- Home

- Todays Market

- Indian Stock Market News January 9, 2017

Sensex Stays Flat; IT Stocks Witness Selling Pressure Mon, 9 Jan 01:30 pm

After opening the day on a flat note, the Indian share markets have continued to trade near the dotted line. Sectoral indices are trading on a mixed note with stocks in the realty sector and FMCG sector witnessing maximum buying interest. Energy stocks are trading in the red.

The BSE Sensex is trading down 20 points (down 0.1%) and the NSE Nifty is trading flat. Meanwhile, the BSE Mid Cap index is trading up by 0.3%, while the BSE Small Cap index is trading up by 0.5%. The rupee is trading at 68.19 to the US$.

The General Anti Avoidance Rules (GAAR), which are tax anti avoidance rules are set to kick in from 1 April 2017.

The tax department has refused to defer the GAAR implementation further, despite strong industry pitches against the same.

GAAR was part of the 2012-13 Budget speech of the then Finance Minister Pranab Mukherjee to check tax evasion and avoidance. However, its implementation was repeatedly postponed because of the apprehensions expressed by foreign investors.

GAAR, which was originally to be implemented from April 1, 2014, will now come into effect from April 1, 2017 (Assessment Year 2018-19). It contains provision allowing the government to prospectively tax overseas deals involving local assets.

Reportedly, the government plans to target Participatory notes or P-notes and tax them as indirect investments. P-Notes are instruments issued by registered foreign institutional investors (FII) to overseas investors, who wish to invest in the Indian stock markets without registering themselves with the market regulator, the Securities and Exchange Board of India - SEBI.

Taxing P-notes as indirect investments would attract a tax rate of up to 15%. To avoid tax altogether under GAAR, an investor may have to prove that P-Notes were not set up specifically to avoid paying taxes.

This may deal a blow to Foreign Portfolio Investors (FPIs) who use P-notes as an investment instruments. Foreign investors pulled out more than US$ 3 billion from the Indian capital markets in 2016, making it the worst period in last eight years in terms of foreign investments.

Moving on to news from the metals sector. Aluminum major National Aluminum Company Limited (NALCO) announced plans to raise its production capacity this fiscal. The company plans to net a capacity of over 7.3 million tonnes up from about 6.8 million tonnes previously.

Besides, the company has signed a Memorandum of Understanding with Utkal University for collaboration in R & D Projects, baseline and impact assessment survey for CSR Projects and Industry Institution Interaction.

In 2016, Nalco posted a growth of 18% in bauxite mining, the highest since its inception, and a record in the mining industry. The company plans to capitalize on the high growth rate and hence is pushing for additional capacity.

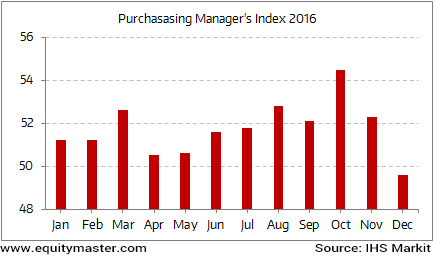

The company's efforts in increasing production comes as a positive sign, especially when the Purchasing Manager's Index (PMI) - which tracks manufacturing activity - fell below the 50-point threshold indicating a contraction in manufacturing.

PMI Shows Contraction in Manufacturing Activity

Such capacity additions will go a long way in lifting the lull from the manufacturing sector caused due to various factors including demonetisation.

NALCO has the largest integrated alumina-aluminum complex of Asia. Additional capacity to this complex will do well for the company trying to continue on its growth path. It remains to be seen if the company is able to match the growth rate of the previous fiscal.

At the time of writing, shares of NALCO were trading up 0.4%.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Stays Flat; IT Stocks Witness Selling Pressure". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!