- Home

- Views On News

- Dec 13, 2021 - The 5 Most Overvalued Stocks in India

The 5 Most Overvalued Stocks in India

One of the biggest worries of stock market investors is figuring out if they are overpaying for a stock.

They are often confused to figure out whether a stock is overvalued or not. After all, their buying decision would depend on it.

For instance, Warren Buffett prefers to invest in a good business and not based on price. He looks for stocks that are cheaper than their intrinsic value.

The price to earnings (PE) ratio, also known as the earnings multiple, gives a quick way to figure out a stock's value. Then there's price to book value (BV).

These two metrics help investors to figure out if the stock is overvalued or undervalued.

With the help of Equitymaster's powerful stock screener, we have shortlisted the top overvalued stocks from the large-cap space.

Let's take a look at each one...

#1 Godrej Properties

After the recent run-up in realty stocks, most stocks from the space have turned overvalued. From the lot, the most overvalued currently is Godrej Properties.

At the current price of Rs 2,100, the company is trading at a price to earnings multiple of 2,590, after considering its trailing twelve months (TTM) consolidated net profit.

The company has posted losses for the financial year 2021 so yearly PE ratio is not comparable.

Its current price to book value is 7.1.

Record low rates of housing loans are helping realty companies lately. Large players have been able to increase their shares because several developers have exited their land parcels and sold them to their larger counterparts.

This year, Godrej Properties became India's largest developer by value and volume of sales achieved.

What has helped Godrej Properties is that it has the lowest bank funding cost of 7.3% p.a. in the sector due to its financial position and the goodwill.

Over the year gone by, shares of the company have gained over 60%.

#2 Adani Green Energy

Shares of Adani group companies grew manifold since the March 2020 crash. Among the group stocks, market value of Adani Green Energy has increased the most.

The sharp rise has put a question mark on the company's valuation. At its current price, the company is trading at a PE ratio of 480.

The PE ratio is not the only concerning factor here. The company is also highly overvalued in terms of its book value. Its price to book value is currently over 100.

Investors are falling head over heels for this green energy company even though its fundamentals are not looking good.

The company has made losses in four of the last five years. Its balance sheet is loaded with debt. It has not paid dividends for the past five years.

Yet the stock trades at a stratospheric PE.

For a weak balance sheet and a loss-making profit and loss statement, Adani Green's valuations clearly seem to be in a bubble.

So why are investors loving this company? Well, they see it as one of the prime beneficiaries of the disruptive shift in the energy landscape.

A shift where traditional hydrocarbon-based energy will be replaced by green energy like solar and wind.

Since its listing in June 2018 at Rs 30, the company's shares have skyrocketed to Rs 1,400 today.

To know more, check out Adani Green Energy's financial factsheet and latest quarterly results.

#3 Adani Total Gas

No surprises here as another Adani group company tops the list of overvalued stocks.

Adani Total Gas trades at a PE multiple of 350 at the current price. Its price to book value of 106 is clearly much higher than the industry average.

Its peers Indraprastha Gas and Gujarat Gas trade at much lower valuations.

Adani Total Gas Comparison with Peers

| Company | EPS (TTM) | PE Ratio (x) | P/BV (x) |

|---|---|---|---|

| Adani Total Gas | 5.3 | 350.0 | 106.0 |

| Indraprastha Gas | 18.2 | 27.4 | 5.5 |

| Gujarat Gas | 21.3 | 31.3 | 10.2 |

Due to these high valuations, market experts have raised concerns.

Things got worse when National Securities Depositories Limited (NSDL) froze the account of three FPIs, holding shares worth Rs 435 bn in four Adani group companies.

If you look at the valuations, Adani group stocks have been trading expensively for some time now.

Just like Adani Green, shares of Adani Total Gas have been on fire this year.

Adani Total Gas, which was incorporated in 2005 and was listed separately from Adani Enterprises in 2018, is the largest private city-gas distributor in India.

#4 Avenue Supermarts

Avenue Supermarts is primarily engaged in the business of organised retail and operates supermarkets under the brand name of DMart.

Avenue Supermarts is not cheap by any stretch of imagination.

Based on its TTM EPS of Rs 21, the stock is trading at a PE multiple of a whopping 227.

