- Home

- Views On News

- Nov 30, 2022 - Best Debt Funds to Invest in 2023

Best Debt Funds to Invest in 2023

Looking to invest in the best debt mutual funds in 2023? Before you zero in on individual schemes, it would be wise to assess where are we on the interest rate cycle so that an appropriate choice is made.

Where are interest rates headed?

With inflation giving sleepless nights to central bankers and synchronised rate hikes potentially wreaking threat to economic growth, global bond markets stand at a crucial juncture.

--- Here's something interesting (Advt.) ---

Imagine Beating The Market By As Much As 70%

This is HUGE. That is the number, one of our most premium and successful research services has achieved.

Mind you it is a less-known strategy to discover huge potential opportunities.

And to top it, it has a successful track record of over 15 years.

A track record that says this has the potential to beat the market by as much as 70%!

We think you should have access to it.

CLICK HERE TO GET YOUR ACCESS RIGHT NOW!

------------------------------

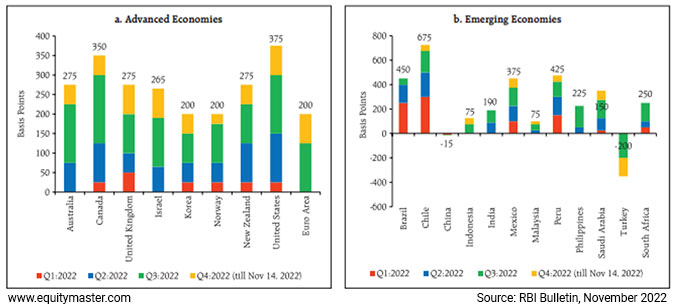

The U.S Federal Reserve (Fed) has increased the interest rates by 375 basis points (bps) so far. 100 bps is 1%. With this, the interest rates in the U.S are 200 bps higher than their pre-pandemic levels.

Graph 1: Synchronised Monetary Policy Tightening by Central Banks

In other advanced and emerging market economies as well, respective central banks have raised their policy interest rates to tame the inflation beast.

Table 1: RBI's Monetary Policy Actions

| Month | Repo Policy Rate | Policy Action (Basis points) | Policy Stance |

|---|---|---|---|

| Feb-19 | 6.25% | -25 | Neutral |

| Apr-19 | 6.00% | -25 | Neutral |

| Jun-19 | 5.75% | -25 | Accommodative |

| Aug-19 | 5.40% | -35 | Accommodative |

| Oct-19 | 5.15% | -25 | Accommodative |

| Dec-19 | 5.15% | Status quo | Accommodative |

| Feb-20 | 5.15% | Status quo | Accommodative |

| Mar-2020 (an exceptional off-cycle meeting) | 4.40% | -75 | Accommodative |

| May-2020 (an exceptional 2nd off-cycle meeting) | 4.00% | -40 | Accommodative |

| Aug-20 | 4.00% | Status quo | Accommodative |

| Oct-20 | 4.00% | Status quo | Accommodative |

| Dec-20 | 4.00% | Status quo | Accommodative |

| Feb-20 | 4.00% | Status quo | Accommodative |

| Apr-21 | 4.00% | Status quo | Accommodative |

| Jun-21 | 4.00% | Status quo | Accommodative |

| Aug-21 | 4.00% | Status quo | Accommodative |

| Oct-21 | 4.00% | Status quo | Accommodative |

| Dec-21 | 4.00% | Status quo | Accommodative |

| Feb-22 | 4.00% | Status quo | Accommodative |

| Apr-22 | 4.00% | Status quo | Accommodative |

| May-2022 (Off-cycle meeting) | 4.40% | 40 | Accommodative |

| Jun-22 | 4.90% | 40 | Turned focus on withdrawal accommodative stance |

| Aug-22 | 5.40% | 50 | Focus remains on the withdrawal of the accommodative stance |

| Sep-22 | 5.90% | 50 | Focus remains on the withdrawal of the accommodative stance |

(Source: RBI Monetary Policy Statements)

Back home, the Reserve Bank of India (RBI) also has hiked policy rates by 190 basis points in 2022. Policy rates in India are now 75 bps higher than their pre-pandemic levels.

