the real estate sector declined 1% in the first half of the current fiscal...However, going forward, incremental bank funding is expected to decline ~5%."

What this clearly tells us is the banks are not really gung-ho about lending to real estate companies anymore. (As can be seen from the accompanying table).

Banks have turned cautious

So what happens from here on? The slowdown in lending from banks explains why real estate companies have been looking at alternative sources of finance through non-convertible debentures and private equity. Data from Crisil points out that the issuances of non-convertible debentures have grown at the rate of 68% per year over the last four years and reached Rs 8,500 crore in 2014-2015. The private equity investments in real estate have also jumped at a very fast rate of 32% per year from Rs 6,600 crore in 2012 to Rs 15,600 crore in 2015.

Over and above this, the recent government moves on foreign direct investment in real estate is also expected to help bring in money into the sector. Earlier foreign direct investment could come into real estate only if the project size was a minimum 20,000 square meters with a minimum capital of $5million. Further, it was required that foreign investors bring in money within six months. This requirement has also been done away with. All this is good news for some cash-strapped real estate companies. But can we conclude from all this that with the money flowing back into the sector again, real-estate companies will not cut prices? The first point I would like to make here is that only a small portion of the builders have received money from the alternative routes. The second point is that the alternative routes of raising money come with a very high cost of funding.

As Crisil points out: "The cost of alternative funding has increased over the last two years as pressure on developers financial position intensified. About one-third of the non-convertible debentures issuances last fiscal yielded an internal rate of return of more than 20%, compared with no issuances of similar yields in 2012."

The same stands true for private equity firms as well. As Crisil points out: "As for private equity [firms], the higher return expectation will increase the refinancing risk for the realtors over the longer term, unless the demand picks up substantially. CRISIL estimates payout for private equity funds for the sector as a whole at Rs 85,000 crore, assuming a return of 20% over a 5 year period. Hence, alternative funding sources such as non-convertible debentures and private equity [firms] are expected to continue providing some respite in the short term only."

What does this mean in simple English? The real estate companies are essentially kicking the can down the road. The money being brought in through the alternative route will also have to be returned. And where will that money come from is a question worth asking?

My guess here is that the money being brought in through non-convertible debentures and private equity firms is being used to pay-off the bank loans of real estate companies that are falling due (It would be great if any Daily Reckoning readers in know of this trend can confirm it by commenting on this). This has allowed the real estate companies to not cut prices. If this money hadn't come in then the real estate companies would have had to cut prices in order to sell unsold homes to repay their bank loans.

Nevertheless, the non-convertible debentures as well as private equity firms will also have to be repaid in the years to come. As mentioned earlier the returns expected by those providing the alternative sources of finances are very high. They will also have to be eventually be repaid.

And how will that happen? The only way real estate companies can do that is by selling homes. Homes will only sell if they are reasonably priced. At current prices the demand will continue to remain muted. As a recent 99acres' Insite report points out in the context of the Mumbai real estate market: "The market is witnessing demand in the affordable and mid-range segments (Rs 25 lakh to Rs 60 lakh), while supply is in the bracket of Rs 1 crore or more." So there is clearly good demand at lower prices.

Further, as Crisil puts it: "demand recovery and deleveraging are the only sustainable solutions to the problems staring at the real estate developer community."

And that ain't happening without prices falling.

Publisher's Note: Vivek Kaul, the India Editor of the Daily Reckoning, just made a bold call - Real Estate prices are headed for a fall. Well, if you are someone who is looking to buy real estate, or is just interested in the space, I recommend you read Vivek's detailed views in his just published report "The (In)Complete Guide To Real Estate". To claim your copy of this Free Report, just reconfirm your Free subscription to the Daily Reckoning...

Vivek Kaul is the Editor of the Diary and The Vivek Kaul Letter. Vivek is a writer who has worked at senior positions with the Daily News and Analysis (DNA) and The Economic Times, in the past. He is the author of the Easy Money trilogy. The latest book in the trilogy Easy Money: The Greatest Ponzi Scheme Ever and How It Is Set to Destroy the Global Financial System was published in March 2015. The books were bestsellers on Amazon. His writing has also appeared in The Times of India, The Hindu, The Hindu Business Line, Business World, Business Today, India Today, Business Standard, Forbes India, Deccan Chronicle, The Asian Age, Mutual Fund Insight, Wealth Insight, Swarajya, Bangalore Mirror among others.

