- Home

- Todays Market

- Indian Stock Market News January 3, 2017

Sensex Stays Flat; IT Stocks Witness Selling Pressure Tue, 3 Jan 01:30 pm

After opening the day on a flat note, the Indian share markets have continued to trade flat and are trading marginally above the dotted line. Sectoral indices are trading on a mixed note with stocks in the consumer durables sector and oil & gas sector witnessing maximum buying interest. IT stocks are trading in the red.

The BSE Sensex is trading up 73 points (up 0.3%) and the NSE Nifty is trading up 30 points (up 0.4%). Meanwhile, the BSE Mid Cap index is trading up by 0.7%, while the BSE Small Cap index is trading up by 1%. The rupee is trading at 68.16 to the US$.

All eyes are set on the GST (Goods and Service Tax) council, which will begin its crucial two-day meeting today. The meeting will also look to finalize the integrated GST bill that deals with the issue of taxation of interstate movement of goods.

The GST council looks to find a middle ground between the center and the states as regards to sharing of administrative powers. A consensus will help the center to table the supporting legislations in the budget session of Parliament beginning later this month. It will also pave the way for implementing GST from the next fiscal-either from 1 June or 1 July.

The committee headed by Finance Minister Arun Jaitley is scheduled to meet representatives of six crucial sectors, including IT, telecom, logistics, banking and insurance, to assess the hurdles in the implementation of the new GST regime.

Sectoral representatives of civil aviation and railways will make presentations at the two-day meeting of the GST Council.

The logistics sector is seen as a major beneficiary of implementation of GST, and shares of logistics companies are firmly in focus, with many of them trading up by as much as 7%. Shares of Container Corp, Gati Ltd, VRL logistics witnessed maximum buying interest, and were trading up in a range of 3%-7%, as compared to the 0.4% decline in the BSE Sensex at 9:30 am.

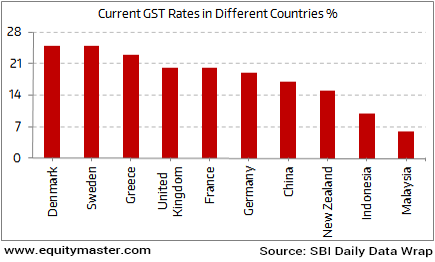

GST is a widely accepted concept and around 160 countries have implemented the same. So how do the rates across the countries looks like? The chart below highlights the same.

What would be India's GST Rate?

GST will subsume a host of indirect taxes levied by the center and the states, including excise duty, service tax, value-added tax, entry tax, luxury tax and entertainment tax. A transparent tax regime may very well be beneficial to the investors, individuals and businesses.

It all paints a rosy picture, but in the long term it may not be the case. Vivek Kaul has a special report ready, which will help you understand how GST actually affects you. You can download this special report - GST & You, for free right here.

Moving on to news from the commodities sector. According to an article in a leading financial daily, gold imports have fallen to their lowest levels since 2003. This can be seen as an impact of the government pushing digital transactions and discouraging purchases of assets using cash.

The demonetisation move had an impact on gold demand, which went up sharply after the withdrawal of Rs 500 and Rs 1000 notes on 8 November, with people scurrying to offload their cash into gold.

However, the gold demand fell sharply in December owing to the cash crunch and the stipulation of furnishing Permanent Account Number (PAN) details when purchasing jewelry or bullion worth more than Rs 200,000.

The import of gold in 2016 in tonnage terms has been the lowest since 2003, according to the GFMS TR. The organization has estimated the official gold import in 2016 at 492 tons, a large part of that being for export.

All efforts to discourage gold import will be incomplete if jewelers don't get local supplies, which is possible only if idle gold lying with Indian households is mobilized and for this the gold monetization scheme (GMS) is an ideal vehicle. The government is pushing banks towards this end.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Stays Flat; IT Stocks Witness Selling Pressure". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!