Given that the CPI inflation is above RBI's comfort range and there is upside risk to inflation, the stance of policy remains focused on the withdrawal of the accommodative stance taken during the pandemic.

It is noteworthy that unlike many other major economies of the world, India didn't follow ultra-loose monetary and fiscal policy and thus is in a better position today.

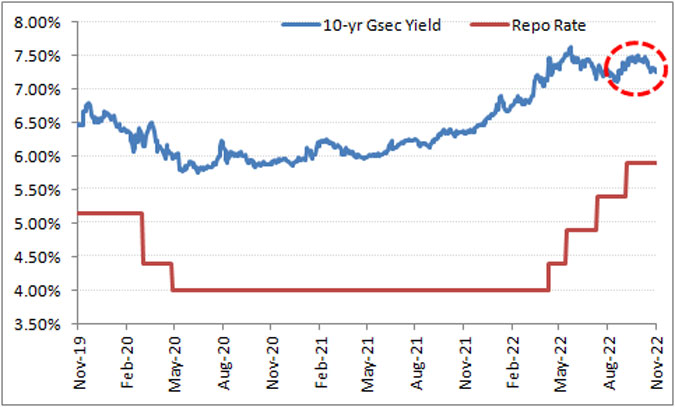

Graph 2: The 10-Year Benchmark Yield Curve

(Source: Investing.com, PersonalFN Research)

India's 10-year G-sec benchmark yield, of course, has shot up 85 bps in 2022. But as the monetary policy stabilises, the yield spread between long-term bonds and the repo rate is expected to compress subject to how inflation moves going forward and whether the country can contain its debt-to-GDP ratio plus its fiscal deficit.

Crude oil price crashing to a 10-month low is a positive for the Indian economy (one of the largest importers of crude oil) and may help reduce the 'fuel & light' inflation and manage India's current account deficit position amid a time when the Indian rupee (INR) has weakened against the U.S dollar.

That being said, we are still in an interest rate upcycle. As long as inflation continues upset policymakers, a pause in the policy rate hikes will be pushed back.

RBI missed the target of maintaining inflation in the range of 2-6%, for three consecutive quarters in 2022. In October 2022, India's retail inflation data came in at 6.77%. Although this reading is a three-month low, it is above the upper end of RBI's inflation target.

The six-member Monetary Policy Committee (MPC) of the RBI is of the view that further calibrated monetary policy action is warranted to keep inflation expectations anchored, restrain the broadening of price pressures, and pre-empt second-round effects (caused by higher wages and increased dearness allowance).

In their view, this shall support medium-term growth prospects. Hence, we might see a few more rate hikes in the current cycle of monetary tightening by the RBI before it turns neutral. The debt markets are already accounting for a few more rate hikes.

Which debt fund categories look attractive?

Given that interest rates are likely to move up further and the present macroeconomic conditions, betting on the shorter end of the yield curve will be a good strategy.

Debt mutual funds that invest in the short maturity segment witness minimal mark-to-market impact when interest rates rise. The longer-duration debt funds (with a maturity profile of 5 to 10 years), on the other hand, would be sensitive to interest rate risk and experience higher volatility in the near term.

But given that debt markets have already priced in rate hikes, it may be a good time to start gradually taking exposure to medium duration whether the maturity profile is 3 to 4 years.

Against the aforesaid backdrop, depending on your risk appetite and time horizon, you might choose among the best Liquid Funds, Ultra Short Duration Funds, Banking & PSU Funds, Corporate Bond Funds, and Medium Duration Funds.

If you are a conservative investor and have a time horizon of 3 months to a year, you might be better off investing in Liquid Funds and Ultra Short Duration Funds.

But if you have a slightly longer horizon of up to 3 years or so, and don't mind taking a slightly higher calculated risk for better returns, then you may consider Banking & PSU Funds, Corporate Bond Funds, and Medium Duration Funds.

