- Home

- Views On News

- Jul 18, 2022 - Top 6 Undervalued Stocks to Add to Your Watchlist

Top 6 Undervalued Stocks to Add to Your Watchlist

Editor's Note: As volatility in the market is going up, investors are scouting for undervalued stocks to cushion their portfolio.

Back in December 2021, we wrote about the top undervalued stocks. Read this updated article to know where these undervalued players stand now, and if there are any new additions to our list.

Here goes...

The year 2022 has started on an extreme volatile note for Indian stock markets.

Benchmark indices BSE Sensex and Nifty 50 have plunged almost 8% since January 2022 due to rising inflation, and geopolitical crisis.

Interest rates, inflation, slowdown in growth, changing geopolitics...all these uncertainties are dragging stocks lower. No one is able to predict what the market will do next.

Amid such volatile market conditions, undervalued stocks with good growth prospects look like an attractive bet.

This is mainly because these stocks have good upside potential and have a high chance of giving good returns.

Moreover, these stocks act as a cushion in a volatile market as they have a high margin of safety.

We have shortlisted six undervalued stocks that can be a good bet in the current market scenario.

Top Undervalued Stocks in India

| Company Name | CMP (Rs) | 1 Month (%) | 3 Months (%) | 1-Year (%) | 3-Year (%) |

|---|---|---|---|---|---|

| Bharat Petroleum Corporation Ltd. | 342.45 | -8% | -8% | -24% | -9% |

| Indian Oil Corporation Ltd. | 124.40 | -3% | 3% | 18% | -17% |

| Power Finance Corporation Ltd. | 109.40 | -8% | -8% | -6% | 0% |

| REC Ltd. | 118.75 | -9% | -6% | -16% | -13% |

| Steel Authority Of India Ltd. | 85.65 | -19% | -12% | -35% | 80% |

| Tata Steel Ltd. | 1188.35 | -11% | 0% | 1% | 153% |

Continue reading to know if these stocks are still undervalued at current level...

Value investing, a concept that is a century old, still holds true even today. This is because investments are made based on the true value of business.

Warren Buffett, Charlie Munger, and Bill Ackman, all follow the concept of value investing, in their own style.

What exactly is value investing?

Value investing is an investment approach where investors try to identify companies trading either above or below their intrinsic value.

Stocks trading above their intrinsic value are considered to be overvalued. Stocks trading below their intrinsic value are considered to be undervalued.

Price to earnings (P/E) ratio and Price to book value (P/B) ratio are the two ratios value investors use to determine whether stocks are undervalued or overvalued.

As per value investors, undervalued stocks provide an excellent buying opportunity.

Here are the top 6 undervalued stocks in the market right now. We have shortlisted using the Equitymaster Stock Screener.

#1 Power Finance Corporation

Power Finance Corporation (PFC) is the most undervalued stock on our list. It's one of the leading non-banking finance corporations in the country.

PFC's current P/E ratio stands at 1.9 while its P/B ratio stands at 0.5.

Compared to its peers, it's trading at a much lower P/E ratio. The average P/E of the finance sector is 45.

The primary business of PFC is to extend financial assistance to the power sector in the country. It provides loans to power companies for power generation, transmission, distribution, etc.

With a market share of 20%, the company is a dominant player in the industry.

Its client base includes various state electricity boards, state, central, and private sector power utilities, power departments, and equipment manufacturers, among others.

In the last three years, its revenues and profits have grown at a CAGR of 12.1% and 5.8% respectively. This was mainly driven by higher disbursement of loans and net interest income. The company has also maintained a net profit margin of 15.4%.

In its latest quarterly results, the company's revenue grew 6.1% year on year (YoY) while net profit grew by 17.8% (YoY).

PFC stands to benefit from new government initiatives to meet the increased demand for electricity.

Check out how the company's shares have performed from January this year.

#2 REC

REC, a Navratna company, is second on our list.

The company's shares are trading at 2.9 times its earnings (P/E) and 0.6 times its book value (P/B). IRFC, its closest competitor in the finance sector, is trading at a P/E of 5.6x.

REC is one of the leading infrastructure finance companies under the Ministry of Power. It finances generation, transmission, and distribution power projects along with its parent company Power Finance Corporation (PFC). PFC holds close to 52.6% stake in the company.

