- Home

- Views On News

- Dec 26, 2022 - Covid 2023 - Who Could be the New Winners and Losers

Covid 2023 - Who Could be the New Winners and Losers

For over eighteen months, pandemic developments were the key driver for markets around the world.

First, it triggered a slump in 2020 and then a strong rally on the back of vaccination programs.

What followed was a series of interest rate hikes over the next few months as central banks across the globe looked to tame high inflation.

The situation was just getting under control.

Indian share markets were starting to move up and smallcaps in particular were seeing a decent rally.

Now, just when we were moving on, worries about the Covid outbreak in China has sent shockwaves through global stock markets.

On 14 December 2022: the Sensex closed at 62,678.

On 23 December 2022: the Sensex ended at 59,845.

That's a correction of over 4% in just eight trading sessions.

Such is the volatility on D-Street these days. Markets have become very reactive to news flow.

A Bloomberg headline read,

China is likely seeing 1 million covid cases and 5,000 deaths per day...biggest outbreak the world has seen.

This is of course scary.

The rapid spread is now casting a shadow of uncertainty on the market outlook as we move into a new year.

If cases spread at this rate, we could possibly see the return of lockdowns. This would threaten the already strained supply chains and damage recovering demand.

With Covid cases rising in China, stocks specific to covid are reacting both ways.

Let us take a look at who could be the new winners and losers of Covid 2023.

We have picked up certain sectors and the top stocks withing each to understand the threats and opportunities that lie before us this year.

Let's start with the sectors which stand to gain...

#1 Pharma

This is the most obvious one. As Covid cases rise in China, it would be a big positive for pharma companies.

What's more, certain stocks are immediate beneficiaries even if Covid is contained in China and doesn't come to India. So yay, a win-win on both sides.

Back in 2020, when most sectors were brought to a halt due to the pandemic, the pharmaceutical industry was relatively resilient.

Pharma stocks were least affected as the industry was immediately categorised as essential services.

After the recent outbreak in China, once again investors are looking back at pharma stocks.

In 2022, a lot of good quality pharma companies saw a decent correction and were tamed as underperformers. We even covered many editorials explaining the reasons for individual stocks. You can check them out here.

Now, pharma stocks are rising and looking good after a long period of underperformance. With experts being cautiously optimistic, pharma companies are already taking the lead like they did in the previous two waves.

Among individual stocks, Cipla, Granules India, IOL Chemicals & Pharma, and Glenmark Pharma will be the biggest beneficiaries.

Cipla and Glenmark Pharma

During the initial covid-19 phase, Remdesivir and Favipiravir were the two drugs which were high in demand.

The two direct beneficiaries here are Cipla and Glenmark Pharma as they have a big presence in the market for the said drugs.

So it should come as no surprise as to why Cipla share price is rising.

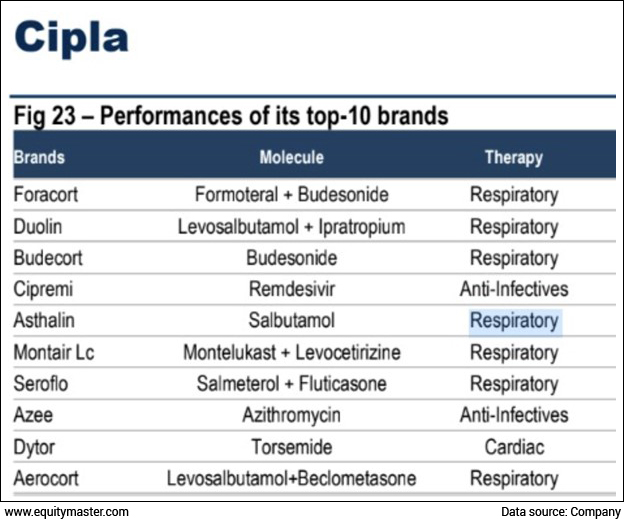

A key focus area for Cipla currently is its respiratory segment. Cipla has a huge respiratory portfolio. 7 out of top 10 brands for Cipla are respiratory.

Granules India - Granules India is one of the largest sellers of paracetamol in India. The company also manufactures and sells Ibuprofen.

IOL Chemicals & Pharma - IOL Chemicals is the largest producer of Ibuprofen in the world! It has around 35% of the global market share. It is the only company worldwide that is backward integrated for all intermediates and key starting materials of Ibuprofen.