Speaking about Banking & PSU Debt Funds, the credit risk is low as they invest in government debt and debt securities issued by PSU companies which are quasi-government entities.

As of 31 October 2022, none of the Banking & PSU Funds have invested more than 9% of their assets in bonds rated below 'AA & Equivalents'.

Some of them such as PGIM India Banking & PSU Debt Fund have preferred to hold as much as 1/4th of their portfolio in cash and cash equivalent assets, in the absence of suitable opportunities.

Speaking about the Corporate Bond Funds, their portfolio holdings as of 31 October 2022 reveal that some of them had up to 19% exposure to debt papers rated 'AA & Equivalents' and below.

A few conservative ones held only top-rated corporate bonds and sovereign debt among others. Ideally, you should opt for Corporate Bond Funds that follow an accrual strategy and avoid excessive yield hunting to accelerate returns.

Medium Duration Funds typically have a time horizon of 3-4 years and have a moderate-to-high risk appetite. As of 31 October 2022, the portfolio compositions of Medium Duration Funds were quite diverse. While some of them chased higher yields, others refrained completely.

For instance, ICICI Prudential Medium Term Bond Fund held almost half of its portfolio in papers rated 'AA & Equivalents' whereas sovereign debt had a weightage of 76% in the portfolio of Sundaram Medium Term Bond Fund.

Table 2: The Best Debt Funds for 2023

| Scheme Name | Returns (Absolute%) | Returns (CAGR%) | Risk-Ratios | ||||||

|---|---|---|---|---|---|---|---|---|---|

| 1 Month | 3 Months | 6 Months | 1 Year | 3 Years | 5 Years | Std. Dev. | Sharpe | Sortino | |

| JM Liquid Fund | 0.54 | 1.48 | 2.75 | 4.61 | 4.07 | 5.29 | 0.02 | 0.76 | 0.61 |

| Mirae Asset Ultra Short Duration Fund | 0.59 | 1.37 | 2.72 | 4.56 | 0.04 | 0.59 | 0.63 | ||

| Axis Corp Debt Fund | 0.86 | 1.34 | 3.14 | 4.19 | 6.91 | 7.3 | 0.72 | 0.12 | 0.25 |

| Aditya Birla SL Banking & PSU Debt Fund | 0.74 | 1.24 | 2.81 | 3.69 | 6.24 | 7.12 | 0.71 | 0.04 | 0.08 |

| IDFC Bond Fund - Medium Term Plan | 1.1 | 1 | 2.6 | 1.61 | 5.3 | 6.5 | 0.9 | -0.06 | -0.12 |

| Category average of Liquid Funds | 0.51 | 1.36 | 2.53 | 4.23 | 4.07 | 5.21 | 0.03 | 0.63 | 0.59 |

| Category average of Ultra Short Duration Funds | 0.59 | 1.38 | 2.73 | 4.48 | 4.85 | 5.65 | 0.11 | 0.33 | 0.52 |

| Category average of Corporate Bond Funds | 0.98 | 1.12 | 3.04 | 2.98 | 6.03 | 6.79 | 0.74 | 0.19 | -0.09 |

| Category average of Banking & PSU Funds | 0.82 | 1.18 | 2.79 | 3.41 | 5.91 | 6.88 | 0.7 | -0.1 | -0.2 |

| Category average of Medium Duration Funds | 1.03 | 1.04 | 3.82 | 4.39 | 5.79 | 5.76 | 1.86 | -0.07 | -0.1 |

| Crisil Liquid Fund Index | 0.56 | 1.51 | 2.83 | 4.76 | 4.39 | 5.53 | 0.03 | 0.2 | 0.16 |

| Crisil 10 Yr Gilt Index | 2.39 | 1.6 | 3.96 | 0.24 | 3.6 | 5.06 | 1.11 | -0.04 | -0.08 |

| Crisil Composite Bond Fund Index | 1.74 | 1.55 | 3.81 | 2.07 | 5.93 | 6.69 | 1 | 0.15 | 0.33 |

*Please note, this table only represents the best-performing schemes based solely on past returns and is NOT recommendations as such.

