- Home

- Views On News

- Jun 27, 2022 - 5 High ROE Companies to Add to Your "Multibagger" Watchlist

5 High ROE Companies to Add to Your "Multibagger" Watchlist

Editor's note: It was March 2020 and the stock market had just started to collapse. As no one knew how harmful the effects of the dangerous virus would be, and what will happen as the economy comes to a grinding halt, governments stepped in and made fresh money easily available.

What followed was a boom in stock markets over the next eighteen-odd months because of this easy money and people cheered their investments.

This resulted in an 'everything bubble'. As the government is slowly and steadily taking away this easy money by raising interest rates, the effect can be seen in the stock market which has collapsed over the past couple of months.

Now, investors are confused what to do in such a volatile market environment. Should they deploy their funds in buying fundamentally strong stocks available for cheap or go all in on cash?

In this market situation, investors can turn to companies which are consistently generating high return on equity (ROE) for their shareholders. Companies which are deploying cash in the business to generate higher returns for shareholders.

Recently, we wrote about the top five companies which are debt free and have consistently reported double digit ROE consistently.

The below list is still extremely relevant today. This is because even as many good stocks corrected 50%-60% from this peak, these companies weathered the storm and fell less compared to peers.

High ROE Stocks

| Company | CMP (Rs) | Down from their peak (%) | FY22 ROE (%) |

|---|---|---|---|

| Nestle India | 17,331 | -16% | 104.5 |

| P&G Hygiene & Healthcare | 13,261 | -19% | 71.6 |

| TCS | 3,315 | -18% | 44.1 |

| Indian Energy Exchange | 176 | -45% | 43.7 |

| Colgate Palmolive | 1,515 | -17% | 62.2 |

Continue reading to know more about these five high ROE companies that may present a multibagger opportunity...

Historically, equity has provided higher returns on investment than any other asset class. This makes equity a lucrative asset class to invest in.

However, equity investments are more complicated than the conventional FDs especially in terms of calculating the return on investment.

In the case of conventional FDs, you can calculate the return on investment prior to making the investment. This is because banks explicitly mention the fixed annual interest rate it offers on the investment.

The same does not hold true for equity investments. When investing in equities, return on investment is the sum of dividend received and the capital appreciation.

A company pays dividends from its profits. Therefore, any company paying dividends should consistently make profits and generate healthy returns on the capital invested in the business.

Return of equity (ROE) and return on capital employed (ROCE) are used to measure a company's efficiency in generating returns on the money invested in the business.

ROE is one of the most important metrics. It tells us how much profit a firm generates for each rupee of shareholder equity. It is useful while analysing debt free companies.

For example, suppose a company invests Rs 100 of its own in the business. Let's say it generates Rs 50 on the money invested. In this case, ROE turns out to be 50%.

On the contrary, if the company has debt on its book, looking at ROE would be a futile exercise and an investor should focus on ROCE.

In this article, we take you through 5 debt free companies that have consistently registered higher ROE over the last few years.

#1 Nestle India

Nestle India is an Indian subsidiary of Swiss based multinational company Nestle.

It's one of the largest FMCG companies in India. Established in 1956, the company set up its first manufacturing facility in 1960 to aid the Indian government in its efforts to build a sustainable milk economy.

Today, the FMCG giant has 9 manufacturing facilities across the country along with an R&D centre in Manesar, Haryana.

Within the FMCG sector, Nestle is a prominent player in the food and beverage sector. It offers products across a range of categories like dairy (Milkmaid), cereals (Nesplus), baby cereals (Ceregrow), etc.

Nestle's brands enjoy superior market share across categories and these brands are leaders in their respective categories. Take for example the case of Nestle's most popular brand in India, Maggi. Maggi commands a market share of 60% in the instant noodles category and its popularity has made it synonymous with noodles.

Similarly, its baby cereals brand Ceregrow commands an astounding market share of 96%, a near monopoly.

What kind of financial performance do you expect from a company which has several dominant brands in its kitty?

An extraordinary one, right?

Well, Nestle has delivered extraordinary financial performance in the last decade and has generated enormous wealth for its shareholders.

The five year average ROE of Nestle is 63.2% which is the highest among large cap companies listed on the Indian stock market. Its financial performance reflects in its stock price too which has zoomed 228% in the last five years.

Nestle India ROE (FY17- 21)

| Year | ROE (%) |

|---|---|

| FY17 | 30.5 |

| FY18 | 35.8 |

| FY19 | 43.7 |

| FY20 | 102.6 |

| FY21 | 103.1 |

During the pandemic, when most companies were struggling to keep themselves afloat, Nestle reported terrific results and posted its highest ever ROE of 103%. This reflects Nestle's ability to face adversity and emerge stronger than ever.