#2 Diagnostics

Take a look at the performance of diagnostic stocks in the last one year.

Stocks from the sector are in limelight right now amid rising Covid cases globally.

Post 2020, Covid testing led to a manifold rise in revenues, margins, and profitability for these diagnostic chains.

But the rise could not be sustained. No one was thinking if the trend would continue for the next 18 months, or once Covid was over.

Covid testing was high margin and high-volume business which lasted for few quarters. As the waves settled, the volumes from this business came down. Even the pricing for Covid tests was capped at much lower levels.

You could see these effects play out in the stock price of listed diagnostic chains.

As testing once again sees demand, diagnostic stocks are rising.

Interestingly, the diagnostic sector is largely dominated by unorganised players, that command majority (close to 85%) market share.

India's rising life expectancy will lead to an increase in lifestyle diseases. This will require more specialised testing which means higher profits for diagnostic companies.

The biggest players in the space include Dr Lal Path Labs, Metropolis Healthcare, Thyrocare, and the recently listed Vijaya Diagnostics.

#3 Oxygen Suppliers

In April 2021, shares of Oxygen suppliers were in focus amid increasing demand for oxygen following a surge in Covid-19 cases.

Later in January 2022, the Omicron variant brought oxygen stocks back to the limelight.

This time around, oxygen stocks are in focus amid the sharp rise in covid cases in China.

Amid a surge in Covid cases, states are asked to immediately strengthen health infrastructure, maintain buffer stocks of essential drugs, and ensure that oxygen supply equipment is fully functional.

Take a look at the performance of Oxygen stocks in the past one month. You'll notice that most of them have seen a sharp rally in the past couple of sessions.

Oxygen Stocks in India

| Company Name | CMP (Rs) | 1 Month | 3 Months | 1 Year |

|---|---|---|---|---|

| Bhagawati Oxygen Ltd. | 41.6 | 14% | 8% | -3% |

| Linde India Ltd. | 3,321 | 9% | -3% | 38% |

| National Oxygen Ltd. | 171.45 | 56% | 21% | 55% |

| Refex Industries Ltd. | 237.4 | -5% | 43% | 92% |

Mind you, tread very carefully when dealing with stocks in this space. Here's an irrational exuberance of the highest order: Bombay Oxygen Investments Limited.

Stock Price on 25 March 2021: Rs 10,000

Stock Price on 19 April 2021: Rs 24,500

That's 2.5x in 25 days.

But the most important fact is this...

Bombay Oxygen Investments has nothing to do with Oxygen.

The company's primary business is manufacturing and supplying of industrial gases which has been discontinued from 1 August 2019.

Last year, investors searched for companies which were in anyway related to the word 'Oxygen'. Such was the frenzy in the stock market.

For more details, read our editorial on the top 4 oxygen stocks in India.

Top Sectors that could get affected by Covid in 2023

Moving on to the most affected sectors by Covid negatively, here are the top three.

#1 Hotels

The tables have once again turned for hotel stocks.

Starting September 2021, the travel and tourism industry saw signs of a revival as the government lifted curbs and people stepped out of their homes.

Hotel stocks in turn were booming as revenge travel caught up and the sector had multiple tailwinds in its favour.

But little did we know that the ambitious plans of hotel companies would come to a halt amid the Covid outbreak in China.

Hotel Stocks - 1 Week Performance

| Company | CMP (Rs) | Change (%) |

|---|---|---|

| Taj GVK Hotels & Resorts Ltd. | 173.70 | -23% |

| HLV Ltd. | 10.93 | -23% |

| Jindal Hotels Ltd. | 35.95 | -20% |

| Oriental Hotels Ltd. | 64.05 | -19% |

| Kamat Hotels (India) Ltd. | 92.80 | -18% |

| Lemon Tree Hotels Ltd. | 72.05 | -16% |

| Asian Hotels (North) Ltd. | 73.50 | -16% |

| The Byke Hospitality Ltd. | 39.05 | -15% |

| EIH Associated Hotels Ltd. | 382.15 | -15% |

| Mahindra Holidays & Resorts India Ltd. | 242.60 | -12% |

| EIH Ltd. | 158.60 | -12% |

| Chalet Hotels Ltd. | 318.60 | -10% |

| The Indian Hotels Company Ltd. | 299.55 | -8% |

Mind you, the prospects of hotel stocks were looking good amid the upcoming big fat Indian wedding season. The prospects are still strong as there's not many serious restrictions in India so far.

