- Home

- Todays Market

- Indian Stock Market News January 5, 2017

Sensex Registers Marginal Gains; Metal Stocks Witness Buying Interest Thu, 5 Jan 11:30 am

After opening the day on a marginally positive note, the Indian share markets have continued the trend and are trading in the green. All the sectoral indices are trading on a positive note with stocks in the metal sector and the oil & gas sector witnessing maximum buying interest.

The BSE Sensex is trading up 214 points (up 0.8%) and the NSE Nifty is trading up 68 points (up 0.8%). Meanwhile, the BSE Mid Cap index is trading up by 1%, while the BSE Small Cap index is trading up by 1%. The rupee is trading at 67.84 to the US$.

According to a report in The Economic Times, over 97% of the banned Rs 500 and Rs 1000 notes have been deposited into banks as on 30 December.

Banks have received Rs 14.97 trillion worth of old notes as of 30 December, the deadline for handing in the demonetised currency. This figure amounts to about 97% of Rs 15.4 trillion rendered worthless by the demonetisation move on 8 November.

Any eventual one-time windfall gain accrued to the Reserve bank of India (RBI) will be closer to Rs 500 billion as on date, much less than the RBI and the Centre's initial estimates of as much as Rs 3 trillion.

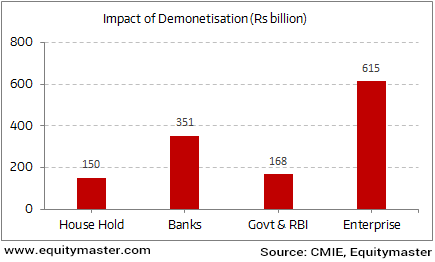

This may put a huge burden on the exchequer as the demonetisation drive has proven to be a costly affair. The transaction cost involved in replacing the currency notes is worth considering. Now, this whole exercise would involve some transaction cost. As per CMIE, the total transaction cost during 50-day window till 30th December, 2016 would be ~Rs1.28 trillion.

Demonetisation may prove to be costly

The amount of demonetised currency returned has turned out to be much more than the estimates of the government and RBI, and might come as a blow to the government's drive to clean out black money. As most of the demonetised money has been returned into the banking channels, it has been legitimatized and accounted for, it cannot be treated as black money.

Speaking of black money, it's no secret that political parties are a kind of black hole to black money. Much of these donations to political parties, being below the limit of Rs 20,000, happen in cash and remain unaccountable (one must note that political parties are currently not required to publicly disclose contributions of up to Rs 20,000). So while you and I need to show an identity proof while depositing our old Rs 500 and Rs 1,000 notes into a bank account, political parties can continue to receive donations of up to Rs 20,000 in cash. And they need not declare where those donations came from.

There is a scope that we as citizens of India can put an end to this discrimination. My colleague Vivek Kaul is on a mission to get us EQUAL RIGHTS. Vivek has initiated a petition to the President of India to request him to set things right. Thousands have already signed the petition. He needs 25,000 signatures before 6th of January to kick this off. In case you haven't, it's time to do your bit now. Sign the petition, and become an agent of change.

Moving on to news from the global economy. The US Federal Reserve released the minutes of the December 13-14 policy review on Wednesday, which hinted at a higher probability of rate hikes in the coming months.

The minutes of the Fed policy review revealed that policymakers saw the looming uncertainty associated with fiscal, trade, immigration or regulatory policies, probably after President-elect Donald Trump takes oath on January 20. They sounded unsure of the size, composition and timing of the policy changes.

The policymakers also predicted the GDP growth to be slightly higher, and estimated the US GDP to grow by 1.3-4.7% in 2017.

The Federal Reserve had announced an interest rate hike of 0.25% during the latest policy review. The rate hike was the first since last December and only the second since the 2008 crisis, when the Fed cut rates to near zero and deployed other tools such as massive bond purchases to stabilise the economy.

But there's more. The Fed's outlook is now for three more 0.25% hikes in the coming year. And then three more increases in both 2018 and 2019. This would mean nine rates hikes over the next three years before the rate levels off at a long-term 'normal' of 3%.

A quick succession of rate hikes would create a massive storm in the global financial markets. But no rate hike would lay the ground for much bigger financial storms later. Sooner or later, there will be an end to easy money policies. And that will lead to some big trends. Here's Asad Dossani, editor at Profit Hunter: Regardless how many more times interest rates go up, one thing is clear. This is the beginning of the end of easy money. At least, the end of easy dollars (easy euros, pounds, and yen will stay with us for a while).As per Asad, the Fed's promise of more interest rate increases will lead to the end of easy money and will create big trends next year that traders can profit from.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Registers Marginal Gains; Metal Stocks Witness Buying Interest". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!