Strong brand recall combined with high pricing power gives Nestle an advantage over its peers. These virtues may help it tide over the lingering high inflation faced by several industries across the globe.

The Indian packaged food market is currently valued at US$35 bn. It's expected to double to US$70 bn by 2025. Nestle is poised for its next leg of growth and would continue to generate wealth for its investors as it did for the past years.

To know more about the company, check out Nestle's financial factsheet and quarterly results.

#2 Procter and Gamble (P&G) Hygiene and Healthcare

India ranks 2nd globally in terms of population. Consumer goods companies tend to do well in countries with large populations. On top of this, if any company is successful in establishing itself as a dominant player, then the benefits are all for the company to enjoy.

Procter and Gamble (P&G) Hygiene and Healthcare is one such example.

P&G Hygiene is an Indian arm of American multinational P&G. It is one of the leading fast moving consumer goods companies in India. Unlike Nestle, P&G specialises in personal care and hygiene products.

Why did P&G choose personal care and hygiene products over food and beverages especially in a country like India which is obsessed with food?

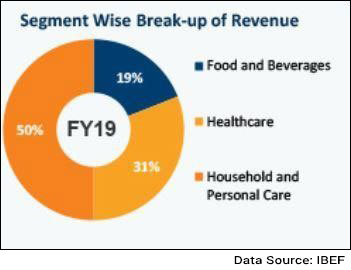

Well, look at the image below.

Revenue from the sales of healthcare and personal care FMCG products together constitute 81% of the total turnover of the FMCG sector.

The product portfolio of P&G includes renowned brands like Pampers, Gillette, Whisper, Old Spice, Head & Shoulder, Ariel etc. Most of these brands are dominant brands in their respective categories.

Unlike other FMCG companies, P&G has adopted a hybrid model of manufacturing. The company outsources its manufacturing in addition to manufacturing products at its 2 wholly owned facilities in Goa and Himachal Pradesh.

The five year average ROE of P&G Hygiene stands at 62.2%. In the last five years the stock price of the company has surged 125%, more than doubling investor's money.

P&G Hygiene ROE (FY17- 21)

| Year | ROE (%) |

|---|---|

| FY17 | 83.5 |

| FY18 | 47.3 |

| FY19 | 47.0 |

| FY20 | 38.2 |

| FY21 | 95.2 |

Growing focus on hygiene and personal care leading to increased spending on hygiene and personal care products has set the stage for P&G to grow in future.

To know more about the company, check out P&G Hygiene's financial factsheet and quarterly results.

#3 Tata Consultancy Services (TCS)

TCS is a multinational information technology (IT) services company based out of India.

It is the largest IT company worldwide and second largest Indian company in terms of market capitalization. The IT giant has a total of 50 subsidiaries through which it services its clients across 146 countries.

Skilled employees are the biggest asset for any IT company. TCS has a total headcount of 500,000 employees. On top of this, TCS' employee management has been exemplary all these years. Let's look at the two most important employee metrics relevant to the IT industry and how TCS scores on them. These two metrics are revenue per employee and attrition rate.

TCS earned an average revenue of US$45,300 per employee in the financial year 2021. Although the amount is not the highest in the industry, higher headcount compensates for low revenue per employee. This seems like a strategic move as it helps the company to acquire more projects by quoting lower bills to its clients.

Attrition rate is the number of people leaving the company with respect to the total number of

employees a company has. TCS reported an attrition rate of 7.2% compared to its peers which struggle to maintain a sub 15% number. TCS has the lowest attrition rate in the industry and beats its peers by a large margin.

All these factors have helped TCS to report robust numbers for years and consequently higher ROE than its peers. The five year average ROE of TCS is 34.5%, the highest in the industry.

The stock has been an enormous wealth generator, surging 218% in the last five years.

TCS ROE (FY17- 21)

| Year | ROE (%) |

|---|---|

| FY17 | 30.6 |

| FY18 | 30.4 |

| FY19 | 35.3 |

| FY20 | 38.6 |

| FY21 | 37.7 |

Covid accelerated digitalization has opened a world of opportunities for the company. It has forayed into providing premium solutions like Artificial Intelligence (AI), blockchain, etc.

TCS being the leading IT services company in the world is set to grow rapidly.

To know more about the company, check out TCS financial factsheet and quarterly results.

#4 Indian Energy Exchange (IEX)

IEX pioneered the concept of power trading in India. It is India's leading power exchange platform with a market share of 98%.

Established in 2008, the platform facilitates trading of several power products.

The platform works in a similar fashion as any marketplace. Take for example Amazon, which helps buyers and sellers to discover each other and trade goods. Simply put, IEX is the Amazon for power.

The platform has over 3,800 registered clients which include power generators (Tata Power, NTPC), power distribution companies (Adani Power, MSEDCL), and industrial corporations.