REC has an extensive network of 22 offices in the country. It provides financial assistance to state governments, state electricity boards, independent power producers, and rural electric co-operatives.

In the last three years, REC's revenues and profits have grown at a CAGR of 13% and 13.4% respectively. This was mainly due to higher disbursements of loans leading to higher interest income.

The company's three-year average net profit margin is 20.9%. It has contained its operating expenses quite well.

In its recent quarterly results, the company's revenues grew 14% YoY. Its profits grew by 23.2% YoY and the net margin stood at 26.9%.

The pandemic has presented both challenges and opportunities for the power sector. While the industrial demand was close to zero during the first three months of lockdown, the consumer demand grew substantially thereafter.

The government's reforms in the power sector also will increase transparency and accountability across the entire value chain. This will positively impact REC.

Check out how the company's shares have performed since January 2021.

#3 Steel Authority of India

Steel Authority of India Limited (SAIL) is one of the largest steel manufacturers in India. It has also made it to our list of undervalued stocks.

The current P/E ratio of SAIL stands at 3.7 while its P/B ratio stands at 1.

It's trading below the average industry levels. The steel industry average P/E and P/B are 12.6 and 4.5, respectively.

SAIL is a Maharatna company. It produces steel and iron at five integrated plants and three special steel plants across eastern and central India.

It has an installed capacity of 21.4 million tonne per annum (MTPA) and is planning to double its capacity to 50 MPTA by 2030.

SAIL's revenues grew 11.8% YoY in the financial year 2021 due to an increase in realisations of saleable steel. The net profit of the company also grew 91.1% YoY during the same period due to lower input costs and interest expenses.

In the latest quarterly results, the company's revenue grew 58% YoY. The net profit jumped 1,075.4% YoY. SAIL's modernisation and expansion plan, and deleveraging, led to operational efficiency. Its margins have improved substantially in the last few quarters.

During the pandemic, the steel industry saw limited contraction of demand.

According to the World Steel Association the demand for steel will increase by 5.8% in 2021, and 2.7% in 2022. The demand will be backed by digitisation, automation, and infrastructure initiatives.

SAIL, being one of the largest steel manufacturers in the country, will have a significant share in the growing demand.

The shares of the company have given 51.6% return since January 2021.

Update: In the post pandemic era, the demand for steel has gone up, while the supply of metal has gone down creating a demand constraint.

To add to this, the Russia-Ukraine war worsened the supply side situation.

It remains to be seen how the largest player in the steel market, will cater to this growing demand.

#4 Tata Steel

Tata Steel, part of the Tata Group, is fourth on our list.

Shares of Tata Steel are trading at 4.4 times its earnings (P/E) and at 2 times its book value (P/B). Its next closest competitor, JSW steel, has a P/E of 8.5 and P/B of 3.5.

Tata Steel is one of the leading global steel companies. It has operations spread across 26 counties and exports products to over 50 countries.

In India, it has an installed capacity of 20 MTPA. In Europe and South East Asia, it has an installed capacity of 12.4 MTPA and 2.2 MTPA, respectively.

It has a diversified product portfolio catering to construction, auto, packaging, and engineering sectors.

In the latest quarterly results, the company's revenues grew 54.6% YoY mainly led by higher realisations and volume growth.

Its net profit also expanded 676.8% YoY .

With the recovery in manufacturing, the steel demand recovery is expected to be strong. Along with this, the government's strong push for infrastructure will also boost steel demand in the country.

The shares of Tata Steel gave close to 81% return from January 2021.

Update: In recent months, the rising cost of raw materials, especially coking coal, has pushed the company to rise the prices of steel. This is mainly done to maintain its margins in an inflationary environment.

In the March 2022 quarter, the company deleveraged its balance sheet to an extent of 152 bn and will continue to focus on deleveraging despite its heavy capex plans.

This shows good growth prospects for the company, despite uncertainties in the macro environment.

#5 Indian Oil Corporation

Indian Oil Corporation (IOC) is one of the most undervalued stocks in the energy sector.

The company's P/E ratio stands at 4.7, while the P/B ratio stands at 1. This is much lower than the industry average of 13.8 (P/E) and 2.7 (P/B).

IOC is a Maharatna energy company with a presence in oil, gas, petrochemicals, and alternative energy sources.

