- Home

- Todays Market

- Indian Stock Market News January 11, 2017

Sensex Registers Marginal Gains; IT Stocks Witness Selling Pressure Wed, 11 Jan 01:30 pm

After opening the day on positive note, the Indian share markets have continued to trade above the dotted line. With the exception of stocks in the IT sector all sectoral indices are trading in the green, with stocks in the metal sector and the banking sector leading the gains.

The BSE Sensex is trading up 195 points (up 0.7%) and the NSE Nifty is trading 72 points (up 0.9%). Meanwhile, the BSE Mid Cap index is trading up by 1.1%, while the BSE Small Cap index is trading up by 1%. The rupee is trading at 68.23 to the US$.

Sales of automobiles, usually an indicator of consumer demand in the economy, declined sharply across segments in December 2016, as most consumers caught unawares by the demonetisation move deferred or even cancelled purchases.

According to data released by the Society of Indian Automobile Manufacturers (SIAM), vehicle sales across categories registered a decline of 18.7% last month at 12,21,929 units, from 15,02,314 units in December 2015.

This is the highest decline across all categories since December 2000, when there was a drop of 21.8% in sales. Sales of two-wheelers and three-wheelers, which are mostly paid for in cash, posted the sharpest decline in monthly sales in some 18 years. Their sales declined 22% and 36.2%, respectively.

Domestic car sales were at 1,58,617 units last month as against 1,72,671 units in December 2015, down 8.14%. It was the lowest rate since April 2014 when sales declined by 10.15 per cent. The decline in car sales means that the Indian passenger vehicle industry is unlikely to post double-digit growth for yet another financial year. SIAM had expected sales to grow 12% in the year to March. Between April and December, sales increased 8.6% year on year.

Except for the light commercial vehicles segment, which saw a growth of 1.2% at 31,178 units, all the other categories of the industry saw decline in sales in December.

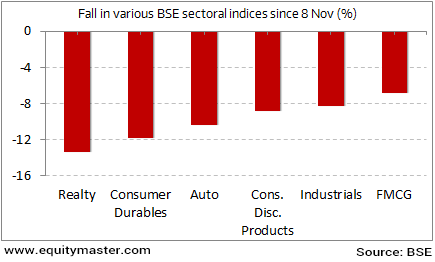

Auto stocks have taken a beating post demonetisation. Stocks from the automobile sector have fallen about 10% since the demonetisation scheme was announced on 8 November, 2016.

The Biggest Losers of Demonetisation

Auto giants are slowly trudging towards recovery and are showing positive signs with investments in R&D and new vehicles. Tata Motors even bucked the industry trend and reported a 4% rise in global sales. However, this rise could well be attributed to sales of its luxury arm Jaguar Land Rover which reported its best ever retail sales in December, up 12% YoY.

As my colleague Kunal Thanvi points out in a recent edition of the 5 Minute WrapUp, the current slump due to demonetisation is only a temporary setback.

Here's Kunal...

- Even if sales take a big blow this year, the auto growth story won't break down. Individuals and businesses will buy cars, two-wheelers, and trucks irrespective of demonetisation. A one-year hit to profitability won't change the long-term earnings power of fundamentally strong auto firms.

It remains to be seen how the auto giants tread on the path to recovery.

Moving on to news about the economy. According to a leading financial daily, Indian industry remains subdued by the economic environment as business confidence for the January - March quarter of 2017 plunged to a 31-quarter low.

The Dun & Bradstreet Composite Business Optimism Index (BOI) stood at 65.4 during the first quarter of 2017 as severe cash crunch heightened the degree of uncertainty amongst companies and dented their optimism. The index saw a decrease of 23.9% as compared to the January-March period of 2016.

The index, measures the pulse of the business community and is arrived at on the basis of a quarterly survey of business expectations. For calculating the composite BOI, each of the six parameters-net sales, net profits, selling prices, new orders, inventories and employee levels-is assigned a weight. The parameter weights are then applied to these ratios and the results aggregated to arrive at the Composite Business Optimism Index.

Disrupted demand and production and rising uncertainty due to the government's surprise demonetisation move is seen as a major reason for the decline in the industry sentiment. Further, the low productivity in the winter session of Parliament and the uncertainty around the implementation date of goods and services tax (GST) are testing the confidence of business community.

Going forward, the extent and speed with which the government and the Reserve Bank of India re-monetise the economy would have a major influence on the way business sentiment shapes up. The measures and policies announced in the upcoming Union Budget on 1 February, would go a long way in shaping and reviving business confidence.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Registers Marginal Gains; IT Stocks Witness Selling Pressure". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!