My Trading System for Regular Monthly Income

This is the fifth and final video of my series on how to create a second income from trading.

Today, I'll show you just how much you stand to gain from using my proprietary trading system.

How you could potentially generate tens of thousands of rupees month after month.

And in case you missed the first four videos of this series, I have a handy recap for you.

Let's dive in...

Hello viewers.

Myself Brijesh Bhatia.

Welcome to our series on 'Creating a Second Income from Trading'

This is the last video of this series.

In this video, I will tell you how I packaged everything I learned from my 10+ years of research into developing a complete trading system.

A system that one could use to potentially ADD tens of thousands of rupees to his or her income... every month...

Irrespective of whether the market is going up or down.

Now before I tell you how I developed my proprietary trading system...

Let's do a short recap of what all we learned till now.

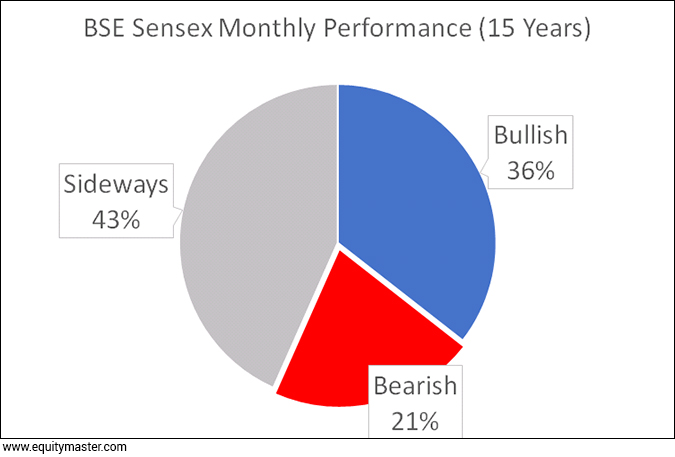

We saw that the stock market is in the bullish zone for only one-third of the time.

So, the secret to making regular monthly income is to find a way to make money even in bearish and sideways market.

That's the only way you can flip the game in your favour and potentially make money in any kind of market. Bullish, bearish, and even sideways.

Then we saw that based on my extensive range of experiments...

The best window for successful trading is around 2 to 3 weeks long.

Because this is the time-frame where you get to ride what I call an 'Alpha Wave.'

When a stock is in an "alpha wave", it makes a big move in a very short period of time.

Giving you a window of opportunity to cash out with sizeable gains, quickly.

These alpha waves are so powerful that I have made them the foundation of my trading system.

But to create a robust trading system... that could potentially generate 5-figure and even 6-figure gains... month after month...

Alpha wave alone is not enough.

You see, the stock market is unpredictable. Despite your best efforts and research your trade can go wrong.

So, you need a way to protect yourself. So that, you lose the least amount of money.

Now after spending countless hours to tackle this problem... I discovered a solution.

I found that it is possible to keep your winning trades running...

And get out of your losing trades quickly with minimal damage.

This way, you WIN BIG but lose small.

So, I made this loss protection module an integral part of my trading system.

Just with the Alpha Waves and this loss protection module, my system was showing a very good performance.

But I was still not happy. I wanted to make it even more robust.

So that, this system could potentially generate tens of thousands of rupees month after month.

After spending many more months on refining, I finally developed a robust trading system.

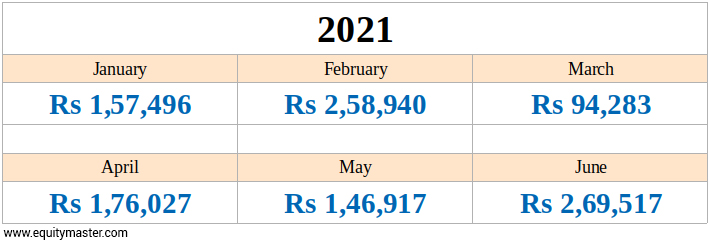

I have been testing this system in real-time since December 2020.

And since then it has shown phenomenal returns in every single month. As you can see on the screen.

At my Alpha Wave Profits special event going LIVE this evening, I will show you exactly how this system works.

And how you could use it to potentially ADD tens of thousands of rupees to your income... every month...

Irrespective of whether the market is going up or down.

You can find the link in the description to join my event for FREE.

So, see you today at 5pm at my Alpha Wave Profits special event.

Signing off.

Warm regards,

Brijesh Bhatia

Research Analyst, Fast Profit Report

Equitymaster Agora Research Private Limited (Research Analyst)

Recent Articles

- Pyramiding PSU Bank Stocks September 22, 2023

- How to trade PSU banking stocks now.

- 5 Smallcap Stocks to Add to Your Watchlist Right Now September 12, 2023

- These smallcaps are looking good on the charts. Track them closely.

- Vodafone Idea - Can Idea Change Your Life? September 6, 2023

- What is the right way to trade Vodafone Idea?

- Repro Books Ltd: The Next Multibagger Penny Stock? August 28, 2023

- Is this the next big multibagger penny stock? Find out...

Equitymaster requests your view! Post a comment on "My Trading System for Regular Monthly Income". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!