It accounts for nearly half of the petroleum products market share as of 2020-2021. It has a strong geographical presence through its subsidiaries in seven countries.

The company has a refining capacity of 80.6 MMTPA and has over 15,000 km pipeline network for fuel distribution and transportation.

IOC operates through 29,000 retail petrol pumps, and 7,000 bulk consumer pumps. Its Indane LPG cooking gas is marketed through a strong network of 12,700 distributors.

In the recent quarterly results, IOC's revenue grew 46.5% YoY due to higher international oil prices.

Its profits only grew marginally over the last quarter. This was because the growth in revenues were offset by higher expenses.

A strong linkage with the government, high operating margins, a robust distribution network, and capex investments in the pipeline segment, all are major growth drivers for the company.

With government initiatives like Atmanirbhar Bharat, and a growing population, the energy demand of the country is expected to be high in the long term. IOC will benefit from the growing demand as it has nearly half of petroleum products market share in the country.

IOC's shares gave 30% return since January 2021.

Update: The company has also forayed into the electric vehicle (EV) space and is setting up 10,000 charging stations across the country to spearhead the EV revolution.

Recently, IOC rolled out M15 petrol, a 15% blend of methanol and petrol on a pilot basis in Assam to address the issue of rising prices of fuel and to reduce import burden.

#6 Bharat Petroleum Corporation

Bharat Petroleum Corporation (BPCL), India's third largest refining company, is on our list of top undervalued stocks.

The company's shares are currently trading at a P/E of 4.7 which is much lesser than the industry average P/E of 13.8.

Its P/B ratio is 1.6 while the industry average is 2.7.

BPCL is a PSU that was set up by merging Burmah Shell Oil Storage and Distribution Company of India with Burmah Shell Refineries.

The company's products are spread across the supply chain - petroleum, LPG, aviation, lubricants, gas, and industrial products.

With an installed refining capacity of 35.4 MTPA, it's India's second largest oil marketing company. It has a strong marketing network of 18,637 retail outlets and a 2,241 km product pipeline.

BPCL owns a considerable stake in its well-known listed joint ventures Petronet LNG, and Indraprastha Gas.

In the recent quarterly results, the company's revenue grew 54% YoY due to higher volume growth and increase in fuel prices.

However, its net profit only grew marginally.

A well-established retail network, strong operational efficiency, extensive branding initiatives, and continued support from the government are its key growth drivers.

Check out how the company's shares have performed since January 2021.

Update: Recently, BPCL tied up with MG Motors to set up EV charging stations in various cities and highways and encourage EV adoption in the country.

It plans to set up 7,000 EV charging stations in the next two-three years along with MG Motors.

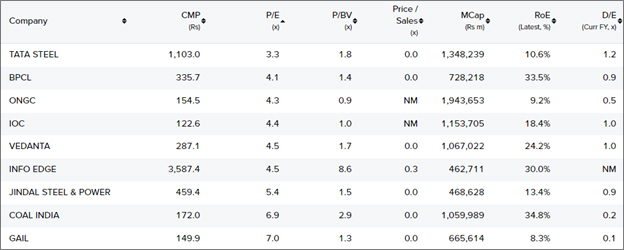

Snapshot of undervalued stocks from Equitymaster's Stock Screener

Here's a quick view of the above companies on important parameters.

Should you buy undervalued stocks?

Valuations do play a major role while choosing undervalued stocks. But that shouldn't be the sole criteria for investing.

A business that is viable, sustainable, has good growth prospects, and is consistently profitable, can be shortlisted as a prospective candidate.

Strong fundamentals is another factor you should consider. A company with good fundamentals is considered as a high-quality business. Such businesses tend to give good returns in the long term in any market condition.

All successful value investors concentrate on staying invested for a long time rather than timing the market.

If you plan to invest, then aim at investing for a long term to reap maximum benefits.

Happy Investing!

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

Equitymaster requests your view! Post a comment on "Top 6 Undervalued Stocks to Add to Your Watchlist". Click here!

1 Responses to "Top 6 Undervalued Stocks to Add to Your Watchlist"

sanjay goyanka

Feb 5, 2022i continuously follow equitymqster for takijng guidance in stock market & it provide me good knowledge & indepth information. Thanks a lot for providing good assistence....