The Day Ahead Market (DAM) power contract is IEX's prominent product. DAM contracts contribute the most to the company's total revenue.

In this contractual arrangement, 24 hours is divided into multiple 15 minute blocks. The buyer and the seller sign a power purchasing contract under these 15 minute blocks. Each contract contains details regarding the power units traded between the parties and each contract is signed 24 hours before the power units are delivered.

Due to its dominant market share, IEX has registered strong financial numbers every passing year. Its five year average ROE stands at 43.8%. IEX made a debut on the bourses in 2017 and since then it has been on an upward trajectory surging 365% from its lows.

IEX ROE (FY17- 21)

| Year | ROE (%) |

|---|---|

| FY17 | 40.8 |

| FY18 | 46.4 |

| FY19 | 45.4 |

| FY20 | 46.3 |

| FY21 | 39.9 |

India is set to get its third power exchange and this may dilute IEX's market share. To mitigate this risk, the company has diversified its business by incorporating India's first ever trading platform for gas products, Indian Gas Exchange (IGX).

To know more about the company, check out IEX's financial factsheet and quarterly results.

#5 Colgate Palmolive India

Colgate Palmolive India is an Indian subsidiary of American consumer goods company Colgate Palmolive. Oral care products are the company's forte, and it offers products across various categories like toothpastes, toothbrushes, mouthwashes. It also offers personal care products under the "Palmolive" brand.

Colgate earns most of its revenue from selling toothpastes. The Indian toothpaste market is valued at US$ 1.5 bn and is expected to grow at a CAGR of 6% over the next few years. Colgate reigns over the toothpaste market with a leading market share of 46.2%.

Although the number is high, the market share of the company has dwindled over the last few years. This is due to increased competition from FMCG giants like HUL, Dabur, and Patanjali. Also, the company was late to introduce ayurvedic products in the market.

To maintain its leadership position and compete with its competitors, Colgate has launched a range of ayurvedic products in the fiscal year 2021. The company has also developed an augmented reality application which aims to make toothbrushing a fun activity for kids.

To meet with the high demand for its products, Colgate has installed 4 manufacturing facilities across India.

Colgate Palmolive India is a midcap company with total market capitalization of Rs 396 bn. Net profit of the company has grown at a CAGR of 12.3% over the last five years. The five year average ROE of Colgate stands at 56.7%. During the same period, the stock price was up 63.5%.

Colgate India ROE (FY17- 21)

| Year | ROE (%) |

|---|---|

| FY17 | 45.5 |

| FY18 | 44.3 |

| FY19 | 53.7 |

| FY20 | 51.2 |

| FY21 | 88.8 |

To know more about the company, check out the company's financial factsheet and quarterly results.

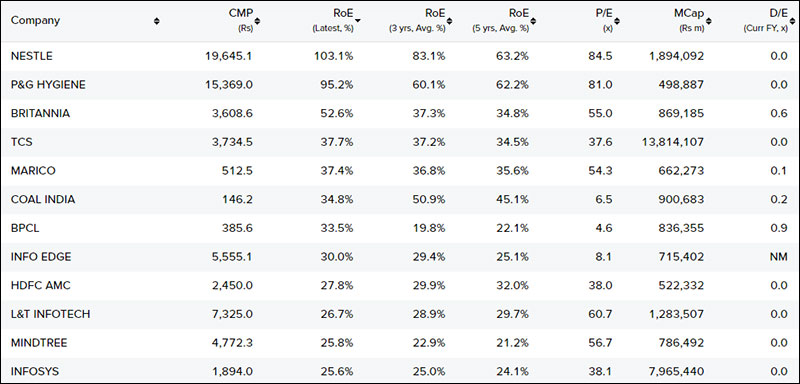

Which other companies have a high ROE?

Apart from the above, here are other companies which have high ROE.

This list of stocks was obtained using Equitymaster's powerful and feature packed stock screener. This tool is very flexible and criteria can be customised so that you can find the stock that you are searching for instantly.

Importance of ROE

ROE is one of the major metrics in the sphere of fundamental analysis. You should have it in your checklist, especially while analysing debt free companies.

However, an important thing to note here is that ROE should not be seen in isolation. It should be seen in conjunction with other quantitative and qualitative metrics like cash flow from operations, corporate governance, and so on.

As mentioned earlier in this article, looking at the ROE of a financially leveraged company would be a futile exercise. In such cases the focus should be on ROCE.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

Equitymaster requests your view! Post a comment on "5 High ROE Companies to Add to Your "Multibagger" Watchlist". Click here!

1 Responses to "5 High ROE Companies to Add to Your "Multibagger" Watchlist"

salim tabbani

Aug 25, 2022very gtood reseach.conggratu lation.