Past performance is not an indicator of future returns. Speak to your investment advisor for further assistance before investing

In the case of Liquid Funds and Ultra-Short Term Duration Funds, the risk-free rate is considered as 3% p.a., while for Banking & PSU Debt Funds, Corporate Bond Funds and Medium Duration Funds risk-free rate is taken as 6% p.a.

Mutual Fund investments are subject to market risks. Read all scheme-related documents carefully.

Best Debt Funds to Invest in 2023

#1: JM Liquid Fund

Launched in December 1997, JM Liquid Fund aims to provide capital appreciation by investing in Debt and money market securities with maturity of up to 91 days only.

As of 31 October 2022, JM Liquid Fund invested 56.45% of its assets in securities rated 'AAA & Equivalent', 0.42% in 'AA & Equivalents' and 9.24% in sovereign debt. Cash and cash equivalents accounted for 33.89% of the portfolio.

JM Liquid Fund has outpaced the category average of Liquid Funds on risk-adjusted returns.

#2: Mirae Asset Ultra Short Duration Fund

Launched in October 2020, Mirae Asset Ultra Short Duration Fund aims to generate regular income and provide liquidity by investing primarily in a portfolio comprising of debt and money market instruments.

Following the conservative approach, the fund has invested 87.5% of its assets in top-quality debt instruments, i.e. either 'AAA-rated' or sovereign debt, as of 31 October 2022. Cash & cash equivalents accounted for 10.4% while AA& Equivalents constituted just 2% of the portfolio.

As compared to its peers, Mirae Asset Ultra Short Duration Fund exposed its investors to lower volatility and has remained one of the top performers in the category of Ultra-Short Duration Funds.

#3: Axis Corp Debt Fund

Launched in July 2017, Axis Corporate Debt Fund aims to offer a steady income and capital appreciation by investing in corporate debt.

Top-quality debt (Sovereign + 'AAA & Equivalents') accounted for 95% of the portfolio as of 31 October 2022. To deal with liquidity needs, the fund held the balance exposure in cash & cash equivalents.

The fund has outperformed its benchmark and peers across timeframes risk-adjusted returns.

#4: Aditya Birla Sun Life Banking & PSU Debt Fund

Launched in May 2008, the fund aims to generate reasonable returns by primarily investing in debt and money market securities issued by Banks, Public Sector Undertakings (PSUs) and Public Financial Institutions (PFIs) in India.

As of 31 October 2022, debt securities issued by PSU banks and financial institutions accounted for 73% of the fund's portfolio and sovereign debt constituted another 18.4%. The weightage of cash and cash equivalent assets was 3.4% in the fund's portfolio.

Aditya Birla Sun Life Banking & PSU Debt Fund has been an outperformer in the category. At a time when its peers have failed to generate positive risk-adjusted returns, the fund has not only managed to keep volatility under check but also generate superior risk-adjusted returns.

#5: IDFC Bond Fund - Medium Term Plan

Launched in July 2003, IDFC Bond Fund-Medium Term Plan aims to generate optimal returns over the medium term by investing in debt and money market securities in such a way that the Macaulay Duration of the portfolio is between 3 years and 4 years.

Although the fund may appear as a laggard as compared to its peers, it's an outcome of the fund's ultra-conservative approach and low-risk preferences, especially during uncertain times.

It's important to note that IDFC Bond Fund-Medium Term Plan had invested 98.4% of its portfolio in sovereign debt as of 31 October 2022.

Whichever debt fund you invest in, remember they aren't risk-free and therefore protection of your capital should be a priority. You should avoid investing in debt funds where the fund manager engages in yield hunting and take high credit risk to generate supernormal returns.

Happy Investing!

Equitymaster requests your view! Post a comment on "Best Debt Funds to Invest in 2023". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!