- Home

- Archives

Archives... Don't Miss Anything, Ever!

Here you will find all the research and views that we post on Equitymaster. Use the tools to customize the results to suit your preference!

An Underdog Mid-Cap: The Next Big Winner?

An Underdog Mid-Cap: The Next Big Winner?

Apr 16, 2024

The mid cap turnaround story that may take you by surprise.

Top 5 Multibagger Stocks for 2024

Top 5 Multibagger Stocks for 2024

Apr 16, 2024

Which stocks should be on your multibagger watchlist this year? Find out...

Why HUL Share Price is Falling

Why HUL Share Price is Falling

Apr 16, 2024

HUL slumps 13% in three months, hits 52-week low. What's behind this bluechip stock slide?

Top 10 Largecap Dividend-Paying Stocks to Keep an Eye on as Dividend Season Approaches

Top 10 Largecap Dividend-Paying Stocks to Keep an Eye on as Dividend Season Approaches

Apr 16, 2024

These ten cash rich companies have the potential to reward their shareholders with dividends in 2024.

One of the Most Important Themes Playing out in the Indian Stock Market

One of the Most Important Themes Playing out in the Indian Stock Market

Apr 16, 2024

Are you profiting from premiumisation?

Why Captain Pipes Share Price is Falling

Why Captain Pipes Share Price is Falling

Apr 16, 2024

The company recently started work on its greenfield expansion in Ahmedabad, expected to complete by December 2024.

Will the Stock Market Crash because of the Iran-Israel Conflict?

Will the Stock Market Crash because of the Iran-Israel Conflict?

Apr 15, 2024

Could the latest crisis cause the stock market to fall? Find out...

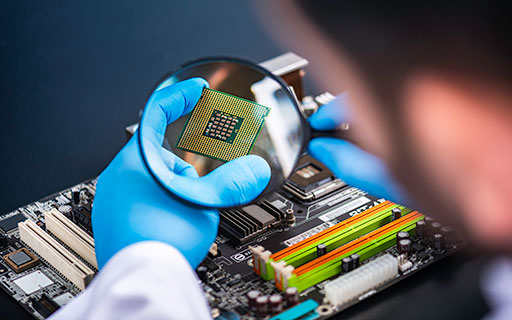

Why the Tata-Tesla Partnership is a Game-Changer for the Semiconductor Sector

Why the Tata-Tesla Partnership is a Game-Changer for the Semiconductor Sector

Apr 15, 2024

Tesla diversifies its supply chain by making this Tata group company its strategic partner for semiconductor chips. What Next?

Stocks to Profit from India's Transformer Gold Rush

Stocks to Profit from India's Transformer Gold Rush

Apr 15, 2024

The transformer is the new gold. These two pick and shovel stocks can be a part of your watchlist.

Top 3 Penny Stocks to Watch Out for in India's Booming Energy Sector

Top 3 Penny Stocks to Watch Out for in India's Booming Energy Sector

Apr 15, 2024

The increasing adoption of EVs, the expanding renewable energy market, and the development of cleaner technologies is creating a big opportunity for energy players.

Top 5 Tata Group Stocks that Pay Good Dividends

Top 5 Tata Group Stocks that Pay Good Dividends

Apr 14, 2024

Looking for blend of growth and passive income? Here are the top Tata Group companies with a strong track record of dividend payments.

Hi-Tech Gears: The Auto Ancillary Stock That's Growing Like Tesla, up 87% in a Month

Hi-Tech Gears: The Auto Ancillary Stock That's Growing Like Tesla, up 87% in a Month

Apr 14, 2024

Nemish Shah, the man who took Infosys public, holds around 7.2% stake in this company.

5 Midcap PSU Stocks That Tripled the Market's Return in FY24

5 Midcap PSU Stocks That Tripled the Market's Return in FY24

Apr 14, 2024

Here are the best performing midcap stocks of FY24.

Ashish Kacholia's Latest Portfolio Rejig: What's new?

Ashish Kacholia's Latest Portfolio Rejig: What's new?

Apr 13, 2024

Ace Investor adds exposure to one stock, cuts stake in two firms.

Top 5 Specialty Chemical Stocks Poised for A Rebound

Top 5 Specialty Chemical Stocks Poised for A Rebound

Apr 13, 2024

Despite near term headwinds, these five chemical stocks are primed for growth.

5 Stocks to Watch Out for Upcoming Dividends in May 2024

5 Stocks to Watch Out for Upcoming Dividends in May 2024

Apr 13, 2024

Looking for steady income streams? These 5 dividend champions are primed to pay out in May 2024.

As Nifty Hits All Time High, We're Closely Tracking These 5 Stocks

As Nifty Hits All Time High, We're Closely Tracking These 5 Stocks

Apr 12, 2024

What are the top stocks in the Nifty right now? Find out...

This Tata Group Stock is Ramping up for a BIG Dividend Bonanza

This Tata Group Stock is Ramping up for a BIG Dividend Bonanza

Apr 12, 2024

This company never disappoints its shareholders and has an unmatchable dividend payout ratio in the industry.

Will Biocon Lead Indian Pharma's Rare 'Patent Cliff' Opportunity

Will Biocon Lead Indian Pharma's Rare 'Patent Cliff' Opportunity

Apr 12, 2024

The last time such a cliff occurred during 2011-15 and offered substantial upside in pharma stocks.

NOT IndiGo or SpiceJet... Vijay Kedia Picks Fresh Stake in this Multibagger Airline Stock

NOT IndiGo or SpiceJet... Vijay Kedia Picks Fresh Stake in this Multibagger Airline Stock

Apr 12, 2024

The Indian airline industry is booming, and Vijay Kedia recently picked a huge stake in this helicopter company. Is it poised to pop?