Hotels with wedding halls or open spaces, can host multiple weddings on a single day. Weddings are generally preceded and followed by customary ceremonies which too, many a times are hosted at the same location.

According to reports, 2.5 million marriages may get solemnised during the wedding season this year with tariffs at hotels up by a record 25-30% over 2019-20 levels.

If the situation gets worse from here, hotels could be the first ones to get severely affected. Many stocks from the sector plunged up to 70% in the initial covid phase.

#2 Airlines

Next in line is airline and travel sector.

As Covid-19 cases surge in China (and across the globe), airline stocks have started to take a beating.

Last week, airline stocks fell as India stepped up measures to curb a fresh wave of infections.

The government issued fresh guidelines for international fliers arriving in India. The aviation ministry has been asked to ensure that at least 2% of passengers in every flight are tested for coronavirus.

Just when airlines were starting to roll out some positive developments including winter sale, the Covid outbreak has halted their journey.

Right now, there aren't any scary headlines which suggest that there's a decline in air travel. People are still not scared to step out of their home.

But if Covid cases were to rise in India, we could see over 50% reduction in air travel...this is exactly what happened in May 2021.

While airlines were slowly starting to increase their margins, the new outbreak has made the situation turbulent again.

Airline Stocks - 1 Week Performance

| Company | CMP (Rs) | Change (%) |

|---|---|---|

| Interglobe Aviation Ltd. | 1914.15 | -3% |

| Jet Airways (India) Ltd. | 69.95 | -10% |

| SpiceJet Ltd. | 35.45 | -13% |

#3 QSR

The last 2 years were dull when it came to festive vibes due to Covid. But this year, the situation was back to good old days.

Diwali had a lot of pent-up demand which boosted sales and profits of many consumer firms. Quick service restaurants (QSR), in particular, saw a sharp rebound.

Almost every QSR company posted good growth and also laid out plans to open up new stores.

These plans now hang on a thread as the outbreak has started to have some effect on QSR companies. Jubilant Foodworks and Devyani International fell up to 5% last week when the benchmarks Sensex and Nifty tumbled over 1% on the back of Covid fears.

Performance of QSRs over a week

| Company | CMP (Rs) | Change (%) |

|---|---|---|

| Devyani International Ltd. | 170.30 | -9% |

| Jubilant FoodWorks Ltd. | 511.00 | -2% |

| Restaurant Brands Asia Ltd. | 106.25 | -8% |

| Westlife Foodworld Ltd | 750.25 | -3% |

Interesting to note that QSR companies have ambitious targets for the future...

The master franchisee of Burger King in India, Restaurants Brand Asia, is still making losses. In financial year 2021-22, the company had 315 outlets (265 in 2021).

This number is set to increase to 390 by end of financial year 2022-23 and further to 470 in the subsequent year, according to reports.

Meanwhile, West Life Development (McDonalds) is on an aggressive store expansion mode. The management has set a target of adding 35-40 stores in FY23 and thereafter 200 restaurants in the next 3-4 years.

On a conservative basis, this adds up to 50-60 stores per year. In the past the company has been adding 25-30 stores per year.

Conclusion

The virus is back again. Some flying restrictions and PCR tests are back. Global stock markets have been rattled. It's too early to know how bad the recent outbreak in China can be. It may or may not lead to more hospitalisations, more deaths, and another lockdown.

But it's indeed likely to weigh heavy on the market mood in the coming weeks.

Watch this space for more as we cover editorials on Covid 2023 and how the trend could play out as we move into a new year.

Happy investing.

Safe Stocks to Ride India's Lithium Megatrend

Lithium is the new oil. It is the key component of electric batteries.

There is a huge demand for electric batteries coming from the EV industry, large data centres, telecom companies, railways, power grid companies, and many other places.

So, in the coming years and decades, we could possibly see a sharp rally in the stocks of electric battery making companies.

If you're an investor, then you simply cannot ignore this opportunity.

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.comDisclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

Yash Vora is a financial writer with the Microcap Millionaires team at Equitymaster. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

Equitymaster requests your view! Post a comment on "Covid 2023 - Who Could be the New Winners and Losers". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!