Disclaimer: The views mentioned above are of the author only. Data and charts, if used, in the article have been sourced from available information and have not been authenticated by any statutory authority. The author and Equitymaster do not claim it to be accurate nor accept any responsibility for the same. The views constitute only the opinions and do not constitute any guidelines or recommendation on any course of action to be followed by the reader. Please read the detailed Terms of Use of the web site.Recent Articles

- The Great Leader Has Won the Cow-Teller Award and Now Wants a Case Study January 17, 2019

- This is a spoof.

- Mohammed "Munna" Aziz and the Summer of 1989 November 28, 2018

- Vivek reminisces a nearly three decade-old summer, spent listening to a Hindi film song.

- I'm Looking for Companies Not Influenced by Farm Loan Waivers and Minimum Support Prices November 16, 2018

- Are there any good companies in the agrochemical space worth looking at?

- Should You Abandon Your Investment Strategy in This Falling Market? November 2, 2018

- It is in these volatile times, when investors' mettle is tested the most...

Equitymaster requests your view! Post a comment on "Why private equity cannot rescue real estate". Click here!

11 Responses to "Why private equity cannot rescue real estate"

Girish Patkar

Nov 23, 2015Till such time you hear about banks and housing finance institutions like HDFC Ltd taking legal action and repossessing assets, real estate prices ( residential/commercial) will continue to remain firm.

Have not heard of HDFC Ltd,the largest landlord repossessing assets ( land/under construction/completed projects)...and builders/corporates ( conglomerates who ventured in RE) are defaulting on every condition of the loan every month.

Girish

Venkatesh V

Nov 22, 2015Thank you for the in-depth analysis of the sector. I have been reading your articles on real estate for a while now.

I just happened to watch interview of Mr.Niranjan Hiranandani.He says this is the best time to buy houses, prices would definitely go up especially thane/Mumbai. All or many developers are in debts is something he has been hearing for last 35 years he says.

I request for your viewpoint bases on this interview.

Rgds

PpD

Nov 21, 2015Sir, Yes. I agree completely. Shameless Greed has engulfed the realty sector which deserves punishment.

Siddhartha Guha

Nov 21, 2015I entirely agree with the comments made. However as long as the Public Sector Banks keep on twiddling with their Balance Sheets by carrying these NPAs by making them standard any which way the samr situation will continue.The bubble should be burst and as soon as possible such that the real situation emerges and the real estate prices fall to a realistic level.

Mario Braganza

Nov 20, 2015In the 3 years that I am living in Goa I notice that prices in the real estate market have stagnated [not dropped] and the correction if it can be so defined is more a time correction than a price correction. Obviously it seems the holding power of investors, builders etc is stronger than estimated!

On the other hand the continued launch of new projects in a market that is stagnant, price wise, defies economic theory ... unless its being buoyed by the flow of unaccounted money notwithstanding the rhetoric of corruption having reduced.

In such a scenario it seems where private equity does not reach ... 'black' equity reaches and this helps the real estate sector hold their prices.

Bahuleyan Ayyode

Nov 20, 2015I fully agree that property rates has to come down drastically.The prices have reached peak levels and are out of the reach of buyers.Greed of builders is the overriding factor that has contributed considerably to this situation.Buying property is not on the must do list of anybody right now.

raghav

Nov 20, 2015Launch of REITs and introduction of crowdfunding in real estate could alleviate some of the woes

shyam

Nov 20, 2015Mr.Vivek Kaul is absolutely right.

Today only the very highly paid Professionals and Businessmen can afford to buy a House. Companies like Housing.com and other start-ups have been sacking 100's of employees. With the economy remaining stagnant,more people across industries run the risk of losing their jobs. Like the Housing Bubble that happened in the U.S which cause a worldwide recession. In this scenario, the only way out for Real Estate companies is to sell at prices the customer is willing to buy. Unfortunately many of the Real Estate companies are so used to running their business in an increasing price scenario that they get into a paralysis when it comes to reducing the prices. The solution they think is in borrowing. With no or meager sales they get into a vicious cycle of borrowing more till it becomes unmanageable. During the last bust in the Real Estate industry, unable to return the customers money, many fled the country. Diversion of funds is another common phenomenon, with the political and criminal nexus that is so much prevalent in the real estate industry.

yrsharma

Nov 23, 2015seventh pay commission is announced, and it would give handsome increase to govt employees apart from lump sum in form of arrears.

This has the potential to give relief to real estate sector, since govt employees will find those houses in their reach, which were unaffordable to them till now.