While the stock might look expensive compared to its peers, market experts feel the valuations are justified given the company is among the fastest growing organised retailers.

The company's business model has made it grow exponentially and is now India's most profitable supermarket chain.

Even when the company debuted on the bourses with its IPO (issue price of Rs 299), the valuations were not cheap.

DMart has already seen a tenfold growth since listing.

#5 IRCTC

Indian Railway Catering and Tourism Corporation (IRCTC), which enjoys a monopoly in the segments it operates, was under pressure a month ago because of its overvalued status.

In October 2021, the company's stock tanked over 45% from its all-time high levels with the marketcap declining to Rs 699 bn.

IRCTC is the only entity authorised by the Indian Railways to provide catering services to railways, online railway tickets and packaged drinking water at railway stations and trains in India.

IRCTC's TTM EPS of Rs 5.3 per share and its current share price is around Rs 870. Thus, the stock trades at a PE ratio of more than 160. The valuations are also stretched on the price to book value front.

IRCTC's share price has skyrocketed in recent times on the back of investors' focus on the unlock theme.

In the last one year, it has gained around 200%.

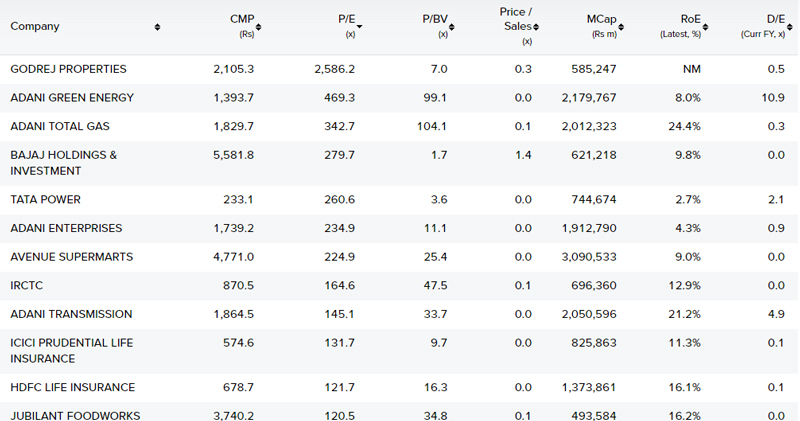

Snapshot of the most overvalued stocks from Equitymaster's stock screener

Here's a quick view of overvalued large-cap companies based on some crucial financials.

Please note these parameters can be changed according to your selection criteria.

This will help you in identifying and eliminating stocks that are not meeting your requirements and give emphasis on those stocks that are well inside the metrics.

Why stock valuation is a crucial aspect

In investing, the saying goes as 'buy low and sell high'. This is usually done by buying undervalued stocks and selling them when they become overvalued.

That is exactly why it's crucial to know how to properly value a stock.

While everyone is always on the lookout for most undervalued stocks, finding overvalued stocks can help you implement investing strategies such as selling a stock.

That is why, if you are looking for overvalued stocks, PE ratio is what you look at. You should also consider the price to book value.

But that does not mean you should part with a stock just because it might have gotten a bit pricey.

Even though stocks have been valued too high at times, there are instances where they rallied more and investors were filled with regret later after selling.

Here's a short snippet of what Rahul Shah wrote about PE ratios back in March 2021, in one of the editions of Profit Hunter:

- Back in December 2000, Infosys, one of the largest wealth creators, was trading at a princely price to earnings multiple of around 130x.

It was a high growth company. It grew its earnings by a whopping 36x between FY01 and FY20.

However, despite the high growth, Infosys wasn't able to outperform the benchmark index by a big margin.

Its share price has gone up by 14x over the last 20 years. This is only slightly better than the Sensex, which has given a 12x return.

This is one of the biggest lessons in investing.

Your future returns are to a large extent, dependent on the valuations you are paying for a stock.

If you pay too high a valuation multiple, even a high growth company may not end up giving returns better than the benchmark index.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

Yash Vora is a financial writer with the Microcap Millionaires team at Equitymaster. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

Equitymaster requests your view! Post a comment on "The 5 Most Overvalued Stocks in India". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!